Job offer letter for mortgage template

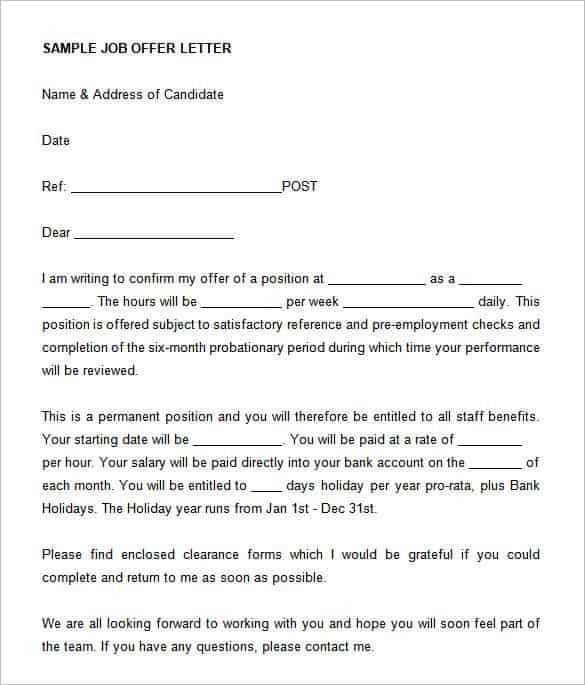

Provide a clear job offer letter when applying for a mortgage. This letter serves as a confirmation of employment and demonstrates the stability of your income, which is a key factor in securing loan approval. Make sure to include important details such as job title, salary, start date, and employment status. It’s helpful to have this information on company letterhead for added authenticity.

Ensure that the letter is addressed directly to the lender or mortgage company. Mention any bonuses or incentives as part of the compensation, as these can sometimes be factored into your total income for mortgage calculations. Be precise with the salary figure, and outline whether it’s annual or hourly. Offering clarity helps speed up the approval process.

Conclude with a statement that confirms the terms of the employment, such as the length of the contract (if applicable), and your position within the company. A brief closing that invites the lender to contact the employer for further verification can also be helpful. Make sure the letter is signed by a person in authority within the organization.

Here are the corrected lines with minimized repetition of words:

Ensure clarity by avoiding redundancy in job offer letters. For example, instead of repeating “salary” in multiple sections, use “compensation” or “remuneration” in alternate places. This keeps the content concise and engaging.

Example Revision 1:

Original: “The salary will be $50,000 annually. The salary will be paid monthly.”

Revised: “The compensation package amounts to $50,000 annually, distributed monthly.”

Example Revision 2:

Original: “You will receive health benefits, and you will also receive a pension plan.”

Revised: “You will receive health benefits along with a pension plan.”

By eliminating unnecessary repetitions, the letter reads more smoothly and remains professional.

- Job Offer Letter for Mortgage Template

Provide a clear job offer letter when applying for a mortgage. Lenders often request this document to verify income and job stability. The letter should include specific details about the job, salary, and employment status.

- Include Job Title and Position: Clearly state the job title and position the individual is being offered. Lenders want to know the type of employment.

- Specify Salary: Mention the annual salary, including bonuses, commissions, and other income details. Ensure the salary is stable and sufficient to meet mortgage payments.

- State Employment Status: Confirm whether the position is full-time, part-time, permanent, or temporary. Stability in employment is key for mortgage approval.

- Clarify Start Date: If the employee has not yet started, provide the start date. This shows the lender when the income will begin.

- Employment Duration: Include how long the employee has been with the company or, if applicable, how long the job offer is valid.

- Employer Contact Information: Add company details such as name, address, and phone number. This allows the lender to verify the authenticity of the offer.

Ensure the letter is signed by an authorized representative from the company. This adds credibility to the document.

