Close my account letter template

If you’ve decided to close your account, it’s important to communicate your request clearly and professionally. A well-crafted letter ensures that your account closure is processed efficiently without confusion or delays. Below is a simple yet effective template you can use when contacting customer support to close your account.

Start by providing your full name, account number, and any other identifying information relevant to the company or service. Be clear and direct about your intention to close the account. It’s helpful to also request confirmation of the account closure and inquire about any final steps, such as outstanding balances or data removal procedures.

Remember to remain polite and courteous throughout the letter. Although you are making a specific request, maintaining professionalism can help ensure a smooth closure process. Use the following template to guide your communication:

Here’s the revised version with duplicates removed:

If you want to close your account, you can follow this simple structure in your letter. Start by stating your intention clearly and mention the reason briefly, if you feel comfortable doing so. Make sure to include your account details for easy identification. Keep the tone polite and straightforward, avoiding any unnecessary details.

Account Information

Include your account number or username in the letter. This helps the company locate your account and process the closure without delay.

Request for Account Closure

Make the request directly: “I would like to close my account.” This eliminates confusion and sets clear expectations for the company.

By following these steps, you ensure your request is clear and processed without complications. Keep your message concise and to the point.

- Close My Account Letter Template

If you want to close your account, a clear and concise letter will ensure the process goes smoothly. Here’s how to structure it:

Key Elements of the Letter

- Your Personal Information: Include your full name, account number, and any other identifying details.

- Request for Account Closure: State your desire to close the account directly and unambiguously.

- Reason for Closure (Optional): If you feel comfortable, mention the reason for your decision, though it’s not mandatory.

- Request for Confirmation: Ask for written confirmation of the account closure and any steps you need to take.

- Contact Information: Provide your contact information in case they need to reach you for follow-up.

