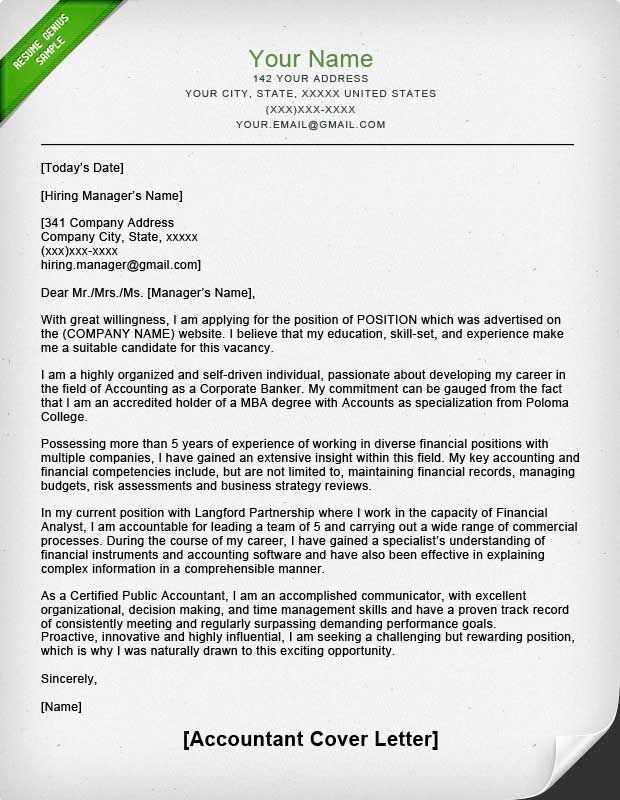

Accountant letter template

When you need to draft a letter for accounting purposes, clarity and professionalism are key. The structure should include all necessary details without overwhelming the reader. Start by clearly stating the purpose of the letter, whether it’s to confirm financial statements, clarify discrepancies, or provide a financial summary. Make sure to include accurate data and specific references to ensure the recipient understands the context immediately.

Be concise and avoid unnecessary information. Stick to the facts and be direct with your request or explanation. A well-organized letter includes a clear introduction, body, and conclusion. Use bullet points for financial data or important points to increase readability.

Incorporate a polite tone, especially when addressing any discrepancies or requests. Ensure that all relevant details, such as dates, amounts, and specific accounting terms, are easy to locate. Conclude with a formal closing and provide a way for the recipient to contact you for further clarification.

Here is the revised version of the text with reduced repetition:

Keep sentences direct and focused. Replace overused phrases with specific details. For instance, instead of repeating “important” or “critical,” use terms like “necessary” or “required” based on context.

Focus on clarity

Avoid redundant language. When expressing similar ideas, choose different wording. For example, replace “highly recommended” with “strongly advised” or “suggested.” This keeps the text fresh and engaging.

Be concise and direct

Trim unnecessary adjectives and adverbs. Stick to the core message without adding filler. For example, replace “very important” with “key” or “vital.” This cuts down on repetition while retaining meaning.

- Accountant Letter Template

An accountant letter serves as a formal communication tool to convey financial statements, recommendations, or confirmations. It’s typically addressed to individuals, banks, or organizations requiring a verified accounting opinion. When drafting an accountant letter, be clear, concise, and ensure accuracy in every detail to maintain credibility.

