Accounts receivable confirmation letter template

A clear and concise accounts receivable confirmation letter helps maintain transparent communication between your business and customers. Start by stating the purpose of the letter right at the beginning, making it easy for the recipient to understand the context. Confirm the amount owed, any terms for payment, and any other relevant details like dates or specific invoices. Clarity here avoids misunderstandings and ensures smoother transactions.

Use a professional, yet friendly tone. Be direct but polite, including necessary details without overwhelming the reader. A well-crafted letter provides a sense of trust and reliability. Ensure the wording confirms the outstanding balance, and, if applicable, request confirmation of the payment or a response regarding any discrepancies.

For added effectiveness, include a deadline for responses or payments. This sets clear expectations while also demonstrating the seriousness of the matter. Be sure to follow up on any necessary actions after the letter is sent, creating a streamlined approach to resolving open accounts receivable.

Here’s the revised version:

Confirming accounts receivable through a letter should be clear and direct. When crafting this type of letter, make sure to include the specific details regarding the outstanding balance, the due date, and the method of payment. You can structure your letter as follows:

Account Details

Clearly state the amount owed, referencing invoices or any other relevant documents. For example, “The total amount due as per Invoice #12345 is $500, which is due for payment on February 10, 2025.” This helps avoid confusion and ensures the recipient knows exactly what to pay.

Action Required

Specify what actions are expected from the recipient. For instance, “Please arrange for payment to be made by the due date via bank transfer.” Be sure to mention any contact details in case they need clarification.

By using this format, you can maintain professionalism while ensuring the necessary details are communicated effectively and efficiently.

Accounts Receivable Confirmation Letter Template

How to Format a Confirmation Letter for Accounts Receivable

Key Details to Include in a Confirmation Letter

Step-by-Step Guide for Sending Confirmation Requests

Common Mistakes to Avoid in Receivable Letters

Best Practices for Ensuring Accurate Responses to Confirmation Letters

How to Resolve Discrepancies in Accounts Receivable Confirmations

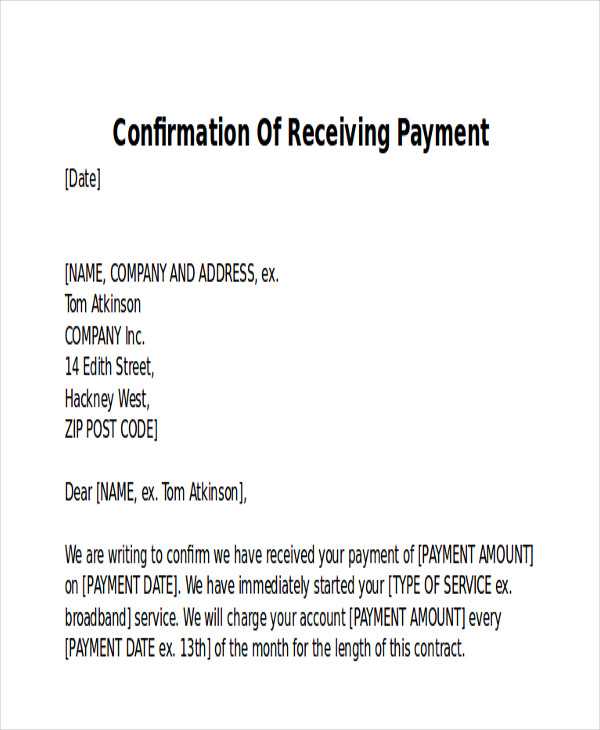

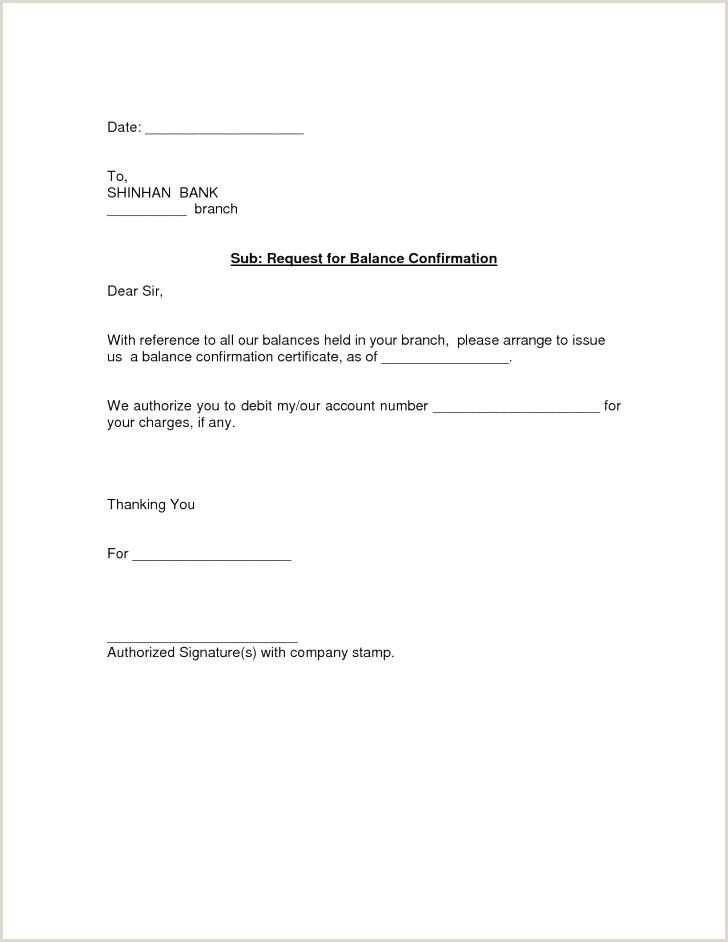

To create an effective accounts receivable confirmation letter, start by addressing the recipient clearly. Include a specific subject line such as “Accounts Receivable Confirmation Request for [Invoice Number].” Ensure you mention the invoice number, the total amount due, and the payment terms. For clarity, list the due date and any relevant contact information.

Formatting the letter starts with a polite and direct tone. Clearly request the recipient to confirm the accuracy of the balance owed. If there are discrepancies, ask them to inform you as soon as possible, outlining the steps they should take to address any inconsistencies. Always provide a deadline for response to keep the process on track.

Key details to include are the invoice number, the total amount due, the date of the original invoice, and the due date. Also, note the payment methods accepted and include a request for a response on whether the payment has been received or the balance is accurate. Make sure to state clearly how they should respond–whether by email, mail, or a phone call.

Sending the confirmation request can be done in three simple steps: first, draft a clear letter with all the necessary details; second, send it to the correct recipient, confirming the delivery method (email or mail); third, follow up with a reminder before the deadline. Always document all correspondence to avoid miscommunication.

Avoid common mistakes like vague or overly technical language. Be specific with the details of the invoice and balance owed, and never assume the recipient will know what you mean without explanation. Make sure all dates and amounts are correct to prevent confusion. Also, don’t delay sending the request or following up after the initial letter.

Best practices include double-checking all amounts and dates before sending the letter. Additionally, provide multiple ways for the recipient to respond, making it easy for them to confirm or resolve any issues. Be sure to send the letter well in advance of the due date to give the recipient enough time to address the request.

If discrepancies arise, investigate the issue quickly. Compare records and reach out to the customer directly for clarification. Document any changes made after the confirmation response to ensure consistency in your accounting records. After the issue is resolved, send a confirmation of the updated balance and any further actions required.