How to Use a Bank Confirmation Letter Template

When dealing with financial matters, formal communication is essential. A well-structured document plays a crucial role in verifying transactions or relationships between parties. It ensures that the information is clear, accurate, and professionally presented, making it easier for recipients to process and understand the details provided. This type of correspondence serves as a formal request for confirmation of account status or financial dealings, which is often required for various business and personal purposes.

Crafting an effective document involves careful attention to detail. It is important to convey all necessary information in a concise and direct manner while maintaining a professional tone. The content must be tailored to suit the specific requirements of the request, whether it’s confirming balances, account ownership, or the nature of transactions.

By following a few key guidelines, you can create a document that not only serves its purpose but also enhances the credibility and professionalism of your communication. The right format ensures that both parties are on the same page, reducing the likelihood of misunderstandings or delays.

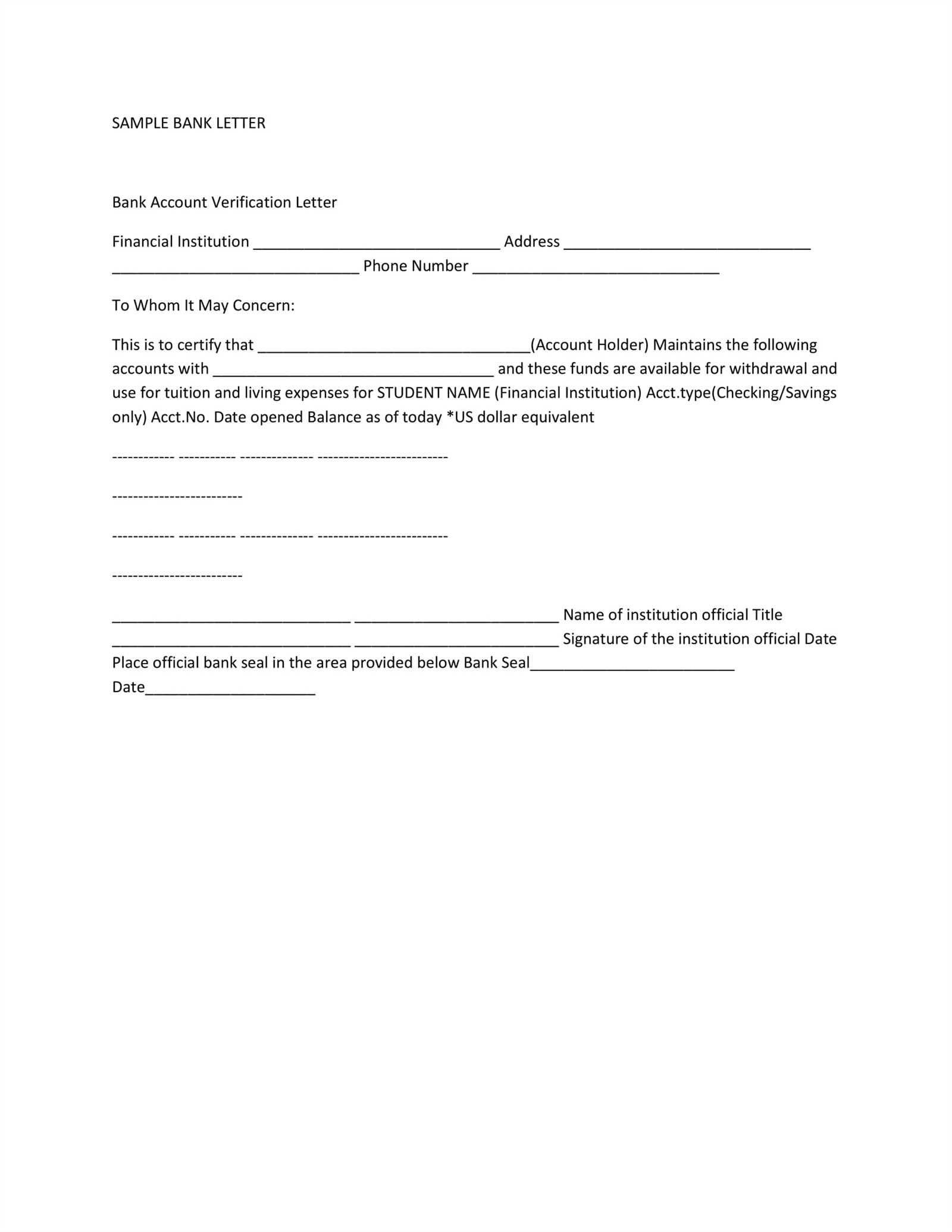

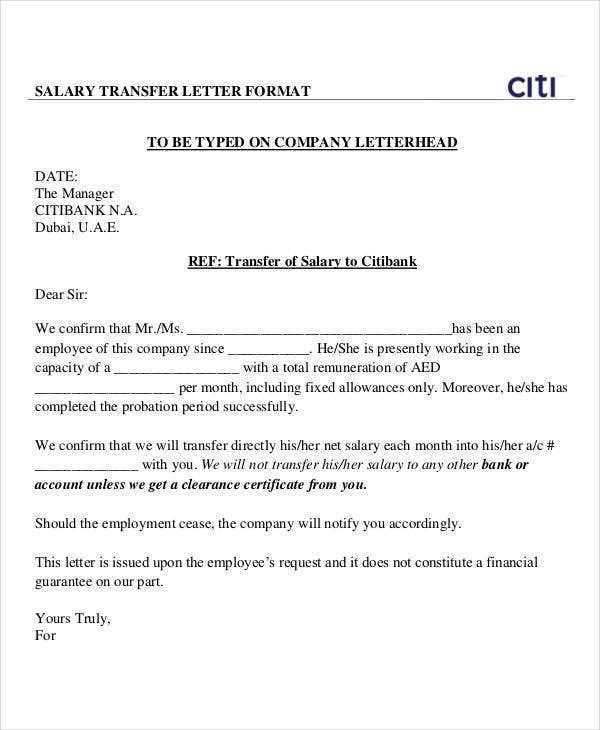

Essential Elements of a Financial Verification Document

When creating a formal document to request financial validation, several crucial elements must be included to ensure clarity and professionalism. These components help establish trust between the parties involved and provide the necessary details to complete the verification process effectively.

Key Components to Include

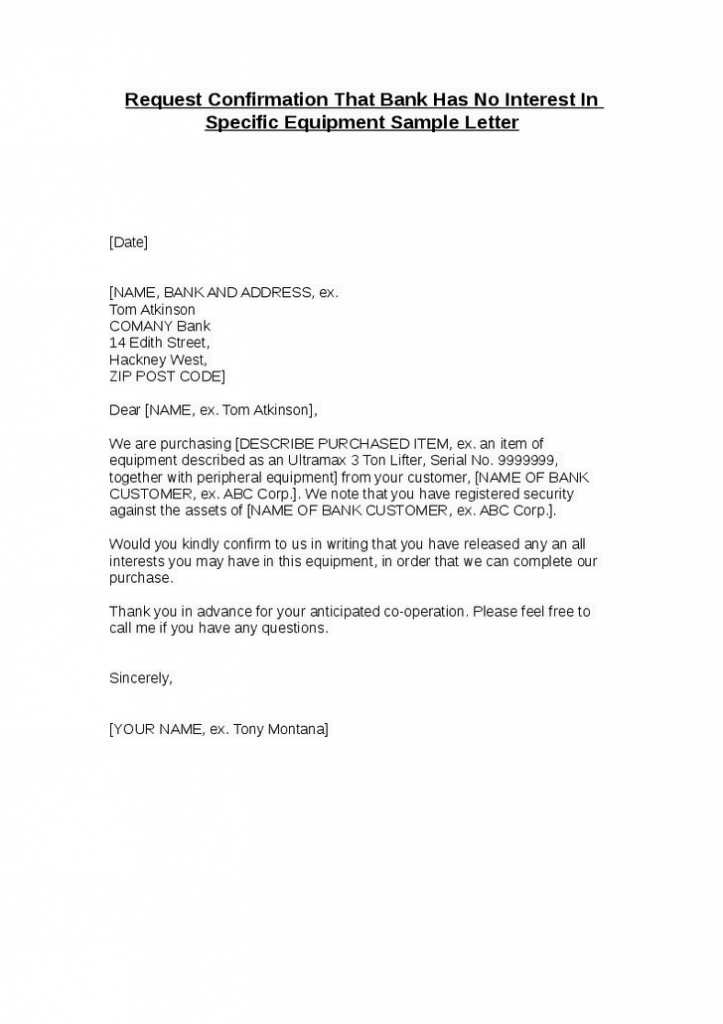

- Header Information: This includes the name of the requesting party, recipient details, and contact information for both sides.