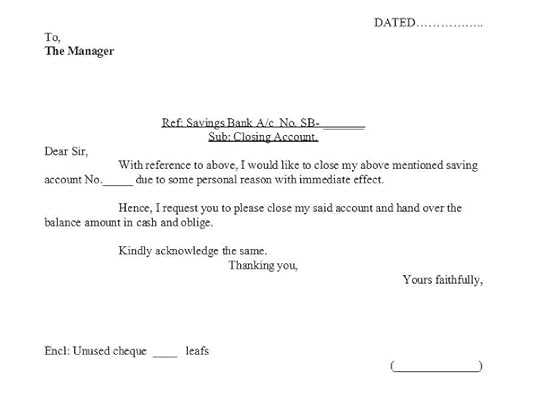

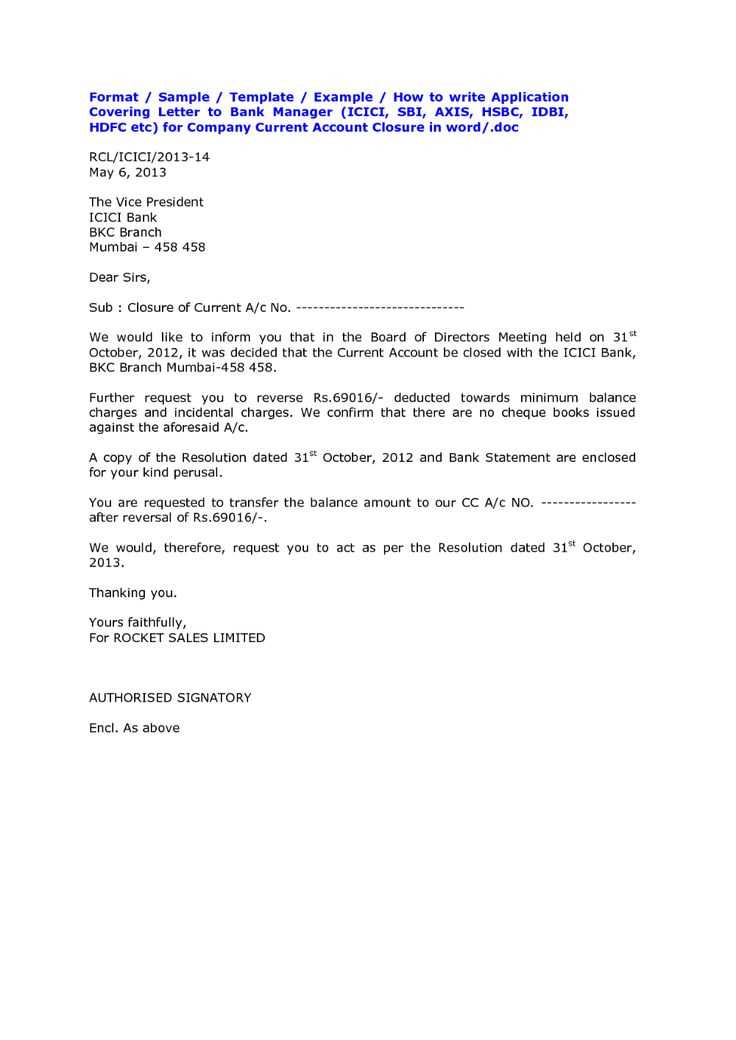

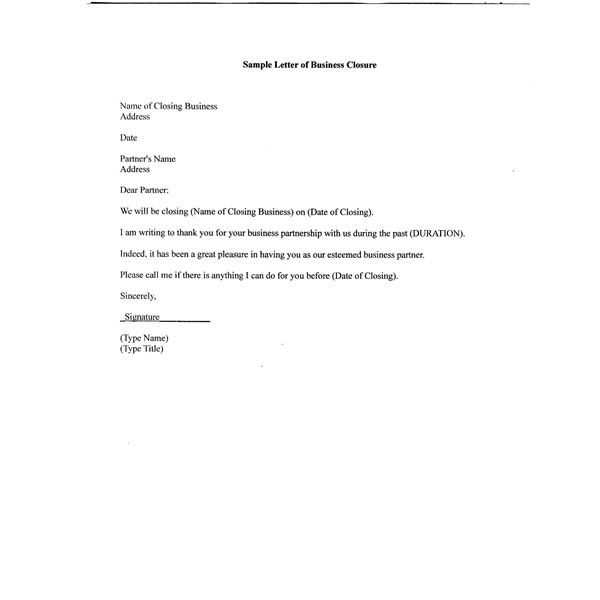

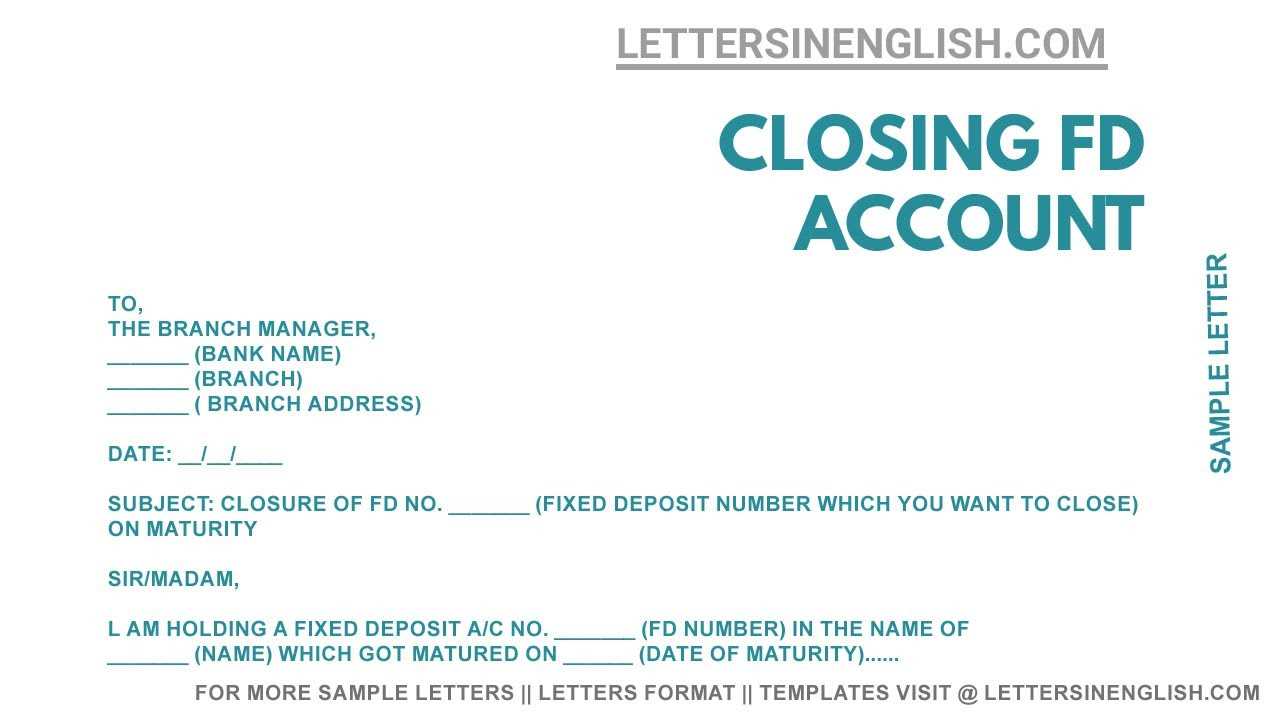

Template Example

Here’s a sample letter template for closing an account:

[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [Bank or Company Name] [Company Address] [City, State, ZIP Code] Dear [Company Name], I am writing to request the closure of my account [Account Number]. Please process this request and confirm in writing once my account has been closed. If any further action is required on my part, please let me know. I would appreciate confirmation of the account closure at your earliest convenience. Thank you for your attention to this matter. Sincerely, [Your Name]

Follow this structure, and make sure all the details are accurate to avoid any delays or misunderstandings.

Begin your letter by clearly stating your intention to close the account. Mention the account type, the account number, and any other relevant identifiers. Use a direct and concise approach, for example: “I am writing to request the closure of my account, [Account Number].”

Next, confirm any necessary steps you’ve taken before the request. If applicable, indicate that you’ve cleared outstanding balances or transferred any funds. This will demonstrate you’ve addressed all obligations. You might write: “All outstanding fees have been settled and no further transactions are pending.”

Include your contact information so they can reach you for confirmation or any follow-up. Provide a preferred method of communication, such as email or phone number. For instance: “Please confirm the closure via email at [Your Email Address].”

Finally, express gratitude for the service received and maintain a courteous tone. Keep it brief but polite: “Thank you for your assistance in closing my account. I appreciate your prompt attention to this matter.”

Finish with a formal sign-off, such as “Sincerely” or “Best regards,” followed by your full name.

Essential Details to Include in Your Letter

Make your account closure request clear and direct by including the following key details:

