CFPB Debt Validation Letter Template

When faced with an unverified financial claim, it’s essential to assert your rights and request clear proof of the obligation. A formal approach ensures that all parties involved have a proper understanding of the situation, and it helps you protect your interests. Below is a comprehensive guide to addressing such issues through written communication.

Why It’s Important to Verify Claims

Verifying a financial obligation ensures accuracy in records and prevents errors that could harm your financial reputation. If a claim is not substantiated with proper documentation, it can lead to unnecessary stress and confusion. By requesting verification, you are ensuring that only legitimate claims are pursued against you.

Key Elements to Include in Your Communication

- Identification Information – Clearly state your full name, address, and account number, if applicable.

- Specific Request – Ask for a copy of the original agreement or any supporting documentation showing your responsibility.

- Legal Reference – Mention any relevant regulations that require verification of claims.

Common Mistakes to Avoid

- Vague Requests – Be clear about what you are asking for to avoid unnecessary back-and-forth.

- Failing to Follow Up – If you do not receive a response in the expected timeframe, be sure to follow up.

- Missing Key Details – Always include all necessary identifying information to ensure a smooth process.

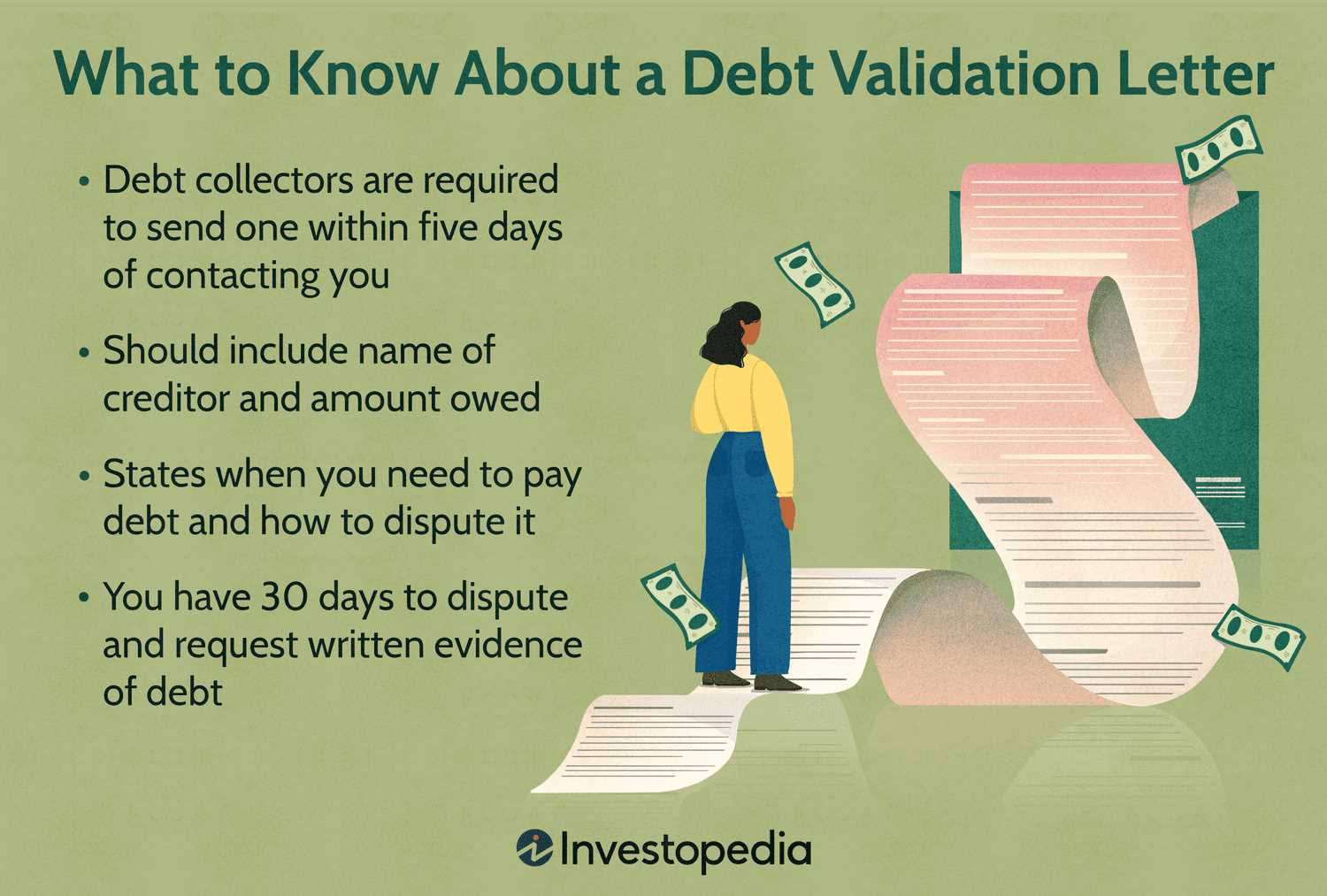

Your Rights When Disputing Claims

You are entitled to request proof of a claim before taking any further steps. The law provides protection against unfair practices, ensuring that any dispute is handled properly and that any potential errors are corrected swiftly. If the claim cannot be verified, it should not be pursued.