- Subject and Purpose: Clearly state the intent of the document, outlining the reason for the request and the type of information needed.

- Specific Requests: Be precise about the details you seek to verify, such as account balance, ownership status, or transaction history.

- Signature Section: A space for the sender’s signature or an authorized representative to confirm the authenticity of the request.

Additional Considerations

- Professional Tone: Maintain a respectful and formal tone throughout the communication.

- Clear Formatting: Use bullet points, headings, and short paragraphs to improve readability and organization.

- Document Length: Keep the content concise while ensuring all necessary information is conveyed.

Including these essential elements helps ensure the document is well-received and meets the expectations of the recipient. Properly formatted and detailed communication strengthens the credibility of the request and facilitates the timely processing of the verification.

Designing an Effective Template

Creating an efficient framework for formal financial requests is key to ensuring smooth and accurate communication. A well-designed structure allows for easy customization, enabling users to quickly adjust the content for specific needs. Whether it’s for confirming account status or requesting transaction details, the format plays a crucial role in delivering clear and professional information.

Important Aspects to Consider

The design should prioritize clarity and ease of use. A logical flow ensures that the recipient can quickly understand the request and provide the necessary information. Key sections like sender and recipient details, request purpose, and specific inquiries should be clearly organized.

Elements to Include in the Design

| Section | Description |

|---|---|

| Header | Includes the sender’s contact information and the recipient’s name and address. |

| Introduction | Briefly explains the purpose of the document and what information is being requested. |

| Details Section | Contains specific data to be verified, such as account balances, ownership, or transactions. |

| Conclusion | Reaffirms the purpose of the document and includes a space for a signature or other finalization. |

By structuring the document with these elements in mind, you create a flexible and effective tool for various financial communication needs. The streamlined approach ensures the document can be tailored to different contexts while maintaining professionalism and clarity.

Key Information to Include in Letters

When preparing formal communications with financial institutions, certain details are essential to ensure clarity and accuracy. It’s important to present precise information in an organized manner to avoid confusion or delays. The inclusion of specific elements helps establish the purpose of the communication and provides the recipient with everything needed for prompt processing.

