Broker Price Opinion Letter Template for Real Estate Professionals

htmlEdit

When assessing the value of a property, professionals often provide a detailed document to express their evaluation. This report serves as an essential tool in various transactions, helping both buyers and sellers understand the true market worth of a property. It outlines key factors that influence the property’s value, taking into account its condition, location, and current market trends.

Crafting a comprehensive and accurate evaluation requires attention to detail and a clear understanding of the property’s characteristics. The document should not only reflect the current value but also offer insights into potential future developments that may impact the property’s worth. Professionals in real estate often use this format to assist in decision-making processes that require a professional’s judgment.

As with any formal assessment, the clarity and structure of the report are crucial. It is important that the writer provides a clear explanation of the methods used to arrive at the valuation. A well-organized document ensures that all involved parties understand the conclusions drawn, thus fostering transparency and trust in the evaluation process.

htmlEdit

Overview of BPO Document Reports

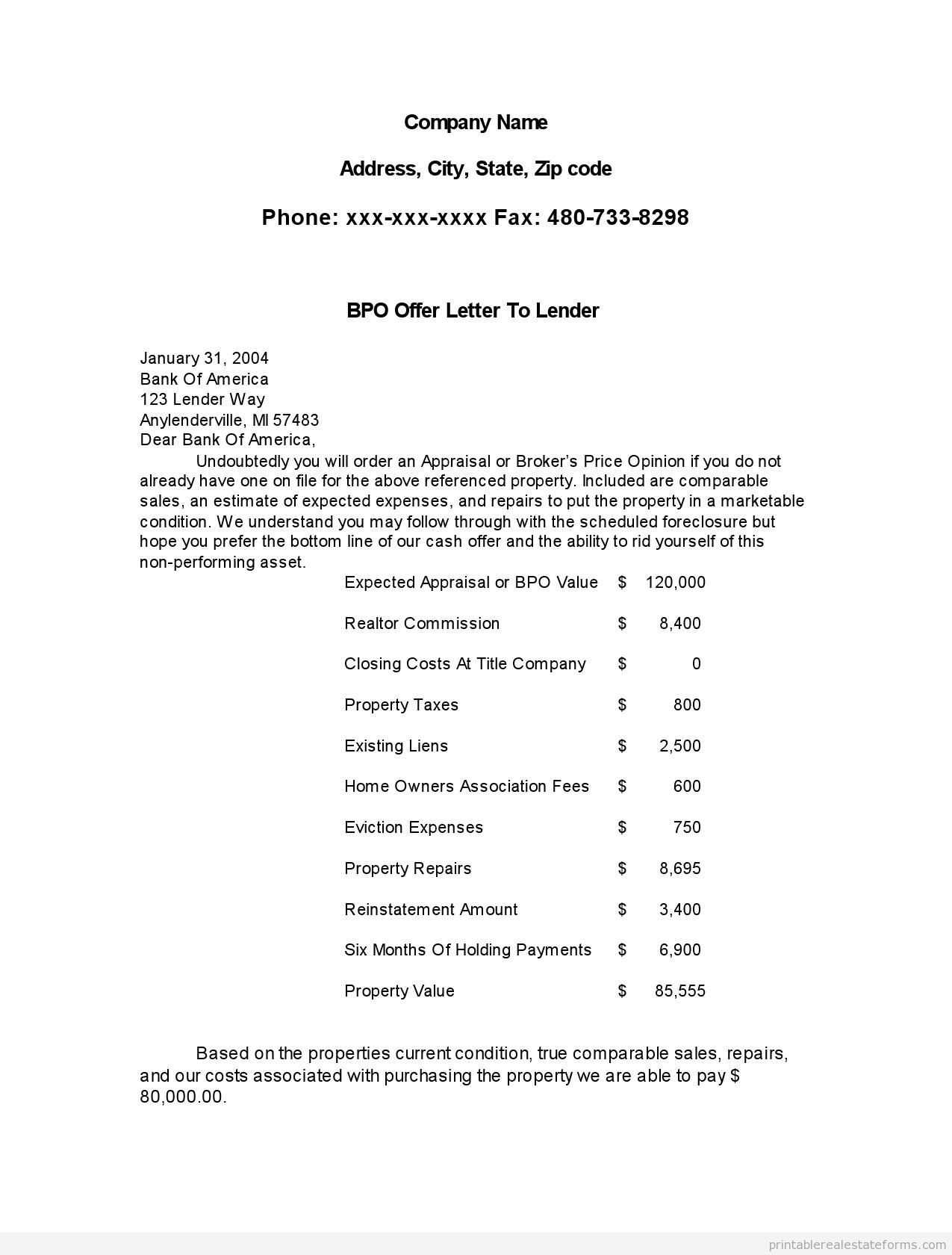

These documents are formal assessments used to communicate the estimated value of a property. They are often prepared by professionals with expertise in real estate, and serve as a crucial reference for various parties involved in a transaction. Whether used for refinancing, sales, or investment decisions, these reports provide detailed insights into a property’s market worth.

Typically, the document includes several key components that help outline the basis for the valuation. Below are the essential elements commonly found in such assessments:

- Property Description: A detailed account of the property’s characteristics, such as its size, location, and condition.

- Market Analysis: Information about current market trends, comparable properties, and local economic factors that influence the property’s value.

- Valuation Method: The approach used to determine the estimated worth, whether based on comparable sales, income potential, or cost approach.

- Professional Insight: The expert’s assessment of the property’s overall marketability and any potential risks or opportunities.

These reports are not only important for buyers and sellers but also for financial institutions that require reliable valuations before making lending decisions. The document is structured to offer clear, concise, and well-supported insights, ensuring transparency and confidence in the evaluation process.

htmlEdit

Key Elements of an Effective BPO

An effective property valuation document should provide a comprehensive and accurate assessment of a property’s market value. It needs to clearly communicate the reasoning behind the estimated worth, backed by relevant data and professional analysis. This ensures that all parties involved have a clear understanding of how the value was determined and can trust the conclusions drawn.

