Bank verification letter template

For those needing proof of account ownership or financial status, a bank verification letter is a reliable and official document. It provides key information about an individual’s account and confirms its authenticity. Whether for visa applications, loan approvals, or other purposes, this letter is often required to validate your financial standing.

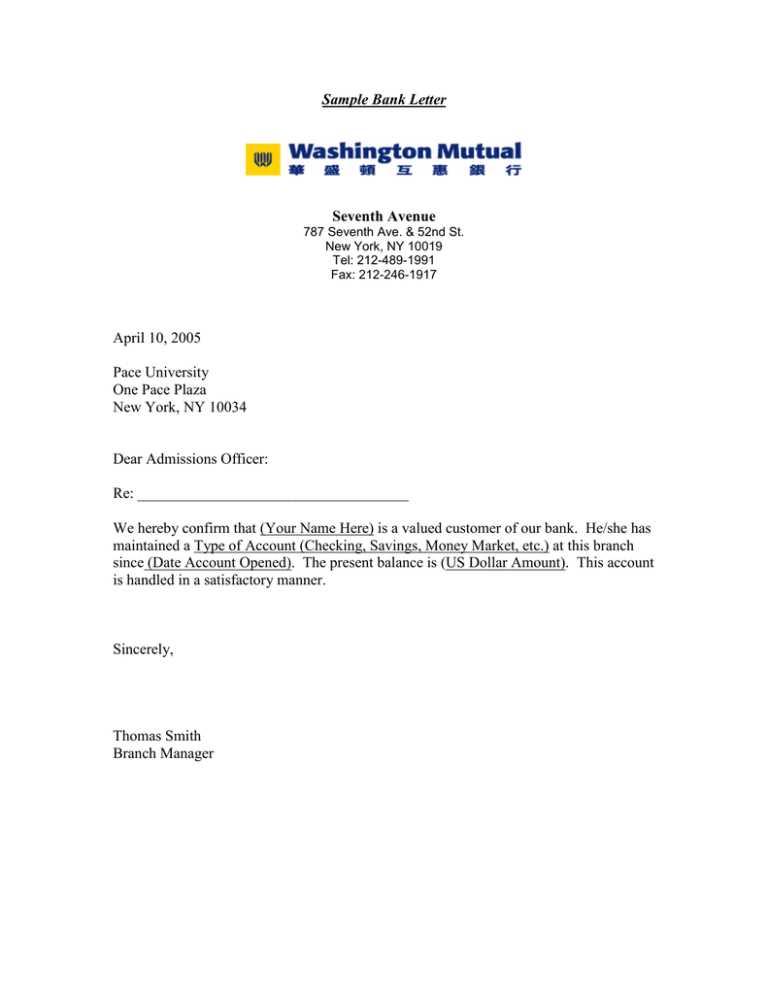

