Bank comfort letter template

A bank comfort letter template serves as a tool to reassure one party in a transaction about the financial reliability of another party. The template usually outlines the bank’s confirmation of a customer’s financial standing, which can help facilitate business agreements or loans. Crafting an effective letter requires clear details, as it should establish trust without excessive elaboration.

The format typically includes the bank’s official letterhead, a formal statement confirming the customer’s financial capability, and specific information about the agreement or transaction. Make sure to include the name of the customer, the nature of the transaction, and any financial conditions relevant to the situation. The bank should also provide details about the credit facilities or financial backing available to the customer to support the transaction.

While each bank may have its own variations, a template should ensure the letter maintains a professional tone, with the necessary legal disclaimers or limitations about the bank’s responsibility. This is important for avoiding misunderstandings and ensuring that all parties know what the letter does and does not guarantee. Keep the content concise yet specific enough to assure the recipient of the financial reliability of the customer.

Here’s a detailed HTML plan for an informational article on the topic “Bank Comfort Letter Template” with six specific and practical headings:

A Bank Comfort Letter (BCL) is a document issued by a bank to confirm the financial stability or capability of its client. It is typically used to support business transactions or financing deals where reassurance about the client’s financial position is required. Below is a detailed guide on structuring and creating an effective Bank Comfort Letter template.

1. Purpose of a Bank Comfort Letter

The primary purpose of a Bank Comfort Letter is to provide assurance to a third party about the financial reliability of the client. It can serve various functions, such as confirming the availability of funds for a specific transaction or offering proof of financial standing for a loan application or contractual agreement.

2. Key Elements of a Bank Comfort Letter

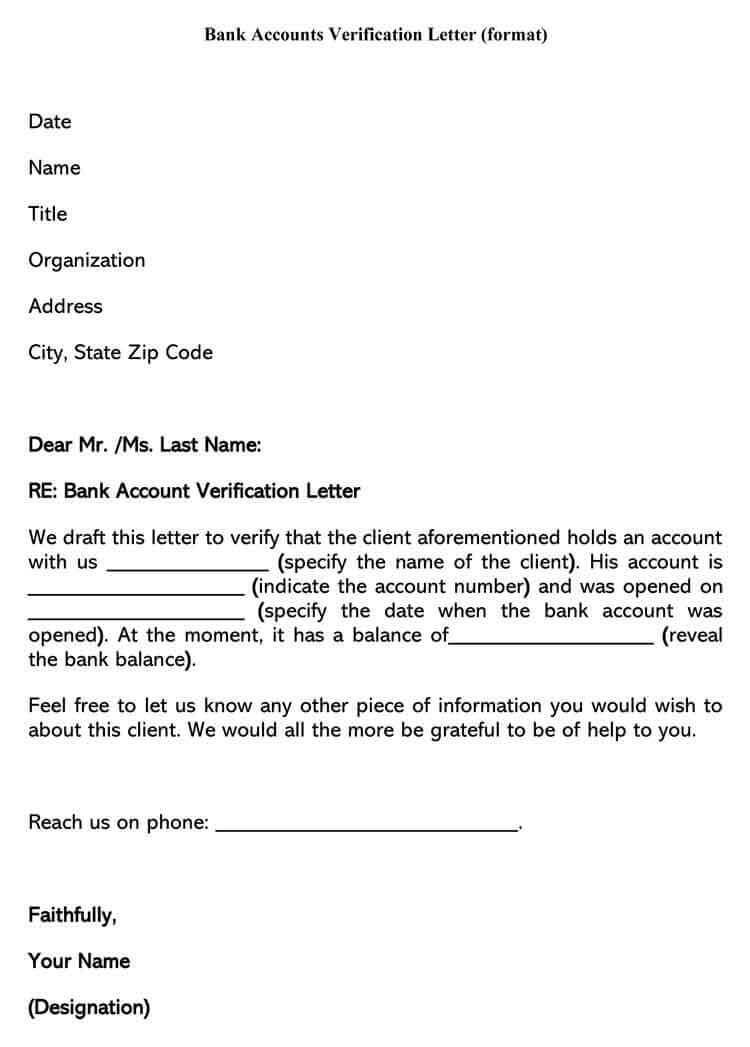

A Bank Comfort Letter typically includes the following key details:

– The name and address of the bank issuing the letter

– A statement about the client’s financial standing

– Confirmation of the client’s ability to meet specific financial obligations

– Any limitations or conditions attached to the letter

– The duration or validity of the letter

These elements are critical to ensure the letter is recognized and trusted by recipients.

