Close bank account letter template

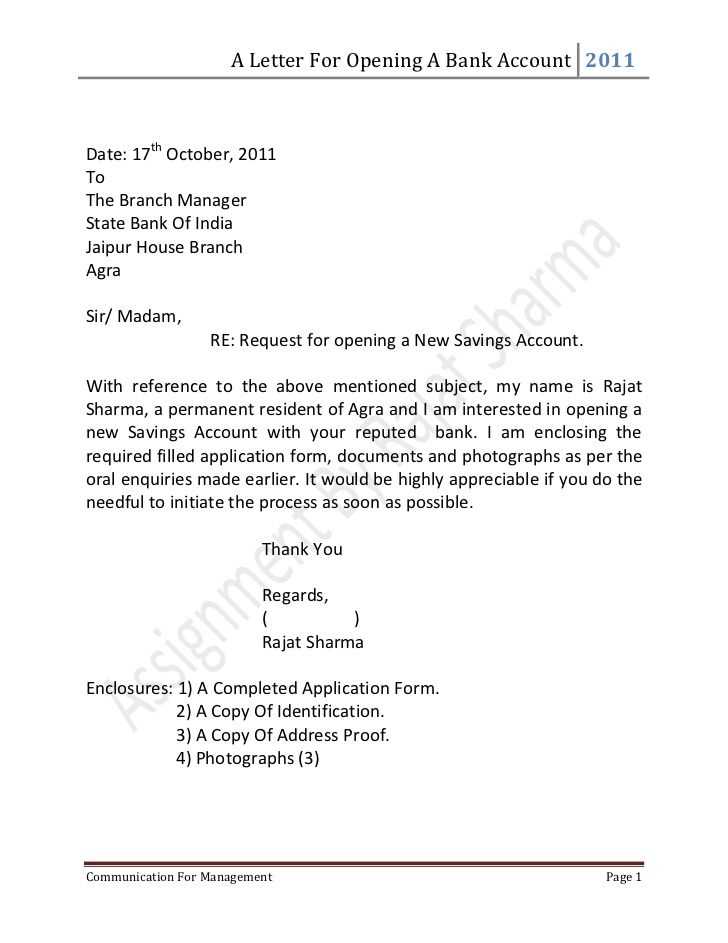

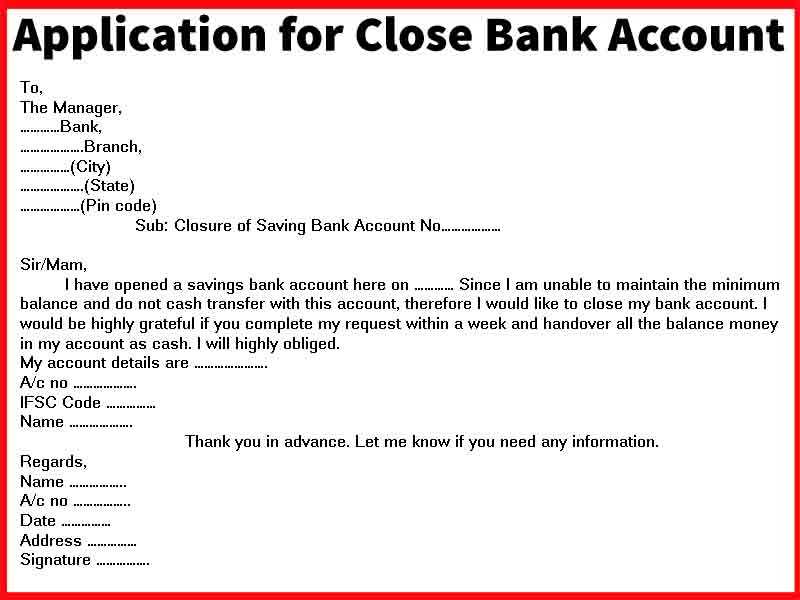

To close your bank account, begin by drafting a formal letter addressed to your bank’s customer service or branch manager. Be clear and direct about your request to close the account, including all necessary details. Start with the account number, the type of account, and any other identifying information that might be required for verification purposes.

Make sure to state your reasons for closing the account, although this is optional. Some banks may request this information, but others may not require an explanation. Regardless, keeping your tone professional and polite is important to ensure a smooth process.

