609 Letter Template for Late Payments Guide

Improving your credit report can be a challenging yet rewarding task. One effective strategy is disputing incorrect information that negatively impacts your score. A formal written request can help clear up mistakes and restore your financial credibility. This guide will show you how to craft an effective dispute communication to address inaccurate entries in your credit history.

How to Start Your Dispute Process

To begin, gather all relevant documents that support your claim of inaccurate information. It is crucial to be specific about the errors you wish to dispute. Identify each entry clearly, providing proof to back up your case.

Gather Necessary Documentation

- Credit reports from all three major agencies

- Proof of payment or settlement if applicable

- Any official communication or receipts

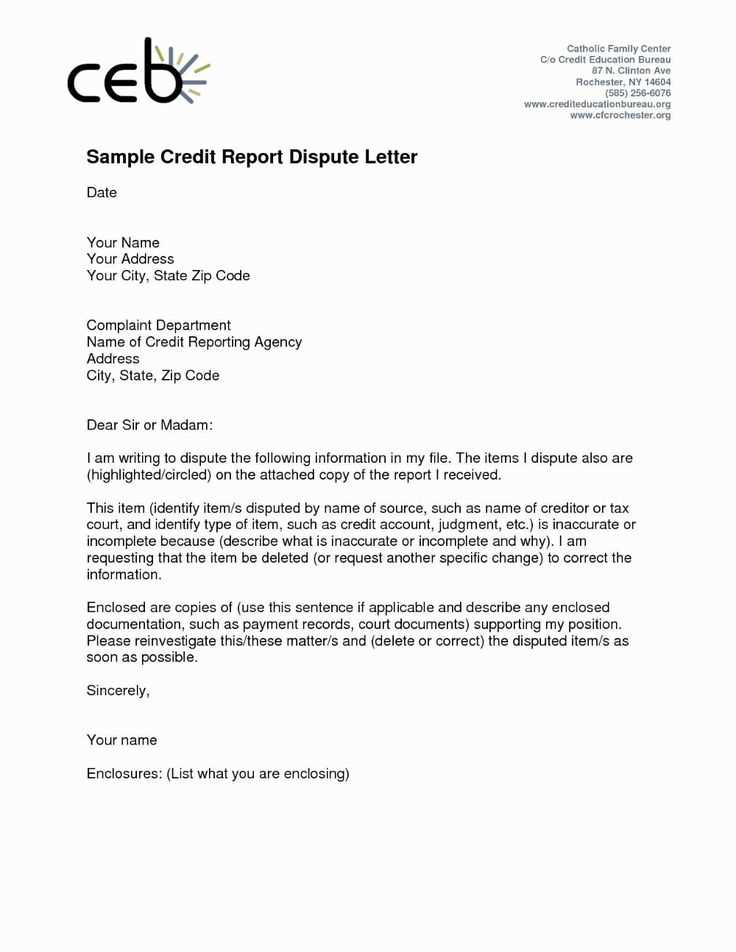

Crafting Your Dispute Request

Your written communication should be clear and concise. Begin by addressing the agency handling your report, stating the facts about the disputed entry. Include supporting evidence that proves the inaccuracy, and request that the error be corrected or removed. Always remain professional and polite, as this increases your chances of success.

Benefits of Addressing Credit Report Errors

By disputing incorrect entries, you stand to benefit in several ways. Successfully removing erroneous marks from your report can lead to a significant improvement in your credit score, which will help you qualify for better financial products and lower interest rates.

Improve Financial Opportunities

Having accurate information on your credit report means lenders will have a more accurate picture of your financial history. A cleaner report increases your chances of getting approved for loans, mortgages, and credit cards with favorable terms.

Enhance Your Financial Health

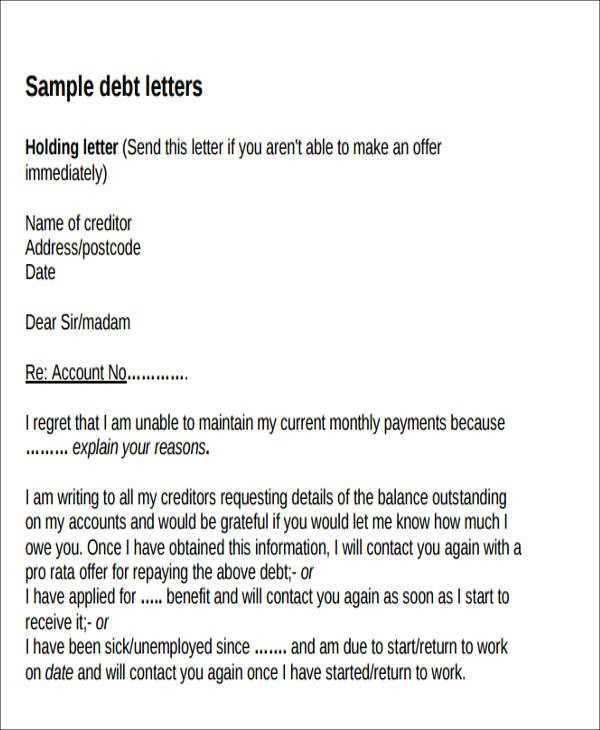

As your credit score improves, so does your overall financial health. Paying off old debts, removing errors, and maintaining a solid credit history allows you to have greater control over your financial future.

Things to Remember

When addressing mistakes on your credit report, patience is key. Agencies are required to respond within a certain time frame, so allow them sufficient time to investigate. If you don’t receive a satisfactory response, consider following up or seeking further assistance from a professional credit repair service.

Disputing Inaccurate Entries and Improving Your Credit

When mistakes appear on your credit report, disputing them is essential for restoring financial accuracy. A formal written request can help challenge errors and facilitate corrections. This approach is an effective way to address discrepancies, especially those that negatively affect your score. By taking the right steps, you can improve your financial standing and secure better credit opportunities.

Understanding the role of a dispute request is crucial. It’s not just about challenging the data, but about ensuring that the information reported reflects your true financial history. Disputing inaccurate entries helps eliminate false marks and strengthens your credit profile.

To use this method effectively, you must be precise and clear in your communication. The request should highlight the discrepancies and include all necessary documentation. By following the correct steps, you can ensure the process works in your favor and leads to positive changes in your credit record.

Steps to Improve Your Credit Standing

Start by reviewing your credit reports regularly. If you spot any incorrect entries, gather supporting evidence, such as receipts or statements, to back up your claim. Ensure your dispute is as detailed as possible, leaving no room for confusion.

Common Mistakes When Writing Disputes

Avoid vague or overly complicated statements. Your message should be straightforward and focused on the inaccuracies. Keep your tone professional and factual. Incorrect or unclear communication can delay the resolution process.

How to Maximize the Impact of Your Dispute

Be concise yet comprehensive in your request. Clearly state which entry is incorrect and provide the necessary proof to support your claim. Ensuring all information is accurate and well-documented will increase the chances of a favorable outcome.

Advantages of Challenging Errors

Disputing mistakes not only helps correct your credit record but can also lead to a significant improvement in your score. As your credit profile becomes more accurate, you’ll have access to better financial products and lower interest rates.

Boosting Your Financial Health

A cleaner credit history translates into more opportunities. With a higher credit score, you’ll find it easier to qualify for loans, mortgages, and credit cards with favorable terms. Over time, this will greatly enhance your overall financial well-being.