Chargeback Refund Template Letter Guide

When a purchase goes wrong or an issue arises with a payment, it’s important to know how to effectively communicate with your financial institution to recover funds. Many individuals encounter situations where the goods or services received don’t meet expectations, and seeking assistance through official means becomes necessary. Understanding the proper approach can make the process smoother and increase the chances of a successful resolution.

One of the most essential steps in this process is crafting a well-written communication to the bank or payment provider. A clear, concise, and formal request can help ensure your case is taken seriously and processed efficiently. It’s crucial to include all relevant details and follow the proper structure to avoid delays or misunderstandings. Knowing how to phrase your request professionally can greatly influence the outcome of your situation.

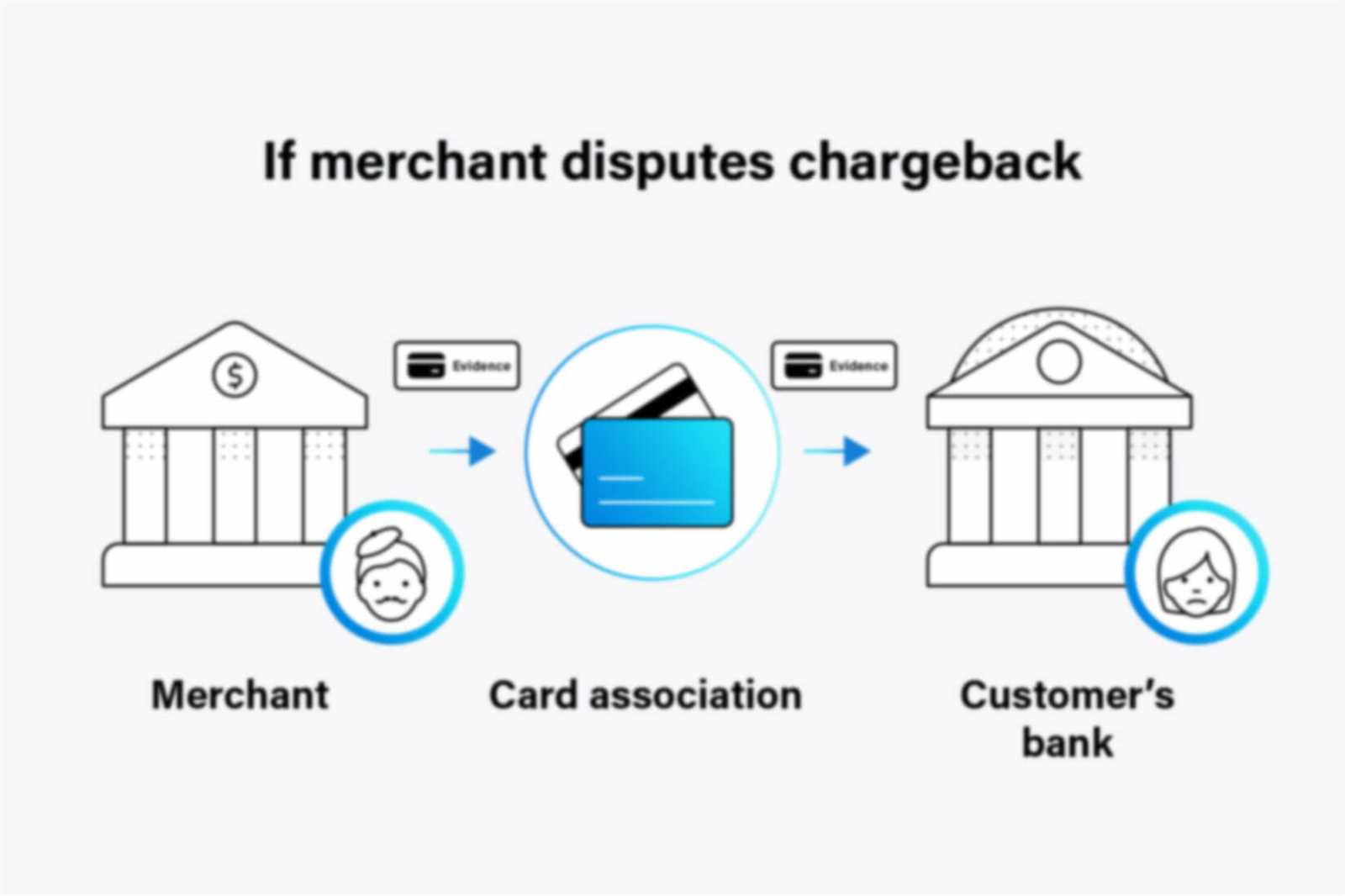

How to Navigate the Reversal Process

When a payment is made for goods or services that don’t meet expectations or are disputed, the option to reverse the transaction may be available. This process allows individuals to recover money in cases where the seller fails to fulfill their obligations or when there are discrepancies in the transaction. Understanding the steps involved can help streamline the procedure and ensure a smoother experience when dealing with payment providers.

It’s important to recognize that the process typically starts with identifying the reason for the dispute, whether it’s fraud, defective goods, or failure to deliver. After that, the appropriate documentation and proof are gathered to support the case. Communicating effectively with the financial institution handling the payment plays a vital role in achieving a successful outcome.

| Step | Description |

|---|---|

| 1. Review Transaction | Examine the purchase to ensure that it’s eligible for a reversal process based on the situation. |

| 2. Gather Documentation | Collect any necessary supporting evidence, such as invoices, receipts, or communications with the seller. |

| 3. Contact Payment Provider | Reach out to the financial institution or service managing the payment to initiate the reversal process. |

| 4. Submit Request | Provide all relevant information and documentation in a clear, organized manner to assist in processing the reversal. |

| 5. Follow Up | Stay in contact with the institution for updates and be prepared to provide additional details if required. |

Understanding these steps and the importance of clear communication can significantly improve the chances of recovering the amount in question. By preparing the necessary details and working with the financial institution, you can navigate the process more effectively.

