Charge off removal letter template

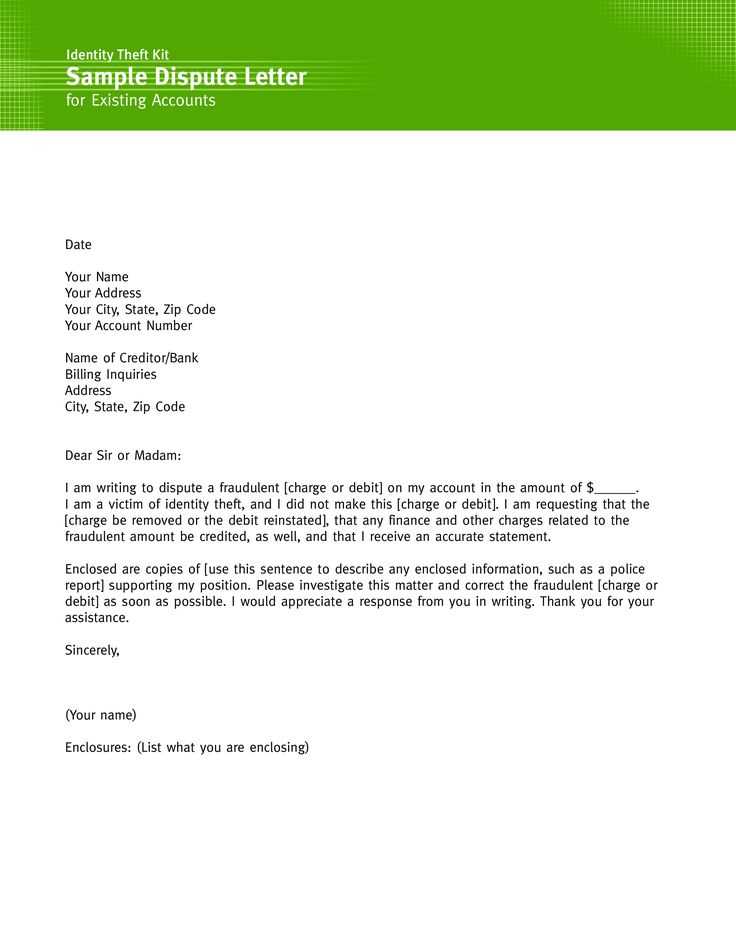

Begin by clearly stating the purpose of the letter, which is to request the removal of a charge-off from your credit report. Be concise and direct in your language. Ensure you address the letter to the correct department, typically the customer service or credit reporting division of the creditor or collection agency.

Start with your personal details at the top of the letter, such as your full name, address, account number, and any other identifiers that can help the recipient locate your records easily. These details make it easier for the creditor to process your request swiftly.

Next, explain the circumstances surrounding the charge-off. Acknowledge the debt, but also provide a brief explanation of why it occurred. Be honest and clear, as creditors are more likely to respond positively when they see a sincere attempt at resolving past issues.

Make your request clear by stating that you wish for the charge-off to be removed from your credit report. You may offer a solution, such as paying a negotiated amount in exchange for the removal, or ask if they would consider a goodwill adjustment. It’s helpful to show a willingness to resolve the matter and maintain a positive relationship.

Finish by thanking the recipient for their attention to the matter, and make sure to include your contact information for follow-up. End the letter on a polite note, offering to provide any further documentation if necessary.

Here’s the revised version with minimal repetition:

To effectively remove a charge-off, it’s crucial to start by contacting the creditor or collection agency responsible. Clearly request the removal of the charge-off from your credit report, ensuring the language is professional and respectful. Provide any relevant evidence, such as proof of payment or a settlement agreement, to support your claim. It’s important to follow up if you don’t receive a timely response, as this helps keep the process moving forward. Keep all correspondence documented for reference.

