Capital Commitment Letter Template Guide

When forming an agreement that ensures financial backing, it’s essential to structure the document clearly and effectively. This type of agreement serves as a formal declaration of the financial commitment made by one party, offering security to the other. The clarity of such a document is critical in preventing misunderstandings and establishing trust between the involved parties.

Key Elements of a Financial Agreement

Every financial document should contain a few fundamental sections to be effective. These typically include:

- Parties Involved: The names and roles of all participants in the agreement.

- Amount and Terms: The total financial sum and the conditions under which the commitment will be fulfilled.

- Timeframe: Clear details about when the funds will be provided or the financial support activated.

- Conditions: Any prerequisites or stipulations for the agreement’s execution.

How to Structure the Document

To ensure clarity, the document should be organized into well-defined sections. Begin by clearly stating the intent of the agreement, followed by detailed descriptions of the financial conditions. Each section should be easy to navigate, allowing quick reference when needed. Maintain a professional tone throughout the document to ensure that it serves its legal and financial purpose.

Common Mistakes to Avoid

One of the most common errors is not specifying the exact terms, such as the precise amounts or timelines. Another pitfall is unclear language, which can lead to disputes later on. It’s also crucial to make sure both parties sign the document, ensuring its validity.

Benefits of Having a Structured Agreement

Having a structured document that outlines the financial arrangement provides both parties with a clear understanding of their responsibilities. This reduces the chance of disagreements and serves as a legal safeguard should issues arise in the future. Additionally, a well-constructed document ensures that the financial transaction occurs smoothly and as planned.

Understanding Financial Engagement Documents

When securing a formal financial pledge, a document is created to outline the terms and expectations between parties. This agreement serves to ensure that each party understands their roles, responsibilities, and obligations in the transaction, fostering clarity and trust. It is crucial that the document be well-organized and clear to avoid future conflicts.

Essential Elements of the Agreement

A well-structured financial engagement document should include several key components to ensure all parties are aligned. These include:

- Involved Parties: Clearly state the names and roles of all parties entering into the agreement.

- Financial Details: Specify the amount being pledged and any relevant terms regarding payment or fulfillment.

- Timeline: Define the period within which the commitment should be honored.

- Conditions and Requirements: Include any preconditions or obligations that must be met before or during the commitment.

Steps to Draft a Financial Agreement

To draft a proper financial document, begin with a clear introduction stating the purpose of the agreement. Follow this with detailed sections that outline the roles of each party, the amount involved, the timeline, and any specific conditions. Be precise and avoid vague language to minimize misunderstandings.

Legal Considerations in Financial Agreements

It is essential to ensure that the document is legally binding. Include clauses that comply with relevant laws and regulations to protect both parties. Legal language should be clear, but it may also be helpful to seek legal advice to ensure that all terms are enforceable and in line with applicable laws.

Common Errors in Writing Documents

Several mistakes are often made when drafting such documents. One common error is failing to clearly state the amount or terms of the engagement. Another issue arises when the document lacks signatures from all parties involved, which can invalidate the agreement. Additionally, unclear or ambiguous language can lead to misinterpretation and disputes.

