Bank resolution letter template

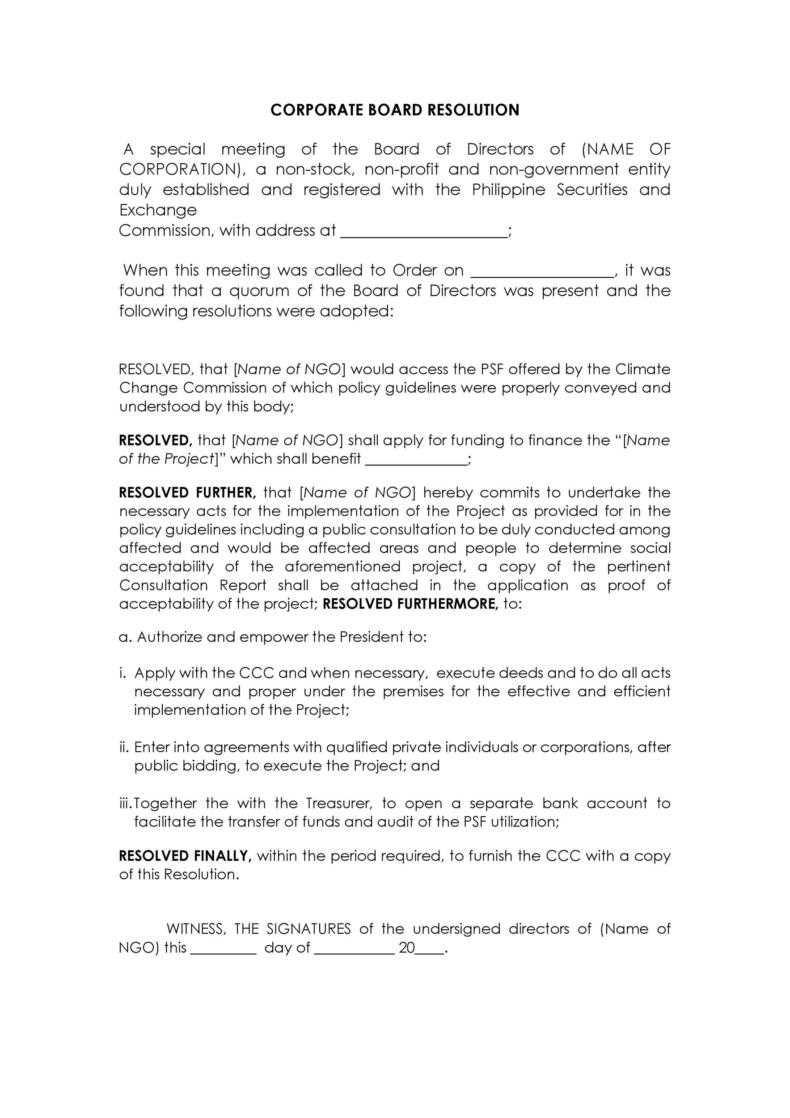

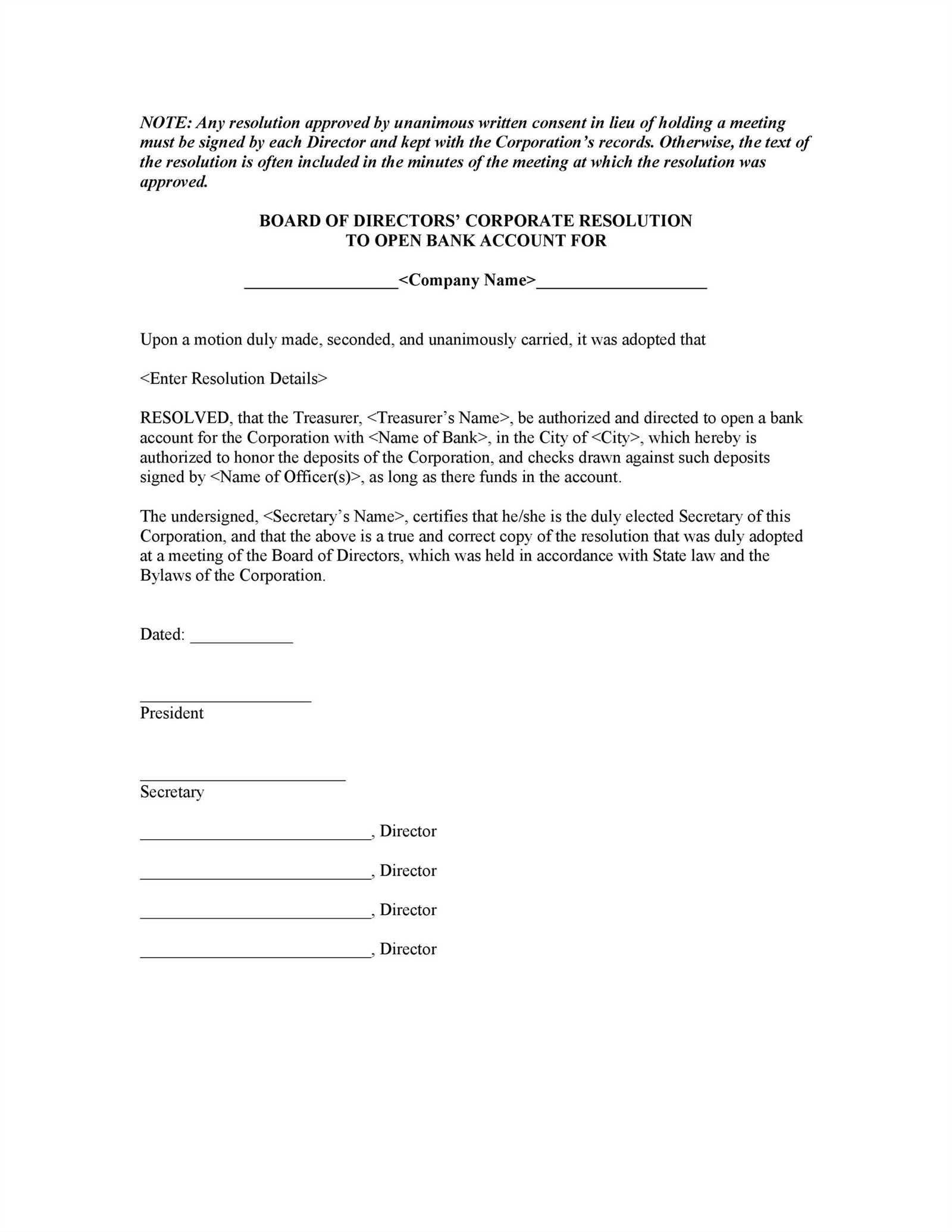

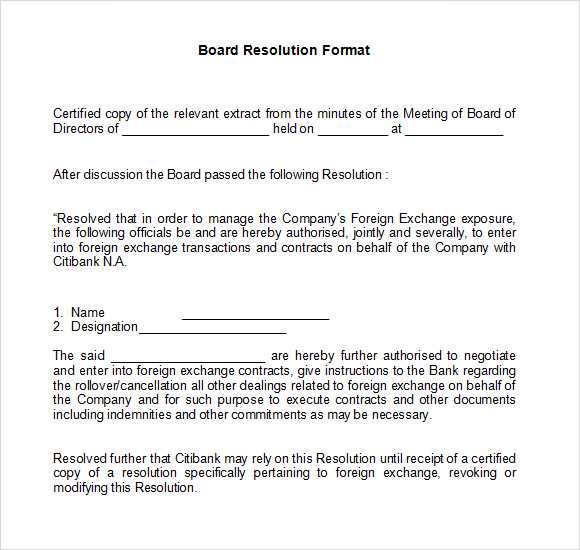

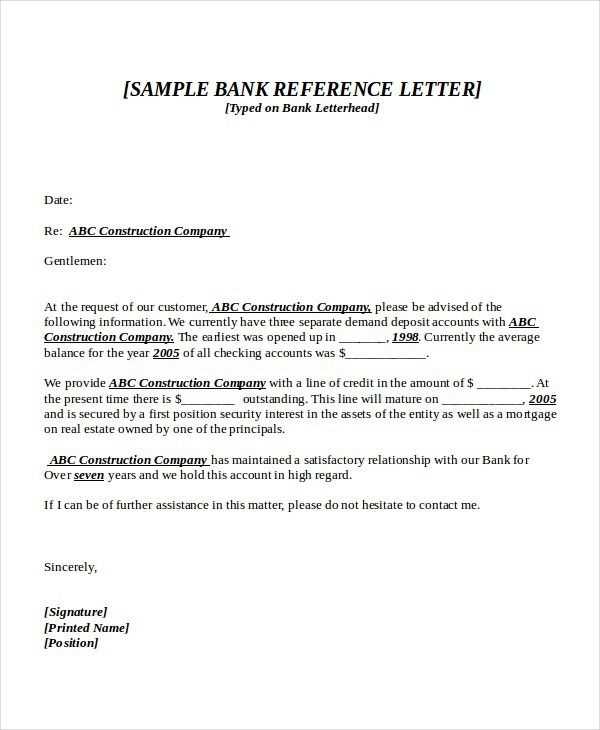

To create a bank resolution letter, it’s crucial to clearly outline the decisions made by a business’s governing body, such as a board of directors, regarding banking matters. This letter serves as formal documentation for banks to verify authorization of actions like opening accounts, authorizing signatories, or making financial transactions.

Start with a concise statement identifying the entity, such as the company or organization, that is making the resolution. Clearly specify the authority granted, including names and titles of individuals permitted to act on behalf of the company. Ensure the resolution’s purpose is stated without ambiguity, outlining the exact transactions or responsibilities the authorized signatories can manage.

Include key details like the company’s legal name, address, and registration number to avoid confusion. The date of the resolution and signatures from relevant officials or board members help confirm its legitimacy. Double-check that all supporting documents (like meeting minutes or official records) are referenced in the letter.

To complete the letter, ensure it includes a closing that reaffirms the validity of the resolution and provides contact information for further inquiries or clarification. This ensures the bank has everything needed to verify the authority behind the transaction or account management request.

