Budget letter template

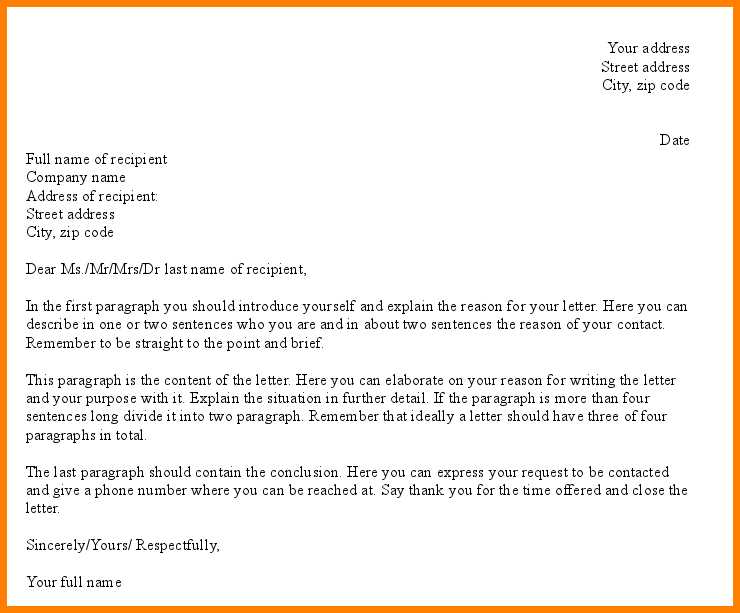

To create an impactful budget letter, focus on clarity and structure. Use a simple and direct approach to outline the financial needs and objectives. Make sure to highlight key figures and explain the purpose behind each budget request or allocation clearly.

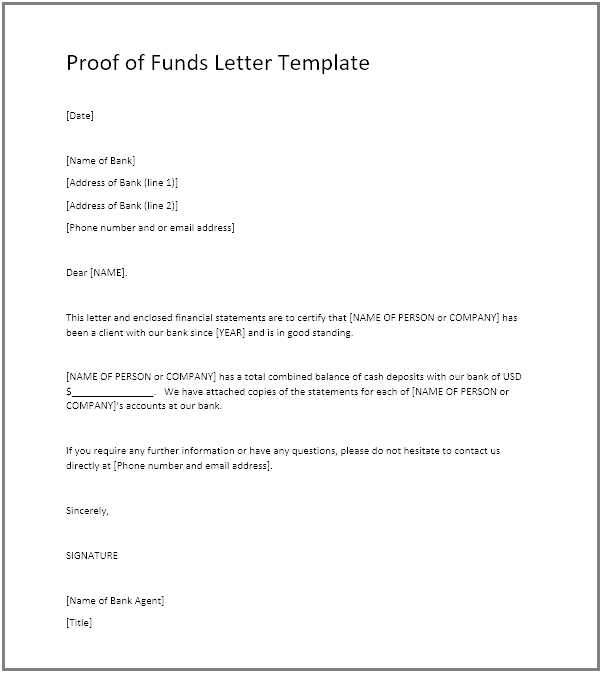

Start with a clear subject line that specifies the purpose of the letter. In the opening, introduce the reason for the letter and summarize the budget proposal briefly. Provide specific figures, and break down the budget into categories for easy reference. Ensure to include dates and relevant timeframes where applicable.

Conclude the letter by emphasizing the expected outcomes or benefits of the proposed budget. Make sure to thank the reader for considering the request, and offer to provide additional details if needed. Keep the tone professional, yet approachable, throughout the letter to maintain engagement.

Here are the corrected lines according to the requirements:

Update your budget categories to reflect the current financial situation. Avoid broad terms and specify amounts clearly.

For income: Include expected sources of revenue, such as sales, grants, or investments. Provide a specific number for each category rather than vague estimates.

For expenses: Break down costs into precise categories like office supplies, salaries, and utilities. Detail each cost with clear numbers, avoiding generalized descriptions.

Formatting: Ensure all figures are presented consistently in the same currency format, rounding to two decimal places where applicable.

Clarify the timeline: Assign specific months or quarters to revenue and expense entries to help track progress and identify deviations early.

Review periodically: Regularly assess your budget against actual performance and adjust it as needed. Make sure that any discrepancies are addressed immediately.