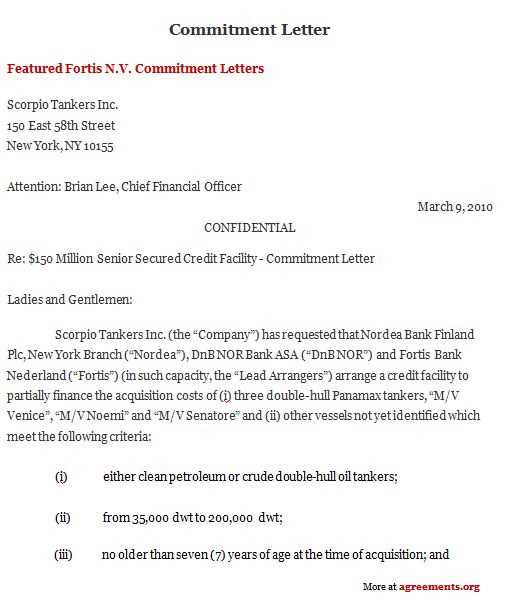

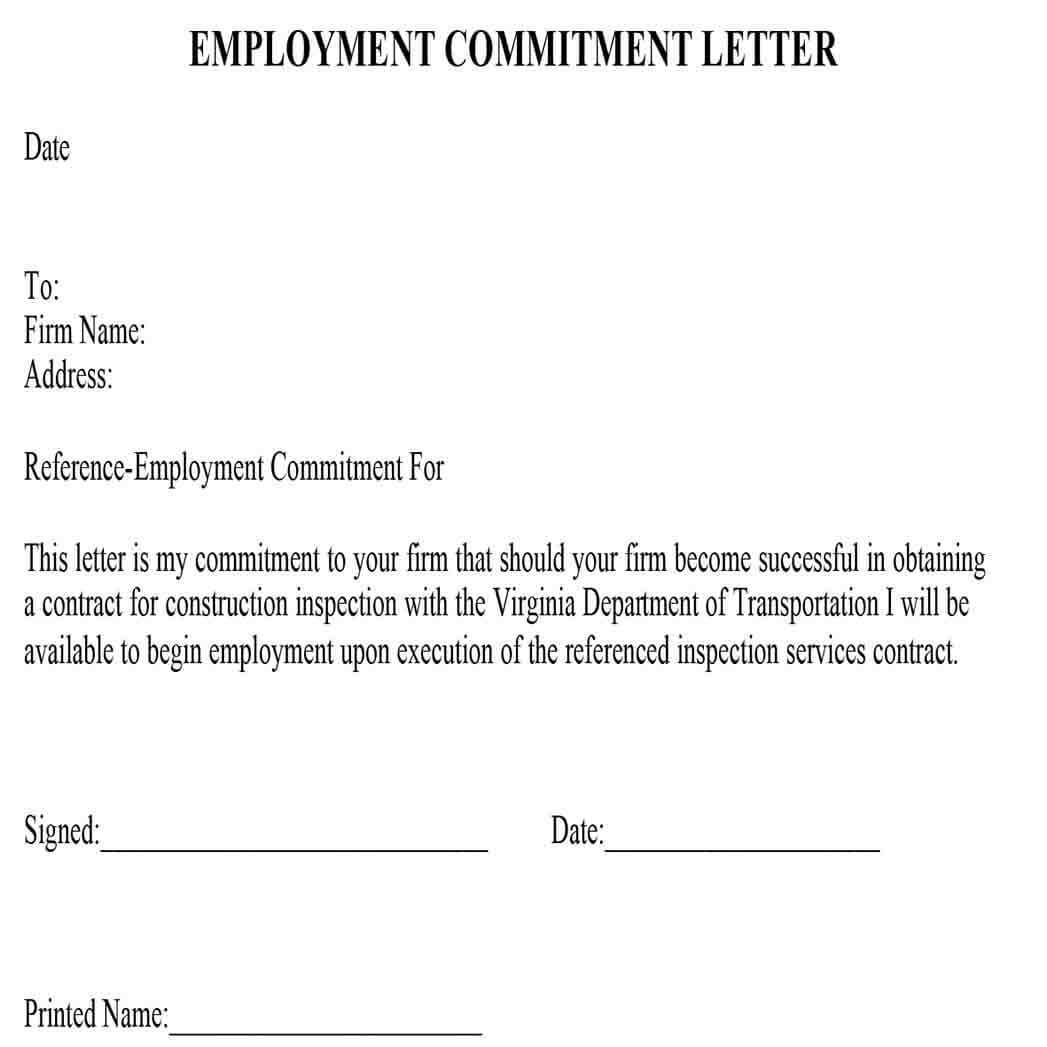

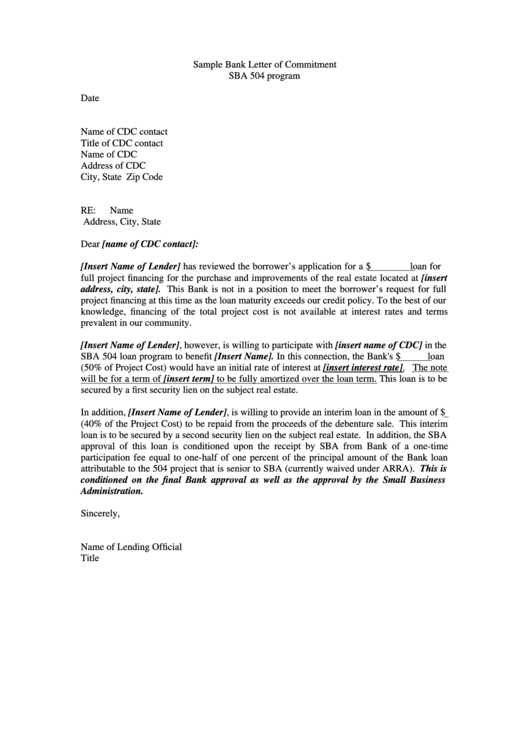

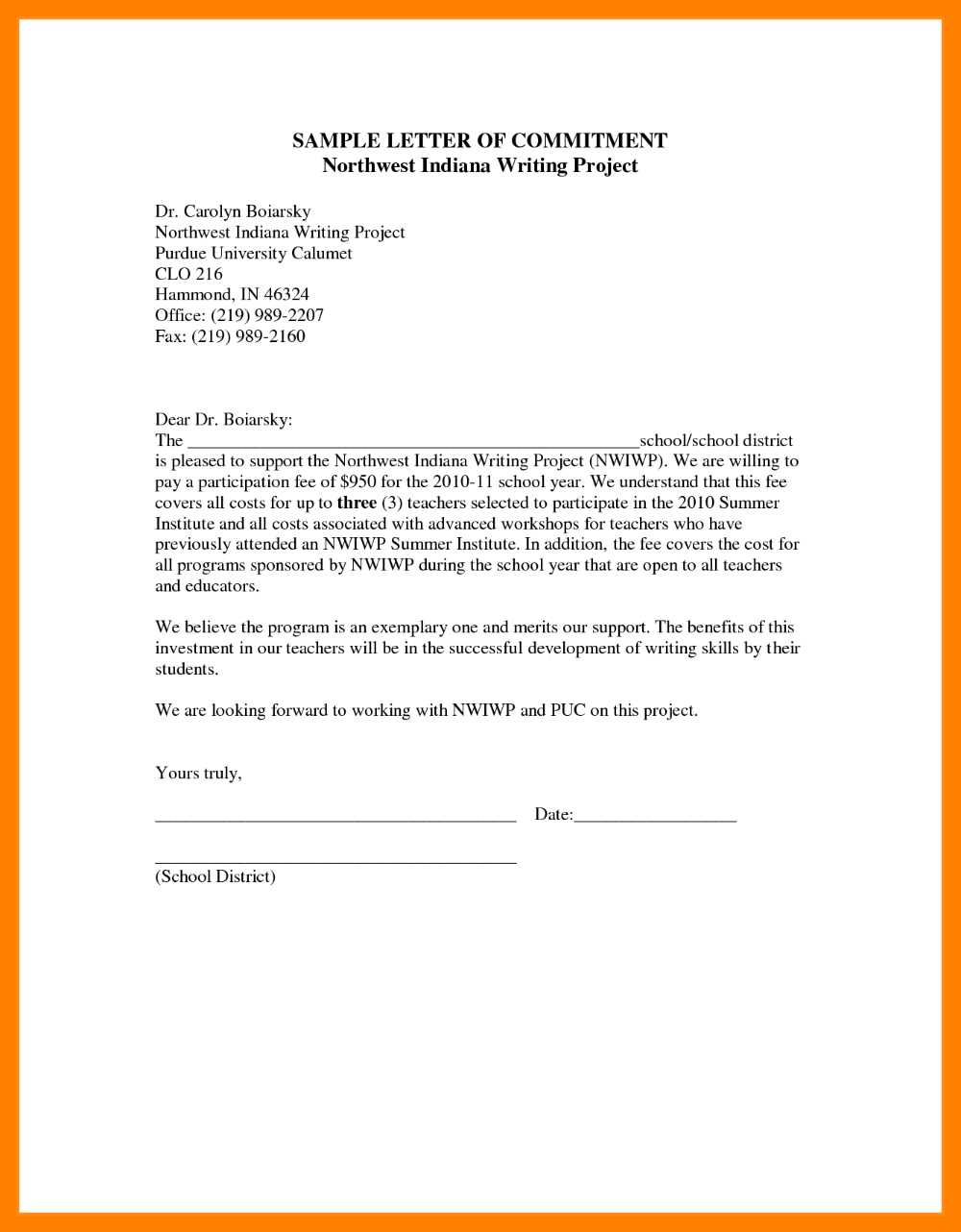

Practical Examples for Clear Understanding

Providing examples of similar documents can help illustrate how the agreement should be structured. These examples offer insight into the proper formatting, language, and sections to include, serving as a valuable guide for those drafting their own engagement documents.

Benefits of Using a Structured Agreement

Using a well-drafted financial agreement offers several benefits, including reducing the risk of misunderstanding, establishing clear expectations, and protecting both parties legally. It creates a foundation for trust and accountability, making the financial interaction smoother and more secure for all involved.