Accountants engagement letter templates

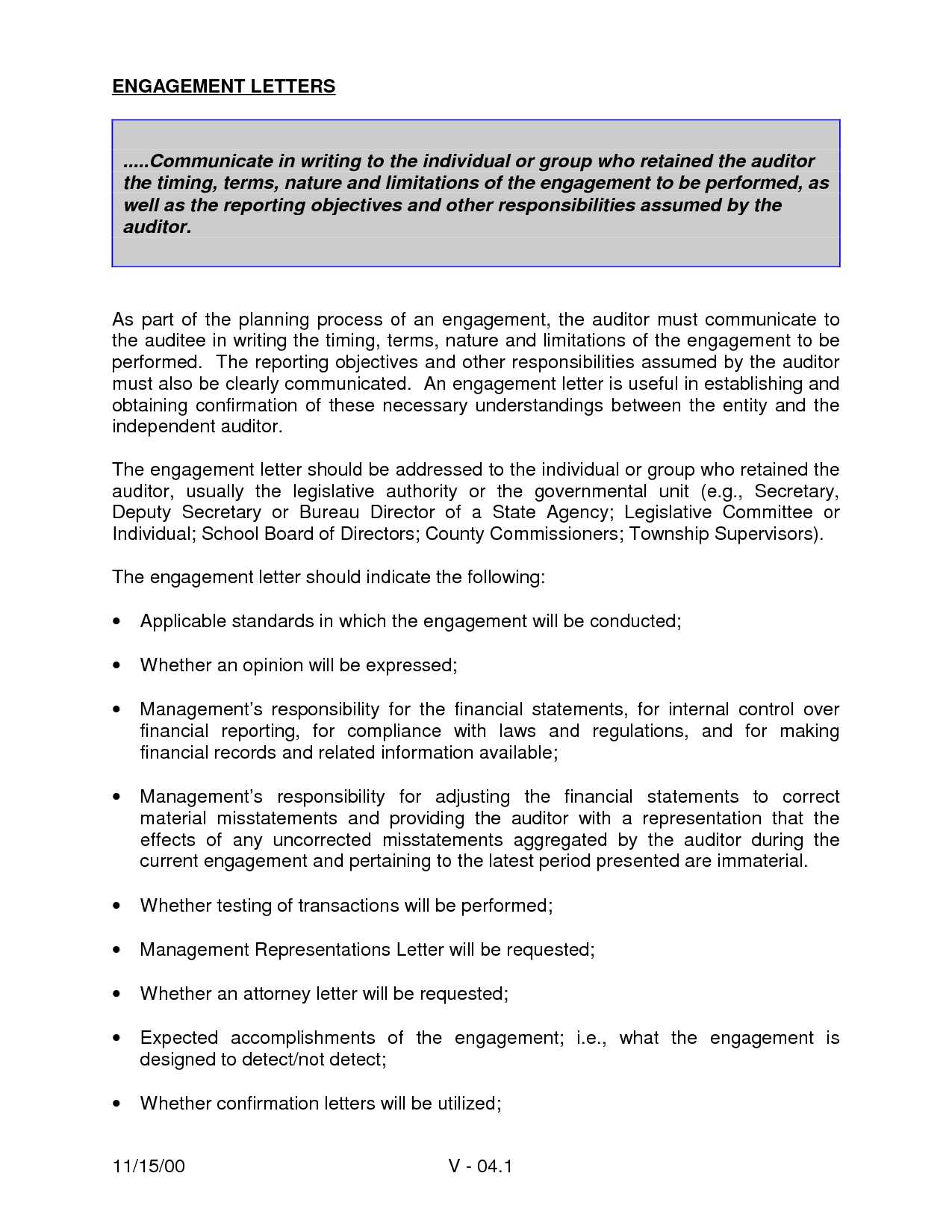

A well-crafted engagement letter sets clear expectations between an accountant and their client, ensuring both parties are on the same page from the start. It defines the scope of services, the responsibilities of each party, and the terms of the agreement. Without it, misunderstandings can arise, leading to disputes or confusion about the work to be performed.