In some cases, offering a goodwill letter can be helpful. This letter should include a clear explanation of the circumstances that led to the charge-off and any actions taken since. It’s important to maintain a polite and concise tone in the letter. Additionally, if the debt was paid in full or settled, include confirmation of the resolution to strengthen your case.

If your request is rejected, consider negotiating for a “pay for delete” arrangement. This means offering to pay off the remaining balance in exchange for the charge-off’s removal from your report. Be sure to get this agreement in writing before making any payments.

Consistency in follow-up and persistence can make a significant difference. If needed, escalate the issue to higher authorities such as the Consumer Financial Protection Bureau (CFPB) for further assistance.

| Step | Action |

|---|---|

| 1 | Contact the creditor or collection agency |

| 2 | Request charge-off removal with supporting evidence |

| 3 | Follow up if no response is received |

| 4 | Consider sending a goodwill letter |

| 5 | Negotiate a “pay for delete” agreement if necessary |

| 6 | Escalate to the CFPB if needed |

- Charge Off Removal Letter Template

To remove a charge off from your credit report, it’s important to send a well-crafted letter to the creditor or collection agency. Below is a template you can use to request the removal of the charge off from your credit history:

Charge Off Removal Letter

Dear [Creditor’s Name],

I am writing to request the removal of a charge off listed on my credit report, account number [Account Number]. I understand that the account was reported as charged off due to an outstanding balance, and I have since taken the necessary steps to address this issue. I would appreciate it if you could reconsider the status of this account and remove the charge off from my credit report as a gesture of goodwill.

In light of my recent payments and efforts to resolve the balance, I believe this action would reflect positively on both my credit history and our ongoing relationship. I would be grateful for your prompt attention to this matter and look forward to your favorable response.

If you require any additional information or documentation, please feel free to contact me at [Your Contact Information]. Thank you for your time and consideration.

Sincerely,

[Your Full Name]

[Your Address]

[City, State, Zip Code]

Include supporting documents, such as payment receipts or any evidence of agreements made with the creditor, to strengthen your case for charge off removal.

