Change of bank account letter to customers template

Inform your customers about a change in your bank account details using a clear and professional letter. This ensures transparency and helps avoid any disruption in payments. Provide all necessary information in a straightforward format.

Key elements to include:

Account details: Clearly state the new bank account number, routing number, and bank name. Include all relevant details to prevent confusion. Mention that payments should be directed to the new account starting from a specific date.

Transition period: Specify how long the old account will remain active for any pending transactions. If applicable, provide instructions on how customers can confirm the transition and update their records.

Customer support: Let customers know who to contact for any questions regarding the change. Provide direct contact details for immediate assistance.

End the letter with a polite request for confirmation that the new details have been received and updated in their records. This will ensure smooth transactions moving forward.

Here’s the revised version with minimal repetition:

To notify customers about the change of your bank account details, make sure to be clear, direct, and concise. Start by mentioning the new bank account information, and emphasize any steps customers must take to update their records. It’s crucial to include both the old and new bank details for clarity.

Steps to Follow:

In the letter, specify the exact date the new account becomes active and indicate if any actions are required on the customer’s side. For example, if they need to update automatic payments or subscriptions, explain the process in simple terms. Keep the tone friendly but professional to maintain a good relationship.

Contact Information

Always include a contact method for customers to ask questions or clarify concerns. Offering phone or email support ensures a smooth transition for both sides. Make sure the information is easy to find, ideally at the end of the letter for quick reference.

Here’s a detailed HTML outline for an informational article on the topic “Change of Bank Account Letter to Customers Template” with six specific and practical headings:

When informing customers about a change of bank account, clear communication is key. A well-structured letter ensures that all relevant details are covered without overwhelming the recipient. Here’s an outline with six essential sections:

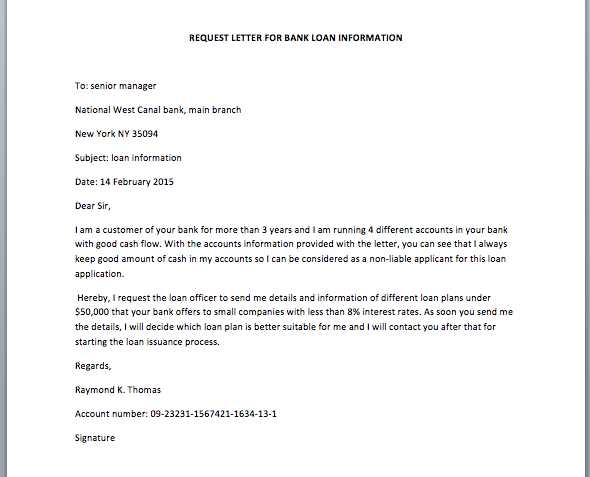

1. Introduction to the Bank Account Change

Start the letter by informing the customer that your bank account details have changed. Provide the reason for the change, whether it’s due to internal adjustments or a more secure account setup.

2. New Bank Account Information

Include the full new bank account details, ensuring you provide the following:

- Bank name

- New account number

- Sort code or routing number

- SWIFT/BIC code (if necessary for international transactions)

3. Action Required from the Customer

Clearly state what action the customer needs to take. Typically, they’ll need to update payment methods or modify automatic payments. Provide guidance on how to do this, either via your online platform or through customer service.

4. Deadline for Updates

Set a deadline for when the changes should be completed. Specify if payments need to be redirected or if old details will no longer be accepted after a particular date.

5. Contact Information for Queries

Make it easy for the customer to reach out for assistance. Provide contact details such as customer service phone numbers, email addresses, or live chat options for quick support.

6. Closing Remarks

End the letter with a professional and polite closing. Thank the customer for their cooperation and emphasize your commitment to maintaining smooth transactions.