- Your Full Name: Provide the exact name associated with the account. This ensures that the company can easily locate your information.

- Account Number or Username: Include the unique identifier for your account. If it’s an online account, the username or customer ID is often sufficient.

- Request for Account Closure: Explicitly state your intent to close the account. Use direct language like, “I request the closure of my account.” This removes any ambiguity.

- Reason for Closure: While not always required, briefly explain why you want to close the account. Whether it’s due to dissatisfaction, moving to another provider, or other reasons, it helps the company understand your decision.

- Any Outstanding Issues: If you have any unresolved issues (such as pending charges, refunds, or service cancellations), mention them. This will help avoid any surprises and ensure that your account is fully closed without complications.

- Contact Information: Provide an alternative email or phone number in case the company needs to follow up or confirm the closure.

- Clearance Request: Ask for confirmation that your account has been fully closed and that all personal information has been removed, if applicable.

These details help speed up the process and avoid any confusion, ensuring a smooth account closure experience.

If the company requests proof of identity, follow their guidelines carefully to ensure the process goes smoothly. Prepare the necessary documents before submitting your request to close the account.

1. Gather Valid Identification

You may need to provide government-issued identification, such as a passport, driver’s license, or national ID card. Ensure the document is current and not expired. It should clearly show your full name, date of birth, and photo for verification.

2. Submit Documentation as Directed

Check the company’s instructions on how to submit your identity documents. Some companies may ask for digital copies uploaded through a secure portal, while others may prefer physical copies sent by mail. Always use the secure option if available.

Tip: Avoid submitting photos or documents that are blurry or hard to read. Clear, legible copies will speed up the verification process.