If you have any outstanding transactions or linked services, mention that you’ve settled them or provide instructions on how to handle them. This will help avoid confusion and ensure that the bank closes your account without any lingering issues.

Before sending the letter, ensure that you’ve withdrawn any remaining balance from the account. You may also want to ask for written confirmation once the account has been closed to avoid any future discrepancies.

Here are the corrected lines:

Make sure to include the exact date when you intend to close your account. Specify any outstanding balance and mention how you plan to settle it. Ensure that your contact details are clear, allowing the bank to reach you for further steps or updates.

Details to include:

Provide your account number and relevant personal information for identification. If you’re requesting the closure by mail or phone, make sure to include those details clearly. State whether you would like a confirmation of closure in writing.

- Close Bank Account Letter Template

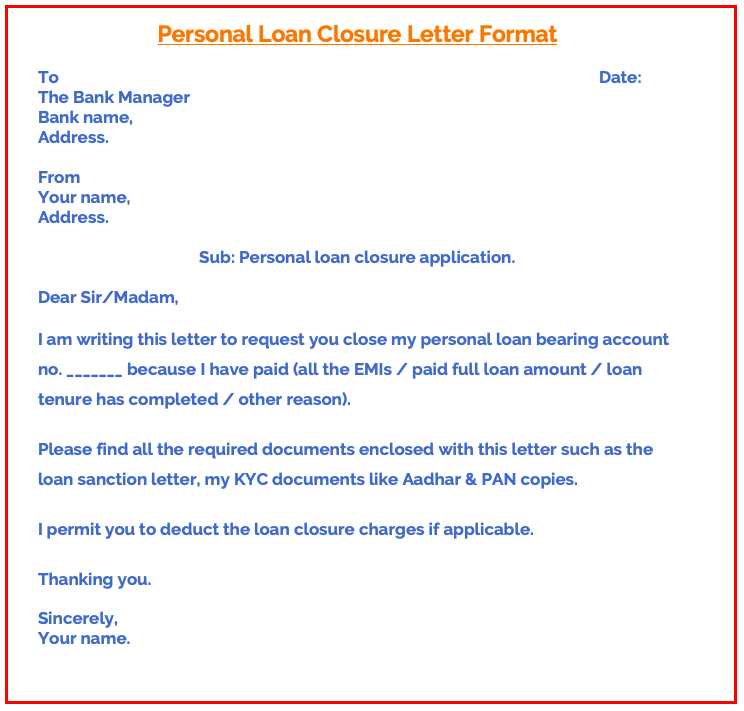

To close your bank account, a formal letter should be sent to your bank. This letter should clearly state your intent to close the account and provide all necessary details to ensure a smooth process. Here’s a template you can use to draft your letter:

Close Bank Account Letter Template

Dear [Bank Name],

I am writing to request the closure of my account with your bank. The details of the account are as follows:

- Account Name: [Your Full Name]

- Account Number: [Your Account Number]

- Branch Name/Address: [Branch Details]

Please transfer any remaining balance to my following account:

- Transfer Account Number: [Your New Account Number]

- Transfer Account Bank Name: [Your New Bank Name]

Kindly send me a confirmation once the account has been closed and the balance has been transferred. If there are any additional steps or documents required from my side, please let me know.

Thank you for your prompt attention to this matter. I look forward to receiving the closure confirmation at your earliest convenience.

Sincerely,

[Your Name]

[Your Address]

[Your Contact Information]

Important Points to Include

- Ensure you mention your full name, account number, and branch details for accurate identification.

- If applicable, request a written confirmation of account closure for your records.

- Include a new account number if you wish to transfer the remaining balance to another bank.

Begin your letter by clearly identifying the purpose: closing your bank account. State your full name, account number, and the type of account you wish to close. For clarity, include the date and address of the bank branch where you hold the account. This helps the bank process your request smoothly and quickly.

Here’s an example of how you could start:

“I am writing to request the closure of my [Account Type] account, number [Account Number], effective immediately. My name is [Your Full Name], and my address is [Your Address]. Please proceed with the closure and send me a confirmation once this has been completed.”