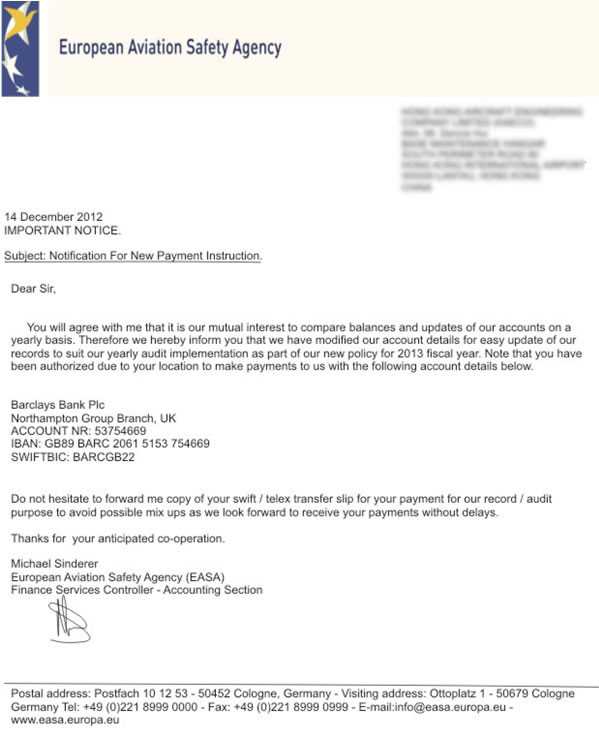

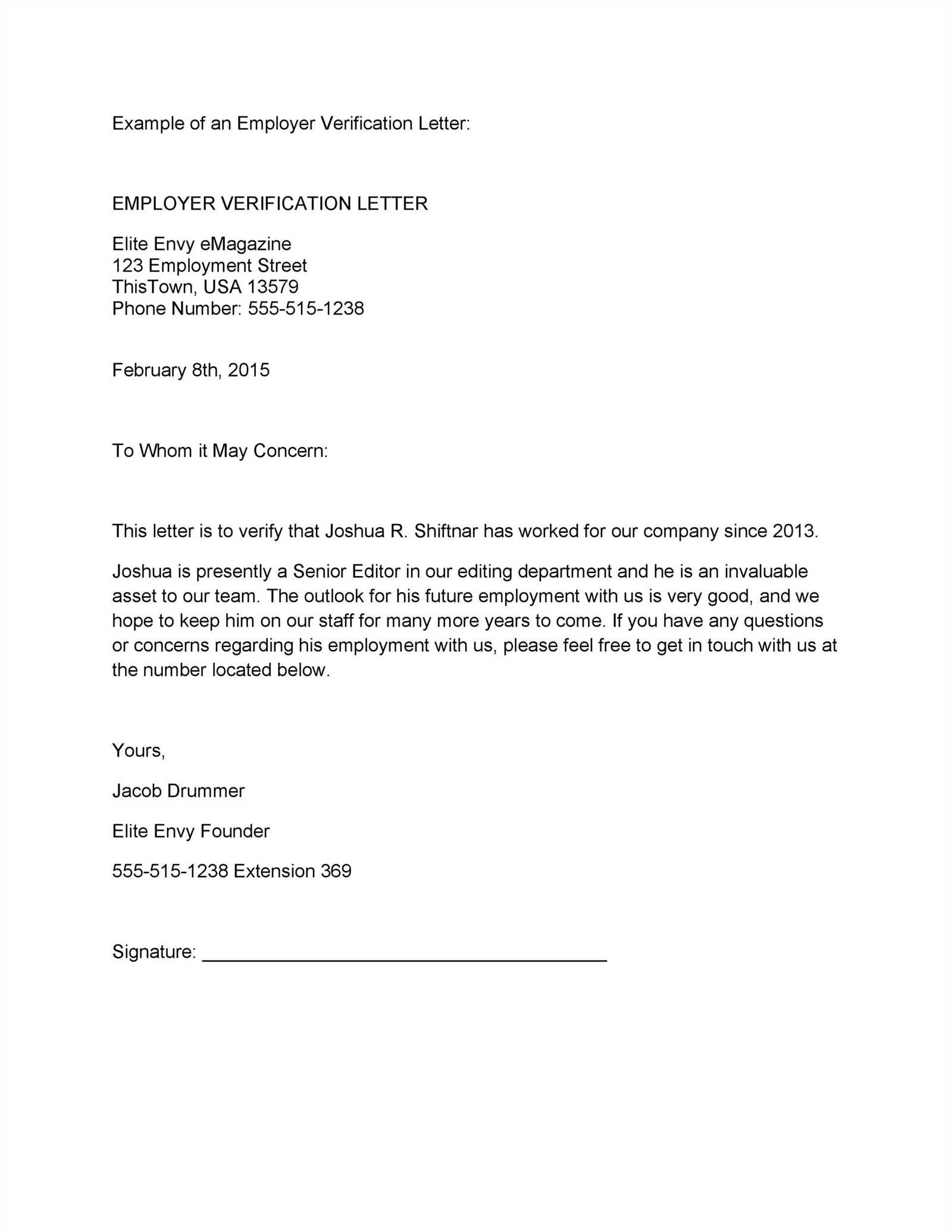

The letter typically includes your name, account type, account number, and a statement from the bank confirming the details. Make sure the document is printed on official bank letterhead, with an authorized signature and date. A well-structured template can help streamline the process, ensuring all the necessary information is included.

