Effective Bank Charges Letter Template for Disputing Fees

When unexpected fees appear on your financial statement, it can be frustrating and difficult to know how to address the issue. Whether the costs are incorrect or unreasonable, it is essential to approach the situation with a well-structured request. Crafting a clear and concise message to the relevant institution is the first step toward resolving the matter efficiently.

In this guide, we will explore how to communicate effectively with the institution, ensuring your concerns are taken seriously. You will learn the key elements to include, how to present your case professionally, and what to expect after submitting your inquiry. A well-written request can significantly increase the chances of a swift and favorable outcome, saving both time and resources.

How to Craft an Effective Request

When you need to dispute an unjust fee, having a clear and well-organized message can make all the difference. The goal is to express your concern in a way that is straightforward, professional, and likely to lead to a favorable response. A well-written request helps the recipient understand your issue quickly, increasing the chances of resolving it efficiently.

Key Elements of a Successful Communication

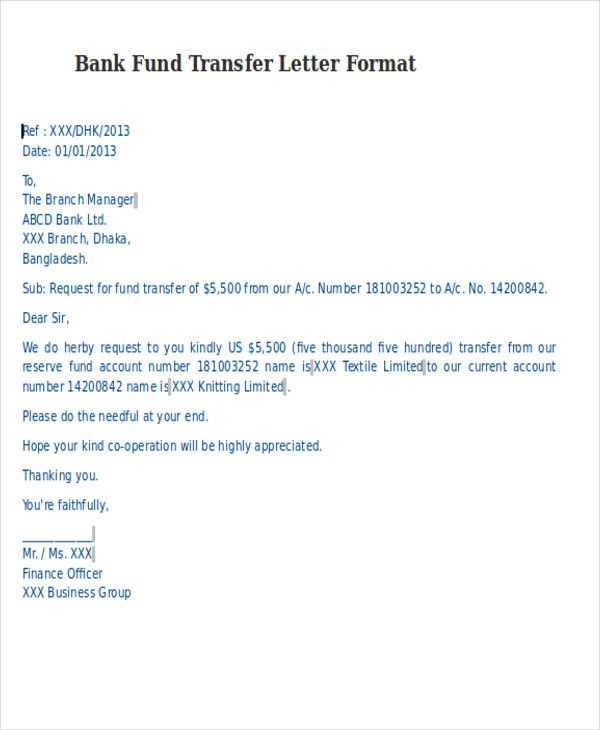

In any request, clarity is essential. Start by clearly stating the reason for your contact and providing any relevant details that support your claim. Include dates, amounts, and any specific terms that are important to your case. Being specific helps ensure that the recipient understands exactly what you are disputing, without leaving room for confusion.

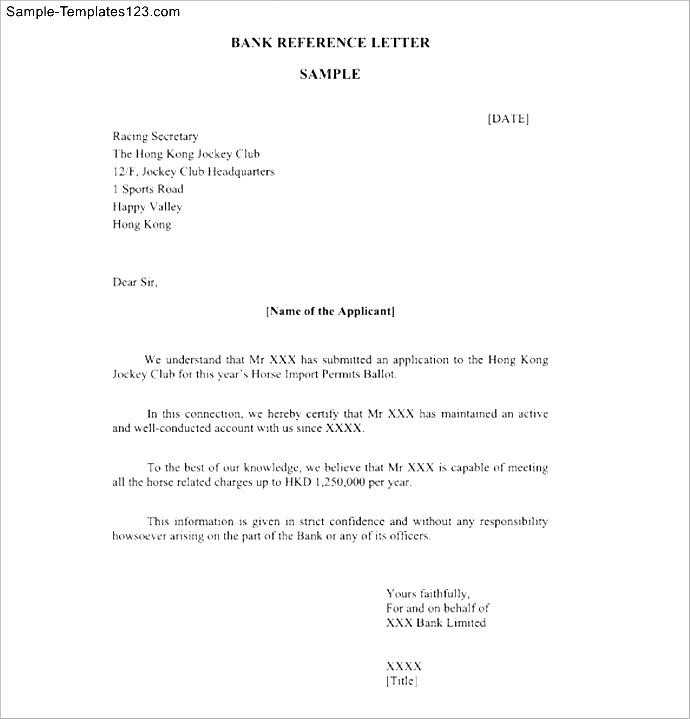

Professional Tone and Language

Maintaining a polite and respectful tone is crucial. Even if you are upset, approaching the matter with professionalism will increase the likelihood that your concern is taken seriously. Avoid using emotional language and focus on the facts to keep the communication productive.

Writing a Clear Request

When addressing an issue related to an unexpected or incorrect fee, clarity is key. A well-structured request should outline the problem succinctly while providing all the necessary details to help the recipient understand the situation. A clear message not only facilitates a quicker response but also increases the chances of resolving the issue favorably.