- Budget Letter Template Guide

Keep your budget letter clear and structured. Begin with a concise introduction stating the purpose of the letter, whether it’s to request funding, allocate resources, or outline expected expenses.

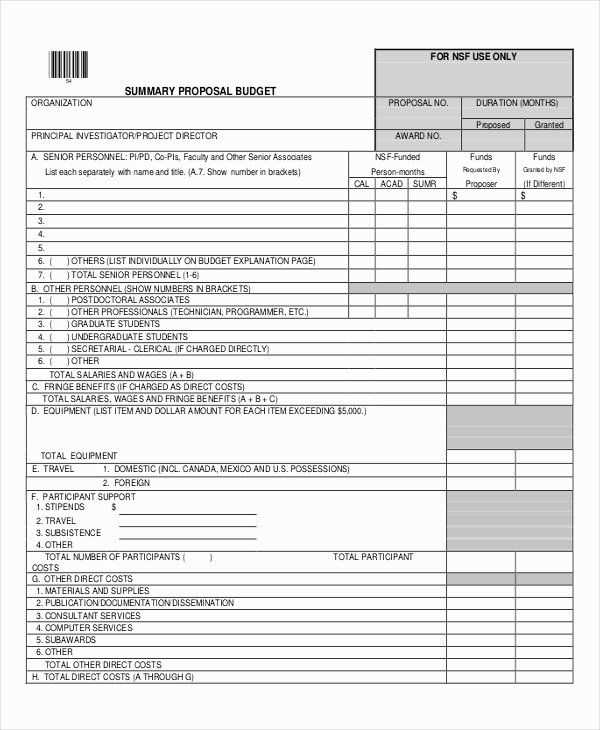

Next, break down the budget into categories. Use bullet points or a table for easier reading. Include detailed figures for each category, such as operational costs, salaries, equipment, or travel expenses.

- State the total budget allocation for each category.

- Provide specific justifications for each expense.

- Clarify the frequency or duration for each cost (e.g., monthly, annually).

In the conclusion, summarize the budget, restating how the funds will be used efficiently. Highlight any significant changes or considerations. Be concise, direct, and maintain transparency throughout the document.

Keep the tone professional but approachable. A budget letter should be straightforward, leaving no room for confusion. Stick to the facts, and avoid unnecessary jargon or explanations.

Begin with a clear and direct opening that identifies the purpose of your letter. State the budget you are requesting or explaining and briefly outline why it is necessary.

Next, break down your budget into categories. Use bullet points or a table to clearly display each category’s expected expenses. This helps the reader quickly grasp the details.

- Income: Include all sources of income or funding that will support the budget.

- Fixed Expenses: List ongoing, predictable costs like rent, utilities, and salaries.

- Variable Expenses: Include costs that may fluctuate, such as materials, transportation, or project-specific costs.

- Contingency Fund: Allocate a portion for unexpected expenses.

Provide a justification for each category, explaining why the allocated amounts are appropriate. Be clear and concise, focusing on the most important details. Support your reasoning with data or examples when possible.

Close the letter by requesting feedback or approval. Reaffirm your willingness to adjust the budget if needed, and express gratitude for the reader’s time and consideration.

Clearly state your financial goals. Whether you are requesting funding or outlining your financial plan, make sure to define your objectives with precision. Specify the exact amount of money needed and its intended use. Avoid ambiguity to help your recipient quickly understand your priorities.

Detailed Breakdown of Expenses

Provide a detailed breakdown of expenses. List categories like salaries, operating costs, and marketing expenses. This transparency helps to demonstrate how funds will be allocated, building trust with the recipient. Use bullet points or tables to make the breakdown easy to follow.

Expected Outcomes or Benefits

Include the expected outcomes or benefits of the budget. Show how the allocation of funds will contribute to the success of the project or initiative. Clear, measurable results provide the recipient with a sense of purpose behind the spending request.

Conclude with a call to action. Ask for approval or offer to discuss the budget further if needed. Make it easy for the recipient to take the next steps by keeping the conclusion concise and direct.

Failing to be specific about the financial figures is a frequent mistake. Always include exact amounts and explain how they were calculated. General estimates can create confusion or doubt about the accuracy of your budget.