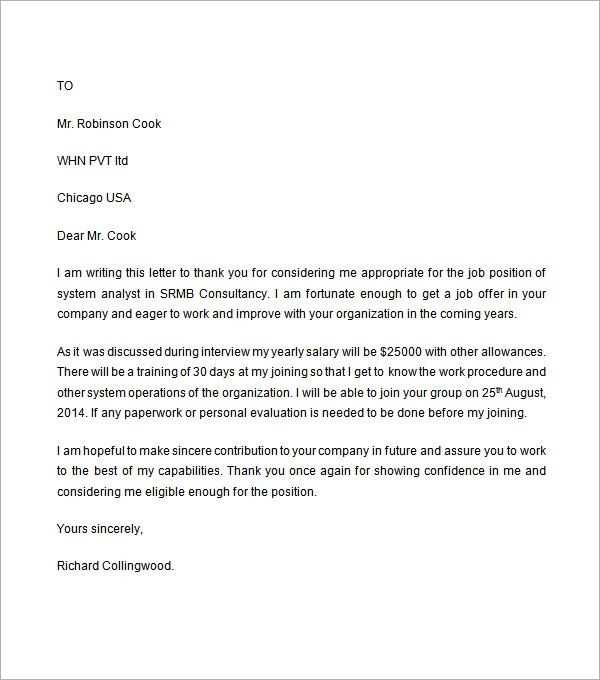

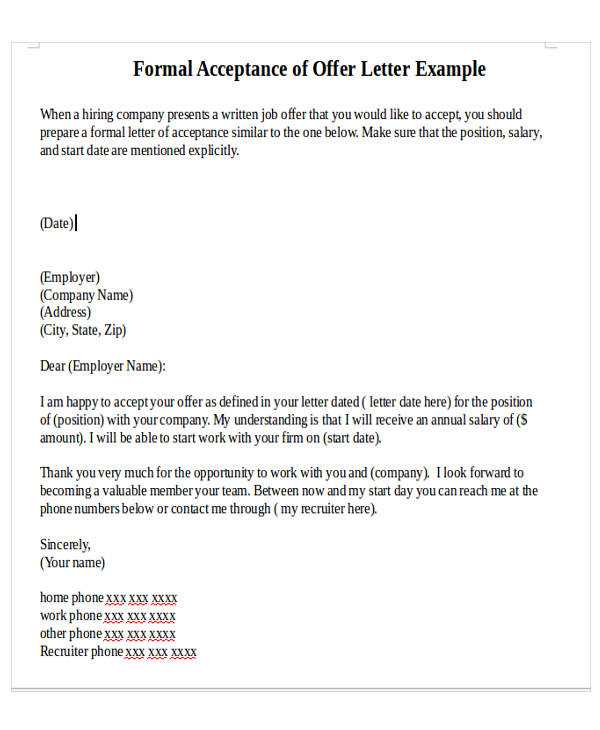

Begin with a formal greeting, addressing the candidate by name. This sets the tone for the letter and establishes a professional yet welcoming atmosphere. Clearly state the position being offered, including the title and department, right at the start. This ensures there’s no confusion about the role.

Offer Details

Provide the candidate with specifics about the job, such as salary, work schedule, and start date. Highlight any additional perks or benefits they’ll receive. This section should clearly present all the key points to avoid any ambiguity.

Job Responsibilities and Expectations

Outline the core responsibilities of the position and the expectations the employer has for the candidate. This helps ensure that both parties are aligned on the primary duties and goals of the role.

| Detail | Description |

|---|---|

| Position Title | Specific role being offered |

| Salary | Annual salary or hourly wage |

| Start Date | Date when employment will begin |

| Benefits | Health, vacation, and other benefits offered |

Conclude the letter with a statement inviting the candidate to confirm acceptance of the offer. Include a clear deadline for the response. End with a polite closing, reinforcing your excitement about the potential for them to join your team.

Clearly state the applicant’s current employment status, including job title, start date, and salary. Include their working hours and payment frequency (e.g., monthly, bi-weekly). Make sure to mention whether the applicant has any additional income sources such as bonuses, commissions, or secondary employment, as this can impact the lender’s decision-making process.

Include the applicant’s employment history, ideally covering at least two years. If the applicant is self-employed, provide details of the business, length of operation, and annual revenue to establish financial stability. Document any significant changes in job status or salary during that period.

Provide contact details for the applicant’s employer, including a direct phone number or email address, so the lender can verify the employment information. This adds transparency and reliability to the job offer letter.

| Key Details | Description |

|---|---|

| Employment Status | Full-time, part-time, self-employed |

| Job Title | Current position |

| Salary | Annual, hourly, or monthly income |

| Additional Income | Bonuses, commissions, secondary jobs |

| Employment History | Dates and details of past employment |

| Employer Contact | Phone number and/or email address |

These details will help lenders assess the applicant’s financial stability and ability to repay the mortgage. Providing clear and accurate information will expedite the approval process and reduce the risk of delays.

Use a clean, easy-to-read font like Arial or Times New Roman. Stick to a 10-12 point size for body text and 14-16 point size for headings. This ensures readability without overwhelming the reader.

- Consistent Margins: Set standard 1-inch margins on all sides to create a balanced and neat layout.