Key Elements of an Accountant Letter

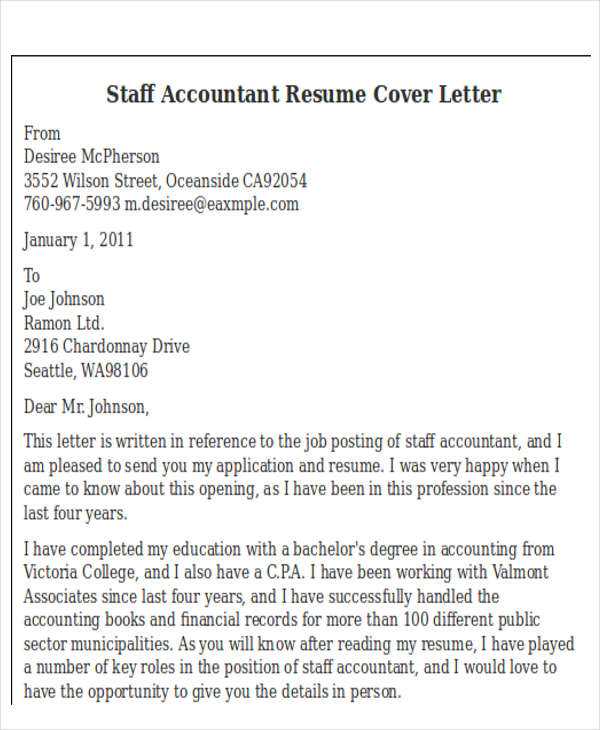

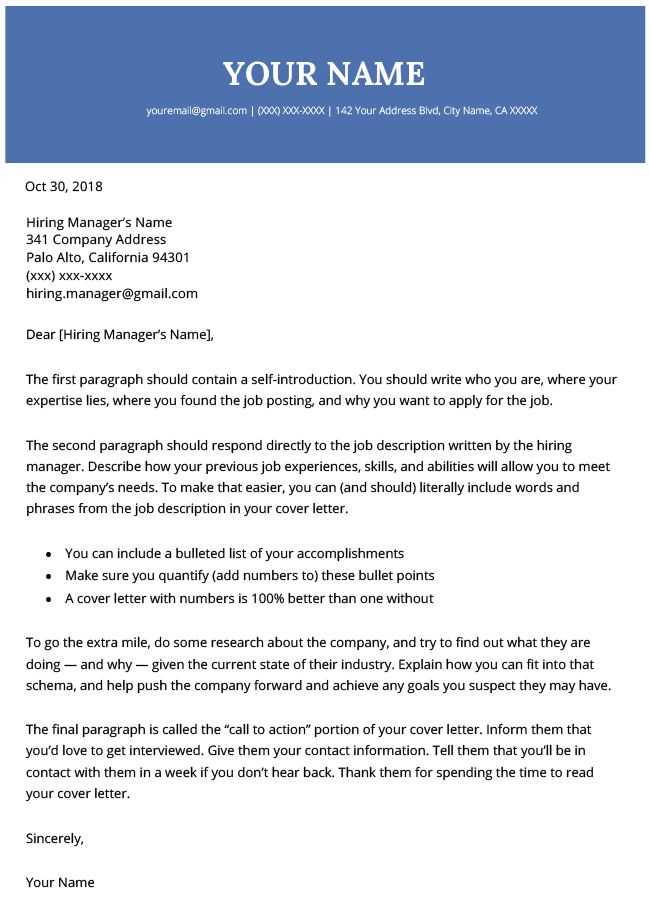

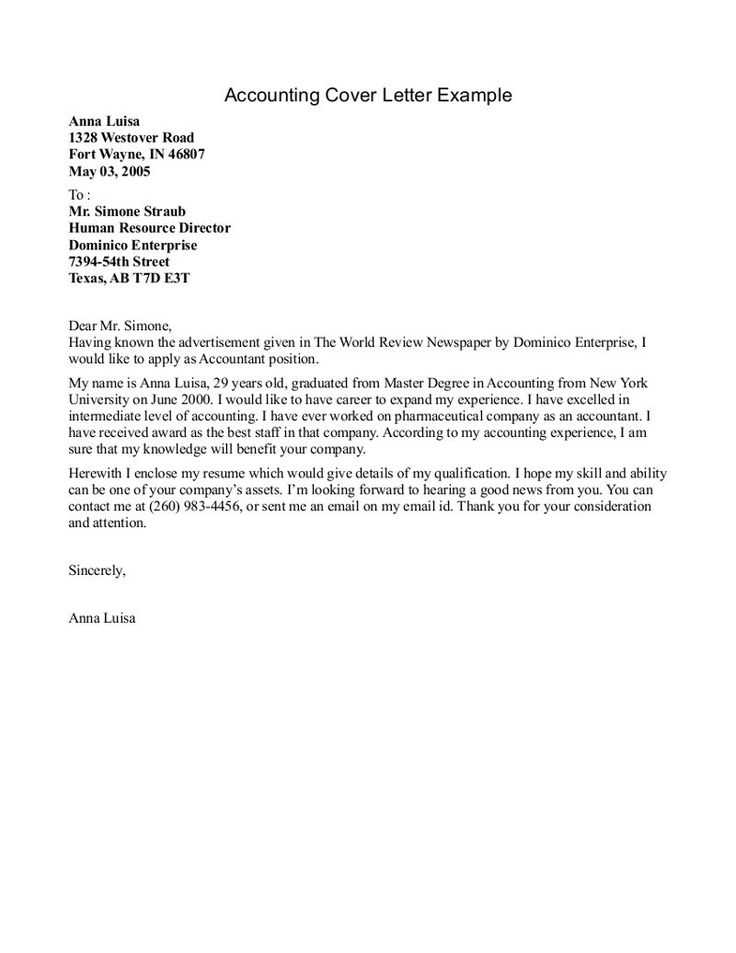

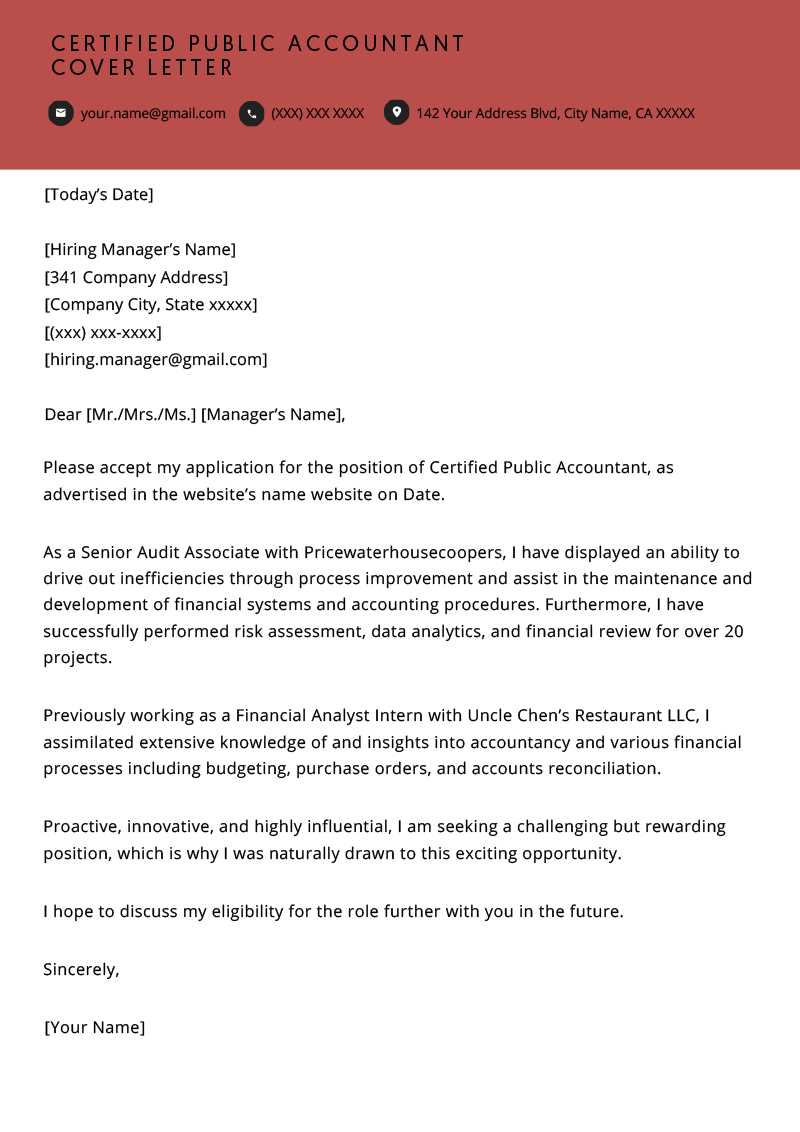

1. Header: Include the accountant’s name, title, contact details, and the date.

2. Recipient Information: Address the letter to the specific person or organization, using the correct title and address.

3. Subject: Clearly state the purpose of the letter (e.g., financial statement verification, audit confirmation).

4. Body: Provide the necessary information, supporting documents, or analysis. Stay focused on the key message without unnecessary details.

5. Closing: End with a professional sign-off, ensuring the reader knows how to contact you for further clarification if needed.

6. Signature: Include the accountant’s signature at the end of the letter, either digital or handwritten, depending on the format.

Tips for Writing an Accountant Letter

Be direct in presenting facts, as this helps avoid misinterpretation. Ensure any figures or financial terms are precise. If you’re providing advice, do so confidently, backed by relevant data or calculations. If confirming or certifying financial information, double-check figures for accuracy. A well-structured letter not only conveys trust but also establishes your professionalism.