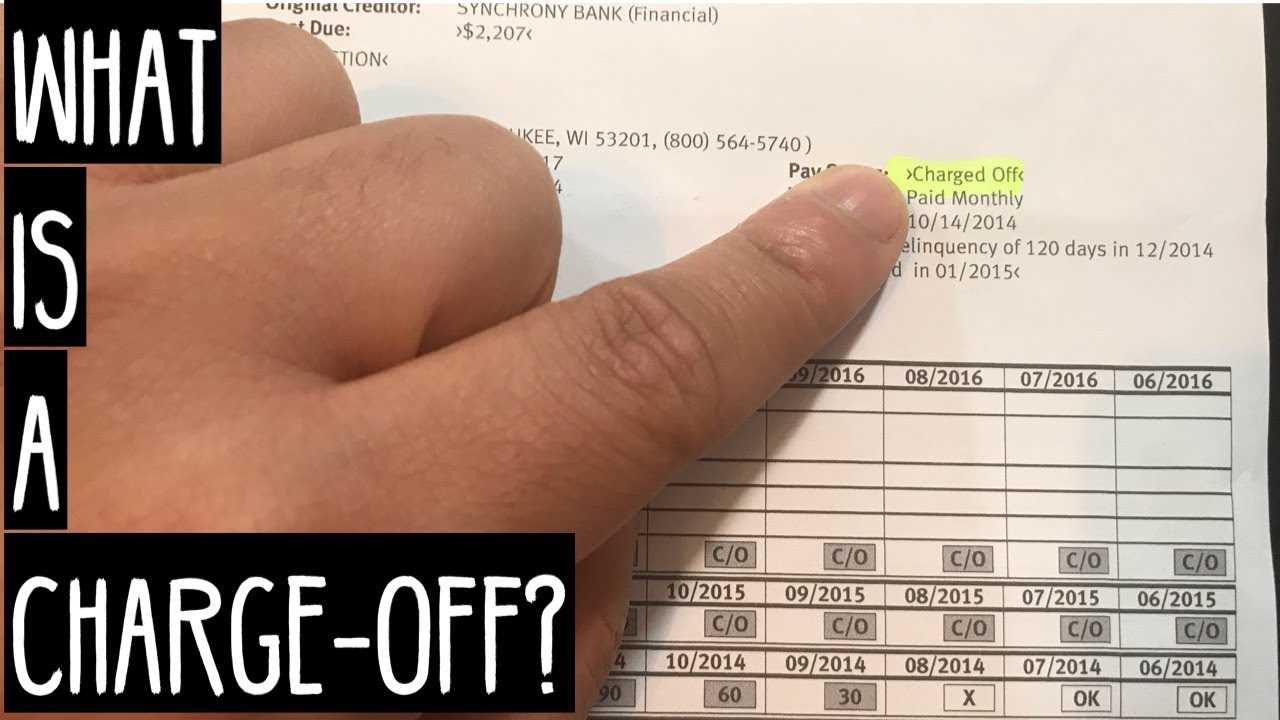

A charge-off removal letter is an official request to remove a negative item from your credit report. It aims to resolve past issues with lenders, offering the possibility to clean up your credit history. The letter is typically sent after a debt has been marked as “charged off” by the creditor, which means they’ve written off the debt as a loss, but it still impacts your credit score. This letter attempts to negotiate or dispute the charge-off with the goal of having it removed or adjusted on your credit report.

Key Points in a Charge Off Removal Letter

- Specificity: Clearly state the account number, creditor name, and the specific charge-off item you want removed.

- Reasoning: Provide a valid reason or justification, such as error in reporting, payment negotiation, or settled debt.

- Request for Resolution: Ask for the account to be updated to “paid” or “settled,” or request a deletion if the circumstances allow it.

Why Send a Charge Off Removal Letter?

- Credit Improvement: A successful removal can enhance your credit score, improving your financial opportunities.

- Clean Record: It helps to correct inaccuracies or outdated information that could affect your creditworthiness.

- Negotiation Power: Lenders might be open to negotiations, especially if you’ve paid off the debt or made significant strides toward resolving it.

To create a persuasive charge off removal document, focus on these key components:

- Personal Information – Include your full name, address, phone number, and account number to help the recipient identify you and your request quickly.

- Account Details – Specify the account that was charged off, including the original creditor’s name, the charge-off date, and the outstanding balance at the time of the charge off.

- Dispute Reason – Clearly explain why you believe the charge off should be removed. This could involve errors in reporting, proof of payment, or other reasons that support your case.

- Supporting Documentation – Attach relevant documents that back up your claim, such as proof of payment, account statements, or letters from the creditor that confirm the charge-off was incorrect.

- Request for Removal – State your desired outcome. Ask explicitly for the removal of the charge off from your credit report or the correction of any inaccuracies.

- Closing Statement – Include a polite, professional closing, offering to provide further information if needed and thanking the recipient for their time and consideration.

Ensure that all details are accurate, clear, and concise to improve your chances of success.

Begin by acknowledging the charge-off directly and clearly. State the account in question, the date of the charge-off, and the amount involved. Keep this section brief and factual, avoiding unnecessary details. It’s important to show that you understand the situation and are taking responsibility, if applicable.

Be Transparent About Your Financial Situation

Provide a concise explanation of the circumstances that led to the charge-off. If you faced financial hardship or unexpected events, briefly mention them without over-explaining. Focus on how your situation has improved or what actions you’ve taken to manage your finances better.

Present a Solution or Request for Removal

Clearly express what you are requesting from the creditor, whether it’s the removal of the charge-off from your credit report or a settlement offer. If offering a payment plan or lump-sum payment, outline your proposal with specific terms. Reinforce your commitment to maintaining good financial habits moving forward.

Common Mistakes to Avoid When Writing a Removal Letter

Keep the tone polite and respectful. Avoid sounding confrontational or accusatory. Instead of making demands, present your case clearly and professionally.

