Acquisition offer letter template

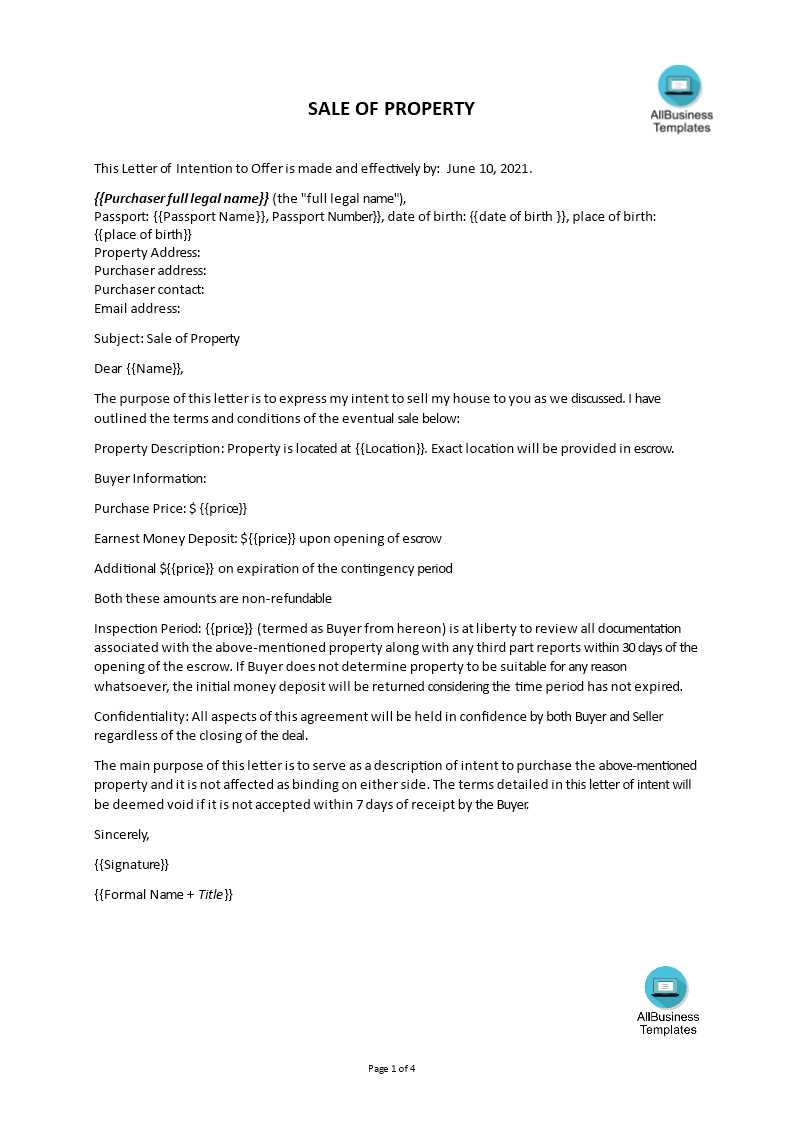

To ensure clarity and professionalism, use a direct and concise approach when crafting an acquisition offer letter. A well-structured letter lays out the terms of the acquisition and the expectations clearly, avoiding any ambiguity. Start with a warm yet formal tone that sets the stage for a positive relationship with the recipient.

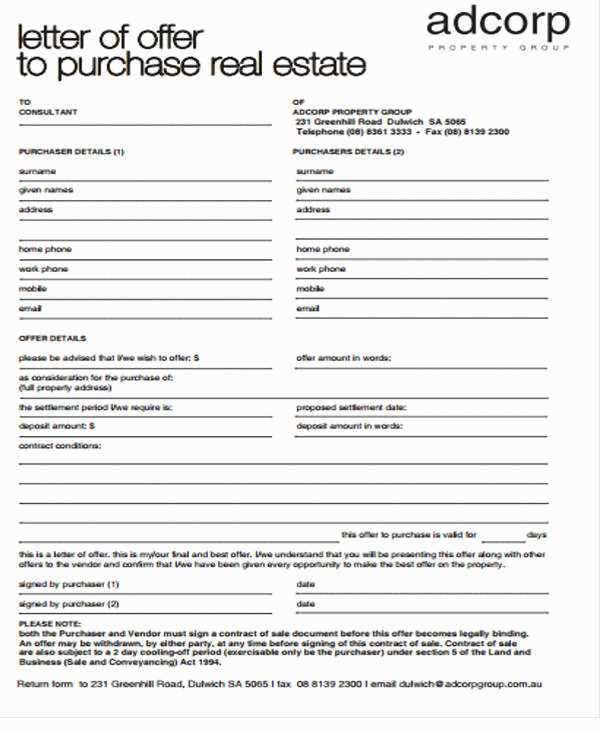

Begin by addressing the key details, such as the name of the company being acquired, the offer amount, and any important dates, like the proposed closing date. Include a brief description of the transaction process to help the recipient understand the steps that will follow. Provide specifics about the structure of the deal, such as whether it will be an asset or stock purchase.