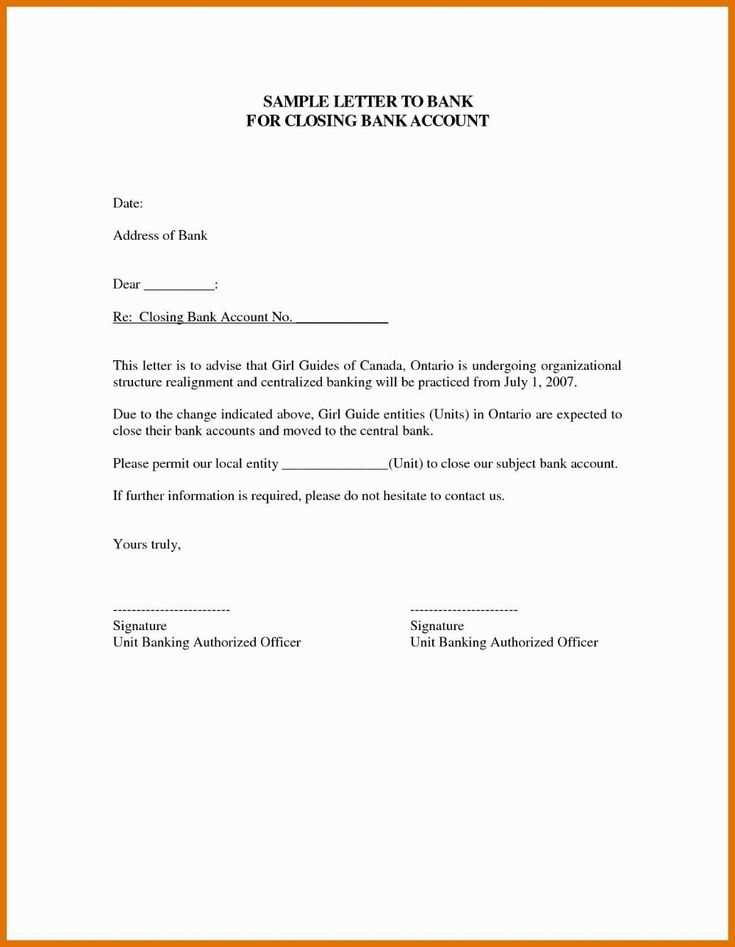

- Change of Bank Account Letter to Customers Template

When informing customers about a change in bank account details, clarity is key. Here’s a direct and concise template to communicate the update:

Subject: Important Update: Change of Bank Account Details

Dear [Customer Name],

We are writing to inform you that our bank account details have changed. Please update your records with the new information provided below:

New Bank Account Information:

Bank Name: [New Bank Name]

Account Number: [New Account Number]

Sort Code: [New Sort Code]

IBAN: [New IBAN]

Kindly use the new account details for all future payments. Any transactions made to the previous account may be delayed or not processed correctly.

If you have any questions, please don’t hesitate to reach out to our customer support team at [Phone Number] or [Email Address].

Thank you for your attention to this matter.

Best regards,

[Your Company Name]

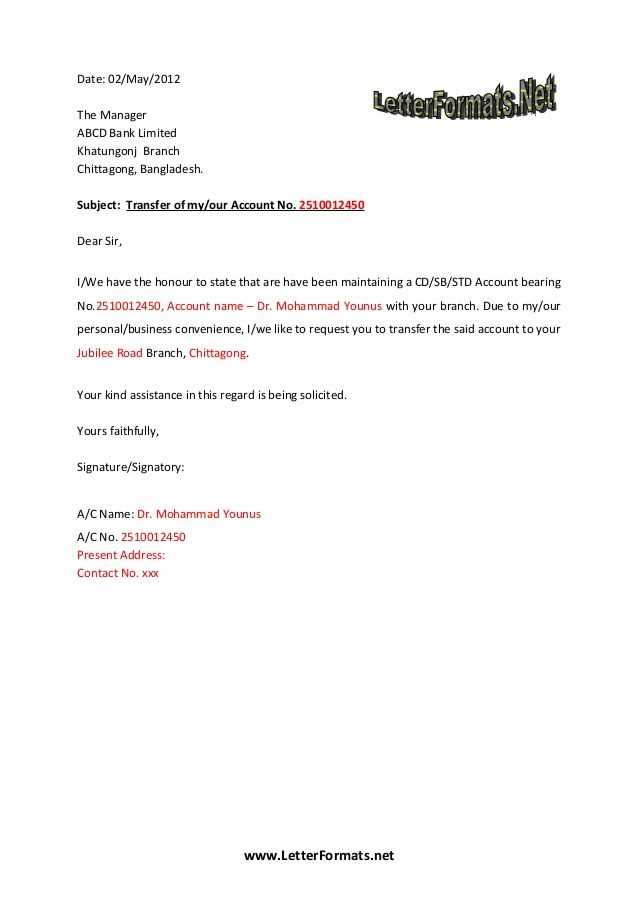

Notify your clients about the change in your bank account details as soon as possible. Send a direct communication, such as an email or letter, that includes the new account number, the bank’s name, and any other relevant details. Make sure to provide a clear deadline by which clients should use the new account information. If needed, offer assistance in case they have questions or need help with the transition.

Keep your message simple and clear. Avoid technical terms that may confuse your clients. Acknowledge the inconvenience this may cause, and reassure them that the process is straightforward. You can also consider providing a contact number or email for any issues or concerns regarding the update.

If your business has a website or an online portal, make sure to update the bank account details there as well. You can also use your social media platforms to reinforce the message, ensuring all communication channels are aligned and up to date.