1. Incorrect Contact Information

Ensure that the recipient’s details are accurate. This includes their name, address, and any reference numbers. Missing or incorrect details can delay the process or cause confusion.

2. Overloading the Letter with Unnecessary Details

Stick to the facts that are relevant to your case. Including unrelated information only distracts from your request. Focus on what is necessary to support your argument for removal.

3. Lack of Clear Request

Make your request specific and direct. Avoid ambiguity. The reader should understand exactly what action you are asking for without needing to infer your intentions.

4. Using Aggressive or Emotional Language

Avoid using strong emotional language or threats. Keep the communication calm and professional. An aggressive tone will not help your case and may lead to rejection.

5. Failure to Provide Evidence

Include all relevant documentation to support your claim. Without evidence, your request might not be taken seriously or could be delayed. Make sure to attach or reference any supporting documents.

6. Ignoring Company Guidelines or Policies

Before writing your letter, familiarize yourself with the company’s specific guidelines or procedures. Ignoring these can result in your letter being dismissed without review.

7. Not Following Up

After sending the letter, it is important to follow up if you don’t receive a response. Lack of follow-up can make it seem like you are not serious about the request.

Tips for Improving Your Chances of Success with Charge Off Requests

Ensure your letter is clear and concise. Clearly state your request to remove the charge-off and provide any supporting documentation that may help your case, such as proof of payment or evidence of an error. The clearer the request, the better the chances of a favorable response.

Document Your Efforts

Keep a record of all communications with the creditor, including emails, letters, and phone calls. This will help you track your efforts and demonstrate that you’ve been proactive in resolving the issue. If you need to escalate the situation, having a well-documented history will support your position.

Provide a Good Will Reason

If you are requesting the charge-off removal due to extenuating circumstances, such as a medical emergency or job loss, include that information in your letter. Demonstrating that the charge-off was due to factors outside of your control can increase the likelihood of success.

Offer to settle the debt if it’s still outstanding. In some cases, creditors may be more willing to remove a charge-off if you can show a willingness to resolve the balance. This could involve negotiating a lower payment or a payment plan.

Be polite and professional. A respectful tone can go a long way when dealing with creditors or debt collectors. Even if you’re frustrated, maintaining professionalism in your request may improve your chances of getting the desired outcome.

Once you’ve sent your removal letter, follow up to ensure that your request is being processed. Wait for at least 30 days to give the recipient enough time to review and respond. If you don’t receive a response, send a polite reminder to check on the status. Keep records of all correspondence for future reference. If your request is denied or not addressed, consider escalating the matter by contacting higher authorities, such as a credit reporting agency or a regulatory body. In some cases, you may need to file a dispute with the credit bureaus to push for a removal if the request was ignored or improperly handled.

If the charge-off is removed successfully, verify that your credit report reflects the change. Request updated copies of your report and check for any errors. If the charge-off is still listed, provide proof of the removal to the credit reporting agency and file a formal dispute. This can speed up the correction process and improve your credit score.

Continue monitoring your credit regularly to ensure that no new issues arise from the same account or another. Patience and persistence are key during this process. Keep communication clear and documented to avoid misunderstandings.

Charge Off Removal Letter Template

Ensure your letter is clear and to the point, addressing the creditor directly. Begin with a formal greeting and mention your intent to resolve the issue. State that you are requesting the removal of the charge-off from your credit report and provide supporting evidence that shows your efforts to settle the debt or resolve the situation.

Example Template:

Dear [Creditor’s Name],

I am writing to formally request the removal of the charge-off listed on my credit report for the account [Account Number]. I have since addressed the outstanding balance and would appreciate your consideration in removing the negative entry from my credit history. I have attached [proof of payment, settlement agreement, etc.] as evidence of my efforts to settle the account.

Thank you for your time and prompt attention to this matter. Please let me know if any additional documentation is required. I look forward to your response.

Sincerely,

[Your Name]

[Your Address]

[Your Contact Information]