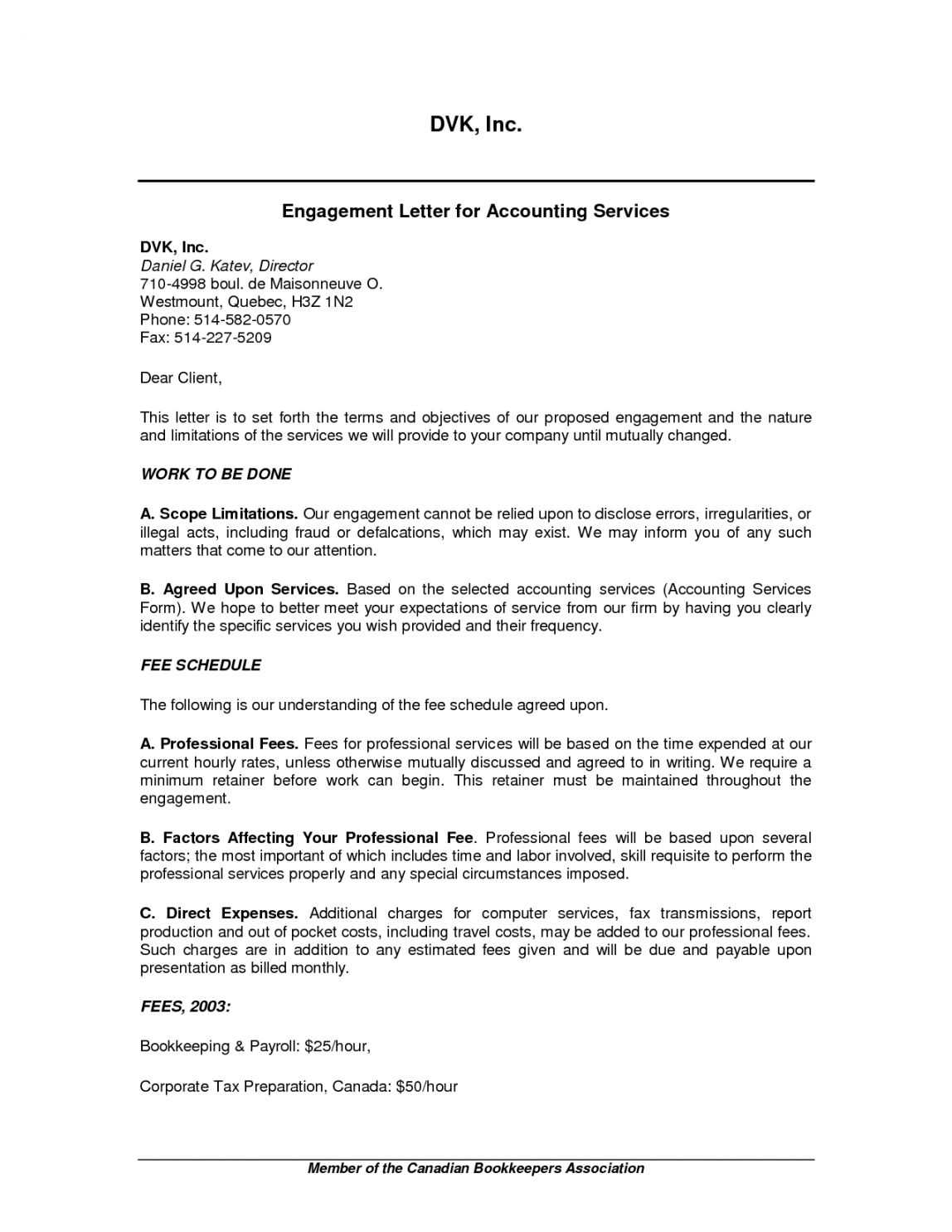

Use an accountant engagement letter template as a foundation to create a document that is specific to your client’s needs. The letter should outline the type of services being offered, including tax preparation, auditing, or financial consulting. Clearly state the fees, billing structure, and payment terms, as well as timelines for completing tasks. Be transparent about any limitations to the services provided, such as exclusions of certain accounting services or limitations on advice given.