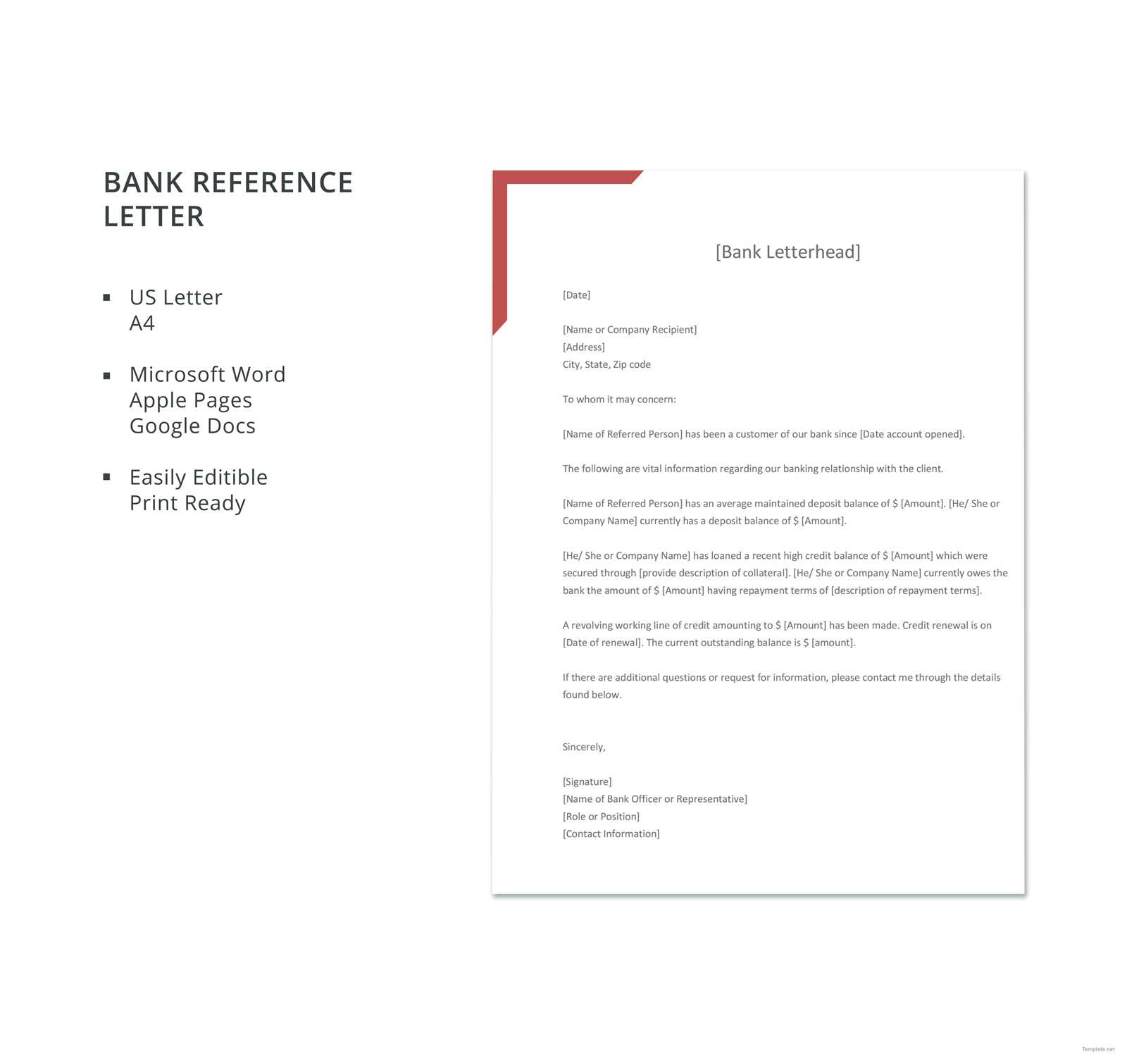

3. How to Format a Bank Comfort Letter

The format should be formal and professional. Begin with the bank’s letterhead, followed by the date, recipient’s name, and address. Include a clear subject line stating “Bank Comfort Letter”. The body should consist of a brief introduction, a statement of the client’s financial position, and a conclusion offering additional details if required. Finish with the bank’s signature and seal.

