Change of Bank Details Letter Template Guide

When it comes to modifying your payment information with partners, clients, or service providers, clear and formal communication is essential. Whether you’re shifting accounts or making adjustments to how payments are processed, informing relevant parties with the right tone and structure ensures a smooth transition and avoids misunderstandings.

Properly crafting such notifications requires attention to detail. It’s important to communicate all the necessary facts in a professional and concise manner. The aim is to keep the process seamless and transparent, so your recipients can easily update their records without confusion or delay.

In this article, we will explore the best practices for drafting such notifications, providing guidance on key elements to include and common pitfalls to avoid. With the right approach, you can confidently update your payment information and maintain trust in your professional relationships.

Understanding the Importance of Updating Financial Information

Maintaining accurate payment data is crucial for smooth financial transactions. When changes occur in your financial setup, informing relevant parties promptly ensures continued operations without disruptions. Failing to update your payment information can lead to missed payments, delays, or even misunderstandings with clients and vendors.

Here are a few reasons why updating your information is essential:

- Avoid Payment Interruptions: Keeping your payment details up to date ensures that there are no delays or missed transactions, which could affect both parties financially.

- Maintain Trust and Professionalism: Transparent communication helps to maintain a strong professional relationship, as clients and partners will appreciate your clarity.

- Ensure Accurate Recordkeeping: Financial records need to reflect the current information to prevent errors in accounting, tax reporting, or financial audits.

- Reduce Fraud Risks: Updating your information helps prevent unauthorized transactions that could arise from outdated data being used fraudulently.

Updating your information isn’t just about practicality; it’s about ensuring long-term stability in your financial relationships. Whether it’s changing payment methods or altering account settings, keeping your information current allows for a more seamless experience for all involved.