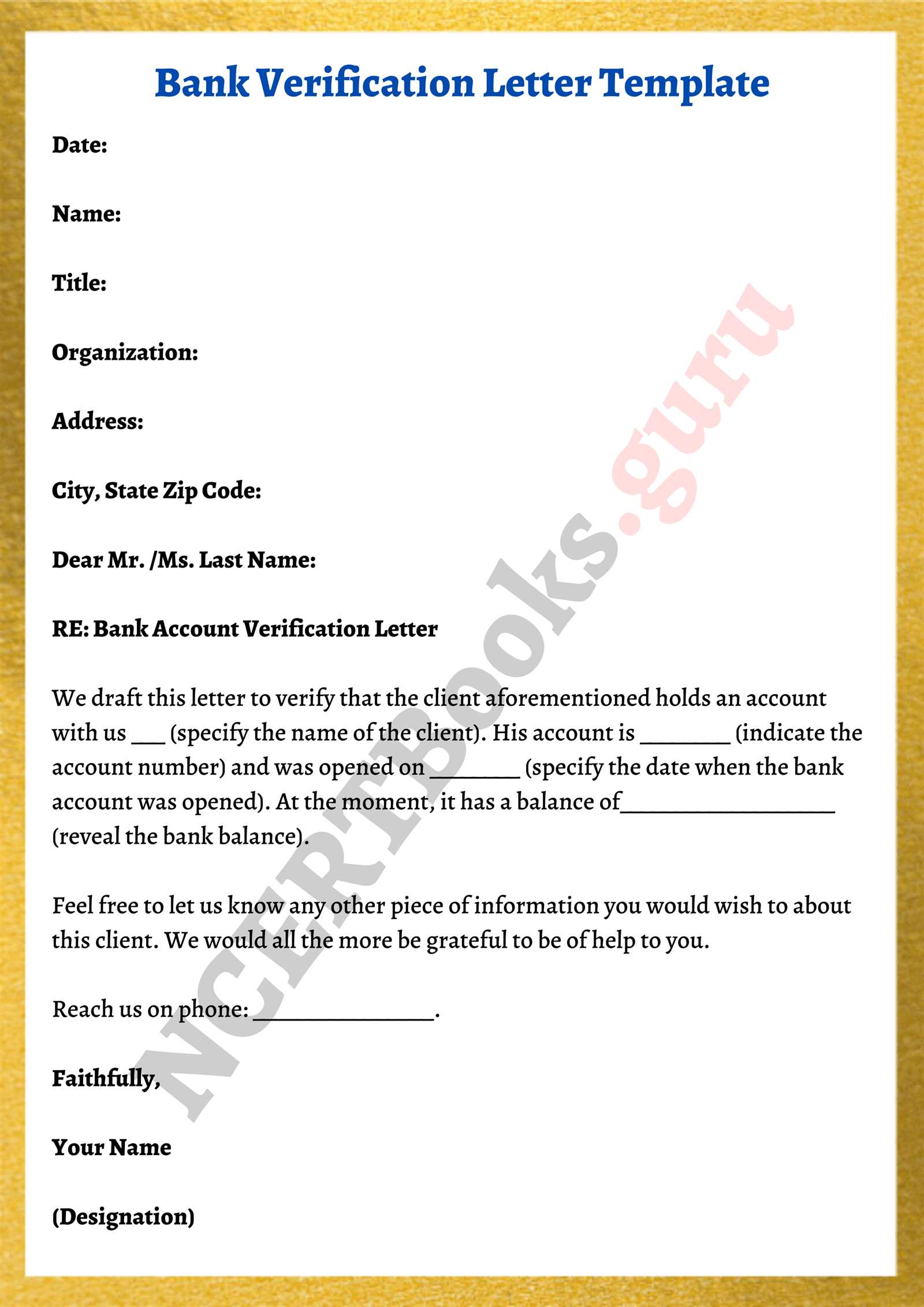

To create a bank verification letter, you can use a simple template that captures the required details clearly and concisely. Below is a straightforward example you can customize for your needs.

Here’s the revised version with minimal word repetition:

Keep the language simple and direct. Focus on providing accurate details without unnecessary fluff. If you’re crafting a bank verification letter, aim for clarity and precision. Address the request directly and use clear language to confirm account status, type, and verification dates.