Always remember to send the notification well in advance to give clients enough time to adjust their records. Additionally, make sure to follow up with clients who have not yet updated their account details to ensure smooth transactions moving forward.

Begin the letter with a clear and direct statement of the change in bank account details. Ensure to include the effective date of the change. This helps customers know exactly when they should start using the new account details. Mention the name of the new bank, along with the full account number and sort code, or IBAN and SWIFT/BIC codes if applicable.

Why the Change is Happening

Briefly explain why the account change is taking place. Be transparent but concise, providing just enough context for customers to understand the reason, such as organizational updates or new banking arrangements.

Action Required from the Customer

Outline the steps the customer needs to take, if any, to update their payment instructions or details. Remind them to use the new account for future payments or transactions starting from the specified date.

Include contact information for any questions. Let customers know how they can reach out for assistance or clarification regarding the change.

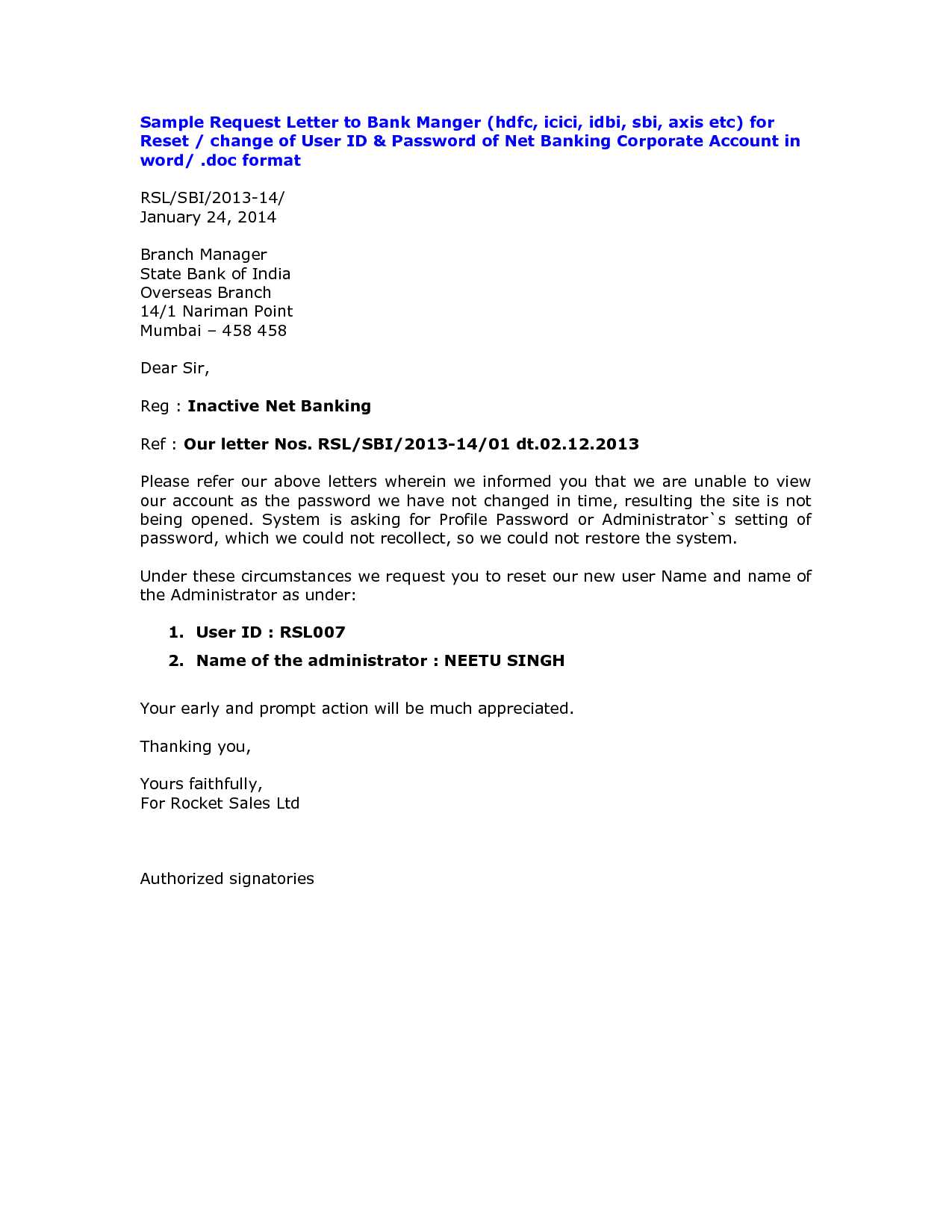

Be clear and straightforward with your message. Use simple language and avoid unnecessary jargon. Customers should understand the details of the account change without needing further clarification.

