Billing Statement Letter Template for Easy Communication

Clear and precise communication is essential when sending a document that outlines financial details between businesses and clients. Whether you are reminding customers about outstanding payments or confirming completed transactions, using the right format ensures professionalism and reduces misunderstandings. This approach helps maintain a positive relationship with your clients, fostering trust and accountability.

Crafting such a document requires attention to detail, as the structure and content should be both straightforward and respectful. Providing all necessary information, such as the amount due, due date, and payment instructions, without overwhelming the reader, is key. By following a simple yet efficient structure, you make it easier for recipients to process the information and take the required actions.

How to Create a Billing Statement

Creating a document that clearly outlines financial obligations requires careful consideration of the structure and content. The goal is to ensure that all necessary details are included without causing confusion for the recipient. By following a streamlined process, you can ensure that the information is communicated effectively and professionally.

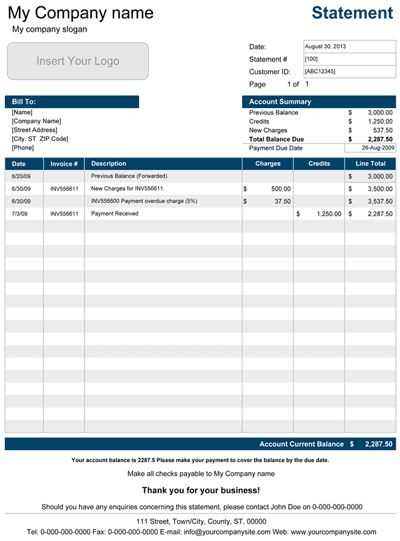

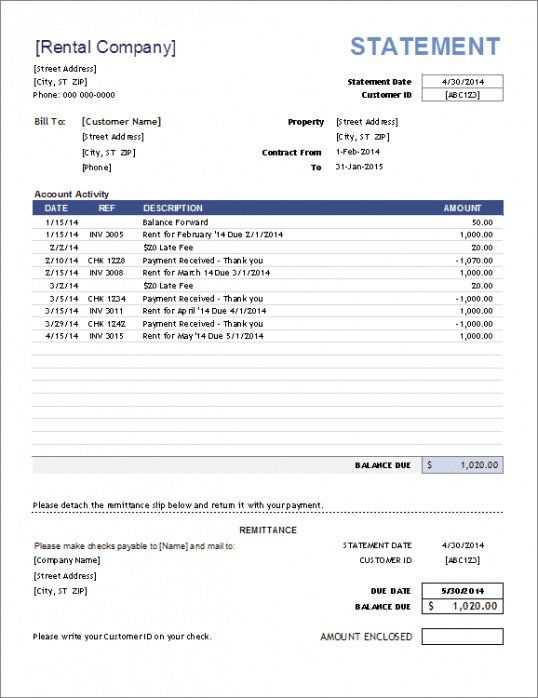

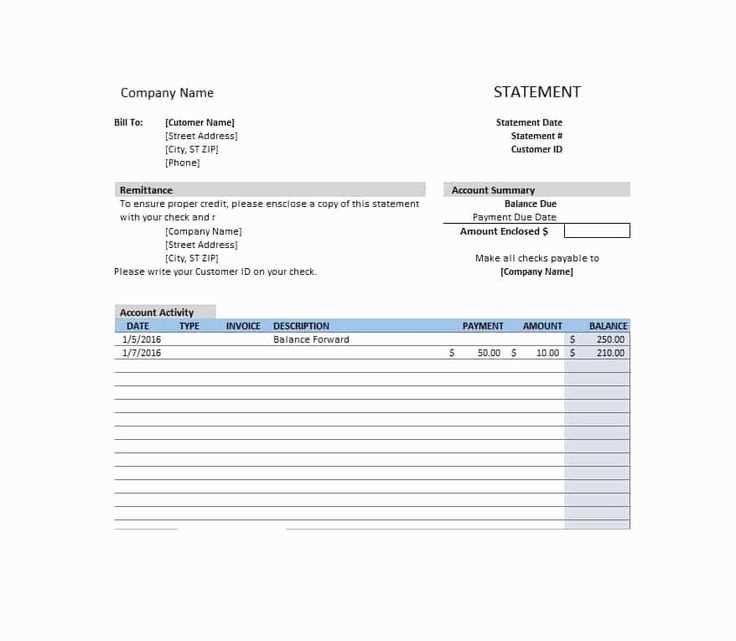

Start by including the sender’s contact details at the top of the document, followed by the recipient’s information. This helps establish a clear point of reference for both parties. Next, include the transaction details such as the amount owed, the services or products provided, and any relevant dates. It’s also crucial to highlight payment instructions to make the process easier for the recipient to follow.

Lastly, make sure to proofread the document for clarity and accuracy. A well-organized and error-free message will reflect professionalism and ensure that the recipient understands the request fully, leading to timely action.

