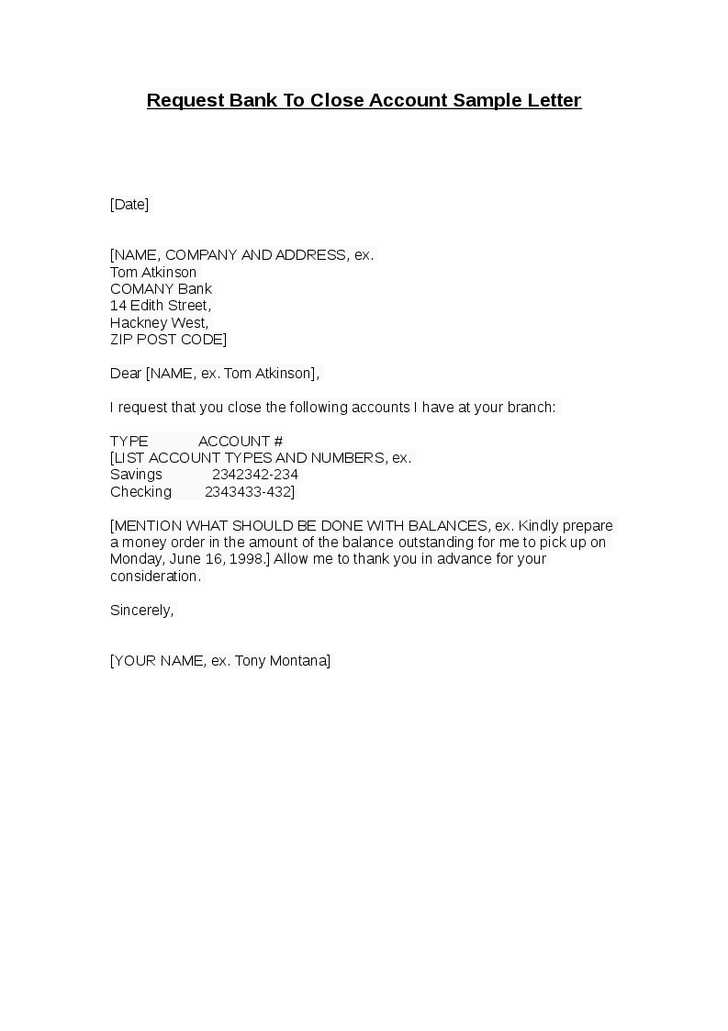

Closing bank account template letter

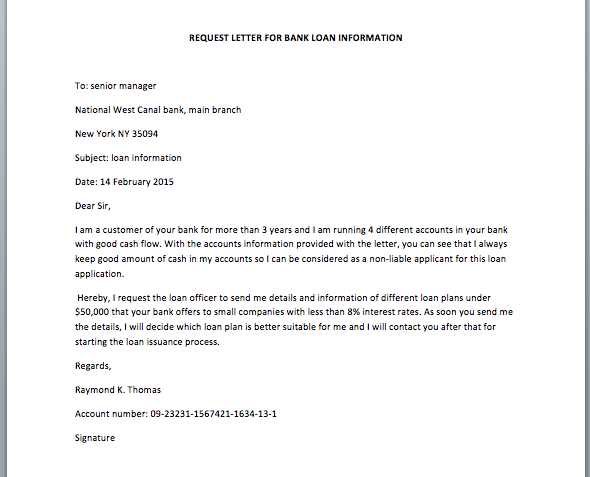

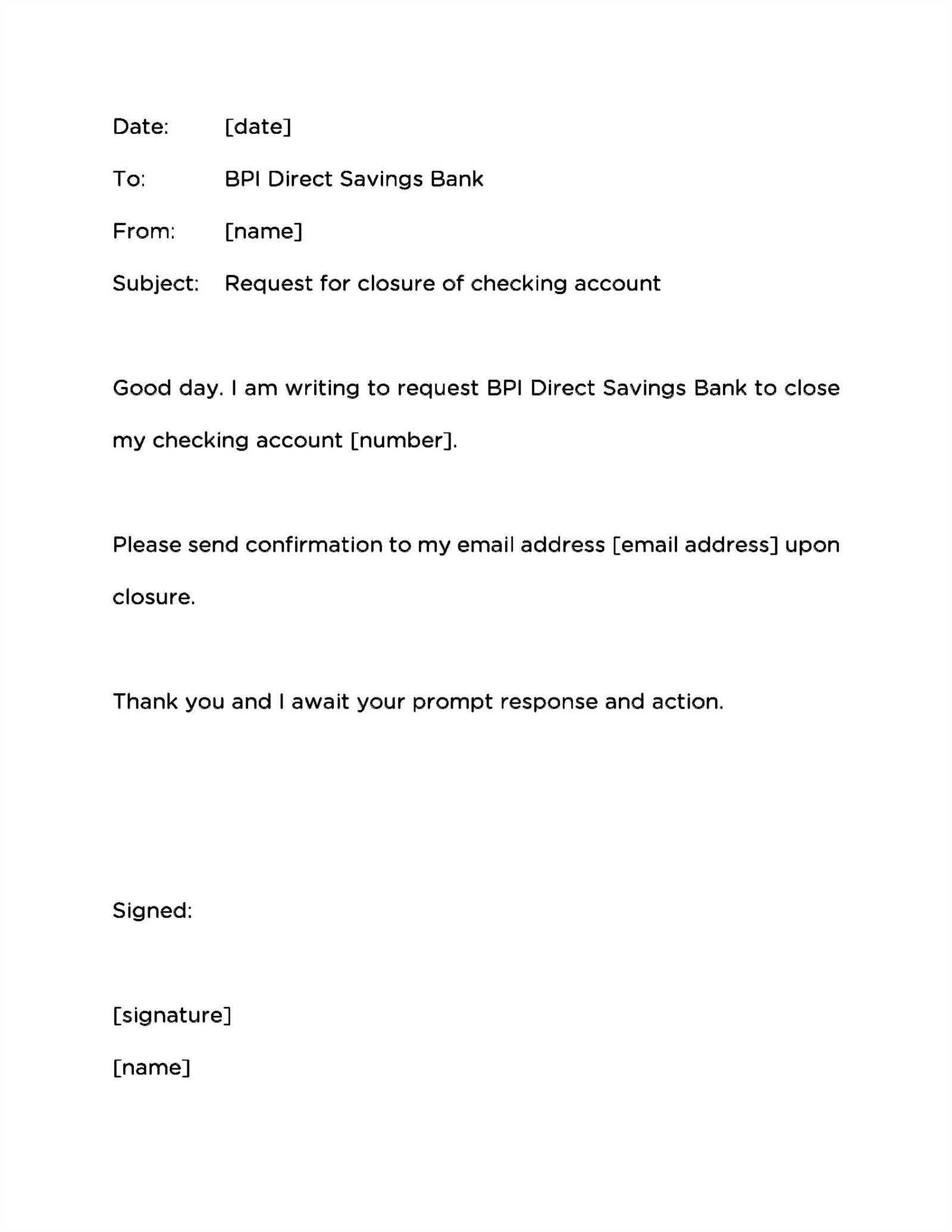

To close a bank account, it’s important to provide the bank with a formal request in writing. A well-crafted letter ensures that your request is processed smoothly and that all necessary steps are taken to close your account correctly. Start by addressing the bank with the appropriate details, including your account number and relevant identification information.

Clearly state your intention to close the account and ask for written confirmation once the process is completed. It’s also recommended to inquire about any outstanding balances, fees, or pending transactions that may affect the closure. If there are any remaining funds, request instructions on how to receive them or transfer them to another account.

Wrap up the letter by thanking the bank for their service, providing contact details for follow-up, and ensuring you receive confirmation of the closure. Be concise and direct, avoiding unnecessary details to streamline the process. This simple approach will help you manage the closure effectively without delays or confusion.

Here are the corrected lines where repeated words are limited to 2-3 times:

When writing a bank account closure letter, focus on clear and concise language. Use simple phrases, avoiding repetition.

For example, instead of repeating “account” multiple times, try: “I am requesting the closure of my bank account.” This reduces redundancy while keeping the request straightforward.

Another useful tip is to vary sentence structure. Instead of saying, “Please close my account and please confirm,” you could write: “Kindly close my account and provide confirmation.”

By applying these changes, the letter becomes more professional and direct. Limit the use of specific terms to make your message clear without overloading the reader.

