Car Loan Hardship Letter Template for Payment Relief

When facing unexpected financial struggles, it’s essential to communicate effectively with your creditor to request a change in payment terms. Whether it’s a temporary delay or a long-term adjustment, crafting a well-written request can make a significant difference. By outlining your situation clearly and professionally, you increase your chances of receiving the help you need.

Understanding the key elements of a strong request is crucial in making a compelling case. A clear explanation of your current financial challenges, along with the desired outcome, helps the recipient understand your position. It’s important to remain respectful and concise while providing necessary documentation, if applicable.

By following a structured approach, you can create a professional appeal that demonstrates your commitment to fulfilling your obligations while requesting the necessary flexibility. This process is about balancing honesty with a solution that benefits both parties.

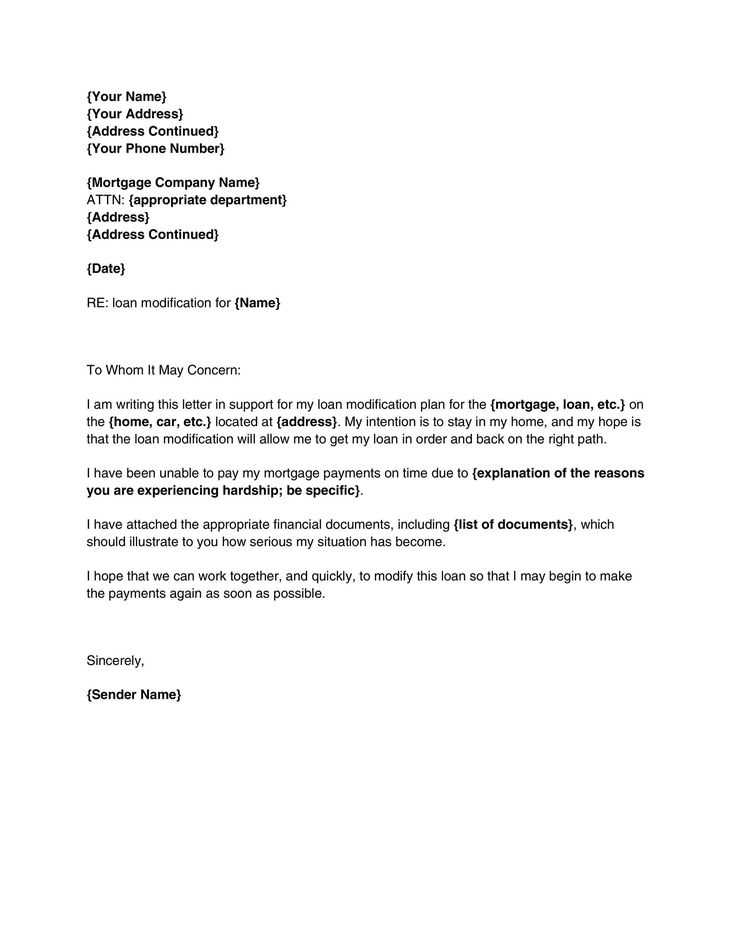

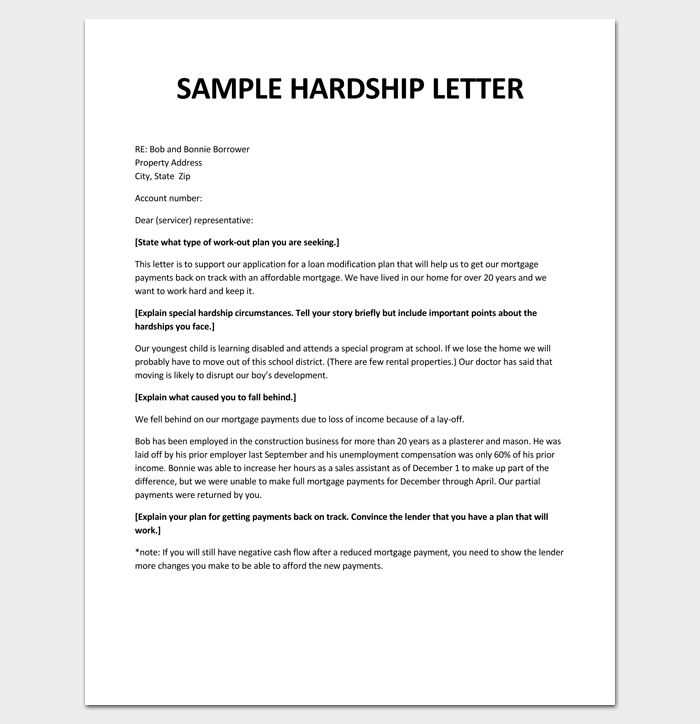

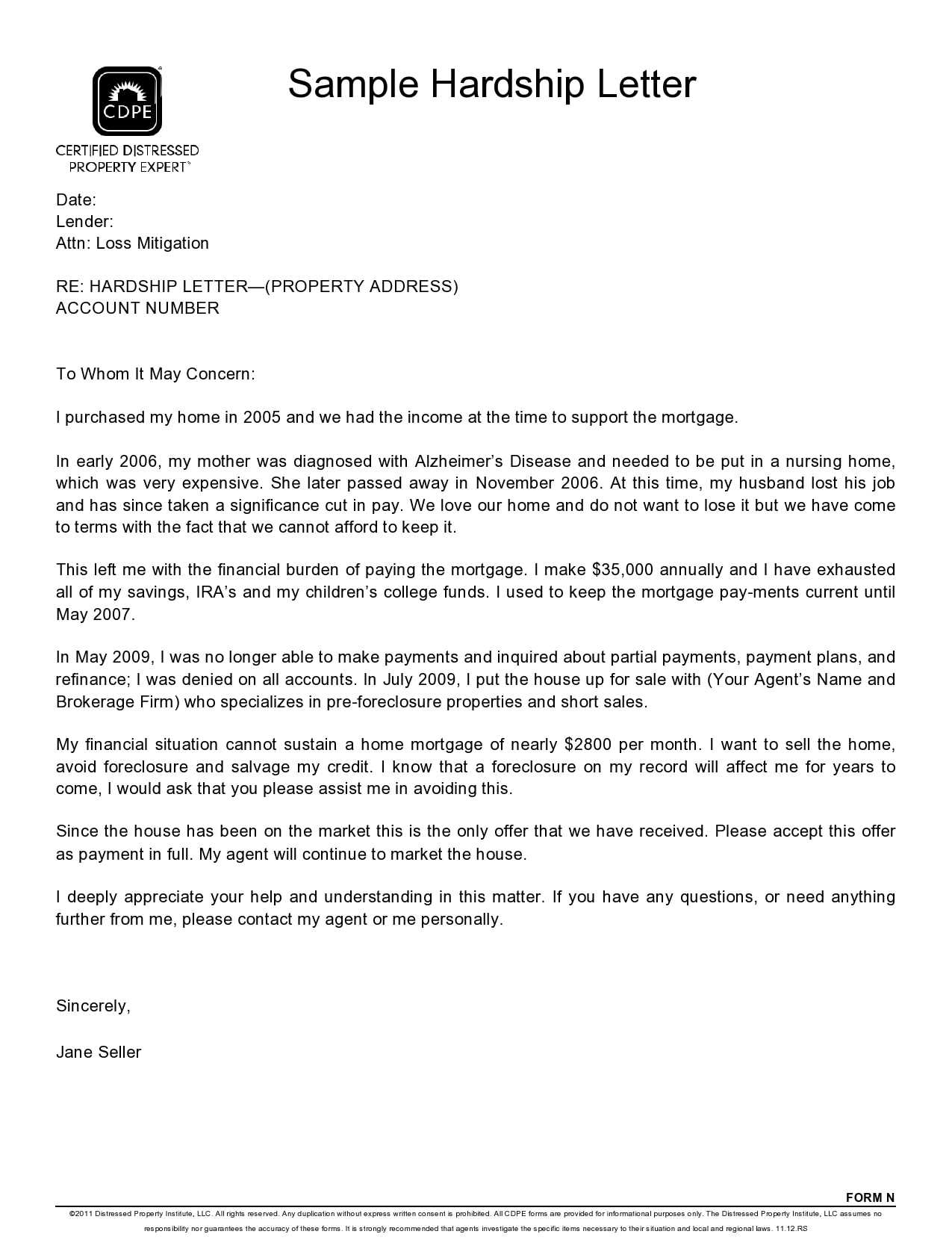

Writing a Car Loan Hardship Request

When facing financial difficulty, it’s essential to communicate your situation to the lender in a clear and respectful manner. By requesting a temporary modification of your payment terms, you open the door for possible solutions that could ease your burden. The key is to provide enough information for your creditor to understand your current financial struggles and your commitment to resolving them.

Key Information to Include