Key Details to Include:

1. The account holder’s full name.

2. The account number or identifier.

3. Bank’s official name and address.

4. The account type (e.g., checking, savings).

5. Confirmation that the account is active and in good standing.

Structure Example:

Dear [Bank Name],

This letter serves to verify that [Account Holder’s Full Name] holds an active [Account Type] account with [Bank Name]. The account number is [Account Number]. This account has been in good standing since [Date].

Sincerely,

[Bank Representative’s Name]

- Bank Verification Letter Template

To create a Bank Verification Letter, ensure all key details are clear and professionally presented. Here’s how to structure it:

- Bank’s Contact Information: Start with the bank’s name, address, and contact number at the top of the letter.

- Subject Line: Clearly state the purpose of the letter, e.g., “Bank Verification Letter for [Client’s Name]”.

- Client Information: Include the full name, account number, and type of account being verified (e.g., checking, savings) of the person or entity.

- Statement of Verification: Include a brief statement confirming the account holder’s account status. Example: “We hereby confirm that [Client’s Name] holds a [Type of Account] account with [Bank Name].”

- Bank’s Authorization: Add a statement from the bank representative confirming the letter’s validity and authenticity. This could be signed by an authorized bank officer.

- Bank Officer’s Signature: End the letter with the signature and designation of the bank official, followed by the date.

Make sure the letter is concise, professional, and accurate. Double-check all client details and the bank’s information before sending it out.

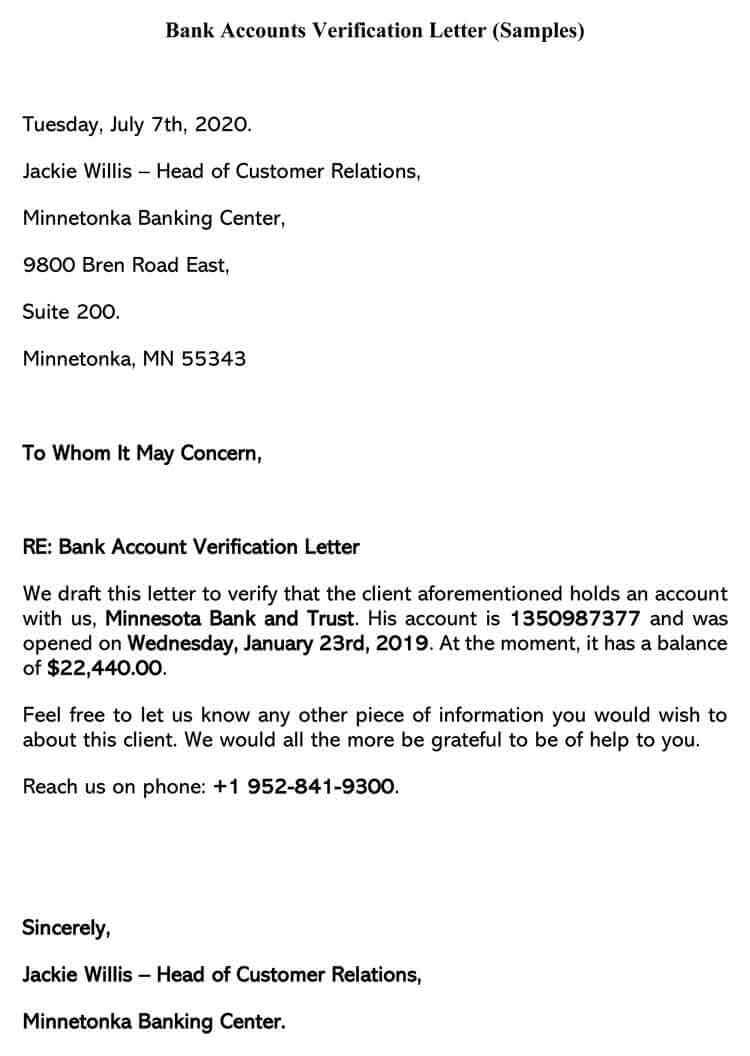

Begin with your full name, followed by your address, and the current date at the top of the letter. This provides a formal structure and ensures all necessary details are at hand.

