Church contribution statement church year end giving letter template

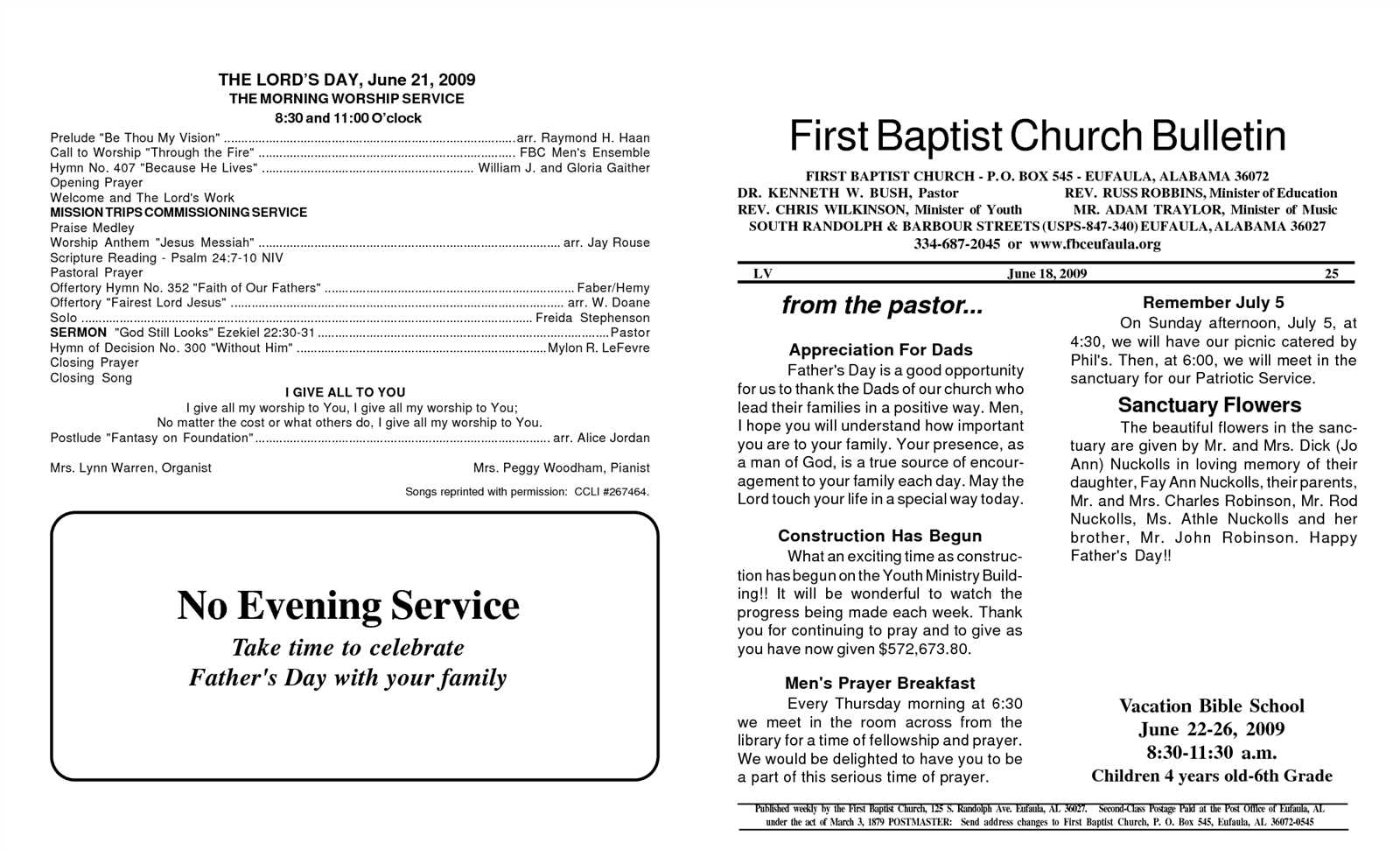

Creating a church contribution statement and year-end giving letter is a straightforward way to provide your congregation with a clear record of their donations. Start by gathering all the relevant financial data for the year, ensuring all contributions, pledges, and donations are accurately listed. This will serve as the foundation for your letter.

Begin the letter with a warm thank you for the generosity shown by your members throughout the year. Acknowledge how their contributions have supported the church’s mission and activities. This reinforces the impact of their giving and builds a connection between their support and the church’s work.