To craft an effective request, start by outlining the reasons behind your current financial situation. Be honest and specific about the circumstances, whether it’s due to medical bills, job loss, or other unexpected expenses. Providing supporting documentation such as pay stubs, medical bills, or termination letters can strengthen your case. Make sure to include a clear proposal for the payment changes you’re seeking.

Maintaining a Professional Tone

While it’s important to explain your situation, maintaining a professional tone is crucial. Avoid sounding desperate or accusatory. Focus on your willingness to cooperate and find a solution. A respectful and well-organized request shows that you’re taking the matter seriously, which can help foster a positive response from the lender.

Essential Details for Your Request

To ensure your appeal is taken seriously, it’s important to include all relevant details in your communication. A well-structured message allows the recipient to quickly grasp your situation and understand the adjustments you’re requesting. This section will guide you through the crucial elements that should be part of any effective request.

Clear Explanation of Your Situation

Start by providing a concise yet thorough explanation of the circumstances leading to your financial difficulties. Whether it’s job loss, medical issues, or other factors, be transparent about the challenges you’re facing. This context will help the lender understand why you’re unable to meet the current payment terms.

Specific Request for Modification

Clearly state what you are asking for, whether it’s a temporary reduction in payments, an extension of the repayment period, or any other form of relief. Be specific about the changes you need and the duration of time for which you’re requesting assistance. Providing these details will help the lender evaluate your request more efficiently.

How to Ask for Loan Assistance