4. Common Uses of a Bank Comfort Letter

Bank Comfort Letters are widely used in international trade, real estate transactions, and corporate mergers. They can also be essential in securing financing for major projects or investments. Companies often request them from their banks to demonstrate their financial reliability when negotiating deals or entering new markets.

5. Differences Between a Bank Comfort Letter and a Bank Guarantee

While both documents offer financial reassurance, a Bank Guarantee typically involves a commitment from the bank to pay a specified sum if the client defaults. In contrast, a Bank Comfort Letter is more of a statement of the client’s financial status, without a direct promise of payment. Understanding this distinction can help clarify expectations in various business dealings.

6. How to Request a Bank Comfort Letter

To request a Bank Comfort Letter, clients should approach their bank with the necessary documents, such as proof of financial standing and details of the intended transaction. The bank may require an application form or formal request outlining the specifics of the letter and any conditions that must be met. It’s essential to maintain clear communication with the bank to ensure all relevant details are included in the final letter.

What is a Bank Comfort Letter?

A Bank Comfort Letter is a document issued by a bank to confirm a customer’s financial standing or to assure a third party of the client’s ability to fulfill a financial obligation. It serves as a non-binding assurance that the bank supports the client in specific transactions, usually in international trade or business agreements. This letter is commonly requested when a business needs to demonstrate financial reliability without the formal commitment of a bank guarantee.

The letter typically includes details such as the client’s name, the nature of the transaction, and the bank’s acknowledgment of the client’s financial stability. It is not a legally binding guarantee of payment but provides reassurance to the recipient that the bank is aware of the client’s financial position and is likely to support them in fulfilling contractual obligations.

Bank Comfort Letters are often used in cases where a seller requires assurance from a buyer that payment will be made or when a financial institution needs proof of funds for a loan. They are less formal than other financial instruments like letters of credit or bank guarantees but still play a crucial role in establishing trust in business transactions.

Key Elements to Include

Begin with the bank’s official name and contact details. Ensure that the address and phone number are current and correct to avoid any confusion. The letter should clearly state that it is a comfort letter, highlighting the bank’s commitment to supporting the financial transactions mentioned within the document.

Details of the Parties Involved

Specify the names and addresses of the parties involved in the transaction. This includes the bank, the beneficiary, and the applicant. Clearly identify their roles and the specific purpose of the letter to avoid ambiguity.

Amount and Purpose

State the specific financial amount covered by the letter, including any limits or conditions that apply. Clearly outline the purpose for which the letter is issued, such as guaranteeing payment for a contract or securing a loan.

Define the term of validity, which should include the start and end date, as well as any conditions under which the letter may be extended or modified.

End the letter with the bank’s authorized signature and seal to validate its authenticity. Make sure the signatory has the proper authority to issue the comfort letter.

How to Customize the Letter

To tailor a bank comfort letter for your specific needs, focus on adjusting key details like the recipient’s name, the purpose of the letter, and the financial terms. Make sure the letter reflects the specific transaction or arrangement it is meant to support.

Adjust Key Details

Begin by editing the header with the correct bank’s name and address. Replace generic placeholders with the recipient’s full name and title. Specify the precise terms of the financial guarantee, including amounts, dates, and any relevant conditions that align with the agreement between the bank and the beneficiary.

Clarify the Intent

Ensure that the letter clearly states its purpose. Whether it is for securing a loan, confirming a deposit, or other specific services, the intention should be unambiguous. Tailor the wording to match the requirements of the transaction and remove any vague language.

Lastly, ensure the tone of the letter remains formal but friendly, focusing on professionalism while maintaining clarity. The customization should always align with the unique aspects of the agreement.

When to Use a Comfort Letter

Use a comfort letter when you need to reassure third parties about the financial stability or performance of a company without making any legal promises. It’s commonly used in transactions involving lending, joint ventures, or new business partnerships. If you’re securing a loan or forming a partnership, a comfort letter from a bank can enhance credibility and support your negotiation process. It can also be helpful when you need to confirm a company’s ability to meet obligations, without directly guaranteeing them.