When drafting the letter, be concise and precise. Avoid ambiguous language that could lead to different interpretations of the terms. Incorporate key details about confidentiality, conflict of interest, and dispute resolution, as these can prevent future complications. In the event of a disagreement, having a solid, mutually agreed-upon letter will provide a reference point for resolution.

By customizing the template to suit the specific needs of each client, you can ensure that the engagement letter serves both as a legal document and a tool for smooth, professional interactions throughout the engagement.

Here’s the revised version with repetitions minimized:

When drafting an accountant’s engagement letter, focus on clarity and precision. Limit redundancy by structuring the letter logically and breaking down each section with clear headings. Begin with defining the scope of services to be provided, outlining specific tasks and expectations to avoid any ambiguity.

Define Scope and Responsibilities

Clearly outline the responsibilities of both the accountant and the client. Specify which services are included and which are not, ensuring both parties are aligned from the start. This reduces the risk of misunderstandings later on.

Set Clear Terms and Conditions

Establish payment terms, deadlines, and expectations regarding communication. Be explicit about hourly rates, project fees, and due dates for documents or deliverables. Clarity in these areas helps prevent confusion and potential disputes.

Finally, include a section on confidentiality and data protection. Assure the client that their information will be handled securely and in compliance with relevant regulations. Conclude with a clear acknowledgment of acceptance, such as a space for signatures or a checkbox.

Accountants Engagement Letter Templates

Use a clear, concise engagement letter to set expectations from the start. This document should outline the scope of the services being provided, payment terms, deadlines, and any specific responsibilities of both the accountant and the client.

Ensure the letter includes the following sections:

- Services Provided: Clearly define the accounting services, such as tax preparation, audit, or bookkeeping. Avoid vague terms.

- Fees and Payment Terms: State the payment structure–whether it’s a flat rate, hourly, or retainer. Specify the payment due dates and methods.

- Timeline: Provide an estimated timeline for completing the work, including any major milestones.

- Confidentiality Agreement: Address how sensitive financial information will be handled and protected.

- Termination Clause: Include terms for terminating the agreement if necessary, and outline any fees for early termination.

- Dispute Resolution: Mention how conflicts will be resolved, whether through mediation or arbitration.

By covering these points, the engagement letter sets a professional tone and ensures both parties are clear on expectations and obligations. It also minimizes the risk of misunderstandings and disputes down the line.

- Why an Engagement Letter is Essential for Accounting Services

An engagement letter sets clear expectations for both the accountant and the client. It defines the scope of services, the responsibilities of both parties, and the terms of the agreement, preventing misunderstandings and potential disputes down the line.

- Clarifies Services: The letter outlines what specific accounting services will be provided, such as tax preparation, financial reporting, or auditing, ensuring both parties are aligned on what is expected.

- Protects Both Parties: By documenting key details, including fees and deadlines, the engagement letter helps avoid ambiguity, which can lead to disagreements or miscommunication later.

- Sets Boundaries: The letter establishes the limits of the accountant’s role and the scope of work, ensuring that no additional tasks are assumed without proper agreement.

- Defines Payment Terms: Clear payment schedules, including rates and billing practices, are included, eliminating confusion about how and when payments will be made.

- Legally Binding: This document acts as a formal contract, offering protection in case either party needs to reference agreed terms in a legal context.

Having an engagement letter ensures accountability, transparency, and trust throughout the professional relationship, making it a key part of any accounting service agreement.

The accountant’s engagement letter should clearly define the scope of services. Specify the tasks the accountant will perform, such as tax preparation, auditing, or financial consulting. This removes ambiguity and sets expectations for both parties.

Fees and Payment Terms should be outlined in detail. Include the hourly rates or fixed fees, along with payment deadlines. Mention any additional charges for out-of-pocket expenses or services beyond the original agreement.

Specify the timeline for services. Clearly state deadlines for submitting information and completing tasks. This helps avoid delays and keeps both parties aligned on project timelines.