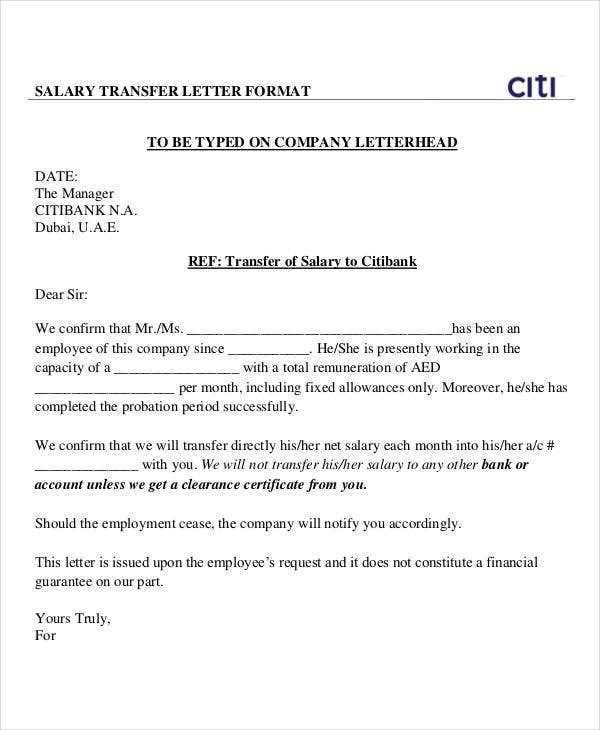

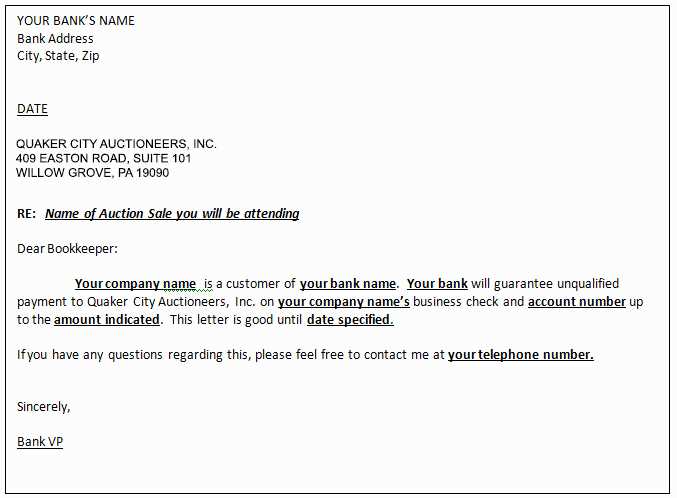

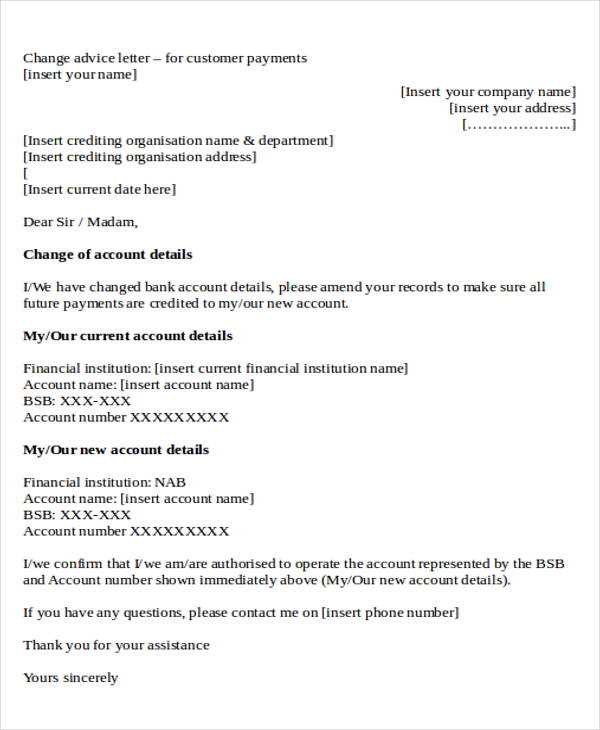

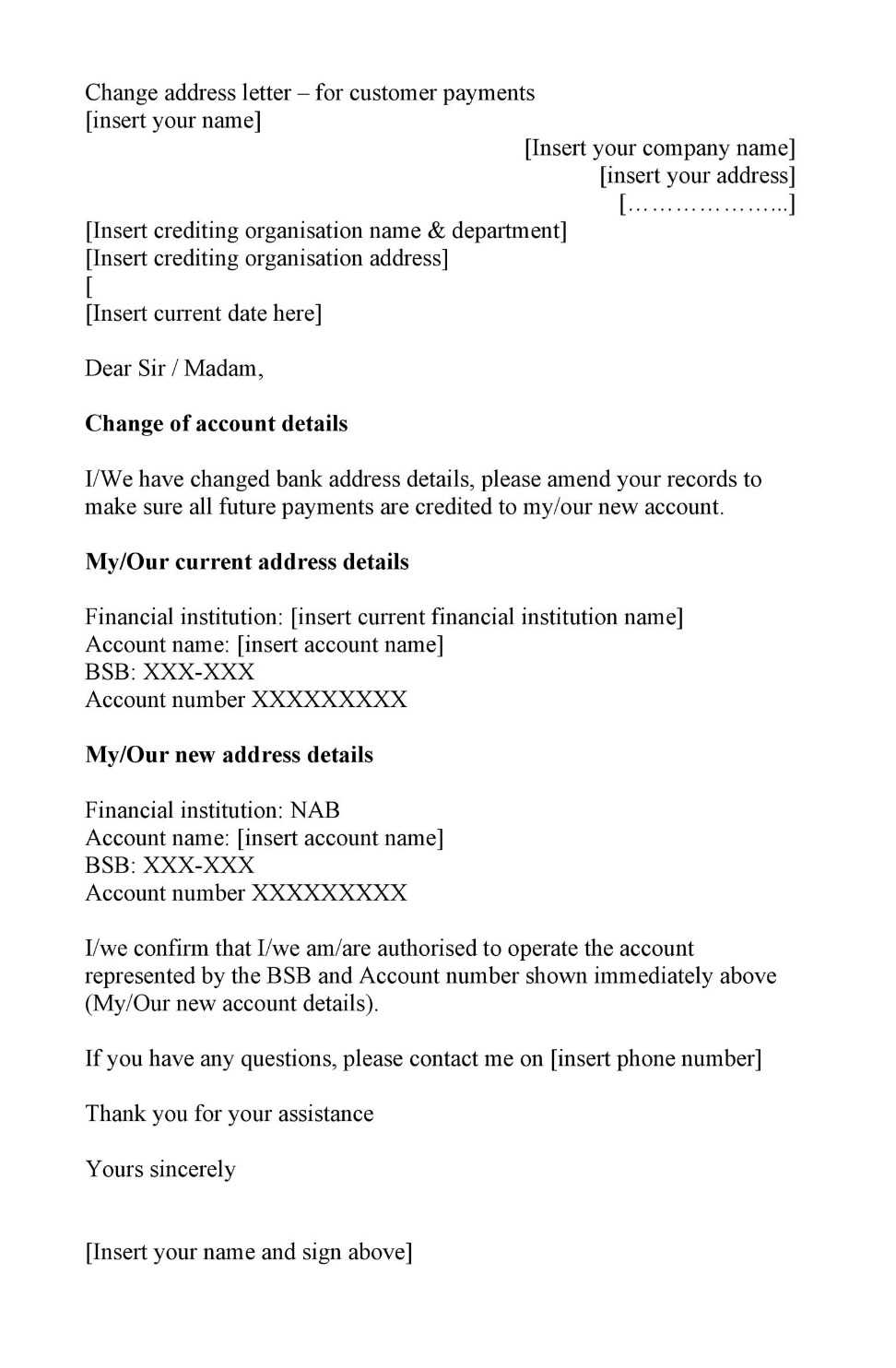

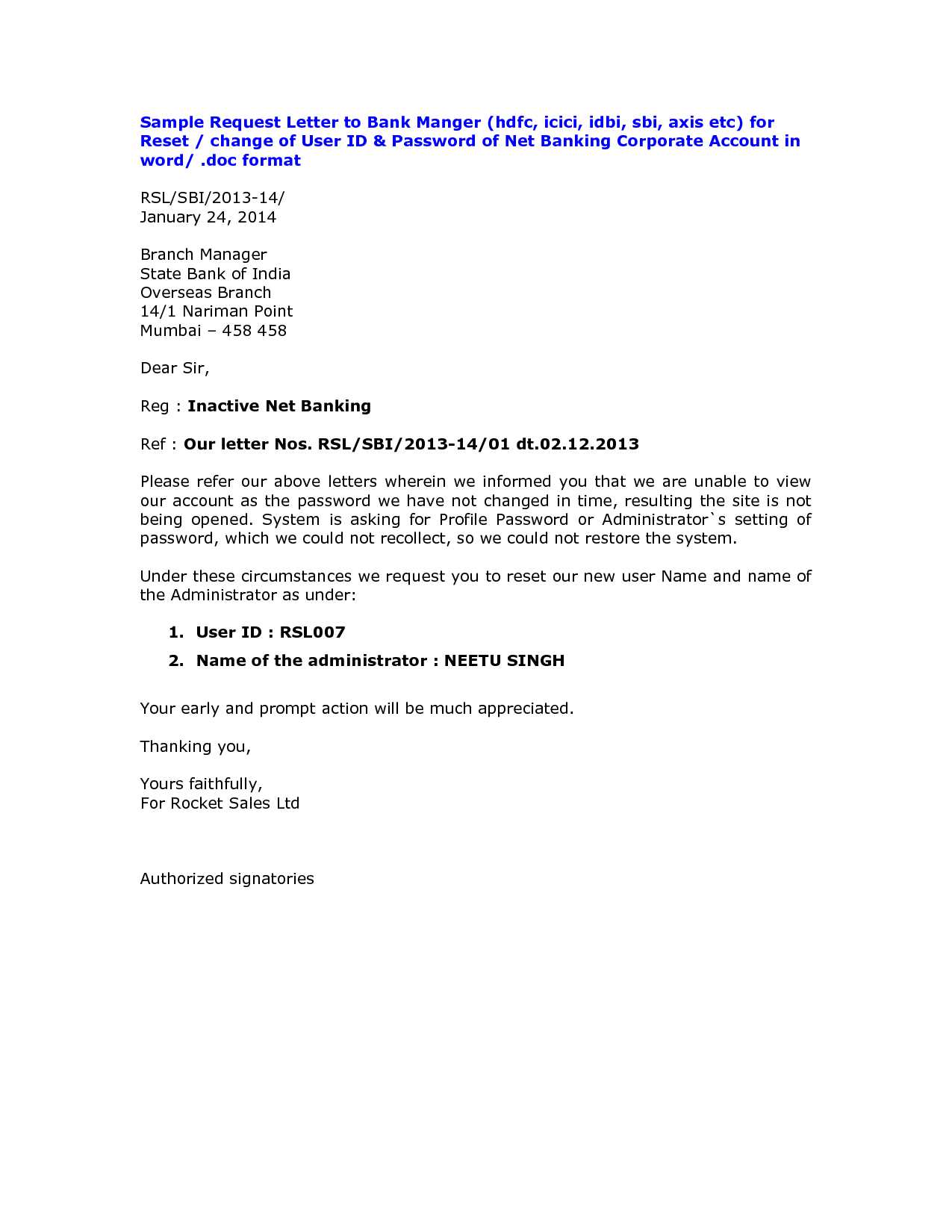

How to Write a Notification for Updated Payment Information

Notifying others about modifications to your financial setup requires clarity and precision. Crafting an effective communication ensures that recipients can promptly update their records and continue processing transactions without any issues. The message should be professional, direct, and easy to understand.

Key Elements to Include

To write an efficient notification, it is important to include all the necessary details. Focus on the key points that will help the recipient process the update smoothly:

- Effective Date: Clearly state when the new information will take effect to avoid confusion.

- New Information: Provide the updated account or payment method, ensuring accuracy and completeness.

- Reason for Update: Briefly explain the reason behind the change to keep the communication transparent.

- Confirmation Request: Ask for acknowledgment or confirmation to ensure that the recipient has received and updated your information.

Formatting Tips for Clarity

Keep the tone professional and concise. Avoid unnecessary details, but ensure you include all pertinent facts. Using bullet points or numbered lists for key items can enhance readability and help the recipient easily identify what needs to be done.

Always double-check the accuracy of the new payment details and ensure that the message is sent to the right contact. Providing a method of contact for further clarification can also help smooth any potential issues.

