Auto insurance letter of experience template

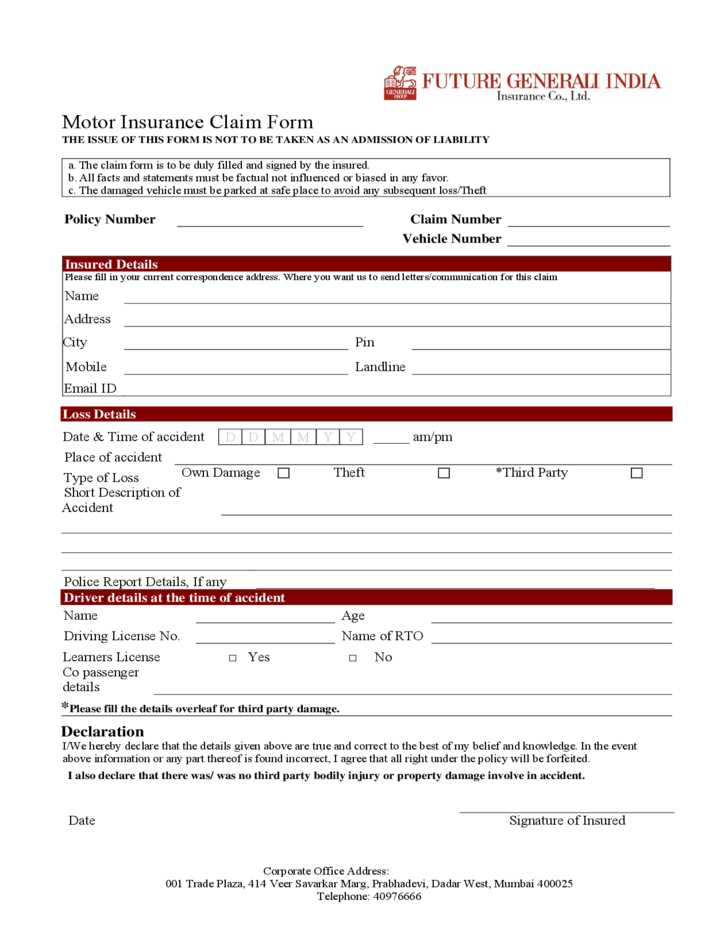

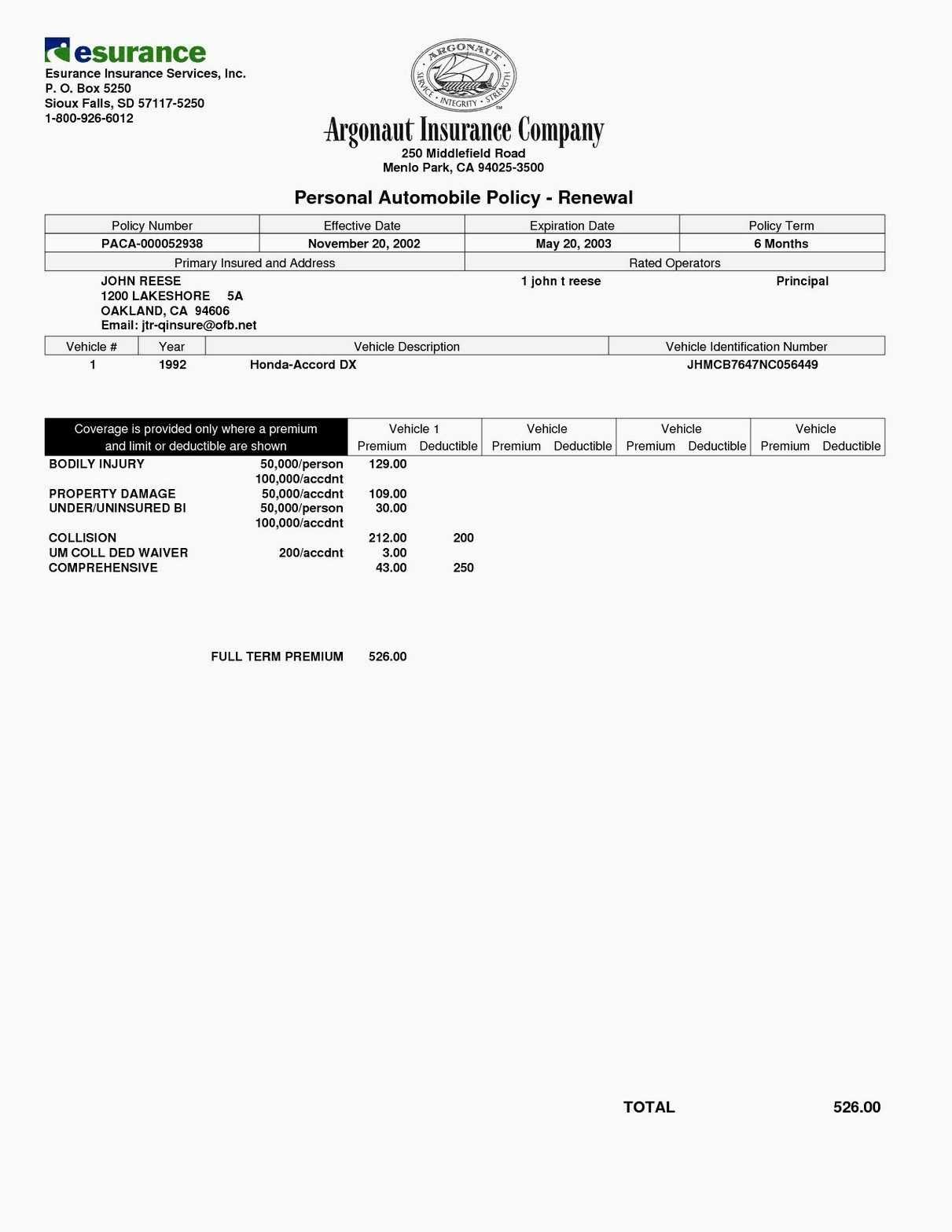

When requesting an auto insurance letter of experience, it’s key to include the right details for smooth processing. Start by clearly stating your personal information, including your full name, policy number, and contact details. This provides insurers with the information they need to locate your records quickly.

Next, include a summary of your driving history. Mention the number of years you’ve been insured, along with any claim-free periods or previous claims. Highlighting claim-free years can be a significant advantage when negotiating rates for future coverage.

Finally, ensure the letter includes a brief statement about the insurer’s verification of your experience. This reinforces the accuracy of the information and makes the letter official. An accurate, well-structured letter will streamline your dealings with insurers and ensure all details are clear.

Sure! Here’s the revised version with reduced word repetition:

To obtain an auto insurance letter of experience, follow these clear steps:

- Contact your previous insurer and request a formal letter outlining your insurance history. Provide your policy details to ensure accuracy.

- Ask the insurer to include specifics, such as policy dates, coverage types, and any claims made during the period of insurance.

- Confirm that the letter includes the insurer’s contact information and references the period of your coverage. This helps future insurers verify the details provided.