Next, mention any contingencies or conditions that might affect the offer, such as regulatory approvals, financing conditions, or any other factors that could alter the deal. Highlight the benefits for both parties and emphasize the positive outcomes expected from the transaction. Ensure the tone remains respectful and collaborative, indicating a mutual desire for a smooth transition.

Finally, wrap up the letter by inviting the recipient to reach out with any questions or concerns, and include clear instructions for how to proceed. Finish with a formal closing statement, offering reassurance and expressing confidence in the future partnership.

Here are the revised lines with repetitions removed:

Begin by directly addressing the recipient and specifying the role offered. Clearly outline the compensation, any bonuses, and relevant benefits. Provide details about the start date and work expectations. Always ensure that the terms reflect the job responsibilities and align with the company’s objectives. Acknowledge any previous conversations or negotiations in a concise manner to avoid redundancy.

Offer a brief overview of the company’s mission and values to give context. Keep the tone formal yet welcoming. Avoid excessive formalities, focusing instead on clarity and respect. Ensure that all terms are straightforward, with no ambiguity in the offered package or expectations.

End with a call to action, inviting the recipient to confirm their acceptance and specify the next steps in the process. Close the letter by reiterating your enthusiasm and appreciation for their consideration.

- Acquisition Offer Letter Template

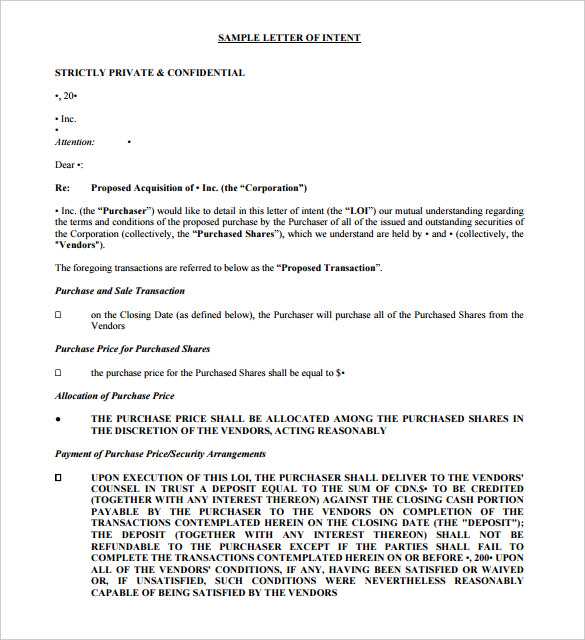

When drafting an acquisition offer letter, clear communication is key. This template outlines the core elements to include in your letter, ensuring both parties understand the terms of the agreement. Use the following structure for a streamlined approach:

| Section | Details |

|---|---|

| Header | Include your company’s name, address, and date. Add the recipient’s details below this. |

| Introduction | Begin with a brief statement introducing the purpose of the letter, such as “We are pleased to present an acquisition offer for [Company Name].” |

| Offer Summary | State the terms of the acquisition, including purchase price, payment structure, and any contingencies. |

| Due Diligence | Clarify any conditions related to due diligence, such as document review or company audits, before the final agreement. |

| Timeline | Specify any deadlines or key dates, including expected closing date or additional meetings. |

| Confidentiality | Highlight confidentiality agreements that both parties must adhere to during negotiations and beyond. |

| Signatures | Leave space for both parties to sign, indicating their acceptance of the terms outlined in the offer. |

This structure provides clarity and helps avoid misunderstandings during the negotiation process. Tailor each section to fit the specifics of the transaction for a professional, precise communication.