Key Information to Include in the Notification

When informing others about modifications to your financial arrangements, it’s crucial to ensure that the right information is communicated clearly and concisely. Providing all the necessary details helps the recipient process the update without confusion or delay. A well-structured message minimizes the chance of mistakes and ensures everything is handled efficiently.

Essential Information to Include

To ensure that your communication is complete and effective, include the following key points:

- Effective Date: Indicate when the new financial information will be in effect. This prevents any overlap or confusion about when the update should be applied.

- Updated Payment Information: Provide the new account or payment method. Make sure this is correct and complete to avoid errors in processing payments.

- Reason for the Change: Briefly explain why the update is necessary. Transparency can build trust and prevent unnecessary questions.

- Contact Information: Include a way for the recipient to reach you in case they have questions or need confirmation about the update.

- Confirmation Request: Ask for acknowledgment to ensure that the recipient has received and processed the update correctly.

Clarity and Precision

In addition to the core elements above, it’s important that the message is written in a clear, professional tone. Keep the information to the point and avoid unnecessary details that might distract from the main purpose. Clear communication ensures that the recipient can easily update their records without complications.

Common Mistakes to Avoid in Financial Information Updates

When updating your financial records, it’s easy to overlook certain aspects that could lead to mistakes. These errors can cause delays, confusion, or even disruptions in your transactions. Ensuring that all information is accurate and presented clearly can prevent these issues from arising and help maintain smooth operations.

Typical Errors to Watch Out For

To avoid complications when modifying your payment arrangements, be mindful of the following common mistakes:

| Mistake | Potential Consequences | How to Avoid |

|---|---|---|

| Missing or incorrect information | Delays in transactions, payments sent to wrong account | Double-check the accuracy of all details before sending |

| Not providing an effective date | Confusion over when new information should be used | Clearly state the effective date of the new payment details |

| Failure to request acknowledgment | Uncertainty whether the recipient has updated the records | Ask for confirmation to ensure the update is processed |

| Overcomplicating the message | Recipient may overlook important details | Keep the message simple, focusing on key points |

Why These Mistakes Matter

These errors can lead to misunderstandings, missed payments, or complications with financial tracking. By being mindful of the common pitfalls, you can ensure that the transition is smooth and efficient for both you and the recipient. Always review your message carefully and ensure that all necessary information is clearly presented before sending.