Here is the corrected text with minimized repetition:

Begin by ensuring clarity in your bank resolution letter. State the intent of the letter without unnecessary phrases. Avoid repeating the main purpose–make it clear in the first paragraph and move on to specifics. For example, if you’re confirming the closure of an account, address the reason directly and avoid multiple mentions throughout the letter.

Clarify the Action

Clearly mention the action being taken, whether it’s a change in account signatories or the closure of an account. Avoid using redundant terms like “this action” or “this decision” multiple times. Instead, restate the core information only when it’s necessary for emphasis.

Conclude With Contact Information

Finish the letter by offering contact information for any follow-up. If you anticipate the need for additional verification or support, specify a point of contact or a direct line. Don’t overexplain; a simple statement suffices.

- Bank Resolution Letter Template: A Detailed Guide

A bank resolution letter is a formal document that authorizes specific individuals to act on behalf of a business regarding its banking matters. The letter outlines the scope of authority granted and provides clear instructions to the bank about how financial matters should be handled. A well-drafted bank resolution ensures that there are no misunderstandings about who has the right to manage the company’s accounts and make financial decisions.

Structure of a Bank Resolution Letter

The letter should include several key sections to be effective:

- Title: Clearly state that the document is a bank resolution letter.

- Introduction: Mention the company name, the meeting where the decision was made, and the purpose of the resolution.

- Authority Grant: Specify the individuals authorized to act on behalf of the company. Include their full names, titles, and the extent of their powers.

- Details of Authority: Describe what actions the authorized individuals are allowed to perform, such as opening accounts, signing checks, or making transactions.

- Signature Section: Include spaces for signatures of the authorized individuals and company representatives to validate the document.

Key Considerations

Ensure that the resolution letter is signed by the appropriate company officers, such as directors or partners, to provide legitimacy. Include the date of the resolution and confirm that all parties understand the responsibilities and powers granted. If necessary, attach supporting documents, such as meeting minutes or proof of authorization, to prevent any issues with the bank.

Use clear, unambiguous language to avoid confusion. Ensure that the letter is legally sound and aligns with the company’s internal policies and procedures. A concise and well-structured resolution letter will help the bank process requests efficiently and reduce the risk of complications.