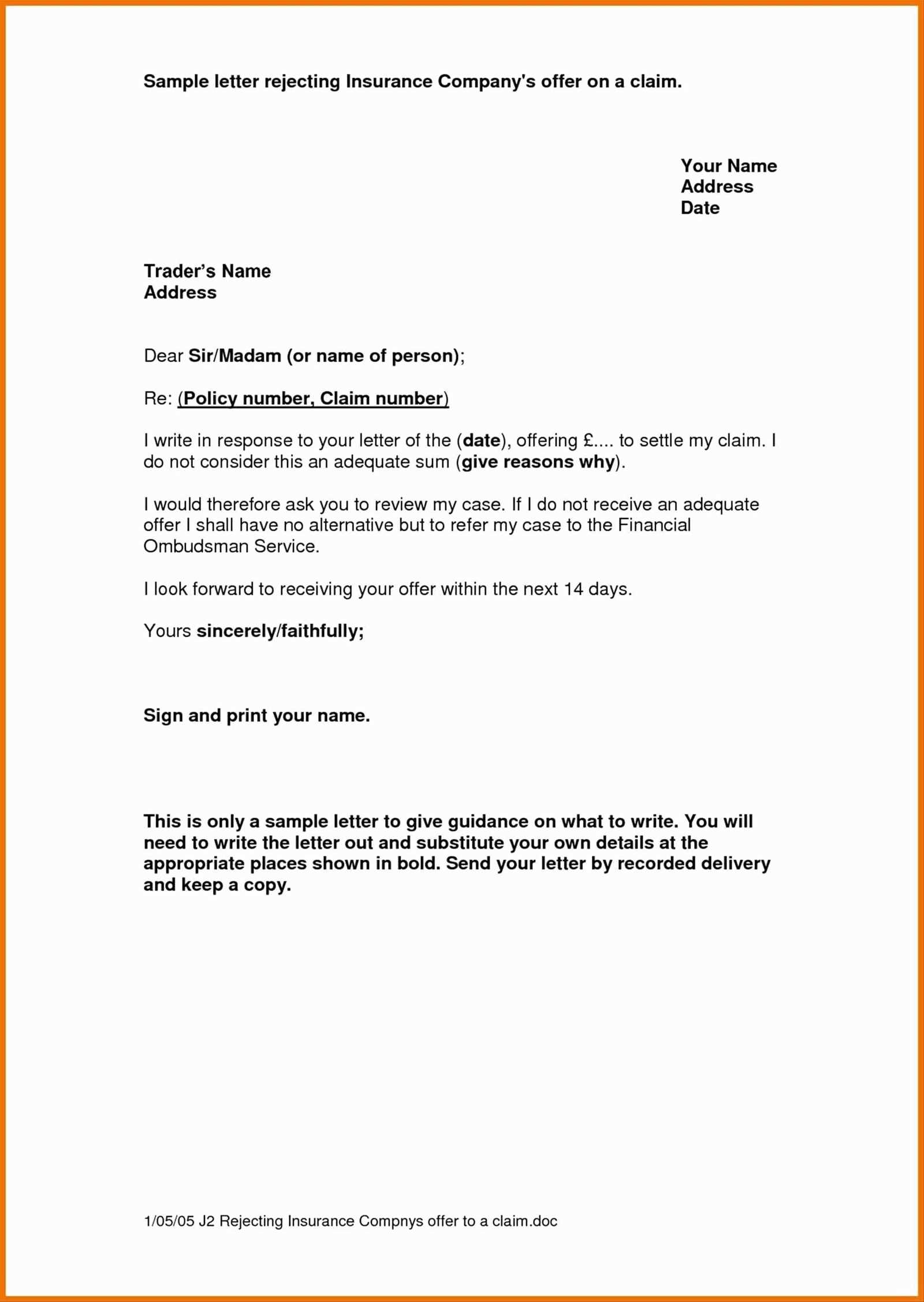

When requesting the letter, be concise and clear about your needs. Ensure that it is signed by an authorized representative to add credibility to the document. This letter serves as proof of your insurance experience, making it easier to secure new coverage.

After receiving the letter, review the details carefully for any errors. If you notice discrepancies, contact the insurer to correct them before submitting the letter to your new provider.

- How to Start Your Letter: Important Information to Include

Begin by clearly identifying your insurance company and the policyholder. Include the full name of the policyholder, the policy number, and the dates the insurance was active. This ensures the recipient knows exactly which coverage you are referring to. If applicable, add your contact details for follow-up. Additionally, mention the type of insurance, whether it’s auto, home, or another form, to avoid confusion. Keep this section concise, as it’s meant to serve as the reference point for the rest of the letter.

Ensure the letter follows a clear and organized structure. Use a professional font such as Arial or Times New Roman, sized between 10-12 points. The margins should be set at 1 inch on all sides for a clean appearance.

Start with the insurance company’s name and contact details in the top-left corner, followed by the recipient’s information on the left as well. Ensure the date is placed clearly beneath the recipient’s contact details.

When writing the content, use short, clear paragraphs. Begin with a formal salutation, followed by an introduction of the purpose of the letter. Keep the tone respectful and direct, and avoid long-winded sentences.

The letter should include specific details about the individual’s insurance history, such as policy number, coverage type, and the period of insurance. Be specific about the person’s role in the policy (e.g., policyholder or beneficiary). To make the information stand out, use bullet points or a table for clarity.

| Information Type | Details |

|---|---|

| Policy Number | 123456789 |

| Coverage Type | Comprehensive |

| Policy Duration | January 2020 – December 2023 |

End the letter with a formal closing statement, and remember to include a signature block with the sender’s name, title, and contact information. Ensure the tone remains formal and factual throughout.

Double-check the spelling and accuracy of the policy details you provide. Mistakes in policy numbers or dates can lead to delays or complications in processing the letter.

Inconsistent Formatting

Maintain a clear and uniform structure. Avoid switching between fonts, font sizes, or alignment styles. Stick to one format throughout to ensure professionalism and clarity.

Omitting Key Information

Make sure to include the insured person’s full name, policy number, and coverage period. Missing any of these crucial details can make the letter incomplete and harder to process.

Don’t forget to sign the letter. A missing signature can raise doubts about the authenticity of the document, leading to unnecessary follow-ups.