Comprehensive Property Details

A thorough description of the property is essential. This section includes important information such as the size, layout, age, condition, and location of the property. It also covers any unique features that could impact its value, such as upgrades, renovations, or special zoning conditions.

Supporting Market Data

One of the most crucial aspects of a strong evaluation is the market analysis. An effective document draws upon recent sales data from comparable properties, current market trends, and relevant economic factors. This data helps contextualize the property’s value and provides a basis for the professional’s judgment.

Lastly, a clear explanation of the valuation method used is necessary for transparency. Whether relying on comparable sales, income projections, or replacement cost, this section should outline the reasoning behind the chosen approach, ensuring the document’s credibility and reliability.

htmlEdit

Components to Include in Your Evaluation

For a comprehensive property assessment, it’s important to include several key elements that support your conclusions. These components ensure that the valuation is clear, accurate, and backed by reliable data, helping all parties involved in the transaction understand the reasoning behind the estimated value.

Start by providing a thorough description of the property, including its size, condition, age, and any distinguishing features that may influence its marketability. Information such as the property’s location, surrounding amenities, and neighborhood characteristics should also be detailed, as these factors often impact value significantly.

Next, include a market analysis that draws from recent sales data of similar properties in the area. This comparison establishes a foundation for your valuation, providing context to the property’s worth based on the current market conditions. It’s also crucial to consider any trends that might affect the property’s future value.

Finally, provide an explanation of the valuation method used. Whether you’re employing a cost, income, or sales comparison approach, this section should clarify the reasoning behind the chosen method, ensuring the assessment is transparent and well-founded.

htmlEdit

How to Format a Property Valuation Document

Proper formatting is key to presenting a clear, professional assessment of a property’s value. A well-structured document ensures that all essential details are easy to follow and that the reasoning behind the valuation is transparent. This approach helps both the client and the evaluator understand the key points that influence the property’s worth.

Essential Sections to Include

To create an effective and organized document, ensure you include the following sections:

- Introduction: A brief overview of the purpose of the document and the property being evaluated.

