Charge off letter template

How to Write a Charge-Off Letter

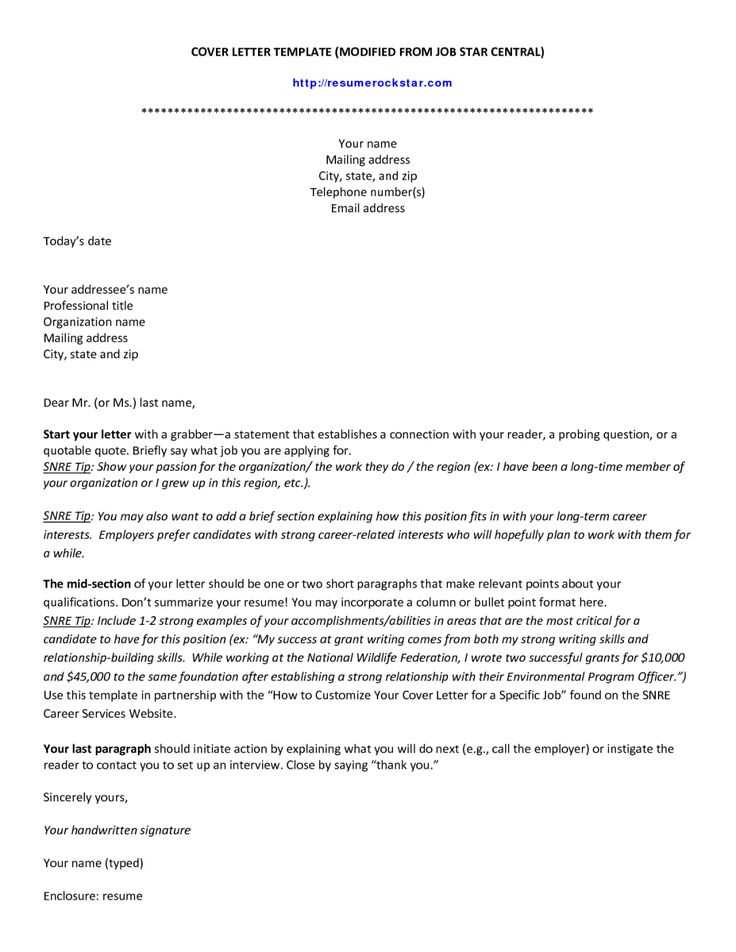

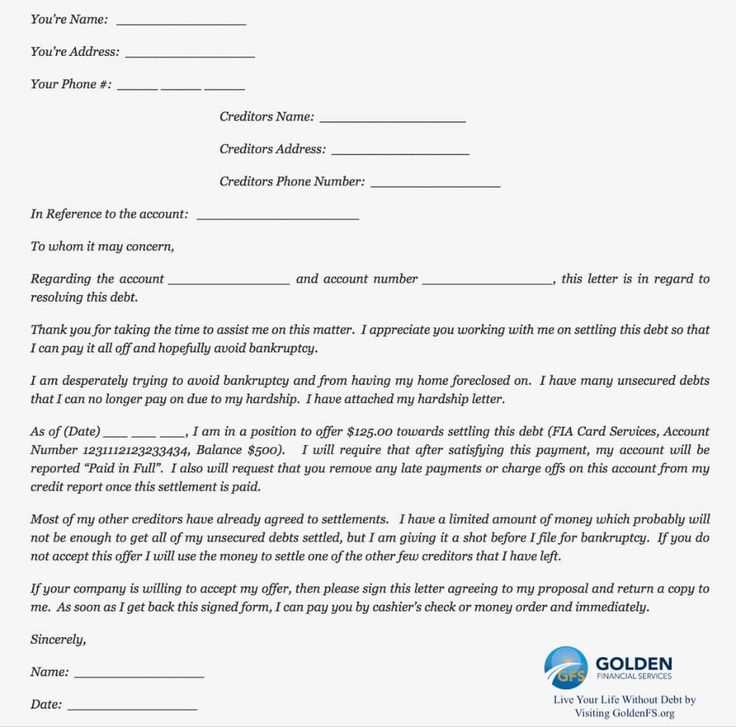

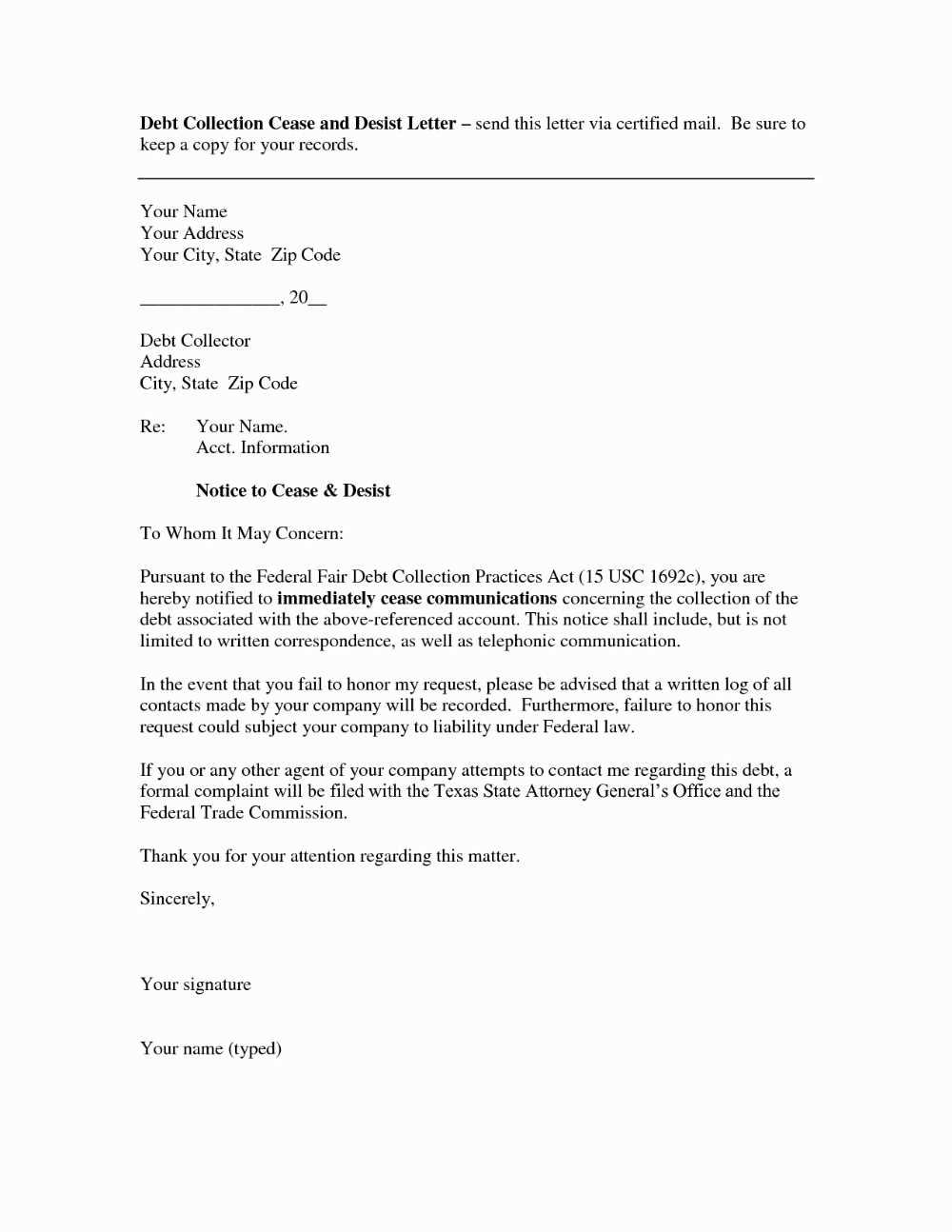

A charge-off letter is a formal request to the creditor to acknowledge that your debt is no longer in collections and is written off as bad debt. If you’ve settled an account or negotiated a payment plan, this letter will help confirm the terms. Use the following template to draft your letter and ensure all necessary details are included:

Charge Off Letter Template

Dear [Creditor’s Name],

I am writing in regard to the outstanding balance of my account with [Company Name], account number [Account Number]. I wish to confirm that the debt has been fully settled or otherwise resolved. Please provide a statement confirming that this account has been written off as a charge-off, and that no further action will be taken regarding this matter.

If this charge-off affects my credit report, I request that you update my account status to reflect that the balance has been cleared. If there are any discrepancies or additional information required, kindly notify me at your earliest convenience.

Thank you for your prompt attention to this matter. I look forward to receiving the official documentation confirming the charge-off of my debt.

Sincerely,

[Your Name]

[Your Address]

[Your Contact Information]

Key Points to Include in Your Charge-Off Letter

- Creditor’s Name and Address: Make sure to address the letter to the proper department or representative of the creditor.

- Account Number: Provide the specific account number associated with the debt to avoid confusion.

- Debt Resolution Details: Mention whether the debt was settled or written off, and include any relevant terms.

- Request for Confirmation: Request written confirmation that the debt has been marked as a charge-off and no further action is required.

- Contact Information: Ensure your contact information is accurate, in case they need to reach you for any follow-up.

Additional Considerations

After sending your letter, monitor your credit report to verify that the account status is updated. If the creditor fails to respond or provide confirmation, consider following up with another letter or contacting customer service for assistance. Keep copies of all correspondence for your records, in case any issues arise later.