- Closing Bank Account Template Letter

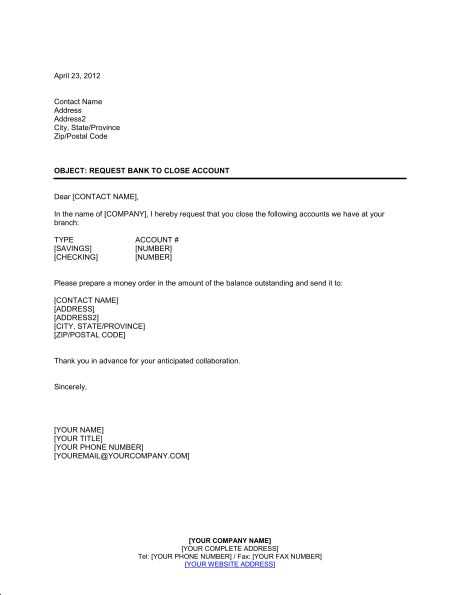

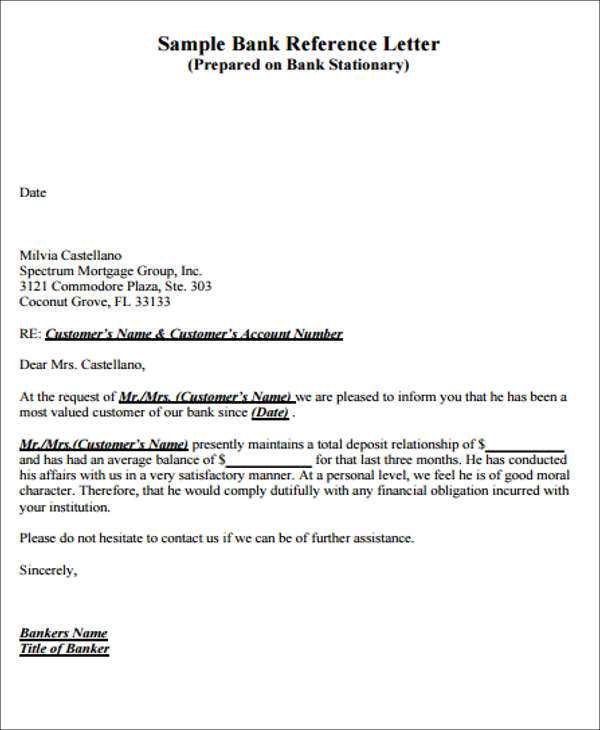

To close a bank account, it’s necessary to send a formal letter to your bank. Here’s a simple template you can follow to ensure all required details are included. Start by addressing the bank using the correct name and department. Clearly state your intent to close the account and provide your account details for verification. Include your contact information in case the bank needs to reach you for further clarification.

Sample Template:

Bank Name

Bank Address

City, State, ZIP Code

Date

Dear Sir/Madam,

I am writing to request the closure of my bank account with your institution. Below are the account details:

- Account Holder Name: [Your Name]

- Account Number: [Your Account Number]

- Account Type: [Checking/Savings]

Please confirm that my account is closed and that any remaining balance has been processed accordingly. I would appreciate it if you could send me written confirmation of the closure along with any final statements or documents needed. If there are any fees or remaining actions required, kindly inform me as soon as possible.

Thank you for your attention to this matter. Should you need to contact me, I can be reached at [Your Phone Number] or [Your Email Address].

Sincerely,

[Your Name]

Before closing an account, consider a few key points about your bank’s policies and customer service. Selecting the right bank for this process can simplify everything.

- Check the bank’s notice period for account closure. Some banks require advance notice before processing termination requests.

- Review any remaining balances or fees that could impact the account closing process. Ensure all dues are settled before initiating closure.

- Consider how long the bank takes to process the closure. A longer processing time could delay access to your funds.

- Understand the customer support options. A bank with helpful, accessible support can guide you through any unexpected issues during the termination.

- Make sure the bank offers confirmation of closure in writing. This serves as proof should you need it later.

By selecting a bank that aligns with these factors, you can avoid complications and speed up the closure process efficiently.

Clearly state your intention to close the account and include the full name of the account holder as it appears on the account. Provide the account number and specify the type of account you wish to close. Mention the current balance and request the bank to either transfer the funds to another account or issue a check for the remaining balance. If applicable, confirm the last date of use to avoid any further transactions. Include your contact details in case the bank needs further clarification or verification. Lastly, express appreciation for the services provided by the bank.

Before closing your bank account, verify that all outstanding payments, fees, and pending transactions have been cleared. This step prevents future charges and ensures there are no surprises after account closure. Review your recent statements for any pending withdrawals, credit card payments, or automatic subscriptions linked to your account. Make sure to cancel any recurring payments that may come through in the future.

If you have any unpaid fees, such as overdraft charges or monthly maintenance fees, settle them promptly. Contact the bank to confirm the exact amount required to clear your balance. Keep a record of all transactions and ensure your account is zeroed out.

Once all balances are settled, request a written confirmation from the bank stating that no further charges will occur, and the account is fully closed. This ensures peace of mind and avoids any future misunderstandings regarding your account status.