How to Draft a Refund Request

When facing an issue with a payment or transaction, it’s essential to communicate effectively with the financial institution or service provider to resolve the matter. The process begins with writing a formal request that clearly outlines the problem and supports your case. A well-structured communication can improve your chances of a quick and favorable response.

To begin, ensure your request includes all pertinent details, such as the transaction date, amount, and the reason for the dispute. Be clear and concise while avoiding unnecessary information. Including any supporting documentation, such as receipts or correspondence with the seller, can strengthen your claim. Maintain a professional tone throughout to ensure your request is taken seriously and processed in a timely manner.

Essential Details for Chargeback Letters

When initiating a formal request for reversing a payment, it’s important to include all relevant information that will support your claim and help the financial institution or payment provider assess the situation accurately. Providing the right details ensures that your case is processed smoothly and efficiently. Below are the key components to include in your communication:

- Transaction Information: Include the transaction date, amount, and any reference numbers or receipts related to the payment.

- Reason for Dispute: Clearly state the reason for your request, whether it’s due to fraud, undelivered goods, or defective items.

- Supporting Evidence: Attach relevant documents such as invoices, screenshots, or email exchanges with the seller that back your claim.

- Contact Information: Provide accurate details so the financial institution can reach you easily if further clarification is needed.

By ensuring that your request is complete and well-documented, you can increase the chances of a successful resolution. Be thorough but concise to avoid any confusion or delays in processing.

Common Errors to Avoid in Disputes

When handling a payment issue or transaction disagreement, it’s crucial to avoid certain mistakes that could hinder the process or delay the resolution. Ensuring that your request is clear, accurate, and professionally presented can make all the difference in achieving a positive outcome. Below are some common errors that should be avoided:

- Vague or Unclear Reasoning: Failing to clearly state why you’re disputing the charge can lead to confusion and delays. Be specific about the issue, whether it’s related to unauthorized charges, incorrect items, or other concerns.