Charge Off Letter Template

Understanding the Purpose of a Charge-Off Notice

Key Elements to Include in a Charge-Off Letter

How to Draft a Charge-Off Letter for Various Creditors

Common Mistakes to Avoid When Writing a Charge-Off Notice

How to Use a Charge-Off Letter to Negotiate Debt Resolution

What to Do After Sending a Charge-Off Notice

When sending a charge-off letter, focus on clarity. A charge-off letter is an official document from a creditor indicating that they have written off a debt as uncollectible. The purpose is to notify you of the debt’s status while also explaining the creditor’s next steps regarding collection.

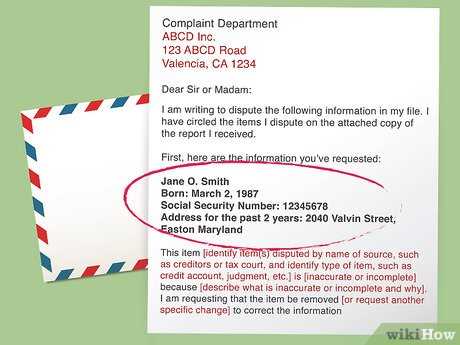

Include the following in your letter:

– Account information (account number, balance)

– Date of the charge-off

– A brief summary of the events leading to the charge-off

– The creditor’s name and contact information

– A note on whether the account has been sent to collections

This keeps your communication clear and sets expectations for what comes next.

When drafting the letter, tailor it based on the type of creditor. For example, a bank may require a more formal tone, while a smaller creditor might allow a more casual approach. Adapt your wording and tone based on the relationship with the creditor, always being direct but respectful. Be sure to confirm the amount owed and any legal implications involved in the charge-off.

Avoid these common mistakes:

– Using vague or unclear language

– Failing to include necessary documentation like account details

– Overlooking deadlines for making payments or negotiating a settlement

These errors could cause confusion or delays in resolving your debt.

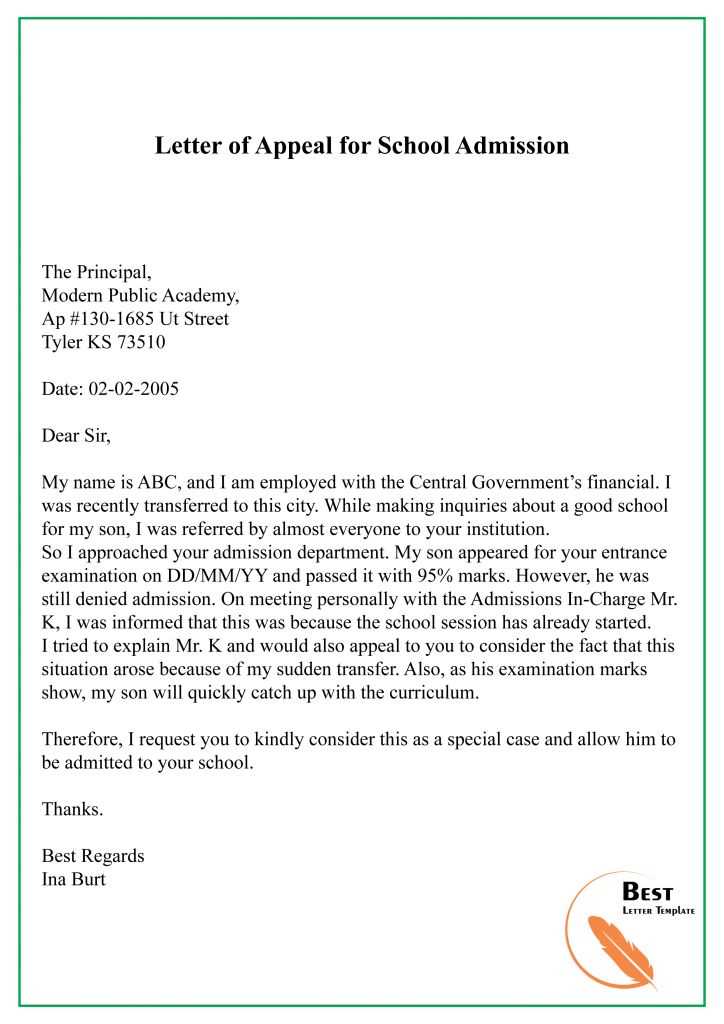

Use the charge-off letter as a starting point for negotiating debt resolution. In some cases, creditors may be open to accepting a lower payment than what’s owed or even consider removing the charge-off from your credit report once the debt is settled. Be proactive about offering a solution if you want to avoid further complications.

After sending the letter, keep track of any communication from the creditor. Monitor your credit report to ensure accuracy, and follow up on any negotiations or updates regarding your debt status. This ensures that all steps are taken to protect your financial standing.