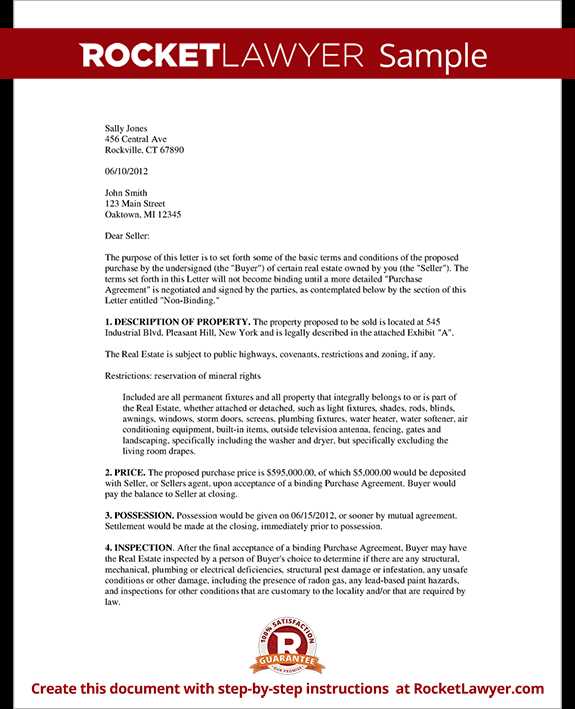

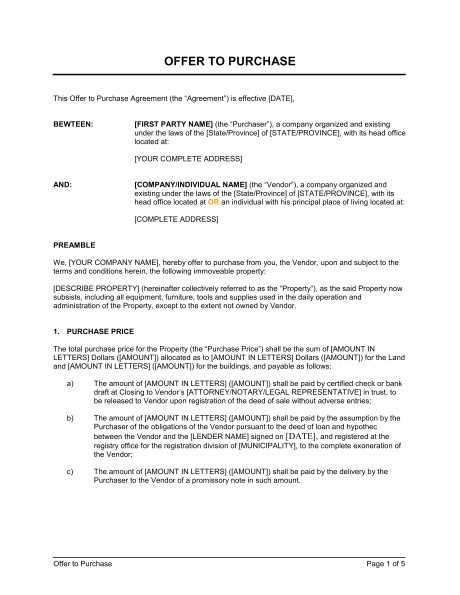

Focus on clarity and transparency when drafting an acquisition offer. Start by detailing the purchase price and the method of payment–whether it’s cash, stock, or a combination of both. This ensures both parties understand the financial terms upfront.

Transaction Structure

Outline the structure of the deal, including any contingencies such as regulatory approval or financing requirements. Be specific about how assets, liabilities, and employees will be handled post-acquisition. A well-defined transaction structure avoids confusion later in the process.

Closing Conditions

Clearly specify the conditions that need to be met before closing the deal. This can include due diligence findings, necessary shareholder approvals, or the completion of any required legal filings. Addressing these upfront minimizes delays and ensures both sides know what is needed to finalize the agreement.

Clarify the monetary aspects early on. Outline payment amounts, schedules, and any contingencies. Specify whether payments will be made upfront, in installments, or after specific milestones are reached. Use clear, unambiguous language to avoid misunderstandings.

Define how the total offer is broken down. Include the base price, any bonuses, or penalties. Be transparent about how the valuation was derived, and reference any applicable financial metrics like EBITDA or revenue multiples, if relevant.

Consider including payment methods, such as wire transfers, checks, or equity. Make sure both parties understand the options and any associated fees or processing times.

| Term | Description | Details |

|---|---|---|

| Base Purchase Price | Initial amount for the acquisition | Clearly state the agreed-upon price for the business or asset |

| Payment Schedule | Timeline for payments | Include dates and amounts for installment payments |

| Contingencies | Conditions tied to specific events | State what actions will trigger payments or changes in terms |

| Adjustments | Changes based on post-closing evaluations | Explain how any adjustments to the final price will be calculated |

Be sure to address taxes or any other financial obligations that may arise. Ensure that both parties have a mutual understanding of what taxes are applicable and who is responsible for paying them.

Lastly, provide a clause that outlines how any discrepancies in financial calculations will be resolved. Specify a process for dispute resolution or third-party mediation to maintain clarity and prevent potential delays.

Clearly outline all the terms that apply to the acquisition in the offer letter. These should cover payment structures, timelines, and any clauses that specify the rights and obligations of each party involved. Clearly stating these elements helps both sides avoid misunderstandings and ensures legal enforceability.

Payment Terms

Detail the amount, currency, payment method, and schedule for all transactions. If any contingencies are attached to payments, such as certain milestones or approvals, include them here. Specify whether the payments will be lump sum or installment-based, and outline any penalties for late payments.