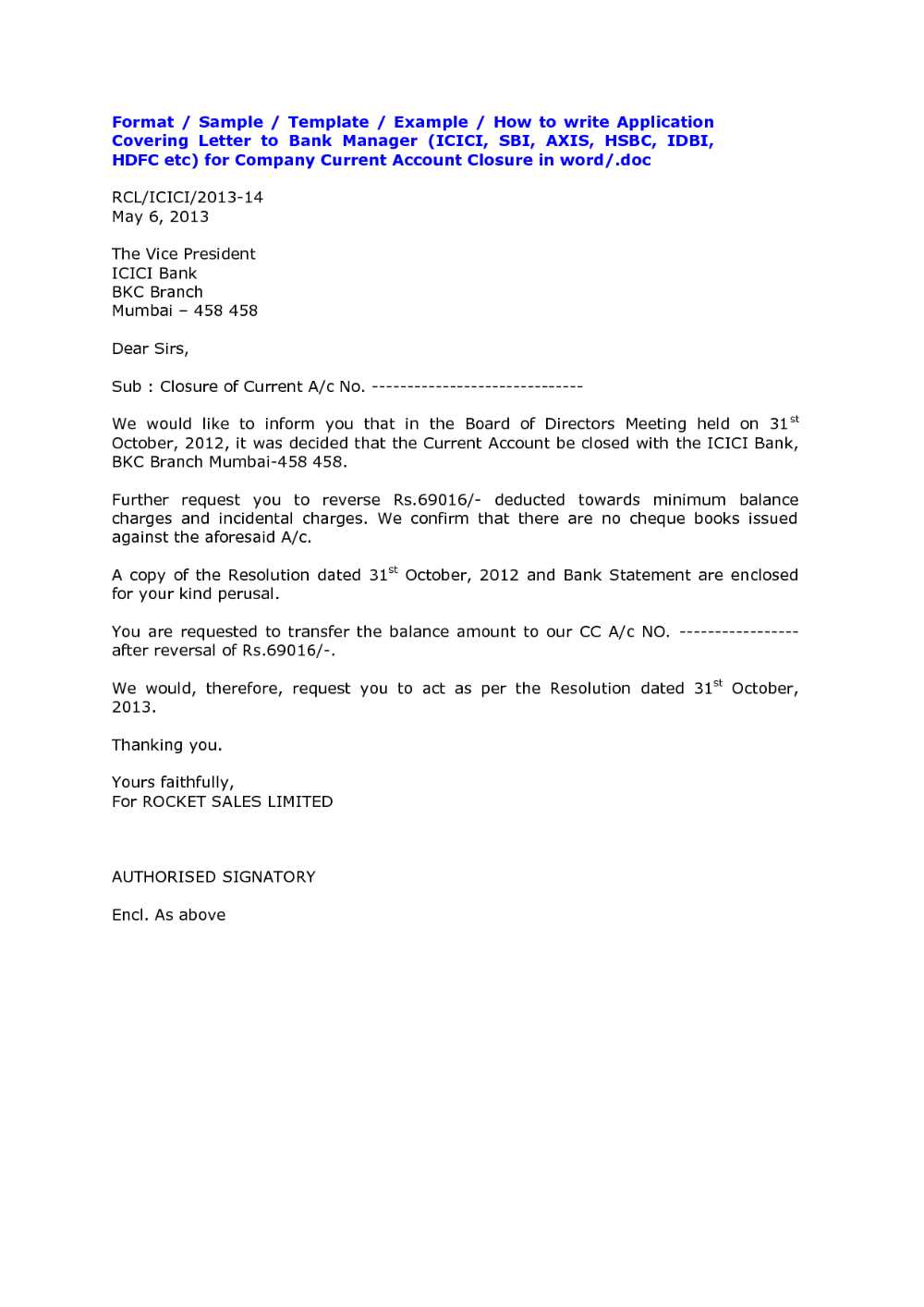

Essential Details to Specify

Start by addressing the institution clearly and include necessary identification numbers or account references. This establishes the context right from the beginning. Next, outline the main request or purpose of the communication. Being straightforward with your intent helps streamline the response process. Additionally, ensure that you mention any timeframes or deadlines that are relevant to the matter.

Supporting Information

Incorporating supporting data such as account statements, transaction histories, or relevant documentation is often crucial. These supplementary details provide further context and aid in verifying the request. Furthermore, don’t forget to include contact information to facilitate further communication if needed.

Step-by-Step Guide for Creation

Creating a formal document to verify financial information involves a series of clear steps. This process ensures that all essential details are accurately presented, serving the purpose of providing legitimacy and confirming the necessary facts to the requesting party.