This direct and clear approach ensures there’s no confusion and sets a professional tone for the rest of the letter. After stating your request, continue with any necessary details or instructions, such as forwarding the balance or confirming that all outstanding payments have been cleared.

Provide your full name and address at the top of the letter for clear identification. This ensures the bank can match your closure request with your account details swiftly.

Include the account number or account type (e.g., checking, savings) to specify which account is being closed. This helps avoid any confusion regarding multiple accounts.

Reason for Account Closure

Briefly mention why you are requesting to close the account. This could be for personal reasons, moving to a different bank, or dissatisfaction with services. A clear explanation ensures the bank understands your request.

Outstanding Transactions and Balances

Confirm that there are no outstanding transactions, fees, or balances left. If there are, settle them before requesting closure. Otherwise, include a statement affirming that all pending items have been resolved.

Provide a forwarding address or contact information for any remaining communications or potential refunds related to the account after closure.

Check if there are any pending transactions. Ensure all checks, payments, or withdrawals have cleared before proceeding. Unresolved transactions can result in fees or complications after closing the account.

Review your automatic payments and subscriptions linked to the account. Update the payment information for services such as utilities, streaming platforms, or insurance to avoid missing payments.

Withdraw the remaining balance. Transfer or withdraw all funds before requesting account closure to prevent funds from being lost or left behind.

Request a confirmation of account closure. Get written confirmation from the bank that the account has been closed to avoid any misunderstandings or future fees.

Check for any early closure fees. Some banks may charge a fee if you close the account within a specific period after opening. Confirm if any such fees apply to avoid unexpected costs.

Consider the impact on your credit score. Closing an account may affect your credit, especially if it has been open for a long time or has an active balance. Evaluate if keeping the account open longer is beneficial for your credit profile.

Ensure you have an alternative account. Before closing, confirm you have another bank account to manage your finances and avoid disruptions in your financial activities.

Before closing your bank account, ensure all pending transactions are cleared. This includes checks, automatic payments, or pending transfers that may take a few days to process. If these transactions are not settled before you close the account, they could result in bounced payments or fees. Here’s how to handle them:

1. Review Pending Transactions

Log into your online banking account or visit your bank to review all transactions that have not been completed. This includes any pending charges or transfers that are still in progress. Make sure no scheduled payments or automatic debits are still pending.

2. Clear Pending Payments

If you notice any pending payments, try to process them before initiating the account closure. You can call or email the recipient and ask if they can wait for the payment to be processed. Alternatively, pay these amounts manually through your online banking platform or at the bank’s branch to avoid delay.

3. Contact Companies for Automatic Transactions

If you have automatic payments, such as subscriptions or utility bills, scheduled through your account, notify the companies of the account closure. Provide them with an updated payment method to ensure your services continue without interruption.

4. Keep the Account Open for Pending Transactions

If transactions are still processing and cannot be cleared in time, consider leaving the account open for a short period after the closure request. This allows any remaining transactions to be completed without issues. Once all pending items are cleared, you can safely close the account.

5. Monitor for Unexpected Charges

After you’ve closed the account, keep an eye out for any unexpected charges or transactions. In case something is missed, contact your bank immediately to resolve the issue.

Transaction Timeline Table

| Transaction Type | Recommended Action | Timeframe to Clear |

|---|---|---|

| Pending Payments | Pay manually or ensure processing before closure | Up to 3-5 business days |

| Automatic Payments | Update payment method with the service provider | 1-2 weeks before the account closure |

| Deposits or Transfers | Ensure all incoming transfers are received | 1-3 business days after initiation |