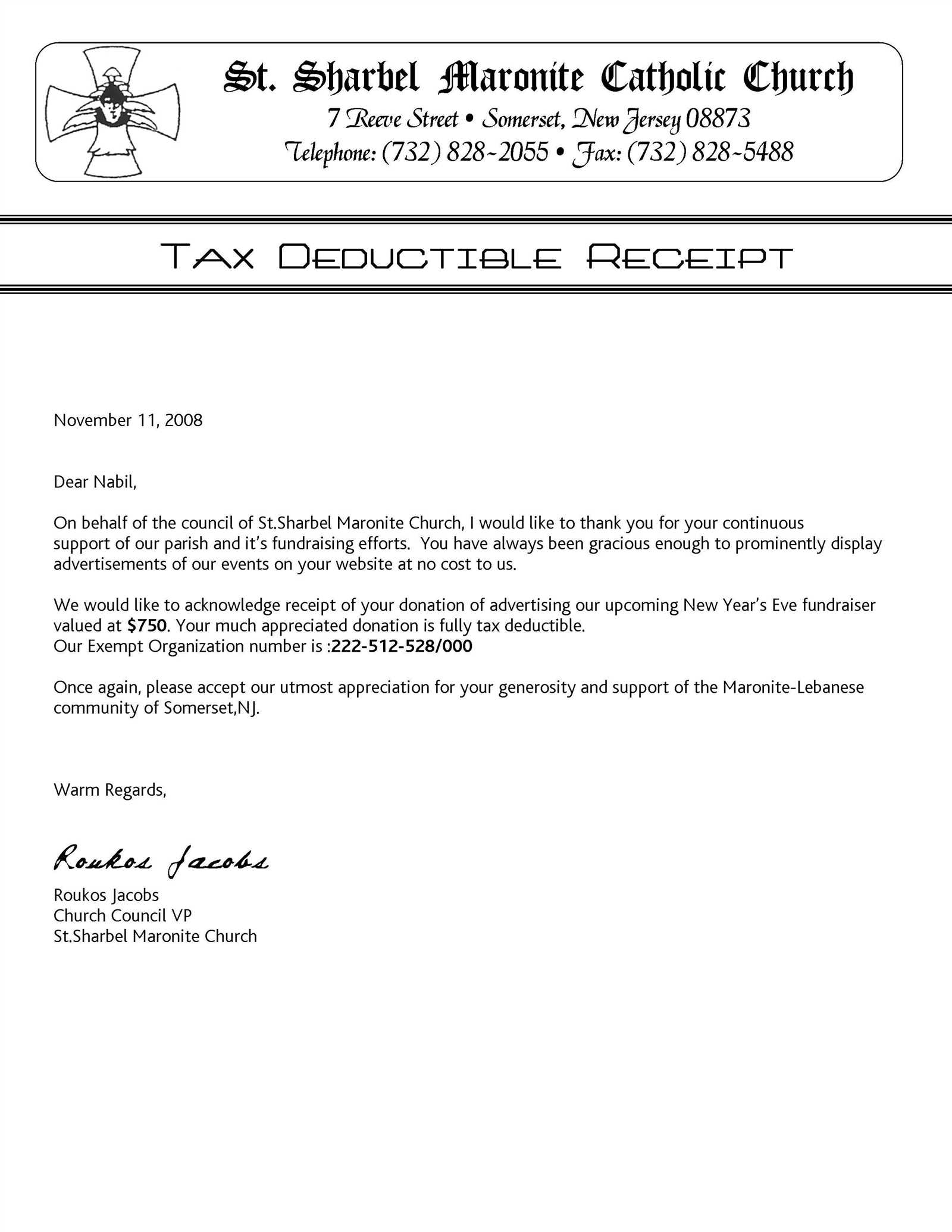

Next, include a detailed breakdown of each donation made by the individual, with corresponding dates and amounts. Be sure to mention any special campaigns or specific funds that may apply to their gifts. If necessary, provide the donor with information regarding tax-deductible contributions. Closing the letter with a reminder of how their giving has made a difference is always a good touch, leaving them with a sense of fulfillment and appreciation.

Here’s the corrected version:

Ensure the subject line is clear and direct. Use terms like “Year-End Giving Statement” or “Your 2024 Contributions Summary” for clarity.

Begin the letter with a warm greeting. Acknowledge the contributions made throughout the year. Emphasize gratitude for the consistent support.

Personalized Giving Summary

Provide a detailed breakdown of the donor’s contributions. Include specific amounts given throughout the year, categorized by type (e.g., weekly, monthly, special donations). Ensure the amounts match the records accurately.