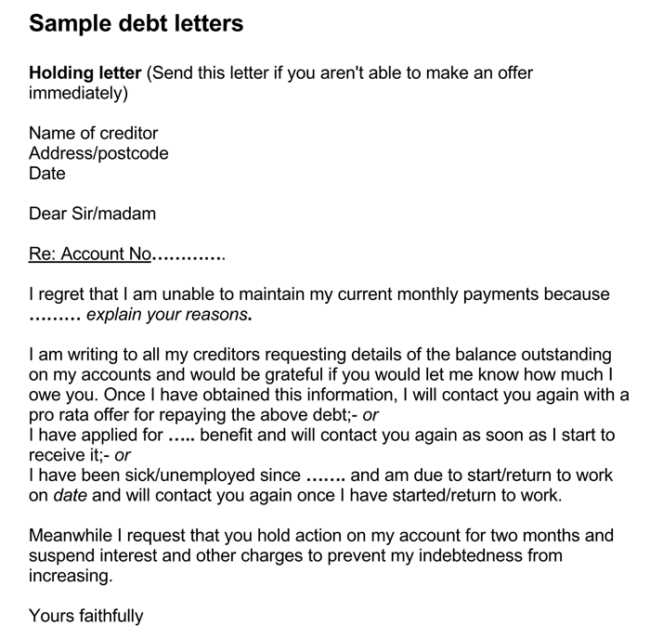

What to Do After Sending Your Request

Once you have sent your formal communication, give the other party time to respond. If the requested proof is not provided, you may have legal grounds to dispute the claim further. Keep records of all communications for future reference, and if necessary, seek legal advice to ensure your rights are protected.

Why Verifying Financial Claims Is Essential

When disputing an unverified financial obligation, it’s crucial to ensure the legitimacy of the claim before taking further steps. Requesting proper proof protects your rights and ensures that only valid claims are pursued. This section will guide you through the necessary actions to dispute such claims effectively and assert your position.

Why Verifying Financial Claims Matters

Verifying a financial obligation ensures that you are not held accountable for errors or fraudulent charges. Many people encounter inaccurate or illegitimate claims, and it’s important to know how to contest them. By confirming the legitimacy of the claim, you avoid paying for something that you don’t owe.