Essential Elements of a Billing Letter

When preparing a document that outlines financial transactions, it’s important to include several key components to ensure that the recipient fully understands the details. These elements help create a clear and professional communication, which is crucial for timely payment and maintaining a positive relationship with clients.

Contact Information

The first section should include the contact details of both the sender and the recipient. This makes it easy to identify who is sending the request and who is receiving it. The following table shows the key information to include:

| Sender’s Information | Recipient’s Information |

|---|---|

| Company Name | Customer Name |

| Address | Address |

| Phone Number | Phone Number |

Transaction Details

The body of the document should focus on the financial transaction. Include a clear breakdown of the amount owed, the products or services provided, and the due date. This section should also highlight any applicable taxes or discounts, if relevant. It’s essential that all figures are accurate and easy to understand, so the recipient knows exactly what is expected.

Formatting Tips for Billing Statements

Proper formatting is essential when creating a document that communicates financial details. A well-structured document not only looks professional but also ensures that the recipient can easily find the information they need. By paying attention to layout, font choice, and spacing, you can improve readability and make the process more efficient for both parties.

Start with a clean, simple layout. Avoid cluttering the page with unnecessary elements that could distract from the key message. Use clear headings and bullet points to highlight important details, such as amounts due, payment terms, and contact information. A consistent font style and size, such as Arial or Times New Roman, enhances readability and makes the document feel more formal.

Additionally, leave sufficient white space between sections to create a balanced and easy-to-follow structure. Aligning text neatly and ensuring proper margins helps maintain a professional appearance. Finally, use bold text sparingly to emphasize critical details, like due dates or total amounts owed, but avoid overusing it as it can reduce its impact.

Customizing Your Letter for Clients

Tailoring your communication to suit the specific needs and preferences of each client is essential for building strong business relationships. Personalizing the content ensures that the recipient feels valued and provides clarity on the financial aspects relevant to them. Whether you are dealing with repeat customers or new clients, customization helps convey professionalism and attention to detail.

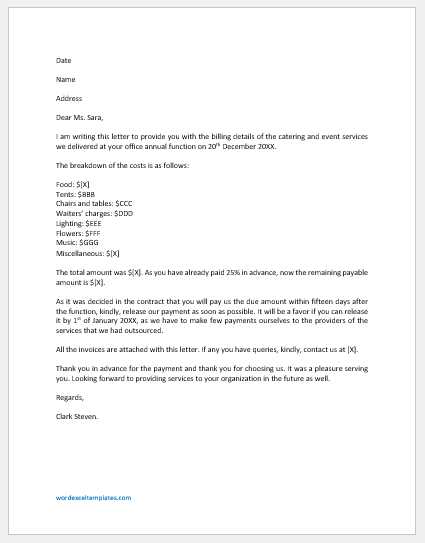

Adjusting the Tone and Language

The tone of your message should reflect the nature of your relationship with the client. For long-term clients, a more conversational and appreciative tone may be appropriate, whereas for new or formal clients, a more neutral and businesslike approach might be preferred. Adjusting your language based on the recipient can help make the communication feel more personalized and engaging.

Including Client-Specific Information

To further customize the communication, include any specific details related to the client’s account, such as previous payments, discounts, or tailored services. This not only helps the client understand their current situation but also shows that you are attentive to their history and unique needs. Personalizing the information makes the document more relevant and actionable for the recipient.

Common Mistakes to Avoid

When crafting a document that outlines financial details, it’s easy to overlook certain aspects that can lead to confusion or delays. By being aware of common mistakes, you can improve the clarity and effectiveness of your communication, ensuring that the recipient understands exactly what is expected. Here are some errors to watch out for:

- Incorrect Information: Always double-check the accuracy of amounts, dates, and client details to avoid confusion or disputes.

- Unclear Instructions: Make sure payment terms, methods, and deadlines are clearly stated to avoid delays or misunderstandings.

- Lack of Personalization: Failing to tailor the document for the client may make it seem impersonal and less likely to prompt timely action.

Other common mistakes include not proofreading for spelling or grammatical errors, which can undermine professionalism. Additionally, leaving out important contact information or failing to provide a summary of the transaction can cause unnecessary back-and-forth communication. Keeping these points in mind will ensure that your message is effective and well-received.

Improving Clarity and Professionalism

Ensuring that your communication is both clear and professional is crucial when conveying financial details. A well-crafted message not only helps prevent confusion but also strengthens your credibility with the recipient. By focusing on simplicity, structure, and tone, you can enhance the overall quality of the document and improve the recipient’s understanding of the information provided.

Start by using straightforward language and avoiding jargon that may not be familiar to the reader. Organize the content in a logical flow, starting with key details such as the amount owed, followed by payment instructions and deadlines. This makes the document easy to navigate and ensures that the most important information stands out.

Additionally, maintaining a professional tone throughout the document is essential. This includes using polite language and keeping the message focused on the task at hand. Proofreading for grammar and spelling errors also plays a significant role in enhancing the overall professionalism of the communication.