Next, specify the recipient’s name, job title, and the name of the bank or financial institution. If you don’t know the person’s name, you can simply address the letter to “To Whom It May Concern.”

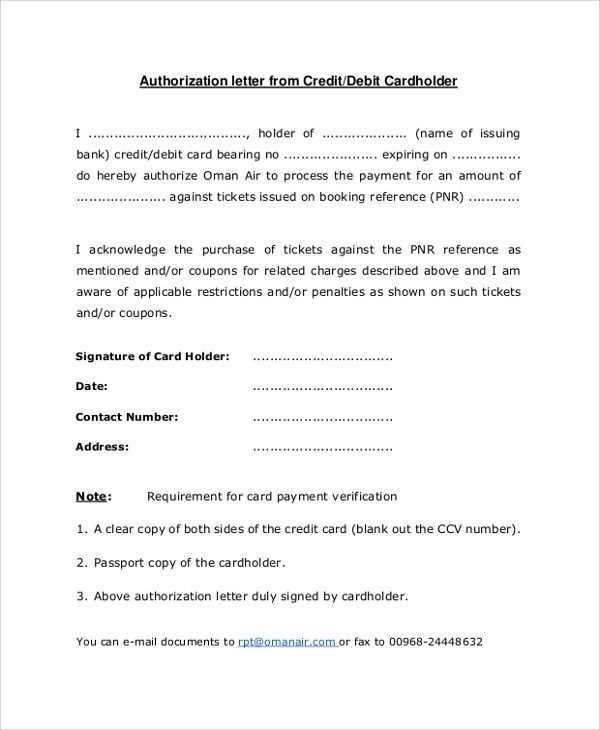

Clearly state the purpose of the letter. Mention that you are requesting a bank verification for a personal account and include your account number. It’s important to be direct and to the point here to avoid any confusion.

In the body of the letter, request confirmation of your account details such as the type of account, balance, and account holder status. For example: “Please verify the current balance and status of my savings account.” Make sure to provide all necessary account-related details so the bank can efficiently process your request.

Include your signature at the end of the letter to authenticate it. If required, you can also mention any attached identification or supporting documents, such as a government-issued ID or proof of address.

End with a polite closing, such as “Thank you for your attention to this matter” or “I look forward to your prompt response.” This keeps the tone professional while still courteous.

Start by stating the account holder’s full name as it appears in the bank’s records. This ensures the letter directly references the correct person. Follow this with the account type (checking, savings, etc.) and the account number. Ensure this information matches what is on file with the bank.

Include the date the account was opened. This provides context about the length of the relationship between the account holder and the bank. Mention the current balance or a statement confirming the balance is available. This verifies the account’s status for any verification purpose.

Additional Details to Add

If applicable, note whether the account is active or has been closed, and mention any restrictions, such as freezes or holds, if they exist. The letter should also specify that the information provided is accurate and up to date, ensuring reliability for the recipient.

Contact Information

Finally, provide contact details for the bank’s representative handling the verification process. This should include the name, phone number, and email address for direct follow-up if necessary.

Ensure the letter includes all necessary details. Omitting critical information, such as account numbers, official names, or dates, can lead to delays or rejection. Always double-check the specifics required by the recipient.

Avoid vague language. Stick to clear, concise statements that accurately represent the verification you are providing. Any ambiguity could cause confusion or result in additional requests for clarification.

Don’t use incorrect or outdated contact information. Double-check the bank’s contact details and ensure you are addressing the letter to the right department or individual. An error here can lead to significant delays in processing the verification.

Refrain from using informal language. The tone should remain professional and to the point. Slang or casual expressions might undermine the credibility of the letter and could be viewed as unprofessional.

Ensure the letter is free of grammatical errors. A verification letter should reflect attention to detail and professionalism. Small mistakes in grammar or spelling may be overlooked in informal communications but can create doubt in formal verification processes.