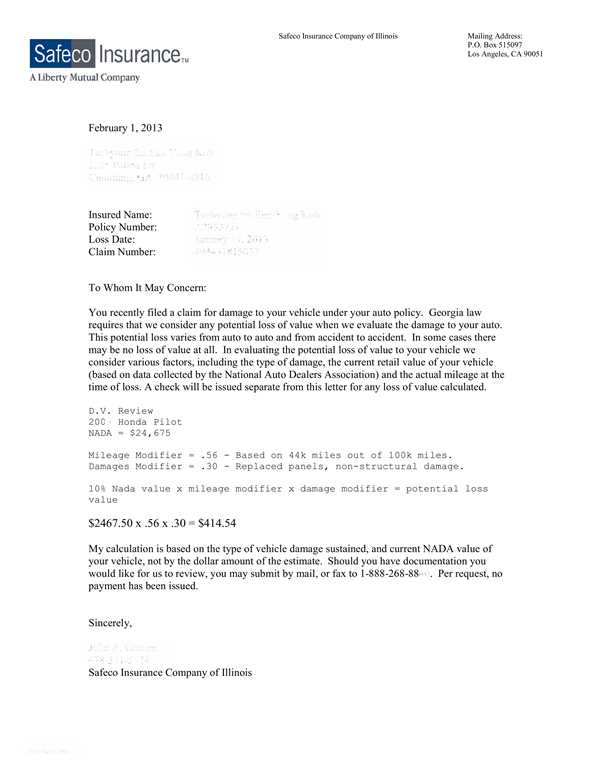

Provide a clear breakdown of the coverage types you have held throughout the policy periods. Specify whether you had liability, comprehensive, collision, or other specific types of insurance. Be precise with the dates when these coverages were active and list any significant changes in coverage levels during the term of the policy.

Coverage Explanation

Describe any special terms or exceptions related to your coverage. For example, if there were any exclusions or additional coverages like roadside assistance or rental car reimbursement, mention them. This ensures the recipient understands the extent of your protection during the coverage periods.

Claims History Overview

Provide a concise summary of your claims history, specifying each incident, the date, and the outcome. For each claim, include the type of claim (e.g., collision, theft, weather damage) and whether it was settled. If a claim was paid out, provide the amount. If there were any instances of denied claims, briefly explain the reason for denial.

Each insurance provider may require different details or formats in your letter of experience. Start by reviewing their specific guidelines, as they might request particular language or information. Customizing your template will ensure smoother communication and faster processing of your request. Follow these steps for a more targeted approach:

- Understand the Requirements: Review any instructions given by the insurer. Some providers ask for more detailed driving history, while others might focus on accident-free years.

- Modify Policy Numbers and Terms: Adjust policy details like coverage limits, premiums, and deductibles to match the insurer’s preferred format. This avoids confusion and ensures clarity.

- Check for Additional Documentation: Some insurers might request attachments such as a claims history report or a no-claim certificate. Add these documents accordingly to streamline the process.

- Use Specific Terminology: Different providers may use distinct terms. Ensure that your wording aligns with the insurer’s terminology to avoid misinterpretation.

By aligning the template with the insurance provider’s expectations, you increase the likelihood of quick approval and clear communication. Tailoring your letter is a small adjustment that makes a significant impact on the outcome.

Submit the letter as soon as you receive it from your previous insurance company. Timing is crucial to ensure that your new provider can access your full driving history without delays. Waiting too long may result in lapses in coverage or higher premiums.

After submission, your new insurer will review the letter and may request additional documents or clarification. Expect a follow-up, typically within 7-10 business days, to finalize your policy details. During this time, stay in touch with the insurer to address any questions they may have.

What to anticipate: Once everything is processed, you will receive confirmation of your new coverage. Ensure that all information is accurate, as discrepancies could affect your claim eligibility or policy terms.

When drafting an auto insurance letter of experience, provide a clear record of your history with insurance providers. Start with your policy number and the time period during which the policy was active. Mention the make and model of the vehicle covered and the policy type (e.g., liability, comprehensive). Be concise but thorough to ensure the recipient understands the coverage details.

Key Details to Include

Include the following in your letter:

- Policy Number: Clearly state the number associated with the insurance policy.

- Coverage Period: Indicate the start and end dates of your coverage.

- Claims History: Mention if there were any claims made during this time.

- Vehicle Information: List the vehicle(s) insured under the policy.

- Insurance Provider: Include the name of the insurer and contact information if possible.

Formatting Tips

Make sure to organize the information in a structured format for clarity. Keep the letter formal but straightforward. Avoid irrelevant details and focus only on the data that pertains to your experience. This will ensure the letter is useful for the reader.