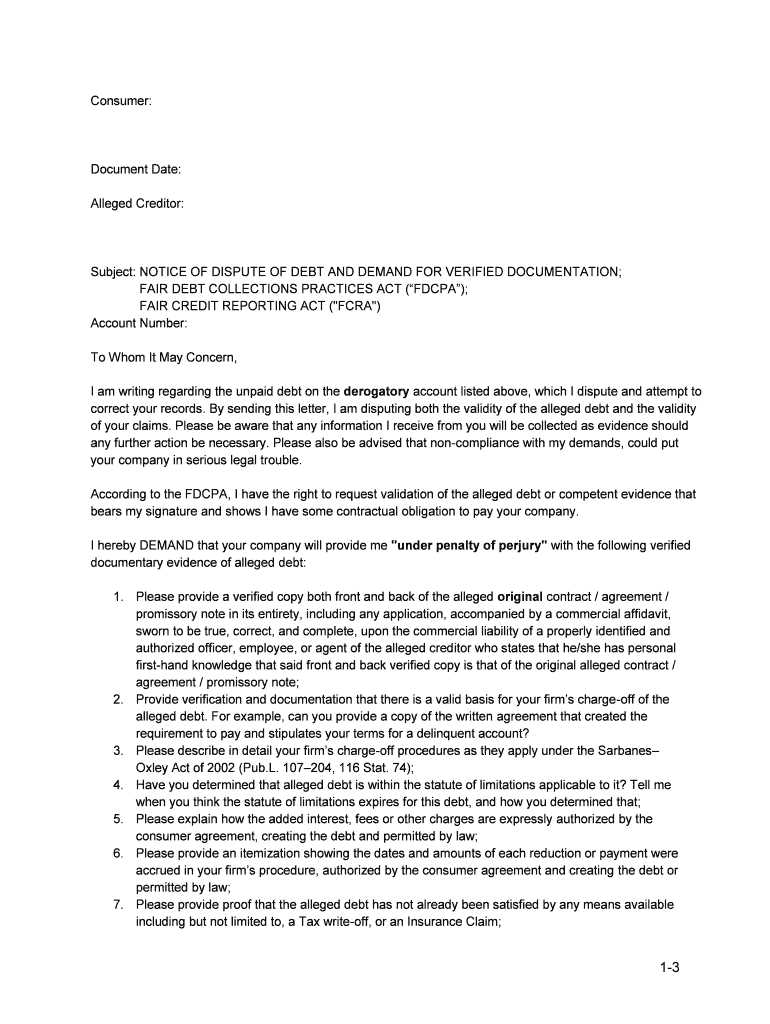

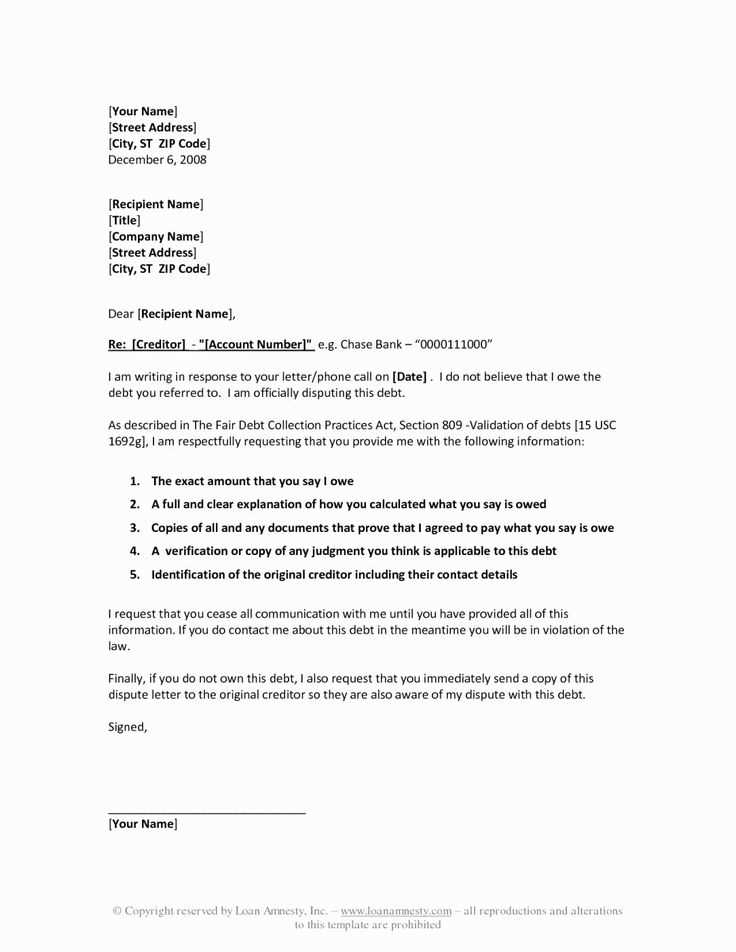

Steps to Draft a Dispute Request

Creating a formal request to challenge an unverified claim is a straightforward process. First, clearly state your intent to dispute the obligation. Provide necessary personal details such as your name, account number, and address to identify the claim in question. Request specific documentation proving the validity of the financial demand, including contracts, agreements, or any other records supporting the claim. It’s important to be clear and concise in your communication to avoid misunderstandings.

Key Details to Include in Your Dispute Request

To make your dispute request effective, include the following details:

- Full Identification – Your name, address, and relevant account numbers should be clearly stated to help the other party identify the claim.

- Clear Statement of Dispute – Clearly mention that you are disputing the obligation and request verification of the claim.

- Specific Documents Requested – Ask for copies of any relevant documents, such as contracts, account statements, or agreements.

- Legal Reference – Cite any applicable laws or regulations that protect your right to dispute inaccurate claims.

How to Address Replies from Collectors

If you receive a response from the party pursuing the claim, carefully review the provided documents. If they fail to provide sufficient proof, you can dispute the claim further. If they do provide verification, assess whether the documents align with your records. Always respond in writing and keep copies of all communication for your records.

Your Rights Under Fair Financial Practices

Under various consumer protection laws, you have the right to request verification of any financial obligation before taking further action. These laws protect you from unfair or inaccurate claims and ensure that you are not held responsible for debts you do not owe. If the claim cannot be substantiated, it cannot legally be pursued against you.

What Happens After You Send the Request

Once you’ve sent your formal dispute request, the other party is required to provide the necessary documentation or cease any further collection efforts. If they fail to do so within the stipulated time frame, you may be able to take legal action. Keep a record of your communication and responses for future reference and, if needed, consult a legal professional to protect your interests.