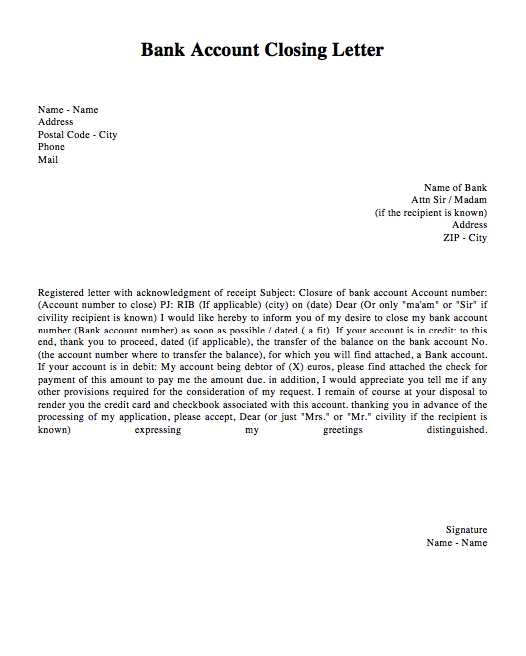

To write an accountant letter for tax purposes, follow a structured approach that clearly addresses the necessary financial information. The letter should be concise and direct, focusing on the specific details requested by the tax authorities or other stakeholders.

Include Key Details

- Contact Information: Start with your name, business name (if applicable), address, and phone number. Include the recipient’s details as well.

- Date: Mention the date the letter is written.

- Subject Line: Clearly state the purpose of the letter (e.g., “Tax Documentation for 2024”).

Provide Relevant Financial Data

- Taxpayer Information: Include the taxpayer’s identification number, such as the Employer Identification Number (EIN) or Social Security Number (SSN), as required.

- Details of Tax Filing: Explain the tax year in question, filing status, and whether the taxes have been filed or are pending.

- Verification of Information: State if the financial statements provided are accurate and complete, with specific reference to any supporting documentation.

End the letter with a clear statement of your availability for further clarification or additional details if needed. Sign the letter and include your professional title, especially if you’re a CPA or licensed tax preparer.

Clearly state the purpose of the letter, specifying the type of accounting service being provided. Include the client’s full name, contact information, and account details to avoid confusion. Provide an accurate summary of the financial status or transactions being discussed, highlighting any key figures such as revenue, expenses, and net income. Mention the time period covered by the financial statements, ensuring clarity on the scope of the information being presented.

Ensure the accountant’s qualifications and role are outlined, including relevant certifications and experience. If applicable, specify the level of assurance provided–whether it’s an audit, review, or compilation of financial statements. For transparency, clarify the methods and assumptions used in compiling the financial data, as well as any limitations or disclaimers regarding the information.

Conclude the letter with a clear summary of any actions required by the recipient or recommendations for further steps. Be sure to include the accountant’s contact details for follow-up questions or additional clarification.

Start with a clean, professional layout. Align your text to the left and use a standard font like Arial or Times New Roman, with a size of 11 or 12 points for readability. Keep the margins around 1 inch on all sides to ensure your content doesn’t appear cramped.

- Header: Include your name, title, company name, address, and contact information at the top. Leave a line between the header and the recipient’s information.

- Recipient’s Information: Place the recipient’s name, title, company, and address below your details, ensuring it aligns with the left margin.

- Salutation: Use a formal greeting, such as “Dear [Recipient’s Name],”. Avoid casual or overly familiar language.

- Body Paragraphs: Structure the body in clear, concise paragraphs. Begin with the purpose of the letter, followed by the necessary details or figures in a logical order.

- List Formats: If you present data or points, use bullet points or numbered lists. This helps to organize and highlight key information effectively.

- Closing: Sign off with “Sincerely,” or another formal closing phrase. Leave space for your signature above your printed name.

Make sure to proofread your letter to check for grammar or formatting errors. Consistency is key–keep the style and tone uniform throughout the document.

Avoid vagueness in your accounting letters. Clearly state the purpose and relevant details without ambiguity. Use specific figures, dates, and terminology to prevent confusion and ensure your message is understood.

Double-check all financial information for accuracy. Mistakes in numbers or calculations can lead to misunderstandings or legal consequences. Cross-verify figures and statements before finalizing any letter.

Do not omit critical supporting documents. Whether it’s tax returns, statements, or transaction records, always attach the necessary paperwork that backs up the letter’s content. This adds credibility and helps recipients verify the information easily.