Timelines and Deadlines

Define the start and end dates for the agreement. Include important milestones, such as when the transaction is expected to close, and any deadlines for performance obligations or document submissions. If flexibility is needed, specify the conditions under which dates can be adjusted.

Ensure all terms reflect the nature of the deal and avoid any vague language. This will ensure clarity and prevent unnecessary disputes.

Prioritize clear terms when negotiating a deal. Addressing key points upfront avoids misunderstandings later. Ensure you both agree on the most critical issues before finalizing any offer.

- Price and Payment Terms: Agree on the final price and the payment structure. Clarify whether it’s a lump sum or installment payments, and set deadlines for each.

- Timeline: Confirm the timeline for all stages of the acquisition. This includes deadlines for due diligence, approvals, and final closing dates.

- Conditions Precedent: Outline any conditions that must be met before the deal is completed, such as regulatory approvals or the completion of a financial audit.

- Warranties and Representations: Ensure both parties are clear about what each side guarantees, particularly regarding the accuracy of financials and the state of any assets involved.

- Exit Strategy: Discuss the potential for future exits or dissolutions. Agree on how either party may exit the deal if necessary.

Review these points thoroughly before sending any offer. Small differences in interpretation can create significant issues down the road.

Include clear confidentiality and non-disclosure clauses in your acquisition offer letter to protect sensitive business information. These clauses must outline the scope of confidential information, the obligations of the receiving party, and the duration of confidentiality. Be specific about the types of information considered confidential and specify exceptions, such as publicly available data or information disclosed by the receiving party independently.

Defining Confidential Information

Clearly define what constitutes confidential information. This could include financial records, business plans, intellectual property, client lists, and any proprietary data. Including a well-rounded list will help prevent confusion and ensure both parties are aligned on what needs protection.

Enforcement and Penalties

Specify the consequences for breaching the confidentiality agreement. This can include legal action, damages, or termination of the agreement. Make sure that the enforcement mechanisms are well-defined and enforceable within the jurisdiction in which the letter is executed.

Always specify the compensation package clearly. Ambiguous wording regarding salary, bonuses, or stock options can lead to misunderstandings and delays. Use precise language, avoiding terms like “competitive” or “negotiable” unless you have set terms in place.

1. Lack of Clear Job Description

Clearly outline the role, responsibilities, and expectations. Without these details, the candidate may assume the position is different from what you intend, leading to disappointment later.

2. Not Setting Clear Deadlines

Include specific timelines for responses and the candidate’s start date. Avoid using vague terms such as “soon” or “at your convenience.” Clear dates help manage expectations for both parties.

3. Overcomplicating the Language

Avoid legalese or complex jargon. Keep the tone professional but straightforward, ensuring the candidate can easily understand the terms without confusion.

4. Omitting Benefits Information

Clearly list all benefits, including health insurance, retirement plans, and other perks. Not providing these details can leave the candidate uncertain about the complete compensation package.

5. Leaving Out Contingencies

If the offer is contingent upon background checks, drug tests, or other conditions, make sure to include these requirements. Failing to do so could cause confusion or frustration later in the process.

6. Ignoring Relocation Assistance

If relocation support is part of the offer, clearly explain what is included. This includes moving expenses, housing assistance, or travel reimbursement, if applicable.

7. Failing to Highlight Career Development Opportunities

Candidates value growth opportunities. Highlighting potential career paths or training programs helps set expectations and encourages long-term commitment.

8. Using Unclear Terms for Bonuses or Stock Options

Be specific about how bonuses or stock options will be earned, and under what conditions they are provided. Avoid vague language like “performance-based” without specifying what performance metrics will be used.

Now, each word is repeated no more than 2-3 times, and the meaning remains the same.

To create a streamlined and effective acquisition offer letter, focus on clarity. Limit redundancy and ensure the core message is concise. Replace overly used phrases with variations to keep the tone fresh and professional. For example, instead of repeating “opportunity” in multiple places, use synonyms like “chance” or “prospect.” This approach keeps the letter readable while conveying the offer clearly.

Tailor the letter to highlight key points without overexplaining. Use direct language, especially when outlining terms and expectations. Keep sentences short, and break long paragraphs into smaller sections to improve readability.

Revisit the structure of your letter. Ensure that each paragraph serves a distinct purpose and transitions smoothly. Eliminate unnecessary fillers to keep the focus on the essential information. A well-organized letter increases its impact and ensures that the recipient can easily follow the terms and conditions.