- Incomplete Documentation: Not providing sufficient evidence to support your case can weaken your position. Always include relevant documents such as receipts, emails, or screenshots to strengthen your claim.

- Excessive Detail: While it’s important to be thorough, overwhelming the reader with irrelevant information can slow down the process. Keep your communication concise and to the point.

- Emotional Language: While it’s understandable to be frustrated, using emotional or aggressive language can make your case less professional and harder to resolve. Stay polite and factual.

- Missing Deadlines: Some financial institutions or payment processors have time limits for initiating disputes. Make sure to act promptly and adhere to any deadlines to avoid losing your eligibility for a reversal.

By avoiding these common pitfalls, you’ll be in a better position to handle the situation effectively and increase the chances of a favorable result.

When to Submit a Chargeback

Submitting a request to reverse a transaction should not be done hastily; it is important to understand when this step is necessary. There are specific scenarios where such an action is appropriate, and knowing these situations can help you avoid unnecessary disputes. In general, a reversal should be pursued only when other resolution methods have been exhausted or when the issue is clear-cut and undeniable.

Situations When a Dispute is Justified

Typically, a transaction can be disputed in cases of fraud, non-delivery of goods, or when the purchased items are significantly different from what was advertised. If the seller fails to provide the product or service as promised, or if there is evidence of fraudulent activity, initiating a reversal may be your best option. It’s also important to keep in mind that many financial institutions have specific timeframes within which you can submit a request, so acting quickly is often crucial.

When to Explore Other Solutions First

Before resorting to a reversal request, consider contacting the merchant or service provider directly to resolve the issue. Many disputes can be settled through communication or negotiation, without the need for involving your financial institution. Only if these efforts fail or if the issue is urgent should you consider submitting a formal request.

Helpful Tips for Successful Chargebacks

Filing a transaction dispute can be a complex process, but with the right approach, you can increase the likelihood of a favorable outcome. Success in these situations depends on providing clear and accurate information, adhering to deadlines, and maintaining effective communication. Below are some valuable tips to help guide you through the process.

Ensure Thorough Documentation

To support your case, always gather and include all relevant evidence. This can include receipts, invoices, email communications, and any other supporting documents that validate your claim. The more thorough and organized your documentation, the easier it will be for the financial institution or service provider to process your request efficiently.

Be Prompt and Clear in Your Request

Timing is crucial when filing a dispute. Be sure to submit your claim within the required time frame set by the payment processor or financial institution. Additionally, clearly explain the reason for your dispute, providing specific details without unnecessary information. A concise and factual approach can help prevent delays and increase the chances of a successful resolution.

Know Your Rights in Chargeback Cases

When you encounter issues with a transaction, it’s important to understand your legal rights in order to make informed decisions and effectively resolve the matter. You have the right to seek a reversal if certain conditions are met, but there are also limits and rules you must follow. Knowing these rights can protect you from unnecessary complications and ensure your case is handled properly.

Understanding Consumer Protections

As a consumer, you are generally protected under various laws that ensure you are not held responsible for fraudulent transactions or purchases that don’t meet the seller’s description. Here are some key points to keep in mind:

- Fraudulent Charges: If your account is charged without your consent or as a result of fraud, you have the right to dispute the transaction.

- Non-Delivery of Goods: If the merchant fails to deliver the goods or services as promised, you may be eligible to request a reversal of the payment.

- Misleading Product Descriptions: If an item or service received does not match the description provided by the merchant, you may have grounds for contesting the charge.

Time Limits and Restrictions

While you have various rights, it’s important to understand the time limits and restrictions that apply to disputes. Each financial institution or payment processor may have different rules regarding how long you have to submit a claim and under what circumstances. Here are a few points to remember:

- Time Constraints: Most institutions require disputes to be filed within a certain period after the transaction.

- Eligibility Criteria: Not all situations may qualify for a dispute, so ensure that your case meets the specific criteria.