Cash Gift Letter Template for the UK

In the UK, when providing funds to someone, it’s important to keep clear and official documentation. This serves as evidence of the transaction, helping avoid any misunderstandings and ensuring compliance with tax laws. The right paperwork can help clarify the nature of the transaction, particularly when large sums are involved.

Why Proper Documentation Matters

Whether you are assisting a family member, friend, or acquaintance, having a formal record of the financial transfer can protect both parties. It ensures transparency, providing a written proof of the amount given and the purpose behind it. Moreover, it helps both the giver and the recipient during audits or tax assessments.

Benefits for the Receiver

- Clear Record: Ensures the receiver has an official acknowledgment of the transaction.

- Avoid Confusion: Helps clarify the nature of the amount received, reducing potential disputes.

- Tax Clarity: Keeps the receiver safe from possible future taxation issues.

Benefits for the Giver

- Legal Protection: Guards the giver from potential legal challenges or questions about the transfer.

- Tax Implications: A well-documented record helps determine whether or not any taxes are due.

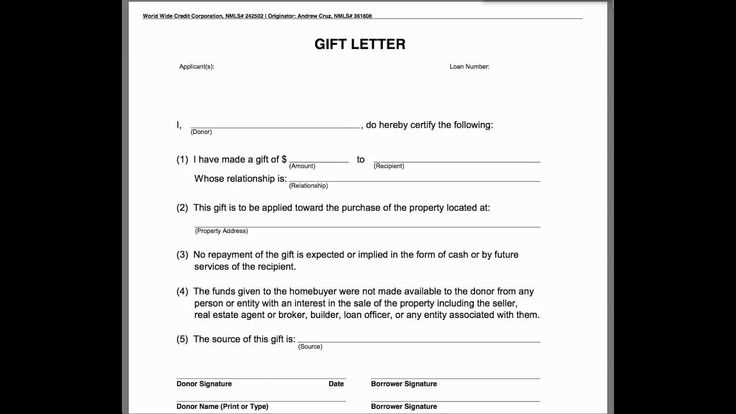

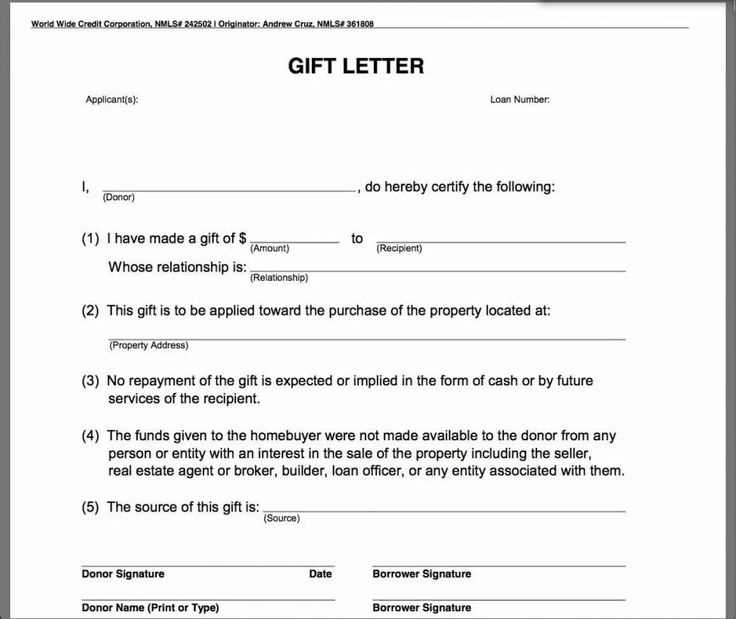

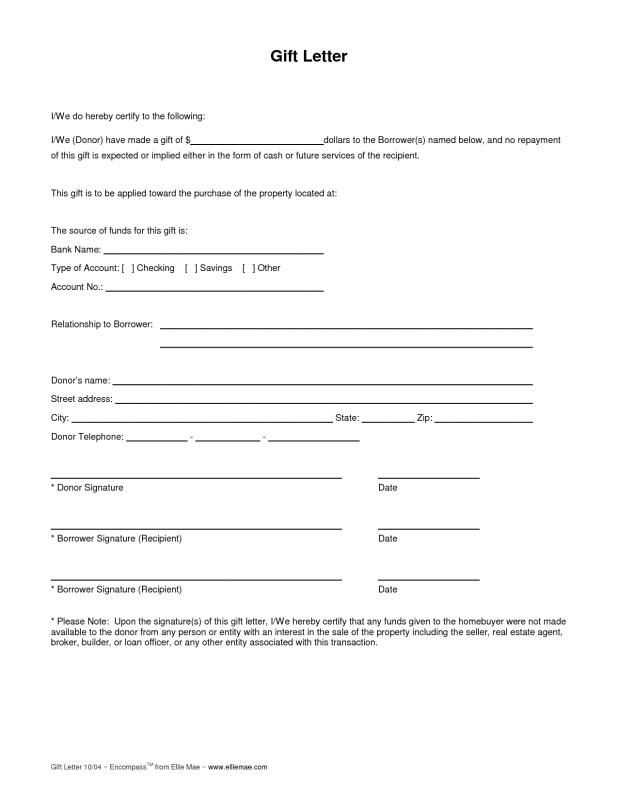

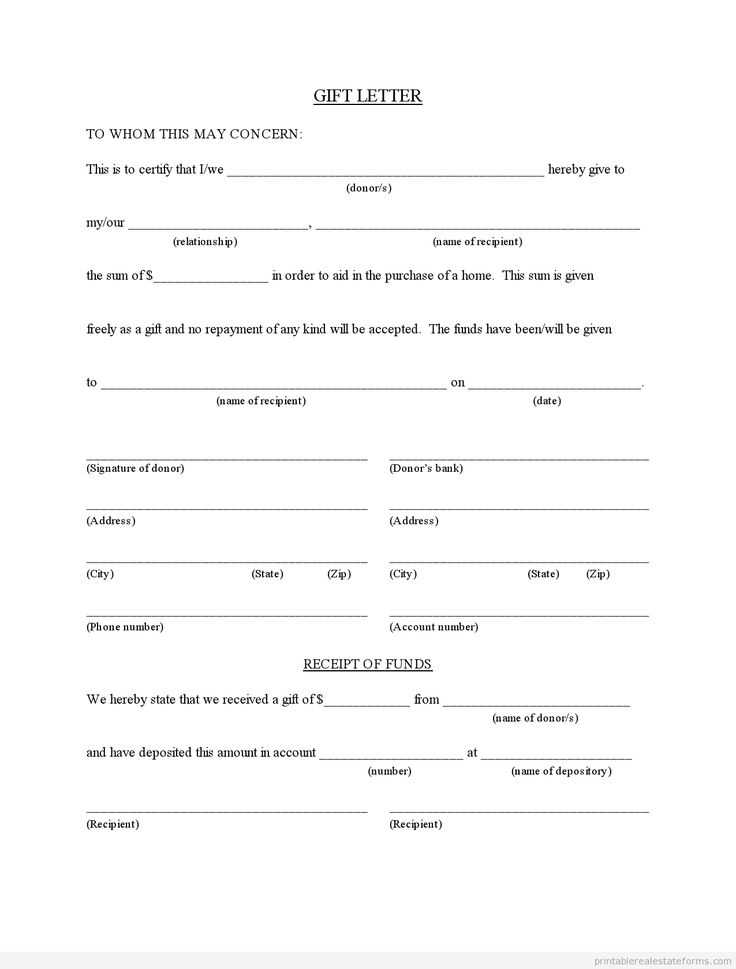

Key Elements of the Document

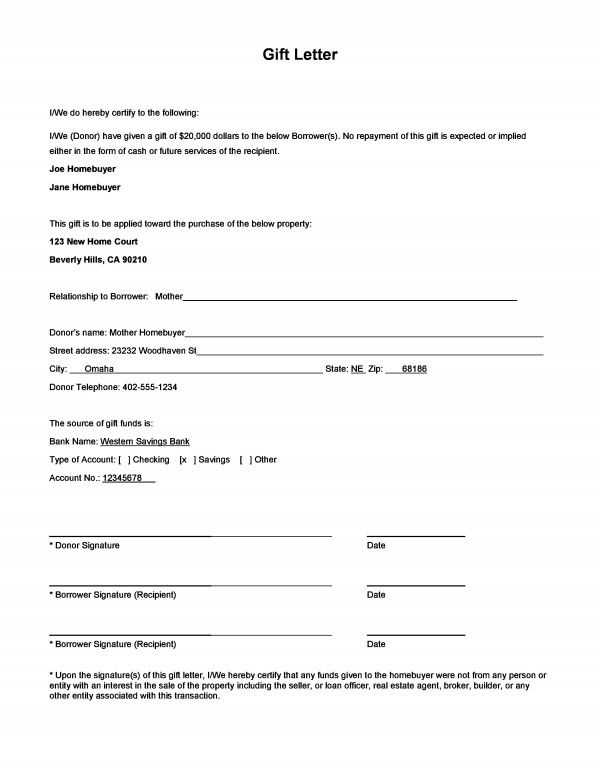

A comprehensive document should include specific details to make the transfer clear and legitimate. These elements ensure that the information is transparent and legally sound.