3. Protect Your Privacy

Ensure your identification is only shared with trusted entities. Be cautious of unsolicited requests for personal information. If you have concerns about privacy, contact the company to confirm the request’s legitimacy before proceeding.

Handling Outstanding Balances or Fees Before Closing Your Account

Before closing your account, make sure to clear any outstanding balances or fees. Addressing these matters ensures a smooth closure and avoids additional charges. Contact the company’s customer service to request a statement detailing any pending payments. Resolve any discrepancies or disputes promptly to prevent complications later.

Steps to Settle Outstanding Balances

Follow these steps to handle any unpaid fees or balances effectively:

- Review your latest account statement to identify any fees, charges, or pending payments.

- Ensure all charges are accurate and inquire about any unclear items with customer support.

- Pay any outstanding balance in full to avoid interest or late fees.

- Request confirmation from the company that all balances have been settled.

- Keep a copy of the payment receipt for your records.

Types of Fees to Check

Before requesting account closure, check for the following potential charges:

| Fee Type | Description |

|---|---|

| Monthly Maintenance Fee | Regular fee charged for account maintenance, often applicable in checking or savings accounts. |

| Late Payment Fees | Charges for missed or delayed payments on credit cards, loans, or bills. |

| Overdraft Fees | Fees applied when an account balance falls below zero. |

| Early Termination Fee | Charges for closing certain accounts before a specified term or agreement ends. |

| Transfer Fees | Costs incurred when transferring funds between accounts or to another institution. |

Common Errors to Avoid When Requesting Account Closure

Start with a clear request. Many users make the mistake of being vague when asking for account closure. Specify the exact account you wish to close, and mention any associated services or subscriptions that should also be canceled.

1. Not Reviewing Terms and Conditions

Before submitting your request, review the company’s terms regarding account closure. Some businesses have specific requirements, such as clearing outstanding balances or completing additional steps. Failing to meet these requirements can delay or prevent the closure.

2. Forgetting to Backup Important Data

Ensure that all personal data, files, and information you need are backed up before closing the account. Some services may delete your data permanently once the account is closed, and recovery can be impossible afterward.

3. Ignoring Auto-Renewals or Subscription Payments

If you have an active subscription tied to the account, check if there are upcoming payments or automatic renewals. Make sure to cancel these before requesting account closure to avoid being charged after closure.

4. Overlooking Confirmation of Closure

Always ask for a confirmation email or receipt when your account is successfully closed. Without confirmation, you have no guarantee that the request was processed correctly, which can lead to misunderstandings later on.

How to Follow Up if Your Account Closure Is Not Processed

If your account closure request has not been processed within the expected time frame, follow these steps to ensure it is handled promptly:

First, check your email for any confirmation or additional instructions from the company. Sometimes, processing delays occur due to missing information or verification steps.

If there is no update, send a follow-up email or message through the support portal. Clearly state that you have previously requested to close your account and ask for a status update. Include relevant details such as your account number, date of request, and any reference number if available.

In case you do not receive a response within a reasonable period, escalate the matter. Reach out to a higher level of support or management, referencing your previous attempts to resolve the issue.

Lastly, if communication continues to be ineffective, consider contacting your payment provider or bank to inquire about any automatic payments linked to your account and request their assistance in stopping transactions.

Replaced some phrases to avoid repetition while maintaining the meaning

To create a more fluid and engaging account closure letter, focus on altering certain phrases to avoid redundancy. For example, instead of repeatedly using “close my account,” you could interchange with “deactivate my account” or “terminate my account.” This keeps the letter concise and ensures each section is distinct. Below is a simple structure you can use to craft your request:

| Action | Alternative Phrases |

|---|---|

| Request for Account Closure | “Terminate my account”, “Deactivate my account”, “End my subscription” |

| Reason for Closure | “I no longer require your services”, “I am switching to a different provider”, “I am no longer interested in this account” |

| Additional Information | “Please process my request immediately”, “Kindly confirm the closure”, “I would appreciate confirmation of the account status” |

This approach provides a clear, straightforward way to convey your request while keeping the tone polite and professional. It avoids repeating the same terms and makes the message more engaging to read.