Arrears Letter Template for Clear and Professional Communication

When managing overdue balances, clear communication is crucial. A well-structured document requesting payment can help recover outstanding funds while maintaining professional relationships. It’s essential to convey the necessary details succinctly and assertively, prompting the recipient to take swift action without feeling alienated.

Why a Professional Approach Matters

Crafting a clear and respectful communication is key to maintaining positive business interactions. By addressing overdue payments in a direct but polite manner, you increase the likelihood of receiving prompt payments. A formal structure not only shows professionalism but also emphasizes the seriousness of the situation.

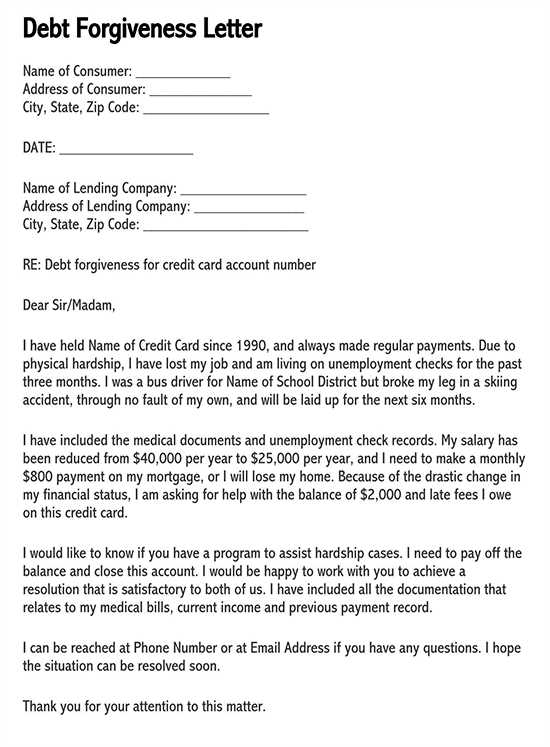

Key Information to Include

- Recipient Details: Full name, address, and contact information.

- Outstanding Amount: Specify the total sum due.

- Due Date: Clearly mention the original due date.

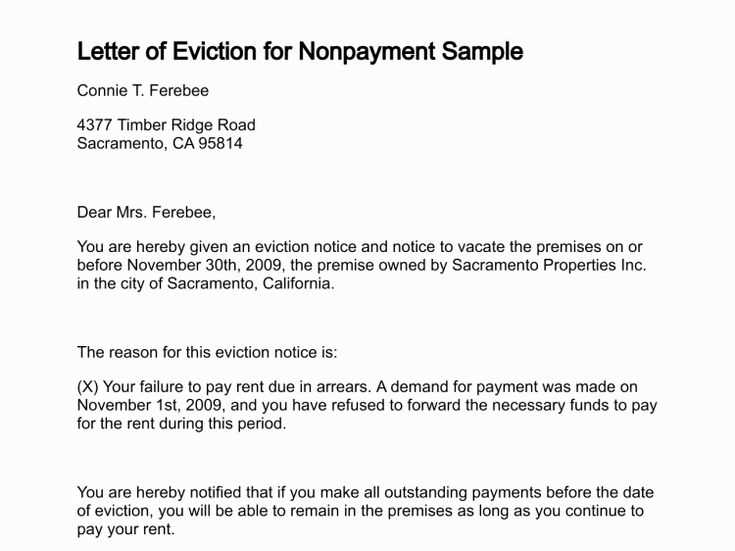

- Consequences of Non-Payment: Briefly explain the next steps if the payment is not made.

- Contact Information: Provide a way to resolve the issue, such as phone number or email address.

Best Practices for Writing a Payment Reminder

To ensure that your notice is effective, follow these guidelines:

- Stay Professional: Even if the payment is overdue, maintain a courteous tone.

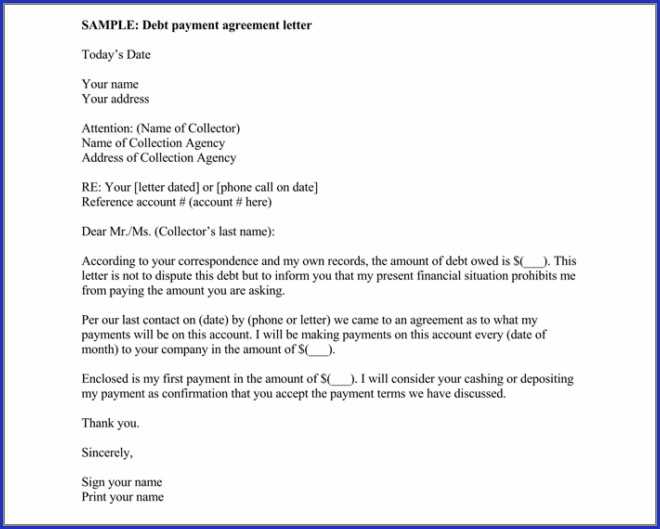

- Be Specific: Include exact dates and amounts to avoid confusion.