Tax Information

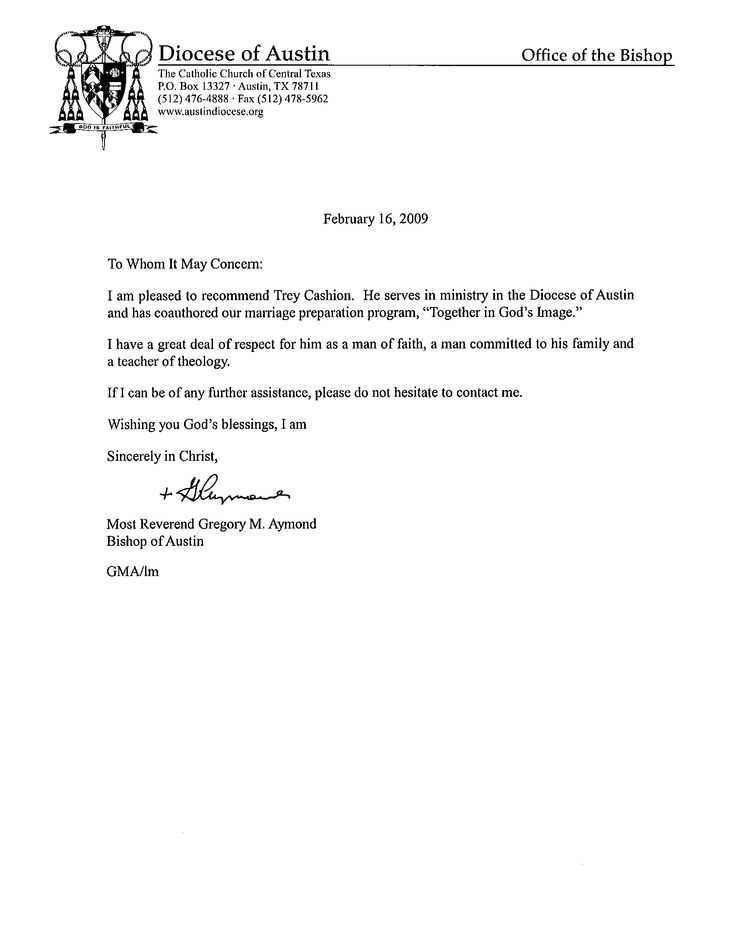

Include the necessary tax information, such as the total amount contributed, and mention that this statement can be used for tax purposes. Offer assistance if the donor needs further documentation or clarification.

Close with a thank-you message and invite them to reach out if they have any questions regarding their statement or future contributions. Encourage them to continue their support in the upcoming year.

Church Contribution Statement: Year-End Donation Letter Template

Start with a clear and straightforward subject line to immediately inform recipients about the purpose of the letter. For example, “Year-End Contribution Statement for 2024.” This ensures transparency and sets expectations for your church members.

Crafting a Clear and Concise Donation Statement

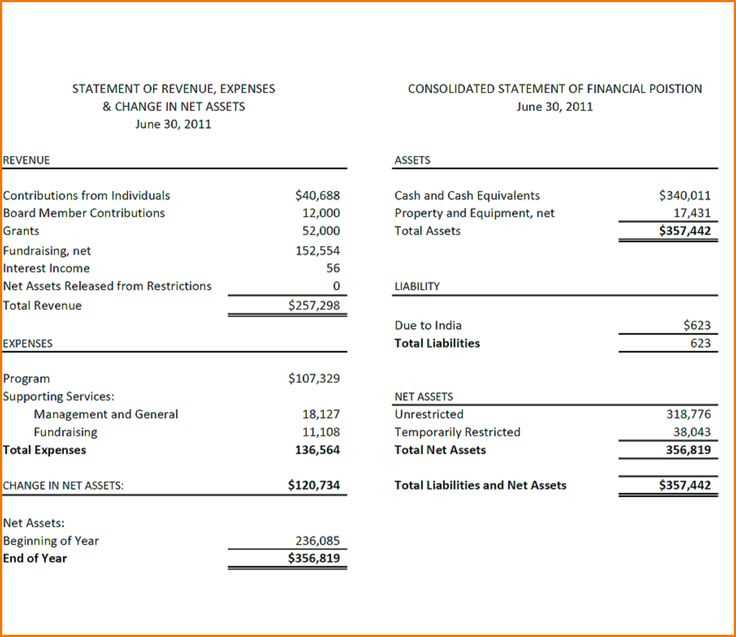

Use simple language and highlight the total amount donated over the course of the year. Be specific about the date range covered (e.g., January 1, 2024, to December 31, 2024). Avoid unnecessary jargon, keeping the statement straightforward and focused on the key financial details.

Essential Details to Include in Your Year-End Giving Letter

Include the donor’s full name, address, and donation total for the year. If applicable, break down the types of contributions (e.g., cash, checks, or online donations). If there were any special fund designations (e.g., mission projects, building funds), list them clearly as well.

Be sure to add a thank you message for the individual’s generous contributions, reinforcing their impact on the church’s mission. Additionally, provide a statement confirming that no goods or services were provided in exchange for the donation, which is important for tax purposes.

Formatting the Statement for Enhanced Readability

Organize the letter into easy-to-read sections. Use bullet points or tables to list donations by type or date. Include a summary table at the end that clearly shows the total for the year, making it simple for the donor to review.

Customizing Your Letter to Encourage Future Contributions

In addition to providing tax information, personalize the message to emphasize how the donations directly support the church’s programs and outreach efforts. This not only expresses gratitude but also motivates donors to continue their support in the future.

Ensuring Adherence to IRS Guidelines for Year-End Statements

Make sure your letter includes the required tax information, such as a statement that the donor did not receive any goods or services in exchange for the donation, if applicable. If you’re issuing a contribution for over $250, include the IRS-required confirmation for donations of this size.

How to Distribute Contribution Statements Effectively

Distribute statements well in advance of tax season to allow donors time to use the information for tax filing. Sending the letters via mail or email both offer a personal touch. For larger churches, consider utilizing a software solution to streamline the process and ensure accuracy.