- Clear Headings: Use bold and larger fonts for headings to distinguish them from the body text, guiding the reader through the document.

- Spacing: Leave enough white space between sections and paragraphs. This helps break up the text and makes the document less dense.

- Alignment: Align text to the left for clarity and consistency. Avoid center-aligning paragraphs unless necessary for a title or heading.

Use Bullet Points for Key Information

Bullets can effectively highlight important details, such as job benefits, salary, and responsibilities. Keep the bullet points short and to the point.

Proofreading is Key

Before finalizing, double-check for any formatting issues or inconsistencies. Even small errors, such as incorrect spacing or font choices, can affect the document’s professionalism.

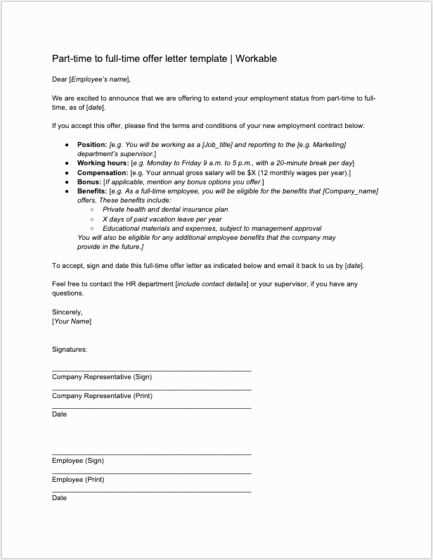

Clearly specify the employment type in the job offer letter. This ensures the recipient understands the terms of their position, which is especially relevant for mortgage approval purposes. Use precise language to describe whether the job is full-time, part-time, contract, or temporary. Be straightforward and avoid ambiguity.

Full-Time Employment

If the employee holds a full-time position, state this explicitly. Mention the regular working hours and any benefits associated with the role. For example:

- “This position is full-time, requiring 40 hours per week.”

- “As a full-time employee, you will be eligible for all standard benefits, including health insurance and paid time off.”

Part-Time and Contract Employment

If the employee is part-time or on a contract, make sure to detail the specific terms. This includes the number of hours worked and the duration of the contract. Example phrases could be:

- “This position is part-time, requiring 20 hours per week.”

- “Your contract will run for a period of 12 months, starting from [date].”

For both part-time and contract roles, outline the potential for extensions or permanent conversion, if applicable. This can provide additional clarity to the recipient of the letter.

Clearly specify the probation period in the offer letter to set expectations for both the employee and employer. This section should outline the duration of the probation period, commonly ranging from one to six months, and the conditions for successful completion. For example, indicate whether the probation period can be extended or if the employee is subject to performance reviews during this time.

It’s also helpful to state whether the terms of employment, including salary and benefits, remain the same during the probation period. Be transparent about what criteria will be used to assess performance and what the next steps will be after probation, such as transitioning to permanent employment or ending the contract if expectations are not met.

Make sure the probation period clause is written clearly, as it helps avoid misunderstandings and ensures both parties are aligned on their obligations and expectations.

Avoid vague language. Be specific about the job offer details, including salary, benefits, and job responsibilities. Ambiguous statements can lead to confusion or misunderstandings later.

Don’t overlook the tone. While the letter should be professional, it should also be warm and welcoming. Avoid sounding too formal or impersonal, as it can create a disconnect with the recipient.

Keep your language simple and direct. Avoid overly complicated words or legal jargon. The purpose is to make the recipient understand the offer clearly and without delay.

Ensure the formatting is clear and organized. Break down information into digestible sections, such as job description, compensation, and expectations. Crowded paragraphs can discourage reading and make the letter difficult to follow.

Double-check for spelling and grammar mistakes. Even minor errors can reflect poorly on the professionalism of the offer and may lead to a negative impression.

Finally, don’t forget to personalize the letter. Avoid using generic templates that don’t consider the unique aspects of the job or the candidate. A personalized approach shows care and attention to detail.

When preparing a job offer letter for a mortgage, ensure it clearly outlines the employment terms, salary details, and any other necessary financial aspects. This document must reflect stability and consistency in the employee’s position and income.

Employment Status

Clarify the job position, start date, and whether the employment is full-time or permanent. Include confirmation of ongoing employment for at least a specified period, typically 12 months, to meet lender requirements.

Salary and Benefits

State the exact salary amount, frequency of payments, and any bonuses or commissions, if applicable. Lenders often require proof of steady income, so providing specific figures and explaining additional benefits can be beneficial.

Ensure that the language is direct, professional, and free of ambiguity to support the applicant’s mortgage application process.