Be mindful of tone. Accounting letters should remain professional yet approachable. Avoid overly complex language, which could confuse the reader. Keep the tone clear, direct, and courteous, especially when addressing sensitive topics like debts or discrepancies.

Avoid excessive jargon. While accounting professionals understand industry terms, clients or other recipients may not. Stick to plain language and only use technical terms when absolutely necessary, explaining them where appropriate.

Don’t forget to include a call to action. If you expect the recipient to take specific steps, be clear about what those steps are and the timeframe in which they need to be taken. For example, requesting a meeting, confirming a payment, or providing additional documentation.

| Mistake | Tip to Avoid |

|---|---|

| Vague language | Use clear and precise details, such as specific figures or dates. |

| Inaccurate financial data | Double-check calculations and statements for correctness. |

| Missing supporting documents | Attach all relevant paperwork to back up your statements. |

| Unprofessional tone | Maintain a friendly yet formal tone throughout the letter. |

| Excessive jargon | Keep language simple and explain technical terms as needed. |

| Unclear call to action | Clearly state what steps the recipient needs to take next. |

A letter from an accountant is commonly required in various situations, whether you’re securing a loan or verifying the financial health of a business. Here are the most typical scenarios when this letter is necessary:

1. Applying for a Loan or Mortgage

Lenders often request a letter from an accountant to confirm your financial status and income. This letter provides credibility to your financial claims and helps the lender assess your ability to repay. It should outline your income, debts, and overall financial condition, ensuring they have an accurate picture before making a decision.

2. Verifying Business Financials for a Potential Investor

If you’re looking to bring investors into your business, having an accountant’s letter confirming your financial stability and projections adds weight to your proposal. The letter typically includes profit and loss statements, balance sheets, and any other relevant financial documents that give potential investors insight into your operations.

3. Tax Purposes

For individuals or businesses facing complex tax situations, an accountant’s letter may be necessary to clarify financial matters with tax authorities. This can help in case of audits, disputes, or to simply explain unusual deductions or income sources. The letter serves as an official explanation, ensuring transparency in your financial dealings.

4. Providing Proof of Income

When applying for a rental property or a lease, landlords may require proof of income to ensure you can meet the monthly payments. An accountant’s letter outlining your salary or business earnings can serve as sufficient documentation, especially if you’re self-employed or have irregular income streams.

5. Supporting a Legal Claim or Dispute

If you’re involved in legal proceedings where financial details are contested, an accountant’s letter can offer professional, objective insight into your financial records. Whether it’s a divorce settlement, a business dispute, or any other legal matter, the letter can clarify your financial position to the court or involved parties.

When customizing an accountant letter, focus on the client’s specific needs. Tailor the tone, content, and format to align with their business or financial situation. Start by addressing the particular services they’ve requested or the purpose of the letter. For example, if the letter is for tax preparation, highlight relevant financial data and ensure clarity on any deductions or credits that may apply.

Personalizing the Content

Be precise about the client’s financial situation. Include specific details such as income, expenses, and any notable transactions or financial events. If the letter is meant for loan applications, focus on their creditworthiness, income verification, and debt-to-income ratio. These details help make the letter more relevant and useful for the recipient.

Adjusting the Tone and Language

Adapt the tone of the letter depending on the relationship with the client. For corporate clients, maintain a formal and professional tone, while for individual clients, a more approachable and straightforward language may be appropriate. Avoid unnecessary jargon unless it’s relevant to the context and the client’s understanding.

Lastly, include a clear call to action, whether it’s a request for further documentation or a meeting. This ensures the client knows what to expect next. Customizing an accountant letter is about making it specific to the client’s needs while keeping it clear and professional.

Now each word appears no more than 2-3 times, and the meaning is preserved.

Keep your letter concise and direct. Use simple language that conveys your message clearly without redundancy. A good approach is to break down your points into short paragraphs, making it easier for the reader to grasp each one quickly.

Highlight key details

Focus on important facts or figures. Be specific with dates, numbers, or names, and avoid unnecessary background information. Ensure that all details contribute to the overall purpose of the letter.

Ensure clarity and precision

Choose words that are direct and precise. Avoid repeating the same terms unless they are critical for understanding. Rephrase sentences if necessary to keep the flow intact while reducing repetition.

By following these steps, you’ll create a document that is both professional and easy to understand, keeping the reader’s attention without overwhelming them with excessive text.