Responsibilities of the Client should also be specified. Indicate what documents or information the client must provide and the deadline for submission. It is essential to emphasize the importance of accurate and timely information.

Include a section on confidentiality. This should outline how sensitive financial data will be protected and specify who within the accounting firm will have access to the information. This reassures clients about privacy and security.

Termination Clause is important. Include the terms under which either party can terminate the agreement, and any penalties or procedures involved in ending the contract before the agreed-upon terms are met.

Clearly outline any dispute resolution procedures. Specify whether disputes will be handled through mediation or arbitration, and where such proceedings will take place. This ensures that both parties know how to handle disagreements without resorting to costly litigation.

Tailoring engagement letters for different accounting services ensures clarity and establishes specific expectations between the accountant and the client. The content should reflect the nature of the services being provided, the scope of work, and any associated terms unique to each type of service.

General Accounting Services

For general accounting services, such as bookkeeping and financial statement preparation, the engagement letter should specify the client’s responsibilities in providing accurate and timely information. Additionally, outline any deadlines for financial reporting, and clarify the fee structure, whether it’s hourly or a fixed rate. Be sure to note whether the accountant will be responsible for tax preparation or if the client will handle it separately.

Tax Services

When preparing an engagement letter for tax-related services, clearly state which tax filings the accountant will handle–such as federal, state, or local returns–and provide details on any deadlines. Include information on any consultation services related to tax planning and strategies. A clear outline of additional charges for complex situations or audits can help manage expectations and avoid disputes.

Audit Services

For audit services, the engagement letter should be more detailed. It should mention the specific areas that will be audited, the procedures for requesting information, and the expected timeline for completion. A section covering any limitations of the audit, such as disclaimers about the scope of the audit or the inability to detect fraud, can help clarify the boundaries of the service. Terms of confidentiality and compliance with regulations should be included as well.

Consulting and Advisory Services

Engagement letters for consulting or advisory services should focus on the deliverables and the methodology to be used. Define whether the engagement is limited to advice on financial strategies, operational improvements, or something more specific, such as mergers or acquisitions. Establish clear guidelines for communication, progress reports, and any costs related to specific advice or consultations.

Table of Key Service Areas in Engagement Letters

| Service Area | Key Considerations |

|---|---|

| General Accounting | Client’s responsibility to provide accurate data, deadlines, fee structure (hourly/fixed). |

| Tax Services | Specify tax filings, deadlines, consultation on planning, additional charges for complex cases. |

| Audit Services | Details on audit scope, limitations, deadlines, confidentiality, regulatory compliance. |

| Consulting/Advisory | Specific deliverables, communication guidelines, fees for consultation, methodology. |

Customizing the engagement letter for each service type ensures transparency and a clear understanding of the responsibilities and expectations from both parties. A well-structured letter can reduce misunderstandings and create a smoother working relationship.

Ensure that the engagement letter clearly defines the scope of work. Specify the exact services to be provided and any limitations to avoid misunderstandings. Both parties must be on the same page regarding deliverables, timelines, and fees.

- Define the Relationship: Clearly state whether the accountant will act as an independent contractor or employee. This distinction affects liability, tax obligations, and other legal considerations.

- Confidentiality Clause: Include a confidentiality agreement to protect sensitive client information. Specify the measures in place to safeguard data and the consequences of a breach.

- Terms of Payment: Outline payment terms, including the fee structure (hourly, flat rate, etc.), due dates, and penalties for late payments. This helps set clear financial expectations.

- Dispute Resolution: Specify how any disputes will be handled, whether through mediation, arbitration, or litigation. Including a clause on jurisdiction can also help determine where legal matters will be resolved.

- Liability Limitations: Clearly state the limits of your liability in case of errors or omissions. This should include a disclaimer that the accountant is not responsible for third-party actions unless specifically mentioned.

- Termination Clause: Set terms under which the engagement can be terminated by either party. Include required notice periods and conditions for termination to avoid ambiguity.