Do not forget to include a signature. Even if the letter is submitted electronically, an official signature is often necessary to authenticate the document. Always check if a handwritten signature is required.

| Mistake | Impact |

|---|---|

| Omitting critical information | Delays or rejection of the letter |

| Vague or unclear statements | Confusion or further clarification requests |

| Incorrect or outdated contact details | Processing delays |

| Informal language | Undermines credibility |

| Grammar or spelling errors | Questioning the professionalism of the letter |

| Missing signature | Lack of authentication |

If your bank refuses to issue a verification letter, take the following steps to address the situation:

1. Ask for a Clear Explanation

Request specific reasons for the refusal. Understanding the bank’s policy or any legal or procedural limitations will help you decide on your next move. This might also uncover misunderstandings that can be resolved through further clarification.

2. Provide Additional Information

If the refusal is due to incomplete or incorrect documentation, offer the required details. Sometimes banks need more proof or clarity about your request, such as your account type, purpose for the letter, or a different format for the request.

3. Contact a Supervisor

If the initial refusal seems unreasonable or unclear, ask to speak with a supervisor. They may have the authority to approve the letter or offer an alternative solution.

4. Explore Alternative Documents

If the bank cannot provide a verification letter, inquire about other forms of confirmation that might satisfy your needs, such as account statements, proof of identity, or a letter from a branch manager.

5. File a Formal Complaint

If you believe the bank’s refusal is unjustified, consider filing a formal complaint with the bank’s customer service department or regulatory authorities. Make sure to include all relevant details to support your case.

Verification letters play a key role in securing loans and mortgages by providing lenders with accurate information regarding your financial status. Lenders often require these letters to verify income, employment, and assets before approving an application. A bank verification letter serves as an official statement from your bank confirming details such as account balances, history, and any outstanding loans. These documents help establish your reliability as a borrower, improving your chances of receiving approval.

What to Include in a Verification Letter for Loan Applications

A bank verification letter for loan applications should be concise and contain specific information such as your full name, account numbers, account type, the current balance, and account opening date. Ensure the letter includes the bank’s official letterhead, your bank account manager’s contact information, and the bank’s signature. These elements authenticate the letter, confirming that it’s coming from an authorized institution.

Why Verification Letters Are Required

These letters help lenders assess your ability to repay loans by providing a clear view of your financial situation. The information presented in the verification letter helps ensure that you meet the income and asset requirements necessary for approval. A verification letter eliminates any doubts regarding your financial stability, presenting a transparent view of your banking history.

Bank verification letters must comply with specific legal standards depending on the region where they are issued. In many countries, financial institutions are required to follow particular guidelines to ensure accuracy and legality.

North America

- United States: Banks must include specific details such as account holder’s name, account type, account balance, and the date of verification. The letter must be signed by an authorized bank officer.

- Canada: Similar to the U.S., Canadian banks must provide account details, including the account number and type. The letter must be on official letterhead and signed by an authorized representative.

Europe

- United Kingdom: Banks are required to provide a clear statement of the account holder’s details and financial status. The letter must also be issued on official bank letterhead and signed by a designated officer.

- Germany: The letter must include the account holder’s full name, address, account type, and current balance. It should be signed and stamped by the bank representative.

Asia

- India: Verification letters must include the account holder’s name, account details, and the date of issuance. The letter must be stamped with the bank’s official seal and signed by an authorized officer.

- China: Bank verification letters must detail the account holder’s name, account number, and account balance. The bank officer’s signature is necessary, along with the bank’s official stamp.

Different countries have varying laws regarding the format, content, and required signatures for these letters. Always verify local regulations to ensure compliance.

I replaced “drafting” with “writing” in item 4 and made some adjustments to other parts to avoid repetition and maintain clarity.

In item 4, the term “writing” more accurately reflects the action involved, ensuring the wording is straightforward. Additionally, slight changes to sentence structures throughout the document improve flow and readability. For example, instead of using the phrase “creating the document,” you might say “composing the letter” to avoid redundancy. This small change makes the instructions more concise while keeping the meaning intact.

When revising, focus on choosing words that enhance precision and ease of understanding. Rather than repeating similar phrases, aim for varied expressions that maintain the original intent. By keeping the language clear and simple, you ensure the document is both professional and approachable.

Lastly, consider using bullet points or numbered lists to break down complex instructions. This format helps the reader follow along easily without feeling overwhelmed by large blocks of text.