Provide Clear Instructions

Outline the steps customers need to follow to update their account information. Keep the instructions short and easy to follow. Highlight any action that requires immediate attention to prevent delays in the process.

Use Multiple Communication Channels

Send notifications through email, SMS, and your website to ensure customers receive the information. This redundancy helps reach a wider audience and increases the chances of the message being noticed.

| Communication Channel | Advantages | Best Use Case |

|---|---|---|

| Formal and detailed, can be referred back to | For detailed instructions and confirmations | |

| SMS | Quick and direct, likely to be seen immediately | For urgent reminders or short messages |

| Website | Accessible to all customers, provides easy reference | For general notices or FAQs |

Consider offering a FAQ section on your website that addresses common questions related to the bank account change. This helps to proactively reduce customer confusion.

When informing customers about a change in your bank account details, clarity and transparency are key. Address potential concerns early in the message to avoid confusion and build trust. Here’s how to tackle the most common issues effectively:

Clarify the Reason for the Change

- Be clear and direct about why the change is necessary. Whether it’s for account consolidation, enhanced security, or a change in banking partners, providing a simple explanation reassures customers.

- Avoid overcomplicating the situation. Keep it short, focusing on what they need to know.

Provide Clear Instructions

- Ensure the steps for updating the payment details are straightforward and easy to follow. Provide a timeline to prevent delays.

- If applicable, mention the specific date when the new account should be used, and offer support channels for those who may have questions or need assistance.

By addressing these concerns directly, you reduce anxiety and enhance customer confidence in the change. Ensure the message is concise and free from any unnecessary jargon, making it easy for customers to adjust without hassle.

Before changing a bank account, ensure you have completed all necessary legal documentation. This includes informing customers about the new account details in a timely and clear manner. Non-compliance with notification requirements could result in penalties or legal disputes. It’s essential to follow the proper procedures as outlined in your contract with clients or customers to avoid potential violations.

Additionally, ensure that any change in account details complies with local financial regulations and industry standards. Some jurisdictions may require that such notifications be sent through specific channels, like registered mail or digital signatures, for validation. Review the applicable laws to avoid any risk of breaching legal obligations.

| Compliance Aspect | Requirement |

|---|---|

| Notification Timing | Notify customers within a specified period before account change (usually 30 days) |

| Proof of Notification | Send notifications via verifiable methods (e.g., registered mail, digital confirmation) |

| Client Consent | Ensure clients consent to the new account details, particularly for recurring payments |

| Local Laws | Follow local financial and consumer protection laws specific to account changes |

Lastly, review any terms of service or contracts that may require amendments or updates due to the change in banking details. A failure to update contract terms could leave you exposed to legal challenges from clients who are unaware of the change.

After sending the notification about the bank account change, make sure to track responses from your customers. Follow up with those who have not acknowledged or confirmed the update within a set time frame, typically 10–14 days. Ensure your communication is clear and polite, offering assistance if needed. It’s also a good idea to send a reminder email or message if no response is received after a reasonable period.

Double-check your internal systems to confirm that all customers’ account details have been updated correctly. If any discrepancies are found, contact the customer directly to resolve them promptly. Keeping accurate records of responses and actions taken will help avoid issues later on.

If a customer has any questions or concerns, be prepared to provide clarification regarding the change. This could include explaining why the change was necessary or offering additional details on the new account. Providing personalized responses will help build trust and ensure a smooth transition for both parties.

Change of Bank Account Notification Template

To ensure a smooth transition when notifying your customers of a bank account change, provide clear and concise information. This letter should cover the following key details:

- Account Details: Specify the new account number and the bank where it is held. Ensure customers can easily locate this information.

- Reason for Change: Briefly explain the reason for the account change. Keep it simple and direct.

- Effective Date: Clearly state the date from which the new account will be used. This helps prevent confusion.

- Action Required: Indicate if the customer needs to update their records, such as automatic payments or subscriptions.

Template Example

- Subject: Important: Update Your Bank Account Information

- Dear [Customer Name],

-

We are writing to inform you that our bank account details have changed. Effective from [Effective Date], please use the following account information for all future transactions:

- New Bank Account: [Account Number]

- Bank Name: [Bank Name]

-

If you have any automatic payments or subscriptions linked to our account, kindly update your records to avoid delays.

-

If you have any questions or need assistance, please don’t hesitate to contact us at [Contact Information].

-

Thank you for your attention to this matter. We appreciate your cooperation.

- Sincerely,

[Your Company Name]

This approach ensures that your communication is clear and direct, allowing your customers to take prompt action without confusion.