Open the letter with a precise statement of the decision being made. Clearly mention the specific action, such as authorizing a financial transaction, approving a loan, or changing business account details. Avoid vague language to ensure the intent is unambiguous.

Provide Details of the Authorization

Include the relevant parties involved in the decision. Specify the role of each individual or group in the process and their responsibilities. If applicable, list the conditions attached to the approval, such as limits on amounts or timeframes for execution.

End with Clear Signatures and Dates

Conclude by noting the signatures of those authorized to make the decision, along with their titles and the date of authorization. This final section ensures legal validity and confirms that all necessary approvals have been obtained.

Key Elements to Include in a Bank Resolution Letter

To draft a precise and clear bank resolution letter, focus on the following key components:

- Company Information: Clearly state the company’s full legal name, business address, and other relevant details such as the registration number.

- Authorization Statement: Include a formal declaration of authority from the company’s governing body to engage with the bank and perform specific actions (e.g., opening accounts, transferring funds).

- Designated Signatories: List the individuals authorized to act on behalf of the company, along with their roles and signatures. Ensure you specify their responsibilities and limits of authority.

- Specific Actions Approved: Mention the exact actions that the bank resolution covers, such as opening or closing accounts, signing checks, or managing investments. Be specific about which transactions are approved.

- Date of Resolution: Include the resolution’s effective date. This helps ensure there is no ambiguity about when the authorization takes effect.

- Meeting Details: Note when and where the board meeting or decision was held, providing minutes or a reference to them if necessary.

Additional Considerations

Before submitting, double-check the consistency between the resolution and the company’s bylaws. If any terms or actions contradict existing policies, they could render the resolution invalid.

After finalizing the letter, include the signatures of the authorized directors or officers, along with the company’s seal, if applicable. This will provide additional confirmation of the resolution’s legitimacy.

Adjust the resolution letter based on the specific account type. For a business account, focus on the company’s legal details, such as registration number, and provide a clear statement of authorized individuals. For personal accounts, ensure the letter includes personal identification information, such as the full name and date of birth, to verify the identity of the account holder.

For joint accounts, include the names of all account holders along with their individual permissions or agreements. Specify who has the authority to make decisions or sign the resolution letter, particularly when one account holder is absent or unable to sign.

When dealing with trust accounts, emphasize the trust’s name, the trustee’s authority, and their capacity to act on behalf of the trust’s beneficiaries. Be sure to include the trust’s legal documents if required by the bank.

Always check for any additional documents or specific language required by the bank for each account type to avoid delays. Tailor the letter’s format and content to reflect the nature of the account, ensuring clarity and accuracy in all details.

Ensure the document reflects the correct authority of the individuals involved. Verify the signers have the legal capacity to act on behalf of the entity. A resolution letter must specify their role and the extent of their powers in relation to the actions being authorized.

Double-check compliance with the bank’s bylaws and internal policies. The resolution must align with these rules, as non-compliance can invalidate the document. Review any necessary formalities, such as required signatures or notarization, to ensure the resolution is legally binding.

Clearly outline the decision being made. The language should be unambiguous and direct, leaving no room for misinterpretation. Avoid vague terms and instead specify the exact actions that are being authorized and any limitations that apply.

Confirm that the resolution addresses potential liabilities or risks. Including appropriate clauses regarding indemnification or responsibility ensures clarity in case of disputes or legal issues arising from the decision.

Consider the jurisdiction in which the letter is being executed. Different regions may have varying requirements for corporate resolutions, including specific documentation, filing procedures, or deadlines. Tailor the content of the resolution accordingly.

Ensure proper record-keeping. The resolution should be documented in the entity’s official records, with copies available for future reference. This ensures that the decision can be traced and verified if necessary.

Precision and clarity are key when drafting a bank resolution letter. Avoid these common mistakes to ensure the letter is both effective and legally sound:

- Ambiguous language – Using unclear terms or vague statements can lead to confusion or misinterpretation. Be specific about the actions being taken, such as the designation of authorized signatories or the purpose of the resolution.

- Incorrect formatting – Make sure the structure follows legal or corporate guidelines. This includes having the proper heading, date, and signature lines in place. A messy or incomplete format can cast doubt on the letter’s validity.