- Amount: Clearly state the exact sum being transferred.

- Date: Indicate the date on which the transfer took place.

- Purpose: Explain the reason for the transaction to avoid confusion.

- Signatures: Both parties should sign the document to validate the agreement.

Tax Considerations

In some cases, such transactions might affect the giver’s taxes. It’s important to understand the tax-free allowance limits. If the amount exceeds a certain threshold, the giver may be required to pay a gift tax. Always consult with a tax advisor to ensure full compliance with the law.

Using a Standardized Format

While a simple document can be used for this purpose, using a recognized format that includes all necessary details makes the process smoother. Several resources are available online, offering ready-made formats for this kind of documentation. These formats help ensure you don’t miss any important details and reduce the risk of errors.

What is a Financial Contribution Document

When transferring money to another person, it is essential to have a formal document that verifies the transaction. This record acts as evidence of the transfer, ensuring that both parties are clear on the amount, purpose, and terms of the exchange. Such documentation helps avoid misunderstandings and provides a written acknowledgment of the transaction.

Why You Should Use a Written Record

Having a formal document is important for both the giver and the recipient. It establishes a clear and transparent record of the transfer, which can be useful for personal and legal reasons. It also protects both parties in the event of a dispute or inquiry, ensuring that there is no confusion about the nature or intent of the transaction.

How to Draft Your Document

Drafting an official record for a monetary exchange is straightforward, but it should include key details to ensure its validity. Begin by clearly stating the amount being transferred, the date of the transaction, and the purpose behind it. The document should also include the names of both parties involved, with spaces for signatures to formalize the agreement.

Key Details for a Financial Document

A well-structured document should cover the following elements:

- Amount: The exact sum being transferred.

- Date: The specific date when the transfer occurred.

- Purpose: A clear explanation of why the funds are being given.

- Signatures: Both parties should sign to validate the document.

Tax Implications for Monetary Transfers

In the UK, financial transfers over a certain amount may have tax implications. While smaller sums are usually exempt from taxation, larger contributions could be subject to tax. It is important to understand the applicable rules and thresholds for tax-free transfers. Always consult a tax advisor to ensure you comply with the relevant tax laws and regulations.

Free Resource for Your Financial Document

If you need a starting point, there are many free resources online offering ready-to-use formats. These templates ensure that you don’t miss any crucial information and help streamline the process of drafting your official document. You can customize these formats to suit your needs, making sure all required details are included.