- Offer Solutions: Provide options for how the recipient can settle the debt.

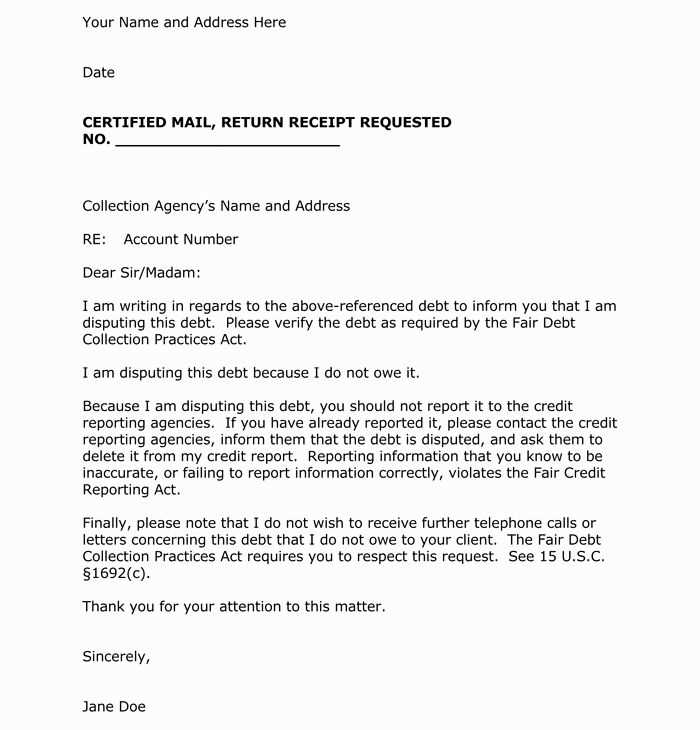

Legal Considerations in Debt Recovery Notices

While it’s important to maintain a professional tone, it’s also essential to ensure that your communication complies with legal requirements. In some jurisdictions, there are specific guidelines for how such messages should be phrased, particularly regarding late fees and interest charges. Be sure to familiarize yourself with local regulations to avoid potential issues.

Understanding the Importance of Payment Notices

Effective communication when requesting overdue payments is vital to the financial health of any business. A well-structured document can ensure that clients understand the urgency of settling their balances, without damaging the relationship. Crafting a professional and respectful notice increases the likelihood of timely payments and encourages smooth business operations.

Key Information to Include

It is essential to provide clear and concise details in any payment request. Key elements should include the total outstanding amount, the original due date, and specific instructions on how the payment can be made. Additionally, you should offer contact information for any inquiries or disputes, while also mentioning the possible consequences of failing to act promptly.

Personalizing Your Payment Request

Personalization is key to maintaining professionalism and ensuring the recipient feels valued. Use the client’s name and reference specific agreements or services provided to reinforce the importance of the outstanding payment. A personalized touch can encourage quicker resolution and avoid feelings of impersonal treatment.

Best Practices for Effective Debt Communication

When drafting a payment request, it’s crucial to strike the right balance between being firm and respectful. Keep the tone professional and direct, but also polite. Highlight any potential issues or penalties for continued non-payment, while ensuring that you offer solutions or flexible payment options. Clear communication improves the chances of the matter being resolved swiftly.

Avoiding Common Mistakes

When requesting payment, avoid vague language, excessive threats, or overly harsh wording. Such approaches can lead to unnecessary conflict. Instead, focus on clear and precise terms, outlining exactly what is owed and when it is expected. Additionally, ensure that all contact information is accurate to avoid delays in communication.

Legal Considerations

In certain jurisdictions, there are laws governing how payment recovery notices should be phrased, particularly concerning late fees, interest rates, and repayment terms. Always ensure your communication complies with these regulations to avoid legal issues. This includes refraining from making demands that could be viewed as excessive or unlawful.

Timing of the Payment Request

Timing plays a critical role in the effectiveness of a payment request. Ideally, a notice should be sent promptly after the due date has passed, but not so soon that the recipient feels rushed. Depending on the situation, a gentle reminder after the initial due date or a more urgent message after a certain period of time may be appropriate.