- Missing signatures – Always ensure that the letter is signed by the appropriate individuals, such as directors or authorized officers, as required by the organization’s bylaws or governing documents.

- Failure to cite relevant documents – Reference important legal or corporate documents, such as meeting minutes or articles of incorporation, that support the resolution. Omitting these can weaken the letter’s credibility.

- Overcomplicated language – Keep the language straightforward and to the point. Overly complex sentences can create misunderstandings or appear unprofessional. Stick to simple, direct communication.

- Leaving out vital details – Include all necessary information, such as the names of individuals authorized to act on behalf of the company, the scope of their authority, and any other relevant dates or conditions.

- Inconsistent terminology – Use consistent terms throughout the letter to avoid confusion. Switching between different terms for the same concept can make the resolution appear inconsistent or unclear.

Tips for Clear and Effective Bank Resolution Letters

- Check for clarity and consistency throughout the document.

- Proofread carefully to ensure no critical details are missing.

- Follow any specific guidelines provided by the bank or regulatory authorities.

Examples of Resolution Letter Templates for Various Situations

Resolution letters can address a wide range of situations. Below are some practical examples to follow when crafting your own letter.

1. Business Dispute Resolution

For resolving conflicts between two businesses or business partners, it’s important to state the issue clearly, provide context, and propose a mutually agreed solution. Here’s a simple template:

| Subject | Resolution of Business Dispute |

|---|---|

| Dear [Recipient’s Name], | We have reviewed the recent issue between [Business Name] and [Other Business Name], specifically regarding [specific issue]. After careful consideration, we propose the following resolution: [describe solution]. Please confirm your agreement to this resolution by [specified date]. |

| Best regards, | [Your Name] [Your Position] [Your Company Name] |

2. Employee Performance Resolution

If an employee’s performance has been under review, and steps have been taken to resolve the issue, this template can be used to confirm the resolution and set expectations for improvement:

| Subject | Performance Review Resolution |

|---|---|

| Dear [Employee’s Name], | Following our recent discussions about your performance, we have agreed upon a resolution plan that includes [list steps or improvements]. We expect to see progress by [date]. Your continued contribution is important to us, and we are here to support your growth. |

| Best regards, | [Manager’s Name] [Manager’s Position] |

3. Customer Complaint Resolution

For resolving customer complaints, focus on acknowledging the issue, providing a solution, and reaffirming your commitment to service. Here’s a basic example:

| Subject | Resolution of Your Complaint |

|---|---|

| Dear [Customer’s Name], | Thank you for bringing [issue] to our attention. We apologize for the inconvenience caused and have taken the following steps to resolve the situation: [steps]. We appreciate your patience and are committed to ensuring your satisfaction moving forward. |

| Best regards, | [Your Name] [Your Position] [Company Name] |

4. Legal Matter Resolution

For legal disputes, clarity and formal language are key. This template addresses an agreement to resolve the matter outside of court:

| Subject | Legal Dispute Resolution Agreement |

|---|---|

| Dear [Recipient’s Name], | We have reviewed the claims regarding [legal issue] and agree to settle this matter through [method of resolution, e.g., mediation, arbitration, etc.]. The terms of the resolution are as follows: [details of the agreement]. We hope this resolution will bring closure to the matter. |

| Best regards, | [Your Name] [Your Position] [Your Law Firm/Company Name] |

Use these templates as guidelines for addressing various situations in a professional and direct manner. Customizing each letter with specific details ensures a clear understanding and resolution.

Ensure your bank resolution letter is concise and covers key points for clarity. Start with a direct statement of authorization, confirming the resolution to take specific actions. For example, outline any individuals authorized to act on behalf of the organization and any limits on their powers. Clearly define the purpose of the resolution and avoid ambiguity.

Provide Clear Instructions

Clearly indicate the actions the organization is authorizing. This can include managing accounts, conducting transactions, or handling any specific financial responsibilities. Be precise about the scope of each action to prevent misunderstandings.

Include Official Signatures

Finish the letter with signatures of all relevant authorities within the organization. This adds legal weight to the resolution. Ensure all signatures are legible and accompanied by titles and dates to confirm validity.