When you find yourself in financial difficulty, it’s important to approach your creditor in a clear and professional manner to request help. Making a well-articulated request can increase the chances of getting the assistance you need. In this section, we will break down the steps you should follow when asking for support in managing your payments.

Steps to Make Your Request

- State the Reason: Clearly explain the situation that has led to your financial struggles, such as a loss of income or unexpected expenses.

- Be Honest and Transparent: Provide truthful information to help the lender understand your current circumstances.

- Specify the Type of Assistance Needed: Outline whether you’re seeking a payment deferral, a reduced payment, or another form of modification.

- Provide Supporting Documentation: Attach relevant documents like pay stubs, medical bills, or termination letters to back up your request.

Maintaining a Respectful Tone

It’s essential to remain respectful and professional in your communication. Avoid using emotional language or making demands. Instead, focus on your willingness to work with the lender toward a solution that benefits both parties.

Avoiding Common Letter Mistakes

When requesting assistance with your payments, it’s crucial to avoid common mistakes that could undermine the effectiveness of your communication. A well-crafted appeal can significantly increase your chances of receiving the help you need. This section will cover the most frequent errors and how to avoid them.

Common Pitfalls to Watch Out For

- Vague Information: Failing to explain the specifics of your financial situation can make it difficult for the recipient to understand your request.

- Overly Emotional Language: While it’s important to share your struggles, excessive emotional appeal can make the message seem less professional.

