Chargeback Letter Template for Effective Dispute Resolution

In some cases, consumers find themselves needing to challenge payments made for goods or services they did not receive or were not authorized. The process of disputing such charges can be daunting without the right approach or documentation. Having the proper paperwork in place can significantly improve the chances of a favorable outcome in such situations.

Crafting a well-written request to your bank or financial institution is a crucial step in the process. A clear and concise statement outlining the nature of the dispute helps ensure that the institution understands the issue and can respond accordingly. It’s important to follow certain guidelines to make sure your appeal is both professional and effective.

Using a structured format to present your case allows for better clarity and increases the likelihood of the matter being resolved quickly. The right structure will ensure that all necessary information is included and easy for the recipient to follow. This article will guide you through the essential steps for creating a strong dispute claim.

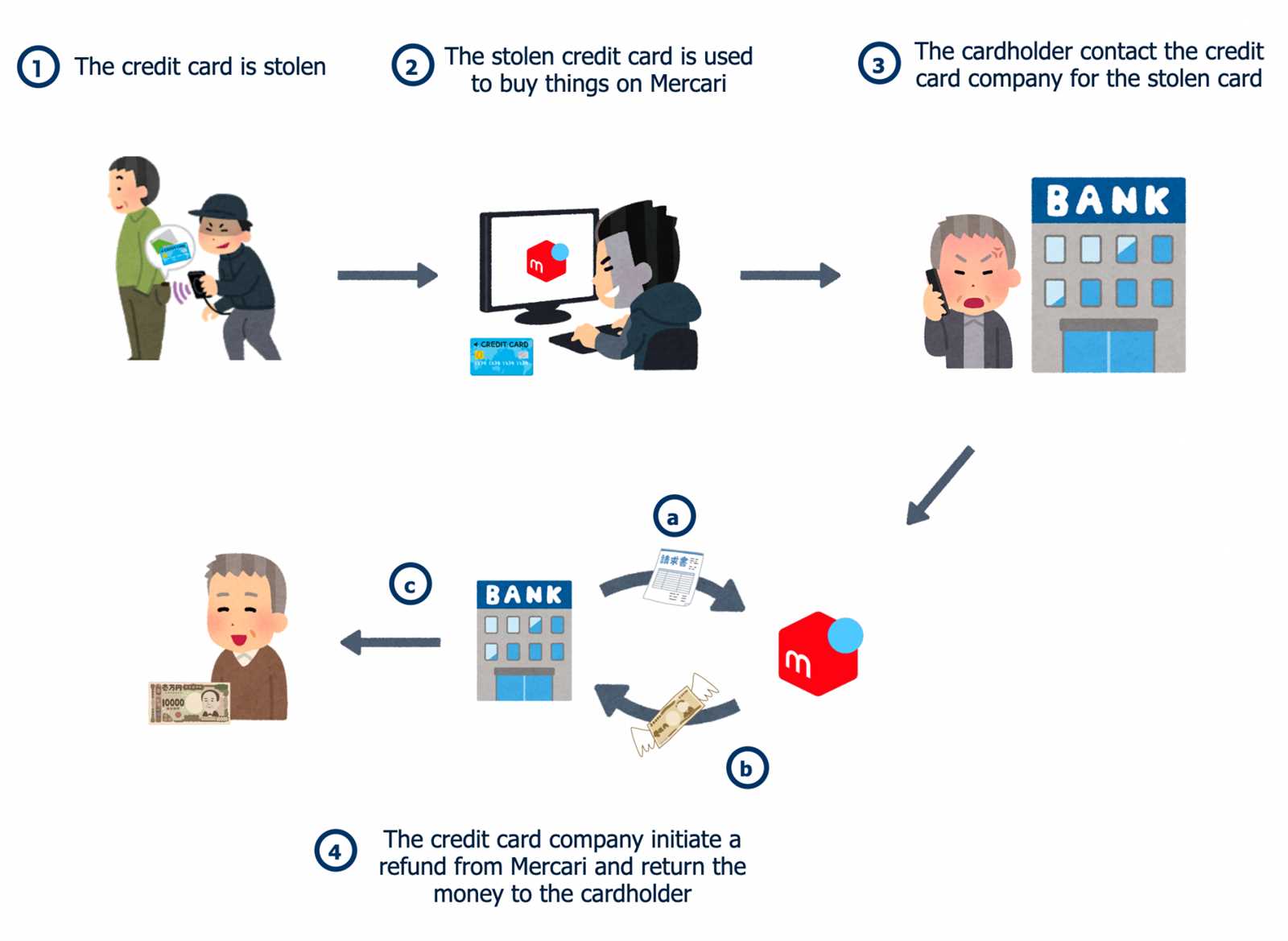

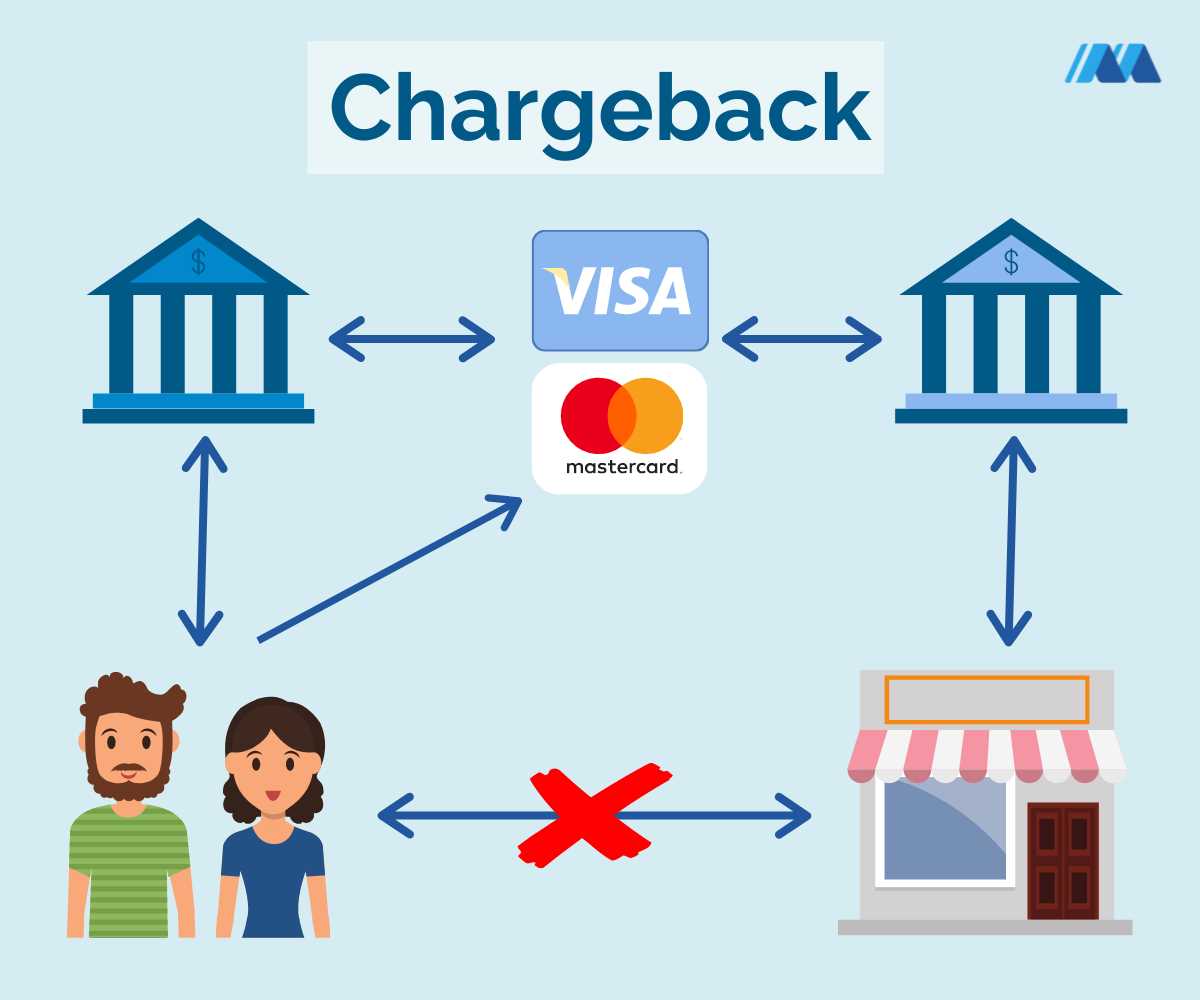

What is a Dispute Request Document

A dispute request document is a formal communication that individuals submit to financial institutions to contest unauthorized or incorrect charges. This document is an essential tool when seeking a refund or reversal of a payment for a product or service that was either never received or improperly processed. It serves as an official record of the issue and initiates the review process by the institution.

Key Characteristics of a Dispute Request

- Clear and concise explanation of the issue

- Detailed information about the transaction in question

- Evidence supporting the claim, such as receipts or correspondence

- Formal tone and structure

Purpose of a Dispute Request

- To inform the financial institution about the erroneous transaction

- To request a refund or reversal of the charge

- To establish a record of the claim for potential future reference

Why You Should Use a Structured Format

When submitting a formal complaint or request to resolve a financial issue, having a pre-designed structure can significantly improve the clarity and effectiveness of your communication. A well-organized document ensures that all necessary information is included in the correct order, making it easier for the recipient to understand the situation and respond promptly. This approach not only saves time but also minimizes the risk of overlooking crucial details.

Using a standardized format also helps maintain a professional tone, which is essential for ensuring that your claim is taken seriously. It ensures that you follow all required guidelines set by the institution, increasing the likelihood of a successful resolution. By relying on a proven structure, you can avoid unnecessary confusion and present your case more persuasively.