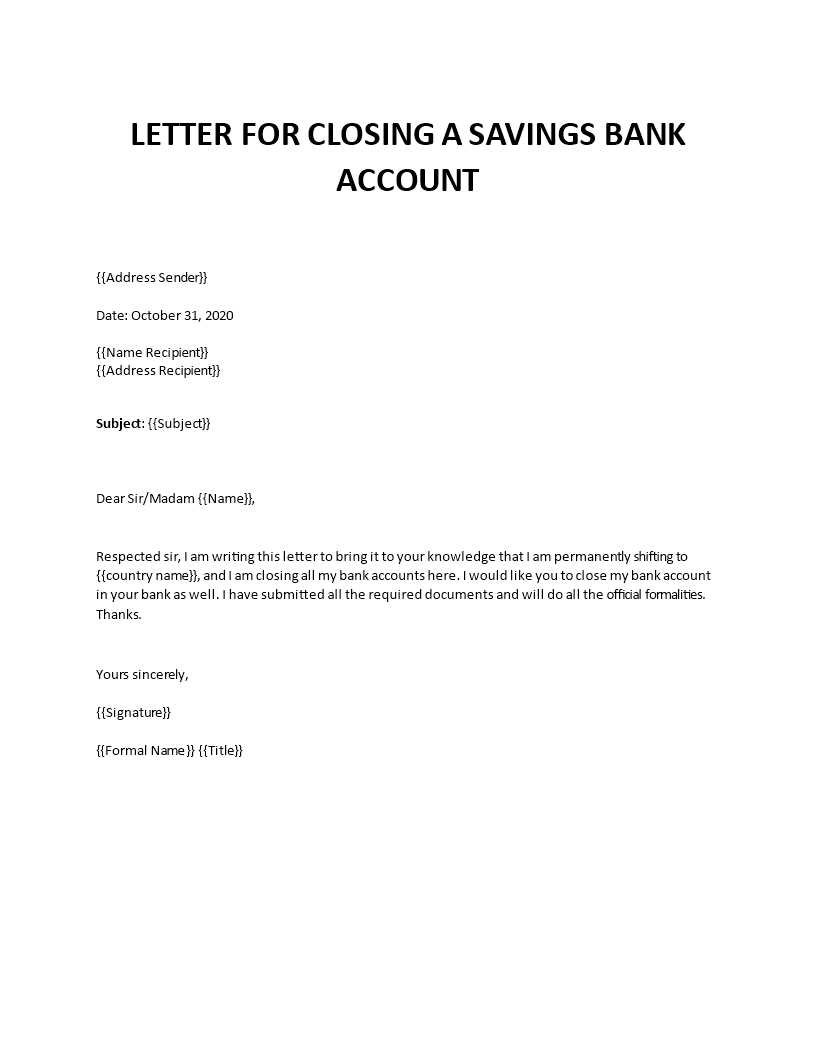

Submit your bank account closure letter directly to your bank’s customer service. You can either send it by mail, email, or deliver it in person at your branch. Be sure to use the method your bank prefers for processing account closures.

Submitting by Mail

Mail the signed closure letter to the bank’s registered address. Confirm that your letter includes all necessary information such as your account details, identification, and signature. Use a trackable mail service to ensure delivery confirmation.

Email Submission

If your bank accepts email submissions, send your letter as an attachment in PDF or Word format. Include a subject line like “Request for Account Closure” and provide all the required details in the body of the email for quick reference.

Once you submit a bank account closure request, expect the bank to review your request and verify that all conditions for closure are met. Here’s what typically happens next:

- Confirmation of Request: The bank will acknowledge receipt of your request. You may receive a confirmation email or letter with details about the process and the expected timeline for closure.

- Account Review: The bank will check if there are any pending transactions, outstanding balances, or open loans linked to your account. Ensure that you clear all dues before submitting the closure request to avoid delays.

- Final Transactions: If you haven’t already, make sure to withdraw your remaining balance. Some banks may require you to provide a reason for the closure, so be prepared to give a brief explanation.

- Account Deactivation: Once everything is in order, the bank will deactivate your account. This could take anywhere from a few days to a couple of weeks, depending on the bank’s procedures.

- Closure Confirmation: The bank will send you a formal confirmation once your account is closed. Keep this for your records in case you need it later.

What You Should Do During This Process

- Check for any automatic payments or subscriptions linked to the account, and update them before closure.

- Verify that no outstanding checks or payments are pending processing.

- Contact customer support if you do not receive the closure confirmation within the stated timeframe.

Ensure the letter clearly states your intent to close the account. Start by mentioning your account number and the type of account you wish to close.

- Include a request for the bank to confirm the closure in writing.

- State that you have cleared all pending transactions, and ask for confirmation of any remaining balance after fees, if applicable.

- If applicable, request the return of any unused checks or bank cards associated with the account.

- Provide a forwarding address for any final statements or refunds.

Finish by thanking the bank for their services and express your hope for a smooth resolution of your request.