- Property Description: Detailed information about the property’s physical characteristics, such as size, condition, and unique features.

- Market Analysis: Insights into recent sales data of comparable properties, current market conditions, and local economic factors.

- Valuation Approach: An explanation of the method used to arrive at the estimated value, such as sales comparison, income, or cost approach.

- Conclusion: A final summary of the assessed value and any recommendations for the property.

Organizing the Document

When structuring the document, start with the introduction to provide context. Follow with a clear description of the property, and then move into the market analysis. Each section should be distinct, with enough detail to support the final valuation. Be sure to use bullet points or numbered lists to break down complex information, making the document easy to read and understand. End with the conclusion, summarizing the key points of your assessment.

htmlEdit

Steps to Organize Your Property Valuation Report

Organizing a property evaluation document in a clear, logical manner is essential for ensuring its effectiveness. Each step in the process should build on the last, providing a coherent flow of information that supports the final valuation. This organization helps readers understand how the estimate was determined, making it easier to follow the analysis and conclusions.

Here’s a step-by-step guide to structuring your report:

| Step | Description |

|---|---|

| Step 1: Gather Property Information | Collect all necessary details about the property, such as its size, layout, age, condition, and location. |

| Step 2: Research Market Data | Identify recent sales of comparable properties in the area and gather relevant market trends. |

| Step 3: Select a Valuation Method | Choose the most appropriate valuation approach, such as cost, income, or sales comparison. |

| Step 4: Write the Property Description | Provide a clear and detailed description of the property’s features, focusing on aspects that affect its market value. |

| Step 5: Analyze the Data | Use the collected market data to analyze the property’s value, comparing it to similar properties in the area. |

| Step 6: Finalize the Report | Summarize the findings, clearly stating the estimated value, and make any necessary recommendations or observations. |

Following these steps ensures that each part of your report is thoroughly researched and clearly presented. It also improves the credibility of the valuation, as all information is organized logically and supported by data.