Essential Information for Your Document

When preparing a formal request to resolve a disputed transaction, including all relevant details is crucial for a smooth and efficient process. The more specific and thorough the information, the easier it becomes for the financial institution to review your case and take appropriate action. Omitting key facts or being vague can lead to delays or even a rejection of your claim.

Your document should include the following vital elements to ensure clarity and completeness:

- Transaction Details: The date, amount, and description of the disputed charge.

- Personal Information: Your account number and contact information.

- Supporting Evidence: Any receipts, emails, or communication that back up your claim.

- Reason for Dispute: A clear and concise explanation of why the transaction is incorrect.

By ensuring all of these details are included, you improve the chances of a quick and favorable response from the institution handling your case.

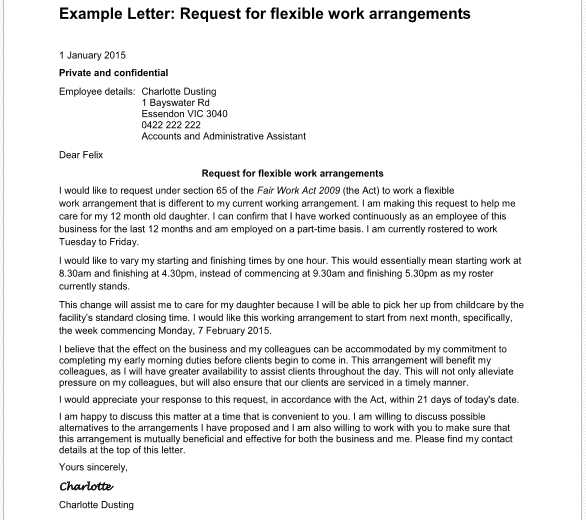

How to Format Your Dispute Request

Formatting your request in a clear and organized manner is essential for effectively communicating your issue. A well-structured document helps ensure that all the necessary details are presented in a logical order, making it easier for the recipient to process your claim. Following a consistent format not only improves readability but also increases the chances of a timely resolution.

Here are key steps to follow when structuring your request:

- Introduction: Begin with a brief introduction stating your intention to dispute a specific charge.

- Transaction Information: Provide the date, amount, and description of the disputed charge. This section should be precise and easy to verify.

- Clear Explanation: Offer a detailed yet concise explanation of why the transaction is incorrect or unauthorized.

- Supporting Documents: Attach any relevant proof, such as receipts, email correspondence, or screenshots, to back up your claim.

- Request for Resolution: State your desired outcome, whether it is a refund, reversal, or other form of compensation.

By following this format, you ensure that your communication is clear, professional, and likely to lead to a swift resolution.

Avoiding Common Document Mistakes

When drafting a formal request to resolve a dispute, it’s easy to overlook key details or make mistakes that can weaken your case. Avoiding these common errors can make a significant difference in the outcome of your claim. Ensuring clarity, accuracy, and professionalism in your communication will increase the likelihood of a successful resolution.

Here are several mistakes to watch out for when preparing your document:

- Vague Explanations: Be specific about the issue. General statements can confuse the recipient and delay the process.

- Omitting Supporting Evidence: Always include relevant documentation to strengthen your claim, such as receipts or email exchanges.

- Incorrect Transaction Details: Double-check the date, amount, and description of the transaction to avoid errors that could discredit your claim.

- Unprofessional Tone: Maintain a polite and formal tone. Aggressive or overly emotional language may harm your chances of a favorable response.

- Failure to Follow Instructions: Different institutions may have specific guidelines for submitting disputes. Be sure to follow them carefully to avoid rejection.

By avoiding these common mistakes, you ensure that your request is clear, complete, and professional, improving your chances for a quick and successful resolution.

Improving the Success of Your Claim

Submitting a well-prepared request is just the first step toward resolving a financial dispute. To maximize the chances of a favorable outcome, there are several additional strategies you can apply. Paying attention to detail, providing compelling evidence, and ensuring that your communication meets all the necessary requirements will help strengthen your case.

Essential Factors for a Strong Request

- Timeliness: Submitting your claim promptly ensures that the issue is addressed while it is still within the institution’s dispute window.

- Accuracy: Double-check all the details in your request to ensure there are no discrepancies that could undermine your case.

- Comprehensive Evidence: Provide clear, organized documentation to support your claims, such as invoices, screenshots, and email exchanges.

Additional Tips for Strengthening Your Case

| Tip | Benefit |

|---|---|

| Be clear and concise | Avoiding ambiguity helps the recipient understand your case faster and reduces the risk of confusion. |

| Include all relevant details | Providing complete information ensures that the review process is efficient and comprehensive. |

| Follow up regularly | Maintaining communication with the institution can help keep your claim on track and ensure timely resolution. |

By applying these strategies and being diligent in preparing your case, you increase your chances of a successful outcome when disputing an unauthorized transaction.