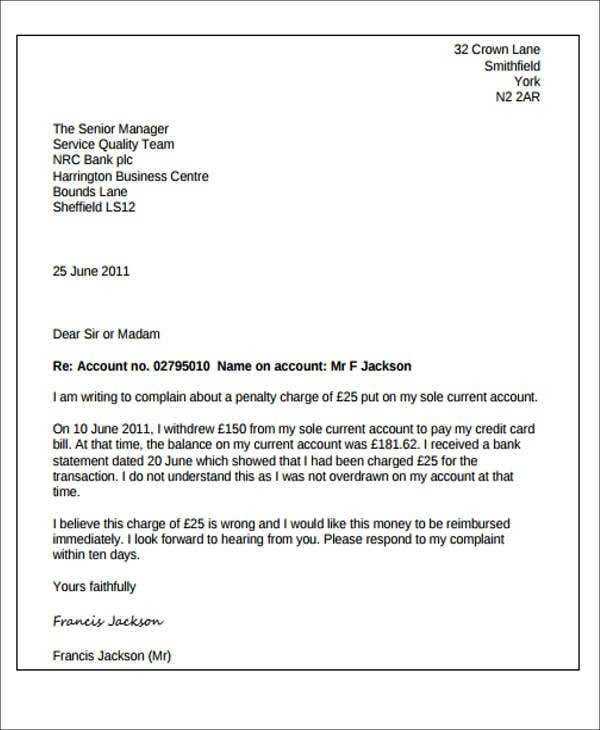

How to Notify Your Clients Professionally

When updating your payment information, notifying clients in a professional manner is essential for maintaining trust and ensuring the smooth processing of transactions. Clear communication will prevent confusion and help them update their records without any issues. The tone and structure of your message can make all the difference in how well the update is received.

Crafting a Professional Notification

A well-crafted notification should be direct, polite, and to the point. Here’s how to approach it:

- Be Clear and Concise: Avoid over-explaining. State the reason for the update, provide the new information, and mention the effective date.

- Maintain a Formal Tone: Even if you have a friendly relationship with your clients, it’s important to keep the communication professional. This reinforces the seriousness of the update.

- Give Clear Instructions: Let your clients know exactly what action they need to take. Providing clear, actionable steps will make the process easier for them.

- Include a Request for Confirmation: Politely ask your clients to acknowledge receipt of the update, ensuring that both sides are on the same page.

Additional Tips for Effective Communication

Aside from the core elements of the message, consider these additional tips for maintaining professionalism:

- Send in Advance: Provide your clients with enough time to process the update. Sending it ahead of the effective date gives them a chance to make the necessary changes.

- Personalize the Message: If possible, tailor the communication to each client. A personalized message shows that you value the relationship and care about making the transition as smooth as possible.

- Follow Up if Necessary: If you haven’t received confirmation or notice of any issues, don’t hesitate to follow up and ensure that everything is in order.

Tips for Ensuring a Smooth Transition

When updating your financial information, making the transition as seamless as possible for both you and your clients is essential. A smooth process ensures that no payments are missed and that all records are updated accurately. By following a few simple tips, you can minimize any disruptions and maintain a positive professional relationship with all involved parties.

Key Steps to Make the Process Easy

To ensure that everything goes smoothly, consider these essential steps:

- Provide Adequate Notice: Give your clients plenty of time to process the update. Notify them well in advance of the effective date to avoid confusion or rushed actions.

- Confirm All Information: Double-check all new payment details before sending the notification. Mistakes can cause delays and lead to errors in processing payments.

- Stay Available for Questions: Let your clients know that they can reach out if they have any concerns or need assistance. Being responsive helps build trust and ensures the transition is smooth.

- Follow Up: After sending the initial update, follow up to confirm that the information has been received and processed. A quick check-in ensures that everything is on track.

Additional Considerations

In addition to the main steps, there are a few more factors to keep in mind:

- Ensure All Contacts Are Notified: Make sure you reach all relevant parties, including clients, vendors, and partners, to ensure no one is left out of the loop.

- Document the Update: Keep a record of your communication for your own reference and to help resolve any potential issues quickly.

- Check Payment Schedules: Verify any recurring payments or billing cycles to ensure they align with the new information, reducing the risk of missed transactions.