- Unclear Request: Not specifying what assistance you need–such as a reduced payment, a deferred term, or a temporary suspension–can confuse the reader.

- Neglecting Supporting Documents: Without necessary documentation, such as pay stubs or medical records, your appeal may not be taken seriously.

Ensuring a Professional Tone

Maintaining a professional and courteous tone throughout your message is essential. Be respectful and clear, keeping the focus on finding a solution rather than on personal emotions or frustrations. This approach helps in building a constructive relationship with your creditor.

Best Timing for Submitting Your Request

Choosing the right moment to send your request for assistance is just as important as crafting a detailed and professional appeal. Timing can impact how your plea is received and processed. In this section, we’ll explore the ideal times to submit your request to maximize the chances of a positive response.

When to Send Your Request

- Before Missing Payments: Submit your request before you miss any scheduled payments. This shows your proactive approach and willingness to work out a solution.

- During Financial Struggles: If you’re already facing challenges but have not yet defaulted, sending a request for modification early can help prevent a more serious situation from developing.

- At the Beginning of the Month: Lenders may be more responsive at the start of the month when they have a fresh workload and budget considerations in place.

- Well in Advance of Due Dates: Giving your creditor time to process the request ensures that you have a response before your next payment is due, allowing for smooth adjustments.

Timing During Personal Circumstances

- After Major Life Events: If your financial situation is due to a life event like illness or job loss, it’s important to reach out as soon as the situation arises, even before it fully impacts your finances.

- When You Have Support Documents Ready: Don’t wait too long if you have the necessary documentation prepared. The sooner you submit a complete request, the better the chances of a prompt resolution.

Key Strategies for Loan Modification Success

Successfully adjusting the terms of your payment agreement requires more than just submitting a request; it involves careful preparation and a strategic approach. This section highlights key strategies that can improve your chances of achieving a favorable modification.

Establish a Clear Financial Picture

Before requesting any changes, ensure you have a complete understanding of your current financial situation. Lenders need to see that you are transparent and well-organized in your approach.

- Provide Accurate Financial Statements: Submit up-to-date information about your income, expenses, and assets to give a complete picture of your ability to meet revised terms.

- Demonstrate Willingness to Collaborate: Showing a proactive attitude by offering potential solutions can go a long way in encouraging a positive response.

- Maintain Open Communication: Keep the lines of communication open with your lender, and be prepared to respond promptly to any requests for additional information.

Request Realistic Modifications

When requesting changes to the payment terms, be realistic about what you can afford. Overly ambitious requests may not be well-received, while reasonable ones that align with your finances are more likely to be considered.

- Ask for a Manageable Payment Plan: Instead of asking for drastic reductions, propose adjustments that ensure you can meet your commitments without straining your finances.

- Propose Temporary Solutions: If your financial difficulties are short-term, suggest temporary measures, like deferring payments, until you are back on your feet.

Understanding the Lender’s Reply Process

Once you have submitted your request for adjustments, it’s important to understand how the lender processes and responds to it. Knowing what to expect during this phase can help you manage your expectations and prepare for the next steps in your journey.

The response from the lender will vary depending on the specifics of your situation and the policies of the institution. Below is a breakdown of the common stages and what each stage involves:

| Stage | Description |

|---|---|

| Initial Acknowledgment | Once your request is received, the lender will acknowledge its receipt. This is usually a formal notification informing you that the process has begun. |

| Evaluation | The lender will assess your financial situation based on the details you provided. They may request additional documentation to fully understand your circumstances. |

| Decision Making | Based on the evaluation, the lender will decide whether to approve, deny, or suggest alternatives for modifying your payment terms. This stage may take some time. |

| Notification | The lender will send you their response in writing, explaining their decision and any further actions required from your side if applicable. |

Understanding each step in the process can help you stay informed and prepared for any requests or follow-up actions from the lender. Keep in mind that this process might take time, and maintaining communication throughout can help ensure smoother progress.