Bank Gift Letter Template for Easy Customization

When receiving financial assistance from a third party, it is often necessary to provide clear and formal documentation to ensure transparency and proper record-keeping. This document serves as an official acknowledgment of the transfer of funds, outlining the terms and intentions behind the financial contribution. It is particularly important in situations where such contributions are intended for specific purposes, such as supporting a major transaction or loan approval process.

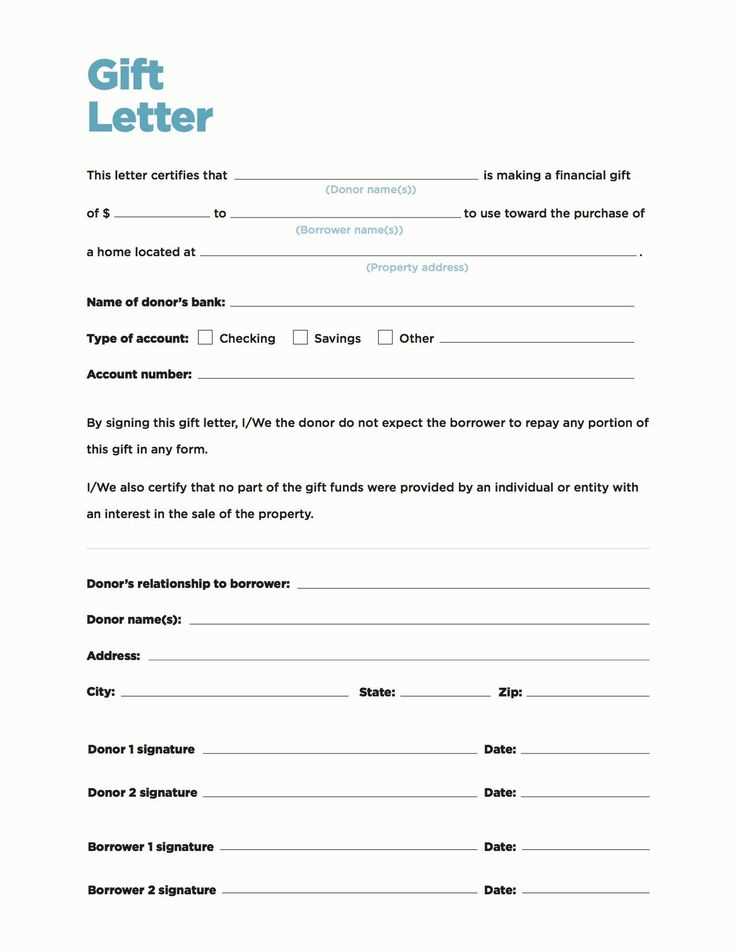

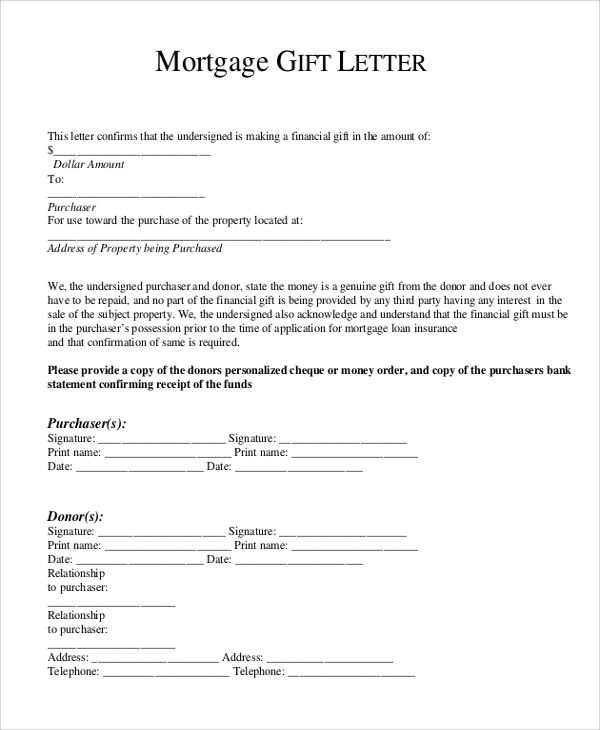

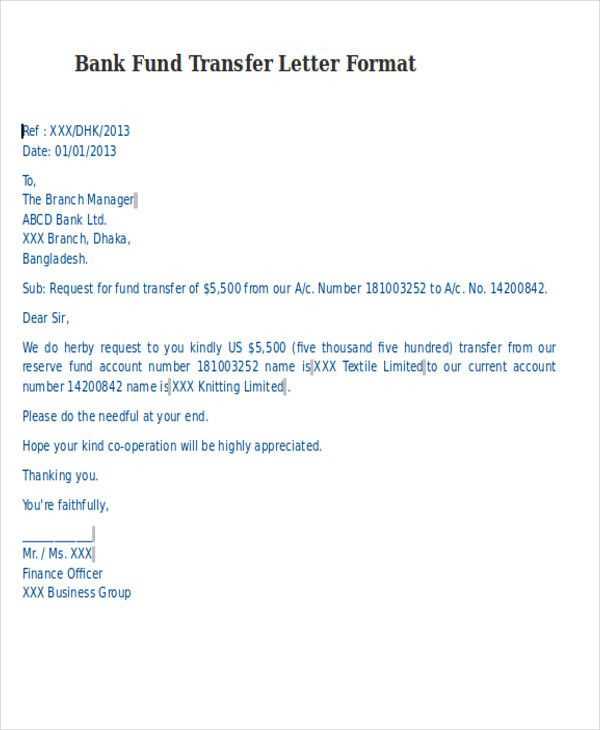

Key Elements to Include in the Document

- Donor’s Information: Full name, address, and contact details of the person providing the funds.

- Recipient’s Information: Full name and address of the person receiving the financial assistance.

- Amount of Contribution: The exact monetary value being transferred.

- Purpose of Transfer: A clear explanation of the reason for the contribution.

- Statement of No Repayment: A declaration stating that the money is a gift and not a loan.

Why This Document Matters

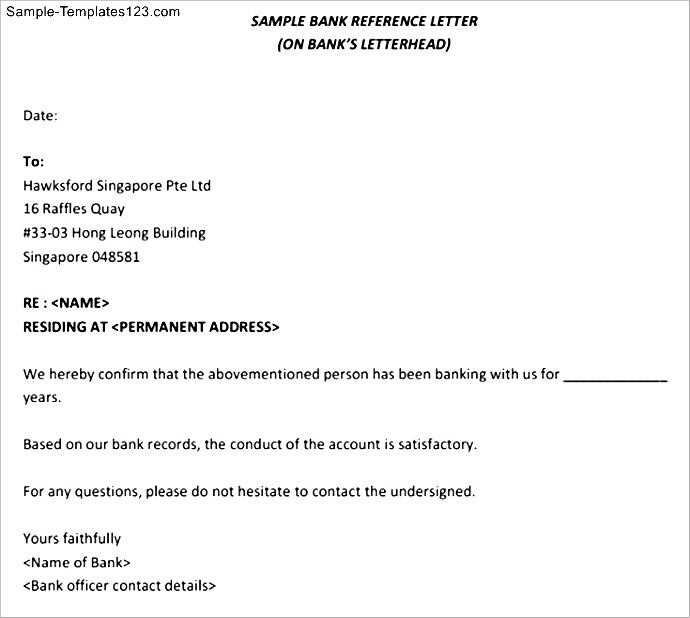

This document is important for both parties involved. For the recipient, it helps to clarify the nature of the funds and avoid any confusion with loans or other financial agreements. It also provides proof of the source of the funds, which is often required by financial institutions, especially when applying for a loan or mortgage. For the donor, it ensures that the financial assistance is properly recorded and does not create any future tax liabilities or misunderstandings.

How to Customize for Specific Situations

In many cases, a basic document can be tailored to fit particular needs. If the funds are intended for a specific purpose, such as purchasing a home or covering medical expenses, this can be clearly outlined in the agreement. Furthermore, if the donor wishes to include any additional stipulations, such as conditions for future assistance or periodic gifts, these should be stated explicitly to avoid future confusion.

Final Thoughts

Having a clear, formal record of any financial support ensures both the giver and the receiver are on the same page. It simplifies processes like loan applications and tax filings, and ultimately protects both parties involved. Taking the time to carefully craft such a document is beneficial in the long run, as it prevents misunderstandings and provides legal clarity for both sides.