htmlEdit

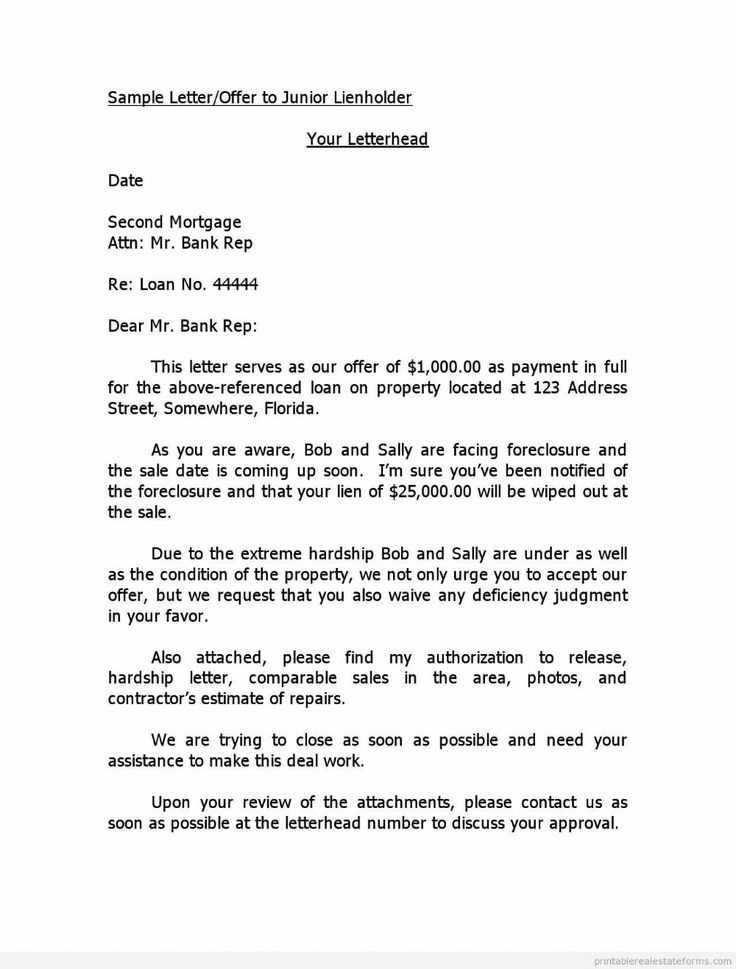

Common Uses for Property Valuation Reports

Property valuation reports are essential tools in various real estate transactions, offering insights that guide decisions about buying, selling, or financing a property. These documents are commonly used by lenders, investors, and legal professionals to assess the worth of a property, ensuring that the value is accurate and based on reliable data. Understanding how these reports are used can help you better navigate the real estate market.

Real Estate Transactions

One of the most common uses of a property evaluation is during real estate transactions, where buyers and sellers rely on these assessments to determine fair market value. These reports provide a clear picture of a property’s worth, helping parties make informed decisions on pricing and negotiating deals.

Loan and Mortgage Assessments

Lenders frequently request valuation reports when evaluating a property as collateral for a loan. The assessment helps the lender determine whether the property’s value justifies the loan amount, ensuring that the financial risk is minimized. Without an accurate valuation, both parties risk overestimating or underestimating the property’s worth.

Additional Uses

- Tax Assessments: Local government agencies use evaluations to assess property taxes.

- Estate Planning: Executors and heirs rely on property assessments when distributing assets in an estate.

- Divorce Settlements: Property valuations play a crucial role in dividing assets fairly between spouses.

- Insurance Purposes: Accurate valuations are essential for determining appropriate property insurance coverage.

htmlEdit

When and Why to Use Property Valuation Reports

Property evaluations are used in various scenarios to determine a property’s value quickly and efficiently, often serving as a more cost-effective alternative to full appraisals. Understanding when to use these assessments and the reasons behind them can help stakeholders make better decisions in real estate transactions or related processes.

When to Use Property Valuations

These assessments are particularly useful when a full appraisal is unnecessary or too expensive. Some common situations include:

- Quick Sales: When selling a property fast and a detailed appraisal isn’t required, a simple valuation can help determine an appropriate listing price.

- Refinancing: Lenders often use these assessments to quickly evaluate a property when refinancing an existing loan.

- Pre-foreclosure or Short Sale: If a property is being sold under duress, a valuation helps establish its fair market value for sale negotiations.

Why to Use Property Valuations

Property evaluations provide several benefits that make them an appealing option for various real estate purposes:

- Cost-Effective: Unlike full appraisals, these assessments are generally less expensive, offering a quick overview of a property’s value.

- Time-Saving: Valuations can be completed much faster than full appraisals, making them ideal for situations requiring fast decisions.

- Reliable Estimates: Despite being less detailed, these assessments still provide an accurate and reliable estimate of a property’s value based on market data.

Using property evaluations in the right situations allows for faster, more efficient decision-making without compromising accuracy or reliability.

htmlEdit

How to Improve Your Property Valuation Accuracy

Ensuring accuracy in property assessments is crucial for making informed decisions in real estate transactions. By following best practices and using reliable methods, you can significantly enhance the precision of these reports, leading to better outcomes for both buyers and sellers.

Several strategies can help increase the accuracy of your property valuations. Proper data collection, detailed property analysis, and adherence to established valuation standards are all essential components. The more reliable the data you work with, the more accurate the final assessment will be.

1. Use Recent and Relevant Market Data

Accurate valuations depend heavily on current market trends and comparable property sales. By analyzing recent sales in the local area, you can ensure that the assessment reflects the current market conditions. Avoid relying on outdated or irrelevant data, as this can lead to skewed estimates.

2. Consider Property Condition and Features

A detailed analysis of the property’s condition and features is vital. Elements such as the age of the property, upgrades, and the overall condition of the home or building should be carefully evaluated. This attention to detail ensures that the assessment reflects the true value of the property, factoring in its unique aspects.

By applying these practices, you can improve the accuracy and reliability of property assessments, ensuring that they serve as effective tools in real estate decision-making.