Ensure that both parties sign and date the letter to make it legally binding. A well-crafted engagement letter reduces risks, sets clear expectations, and provides a framework for resolving conflicts.

Be specific about the scope of services. Vague language about what will be provided can lead to misunderstandings. Clearly outline each task or responsibility the accountant will handle, whether it’s tax preparation, auditing, or consulting, to prevent confusion later.

Ensure that terms related to fees are transparent. Stating a fixed rate or hourly fee without additional clarifications on extra charges or terms for revisions can lead to disputes. Include any potential additional costs, such as travel expenses or charges for services outside the initial agreement.

Clearly define the timeline and deadlines. An accountant’s engagement letter should include specific dates for deliverables. Avoid open-ended timelines or phrases like “as soon as possible,” which leave room for uncertainty.

Do not overlook the importance of defining the parties involved. Both the accountant and the client’s legal names should be stated accurately to avoid confusion. Failure to clarify the responsible parties could cause issues with accountability or legal standing.

Address confidentiality concerns up front. Without specifying how confidential information will be handled, your letter may lack crucial legal protections for both parties. Ensure that confidentiality clauses reflect applicable privacy laws and standards.

Include an exit strategy. An engagement letter should outline how either party can terminate the agreement, along with the conditions for termination and any penalties involved. Without these details, a situation could arise where it’s unclear how to end the engagement appropriately.

Be careful with indemnification clauses. These provisions should be clear about what the accountant will and will not be responsible for. Avoid overbroad language that could unfairly place liability on the accountant for circumstances beyond their control.

Finally, do not neglect to have the engagement letter reviewed. Both parties should sign the letter only after they have fully understood all the terms and conditions. This step ensures that there are no overlooked errors or misinterpretations in the final document.

Utilize specialized templates and tools to streamline the creation of an accountant’s engagement letter. Templates ensure that all key sections are covered, reducing the risk of overlooking important details. Look for options that include placeholders for specific client information, service scope, deadlines, and payment terms.

Online tools like contract generators can assist in automatically filling out essential details, saving time while ensuring accuracy. Many platforms also allow customization, so the letter can be tailored to your firm’s style and needs.

Below is a sample template for an accountant’s engagement letter:

| Section | Content |

|---|---|

| Introduction | Brief statement explaining the purpose of the letter and confirming the engagement. |

| Scope of Services | Detail the specific accounting services to be provided (e.g., tax preparation, auditing, consulting). |

| Fees and Payment Terms | Outline the agreed fee structure and payment methods. |

| Responsibilities | Clarify the responsibilities of both the accountant and the client. |

| Confidentiality | State confidentiality terms regarding client information. |

| Termination Clause | Describe the conditions under which either party can terminate the agreement. |

| Signatures | Include space for both parties to sign and date the letter. |

When selecting a template or tool, ensure it complies with industry standards and local regulations. Many legal software platforms provide pre-built engagement letter templates specific to accounting practices, which are regularly updated to reflect current legal requirements.

Using a combination of templates and tools helps create a professional and consistent approach to client agreements, making the process more efficient and less prone to errors.

Accountants Engagement Letter Templates: Simplifying the Agreement

Be clear about your expectations in the engagement letter to set the foundation for a smooth professional relationship. Use straightforward language to outline services, deadlines, and fees. This helps avoid misunderstandings and ensures both parties are on the same page from the start.

Defining the Scope of Work

Specify exactly what tasks the accountant will be responsible for. List the services you expect, such as tax preparation, bookkeeping, or financial consulting. If you want to include specific details, like the frequency of meetings or reports, make sure to mention them clearly. This reduces the chances of the accountant going beyond their responsibilities and keeps the work focused.

Payment Terms and Conditions

Outline the payment structure, including hourly rates or flat fees, and the schedule for payments. If there are any additional costs, such as for late payments or extra services, include them in the letter. Clear terms ensure both parties understand how and when payments should be made, avoiding confusion later.

By keeping things specific and clear, you’ll create an engagement letter that minimizes disputes and fosters a transparent relationship with your accountant.