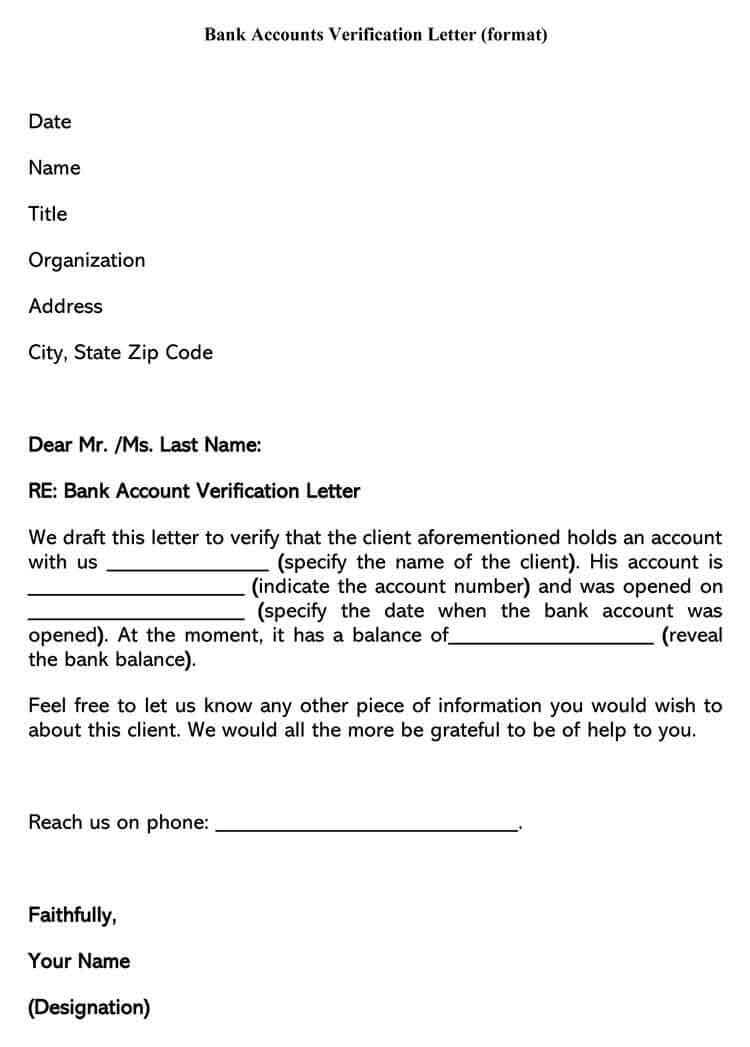

Why You Need a Financial Support Document

When receiving financial assistance from another person, it’s essential to have proper documentation to formalize the transaction. This ensures both parties are clear about the nature of the funds, protects against future misunderstandings, and satisfies any legal or institutional requirements. Whether for personal or financial purposes, a properly drafted document can help prevent issues down the road.

Key Details for a Financial Support Statement

To ensure clarity and avoid complications, it’s important to include several key details when preparing the document. This includes the names and contact information of both the giver and the recipient, the amount being transferred, and a clear explanation of the purpose. Additionally, the document should state that no repayment is expected, establishing the funds as a one-time contribution rather than a loan.

Steps to Draft a Financial Assistance Record

Creating a proper record involves a few simple steps. Start by identifying the parties involved and clearly state the amount being provided. Next, describe the intended use of the funds and confirm that no repayment is required. Lastly, ensure both parties sign the document to validate it. The record should be clear and concise to avoid any confusion later on.

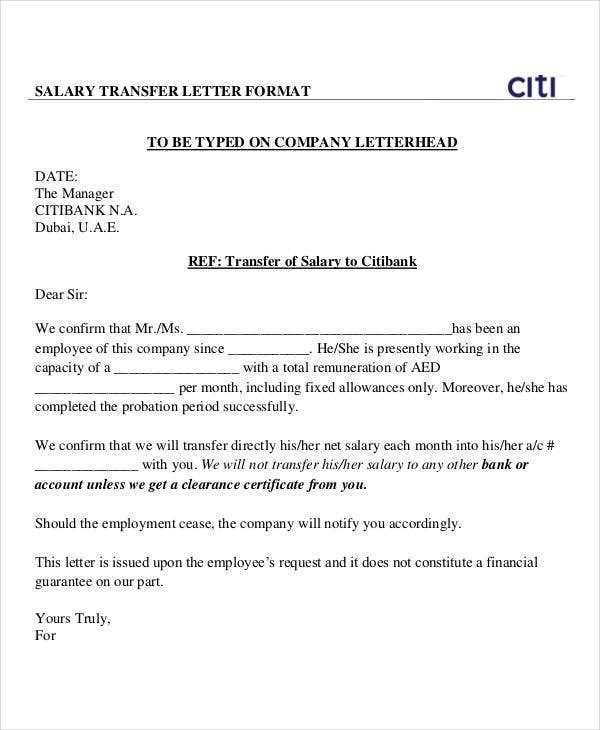

Criteria for Financial Institutions

When dealing with lenders or other financial institutions, this document may be required to prove the legitimacy of the funds. Institutions may request specific details, such as the purpose of the funds, to ensure they comply with regulations. It’s important that the document meets these criteria, as failure to do so could delay or even prevent the processing of financial applications.

Common Errors in Drafting Financial Support Statements

One of the most common mistakes is failing to clearly outline the nature of the contribution. Without specifying that the funds are a gift and not a loan, confusion can arise. Additionally, errors in spelling, missing signatures, or incomplete details can make the document invalid. Ensuring all information is accurate and complete is essential to avoid any issues later on.

How a Structured Approach Simplifies the Process

Using a well-organized approach can greatly simplify the creation of the document. A predefined structure allows for consistency and ensures all necessary details are included. With a proper outline, the document can be completed quickly and correctly, saving time and effort while ensuring compliance with any requirements.

Tips for Personalizing the Financial Support Statement

While a standard format can be used, personalizing the document to reflect specific circumstances can add clarity. If the contribution is intended for a particular purpose, such as a home purchase or education expenses, stating this clearly can help avoid misunderstandings. Personalizing the language to suit both parties’ needs can make the document more effective and relevant.