Consider using a comfort letter in situations where the third party is seeking assurance about your financial standing but is unwilling to accept the level of risk associated with a direct guarantee. It’s ideal when you want to signal trust and commitment but within limits that don’t involve a binding financial guarantee.

Legal and Financial Implications

Before using a bank comfort letter, carefully assess the legal and financial implications to ensure smooth transactions and avoid complications. A bank comfort letter serves as a formal guarantee, providing assurance to third parties that the applicant has the financial ability to meet specific obligations. However, it does not provide a guarantee for repayment, making its scope limited.

Legal Risks

Legal risks arise if the bank’s language in the letter is not clear. Ambiguities can lead to misunderstandings or misinterpretations of the obligations. Ensure that the terms and conditions are precise and well-documented. Consult legal counsel to verify the contract terms align with the intended purpose of the comfort letter and the applicable jurisdiction laws.

Financial Implications

Financially, the bank may impose fees for issuing a comfort letter. These costs can vary based on the bank, the transaction’s size, and the complexity involved. It is crucial to review these fees upfront and assess their impact on the overall cost of the transaction.

| Fee Type | Example Percentage | Possible Additional Costs |

|---|---|---|

| Issuance Fee | 0.5% – 2% | Processing and Administrative Costs |

| Renewal Fee | 0.25% – 1% | Ongoing Monitoring Fees |

Consider these costs and ensure that the bank’s comfort letter aligns with the financial arrangements of the transaction. Be prepared for additional financial obligations, such as penalties for late payments or breach of conditions, which can add to the cost of the letter’s use.

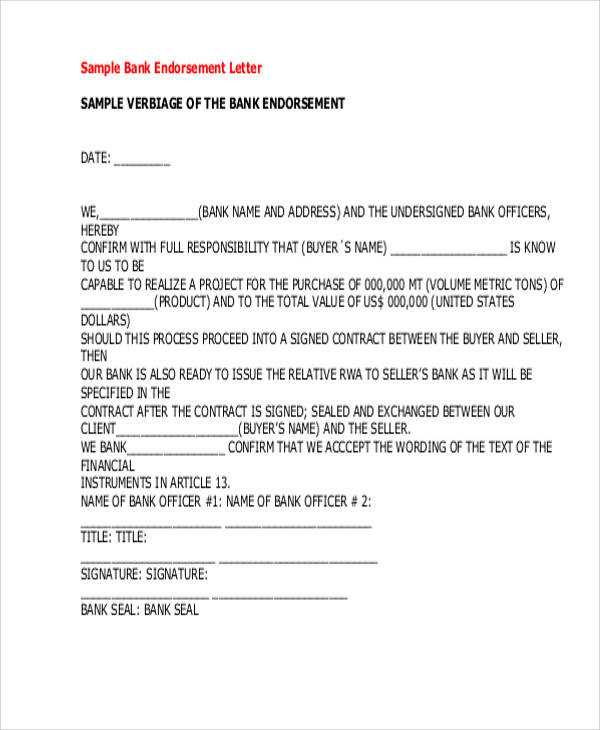

Common Mistakes to Avoid

One common mistake is not clearly stating the exact amount of credit or financial support covered by the letter. Ensure that the monetary value is specified in both words and figures to avoid confusion.

Another issue arises when the letter lacks a specific expiration date. It’s vital to indicate a clear time frame for the comfort letter’s validity, so the parties involved understand the terms and conditions.

Make sure that all signatories are authorized to issue such letters. Failing to confirm this can lead to invalid documents, causing delays or rejection by the recipient institution.

Avoid vague language or ambiguous terms. Ensure the letter is direct and contains precise terms, such as the purpose of the guarantee and the specific conditions under which it applies.

Misleading Statements

- Do not imply an unlimited guarantee when the coverage is capped.

- Avoid statements suggesting unconditional support without outlining the specific conditions for release of funds.

Lack of Proper Formatting

- Ensure the letter follows a formal structure with headings, proper signatures, and a clear outline of terms.

- Double-check for correct contact details of the issuing bank and recipient.