Steps to Writing a Clear Message

Follow these steps to ensure your request is clear and effective:

- Start with a clear subject: Make sure the purpose of your communication is immediately apparent.

- State the issue directly: Briefly explain the problem without unnecessary details.

- Provide supporting information: Include relevant dates, amounts, and any documentation that supports your claim.

- Request a specific resolution: Be clear about what outcome you are expecting and why it is reasonable.

Things to Avoid in Your Request

To make sure your message remains effective, avoid the following common pitfalls:

- Avoid vague language: Be specific about the issue and your expectations.

- Do not include emotional language: Keep the tone professional and factual.

- Skip unnecessary details: Only provide relevant information to keep the message focused.

Common Errors to Avoid in Your Letter

When crafting a request to resolve an issue with a fee, certain mistakes can hinder your chances of a positive outcome. It’s important to ensure that your communication is clear, focused, and professional. Avoiding common errors can help streamline the process and improve the likelihood of a favorable response.

One of the most frequent mistakes is failing to provide enough detail or context. A vague or incomplete request can leave the recipient unsure of the exact issue, making it harder for them to address your concern. Additionally, using overly emotional or accusatory language can alienate the recipient, making them less inclined to resolve the matter quickly.

Other errors include poor organization of the content, which can make the message harder to follow, and neglecting to follow up if necessary. A well-structured request that includes all pertinent details and a professional tone can greatly improve your chances of a successful resolution.

Key Details to Include in Your Request

To ensure your communication is effective and increases the chances of a positive response, it’s crucial to include all relevant information. A clear, concise request with the right details will help the recipient understand your issue and take appropriate action. Missing key information can lead to delays or misunderstandings.

Start by providing your account number or any unique reference that can easily identify your transaction. This will help the recipient locate the relevant records quickly. Additionally, be sure to mention the date when the issue occurred and specify the amount that you are disputing. Including this information makes your request more straightforward and reduces the need for back-and-forth communication.

It’s also important to clearly explain the reason why you believe the fee is incorrect or unjust. Mention any relevant terms or conditions that apply to your situation. If applicable, provide supporting documentation, such as screenshots or receipts, to reinforce your case. This ensures that your request is backed up with solid evidence and can be addressed more effectively.

How to Submit the Letter to the Institution

Once you have drafted a clear and concise request, the next step is to send it to the relevant institution. The submission process may vary depending on the institution’s preferences, but understanding your options will help you choose the most efficient method. Choosing the right submission method ensures that your inquiry is received and processed promptly.

Submission Methods

There are typically several ways to submit your communication, each with its own advantages:

| Method | Advantages |

|---|---|

| Online Submission Form | Fast and often results in quicker response times. |

| Convenient and allows for easy tracking of your message. | |

| Postal Mail | Provides a physical record of your request. |

| Phone Call | Allows for direct communication, which may expedite the process. |

Things to Keep in Mind

Regardless of the method you choose, it’s important to retain proof of submission. For digital methods, ensure you keep a copy of your email or online submission confirmation. If you’re mailing a physical document, consider sending it via registered mail to ensure it arrives safely and you receive a confirmation of receipt.

What Happens After Sending Your Letter

Once your communication has been sent, the next step is to wait for a response. Depending on the method of submission and the complexity of the issue, the institution may take different amounts of time to review and respond. Understanding what typically happens after your submission can help you know what to expect during this waiting period.

After receiving your request, the recipient will usually acknowledge the inquiry and begin their review process. They may assess the details you provided, check relevant records, and determine if further information is needed. In some cases, they may contact you directly for clarification or to request additional documents. If the issue is straightforward, they might resolve it without further back-and-forth.

It’s important to monitor your communication channels for updates, whether through email, phone calls, or postal mail. If you don’t receive a response within a reasonable time frame, it’s appropriate to follow up to ensure your request is being processed. Keep records of all communications for reference in case further action is needed.

Other Ways to Dispute Fees

If your request for a fee adjustment or refund is not resolved through the initial communication, there are other avenues you can pursue to dispute the fees. These options provide additional ways to address your concerns and potentially reach a resolution.

Alternative Dispute Methods

- Escalating the Issue to a Supervisor: If the initial representative cannot assist you, ask to speak with a supervisor or manager who may have more authority to handle your request.

- Filing a Formal Complaint: Many institutions have a formal complaints process in place. By following this process, you can ensure that your issue is addressed at a higher level within the organization.

- Contacting a Consumer Protection Agency: In some cases, a consumer protection agency may offer guidance or intervene on your behalf if you feel the institution is not responding fairly to your complaint.

- Seeking Legal Advice: If all else fails, you might consider consulting a legal professional to explore your rights and options for taking legal action if the issue is unresolved.

While these options may take additional time and effort, they are important alternatives when your initial request does not lead to a satisfactory outcome. Be sure to keep records of all communications throughout the process for reference and support.