Another mistake is not aligning your budget with the purpose of the letter. If it’s a proposal for funding, break down how each cost relates directly to the project’s needs. Avoid irrelevant information that doesn’t support your argument.

Don’t forget to account for potential unforeseen costs. A well-prepared budget includes contingencies, showing you’ve thought through possible challenges. Ignoring this can make your proposal seem underprepared.

Being too vague or not offering enough justification for certain expenses can weaken your letter. Always provide reasoning behind your budget choices to demonstrate thoughtfulness and planning.

Avoid presenting your budget without clear organization. Break down the costs into categories, such as “Personnel,” “Materials,” or “Administrative Expenses.” A structured layout makes it easier for the reader to understand and follow.

Lastly, don’t skip proofreading. A budget letter with typos or calculation errors can harm your credibility. Double-check your numbers and language for accuracy before sending it out.

Strike the right balance between professionalism and approachability when writing a budget letter. Be direct and clear while maintaining a respectful tone. Start with a positive outlook, focusing on what can be achieved rather than what is not possible. Highlight areas where savings can be made without compromising key priorities.

Keep your language straightforward. Avoid overcomplicating sentences or using technical jargon that may confuse the reader. Use simple phrases that clearly explain your financial goals and limits.

Stay neutral when addressing challenges. Instead of sounding defensive or apologetic, focus on offering solutions. Acknowledge the constraints, but emphasize your willingness to work within them to achieve the best outcomes.

Maintain a friendly, collaborative tone. The goal is to keep the conversation productive, so make sure the language feels inclusive and open, not confrontational. This helps build trust and encourages cooperation.

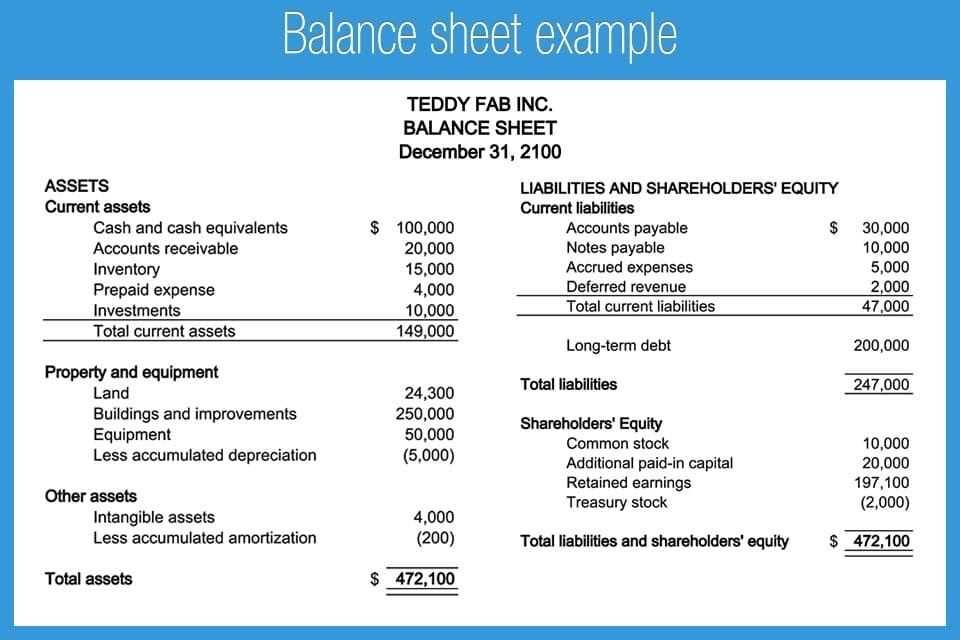

Begin by determining the context of the budget letter. For personal use, focus on outlining income, expenses, and savings goals. For business, emphasize income sources, operating costs, and projected profits. Adjust the tone to match the purpose–personal letters may be informal, while business letters should remain professional.

For personal use, include categories like housing, utilities, transportation, and leisure. Set realistic limits for each category and highlight areas where spending can be reduced. Ensure that income is clearly stated, along with any debts or obligations.

In a business context, break down your budget into key sections such as revenue, fixed costs, variable expenses, and profit margins. Use clear headings for each section to avoid confusion. Include any anticipated fluctuations in costs, such as seasonal changes or marketing campaigns.