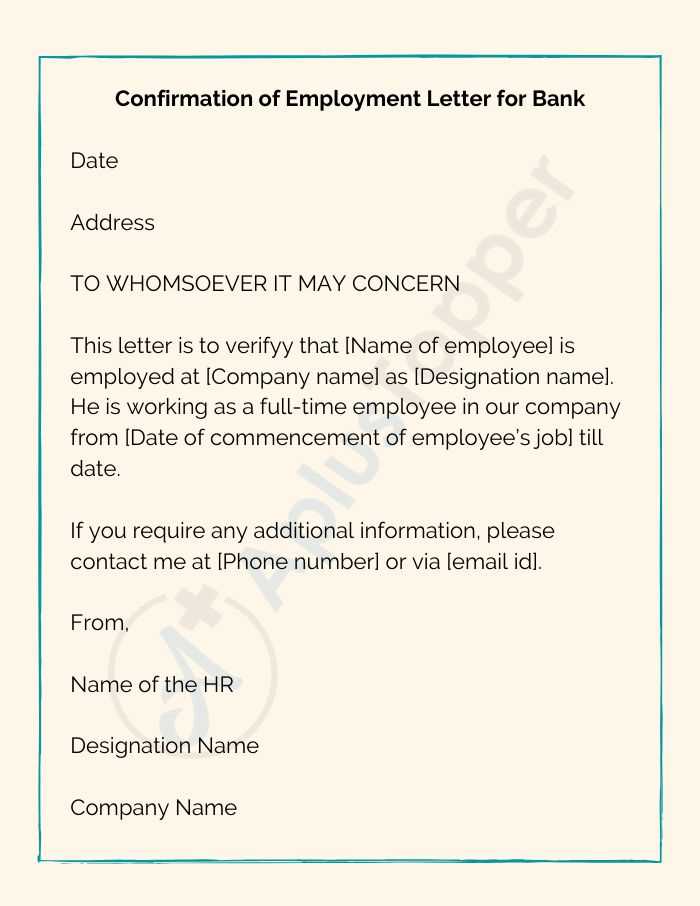

Begin with Essential Details

The first step is to collect the critical information that needs to be included. This typically consists of the name of the entity, contact details, specific financial data, and a statement of authenticity. Ensure that these elements are clearly identified and placed at the beginning of the document.

Structure the Document for Clarity

The next phase is organizing the content in a way that is easy to follow. This includes drafting an introduction to the document, outlining the verification request, and providing a clear conclusion that states the confirmation. The structure should be formal, precise, and consistent throughout.

Common Mistakes to Avoid in Templates

When preparing official documents, certain errors can compromise their professionalism and accuracy. It’s important to be mindful of these common pitfalls to ensure that the document is both clear and valid for its intended purpose. Below are some critical mistakes to avoid during the drafting process.

Omitting Essential Information

Leaving out key details, such as the correct contact information or required financial facts, can lead to confusion or render the document ineffective. Ensure all necessary elements are included and properly formatted.

Using Informal Language or Tone

Adopting a casual tone in a formal document is a significant mistake. The language should remain professional and direct, avoiding slang or overly complex terms that could detract from the document’s credibility.

Best Practices for Customizing Content

Tailoring your document to fit specific needs is crucial for ensuring it meets expectations and serves its intended purpose. Personalizing content enhances relevance and clarity, providing a more effective communication tool. Below are some best practices to follow when adapting your material.

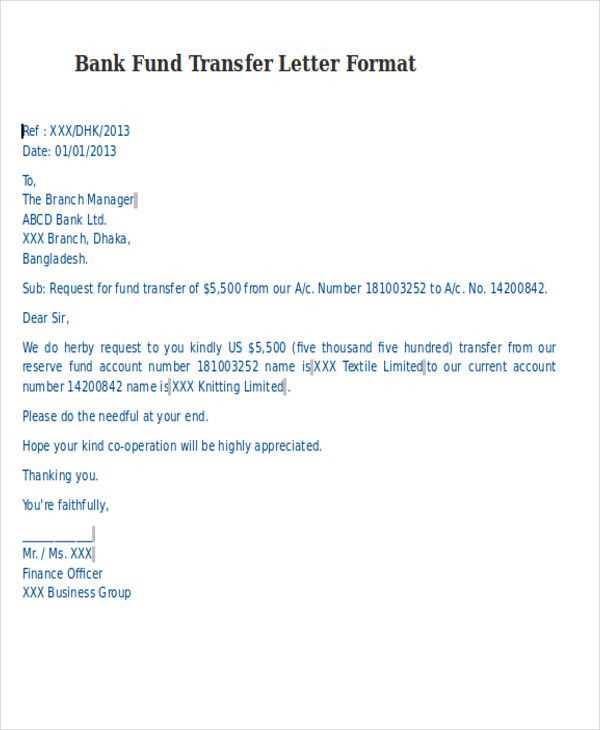

- Maintain a Clear Focus: Ensure the content is focused on the key information required, leaving out unnecessary details. This keeps the message concise and to the point.

- Adjust Tone and Language: Adapt the tone to match the recipient’s expectations, whether it’s formal or semi-formal. This ensures that the document aligns with its intended context.

- Include Relevant Data: Always customize the document with specific and accurate information, such as dates, names, and amounts, to avoid generalizations.

- Ensure Consistent Formatting: Keep the formatting uniform throughout the document. This includes font size, headings, and spacing to create a professional appearance.

- Personalize the Closing: The conclusion should be tailored to the recipient, expressing gratitude or confirming next steps, depending on the context.