If creating a budget letter for both personal and business purposes, customize the tone and sections accordingly. Begin with a general overview and break down each area with specifics. Avoid overly technical jargon in personal letters, but be precise and clear in business letters.

| Category | Personal Budget | Business Budget |

|---|---|---|

| Income | Salary, investments | Sales revenue, services |

| Expenses | Rent, utilities, groceries | Payroll, utilities, marketing |

| Savings/Profit | Emergency fund, savings goals | Net profit, reinvestment |

Tailor your format to the audience. Personal letters may be more direct and concise, while business letters might require a more detailed breakdown of financial strategies and projections.

Examples of Templates for Different Budget Letter Situations

Writing a budget letter requires clear, concise communication, and the format often varies depending on the situation. Below are examples tailored for different scenarios, each offering a straightforward approach for crafting effective budget letters.

1. Requesting Additional Funds

This template is used when requesting extra funds for a project or department. It should justify the need for more resources, outline how they will be used, and provide a clear breakdown of the anticipated expenses.

Subject: Request for Additional Budget Allocation

Dear [Manager’s Name],

I hope this message finds you well. I am writing to request an increase in our department’s budget allocation for the upcoming quarter. Due to unforeseen circumstances, including [brief reason for the need], additional funds are required to [explain purpose]. The following breakdown outlines the anticipated costs:

- [Expense 1] – $[Amount]

- [Expense 2] – $[Amount]

- [Expense 3] – $[Amount]

We believe this additional funding is crucial for meeting our project goals and ensuring smooth operations. I would appreciate your consideration of this request and look forward to discussing it further.

Thank you for your time and support.

Best regards,

[Your Name]

2. Reporting on Budget Performance

This template is designed to report how a budget is being utilized, typically sent to higher management. It includes an overview of the current budget status, highlighting any variances and suggesting adjustments if necessary.

Subject: Budget Performance Update

Dear [Manager’s Name],

I would like to provide an update on our budget performance for the [time period]. As of now, we have utilized [X]% of our allocated budget, with the following breakdown:

- [Category 1] – $[Amount] spent out of $[Total budget]

- [Category 2] – $[Amount] spent out of $[Total budget]

- [Category 3] – $[Amount] spent out of $[Total budget]

Currently, we are slightly over budget in [category], primarily due to [reason]. To address this, we propose the following adjustments:

- [Adjustment 1] – $[Amount]

- [Adjustment 2] – $[Amount]

We are confident that these changes will bring us back in line with our budget goals. Please let me know if you have any questions or suggestions.

Best regards,

[Your Name]

3. Confirming Budget Approval

This template is used when confirming the approval of a budget. It expresses gratitude and assures the recipient that the approved funds will be used appropriately.

Subject: Confirmation of Budget Approval

Dear [Manager’s Name],

Thank you for your approval of the budget for [specific project/department]. We are excited to move forward with the allocation of funds as outlined. The total approved amount is $[Total Budget], and we have planned the following spending:

- [Category 1] – $[Amount]

- [Category 2] – $[Amount]

- [Category 3] – $[Amount]

We will ensure all expenditures align with the approved budget and provide regular updates as we proceed. Please don’t hesitate to reach out if you require any further details.

Best regards,

[Your Name]

To create a solid budget letter, make sure to structure it clearly and succinctly. Focus on providing a transparent outline of expected income and expenses, ensuring both parties understand the financial priorities. It’s crucial to provide accurate figures and offer reasonable explanations for any projected changes in the budget, whether it’s due to unforeseen costs or new investments. Avoid unnecessary jargon–clarity should always take precedence.

Clear Breakdown of Income

Start by detailing all sources of income, specifying amounts and expected dates. This includes salaries, investments, or any other regular contributions. Ensure that the information is easy to follow to avoid confusion down the line.

Outline of Expenses

Next, lay out the expenses with precise categories: operational costs, anticipated purchases, debt repayments, or planned savings. Ensure each category is detailed enough to allow both parties to assess financial commitments accurately. Always add flexibility in your expense estimates to account for any unforeseen adjustments.

Conclude the letter by outlining any adjustments or actions needed if expenses exceed expectations or if income fluctuates. This shows proactive planning and helps maintain transparency throughout the financial process.