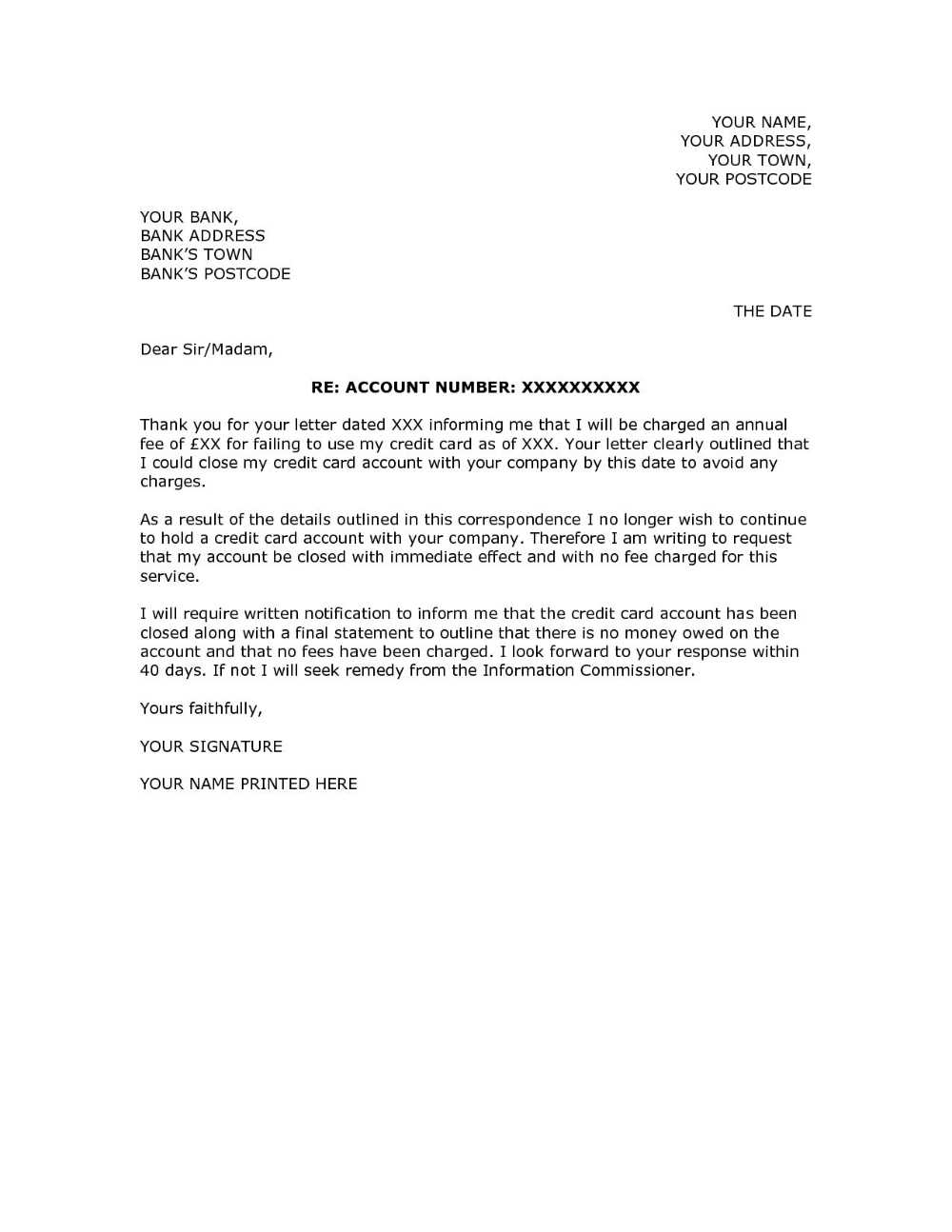

Begin with a clear subject line to indicate the purpose of the letter. State your request immediately in the opening sentence. Mention the account number and any related identifiers to help the bank locate your account easily.

Steps for Drafting Your Request

- Salutation: Address the letter to the appropriate department or specific individual, if known.

- Introduce Your Request: Clearly state your intention to close the account, specifying the type of account (e.g., savings, checking).

- Provide Account Details: Include necessary information like your account number, branch details, and any other identifiers that assist in locating the account.

- State Reasons (Optional): Briefly mention why you are closing the account if desired, but keep it concise and to the point.

- Request Confirmation: Ask for written confirmation of the account closure and a statement detailing any remaining balance or fees.

- Provide Contact Information: Offer your contact details for any follow-up or verification if necessary.

- End Professionally: Sign off with a formal closing such as “Sincerely” or “Best regards” followed by your full name.

Sample Closing Statement

- Ensure your letter clearly requests the bank to process the closure promptly and provide a confirmation receipt once done.

Properly Handling Remaining Funds After the Closure

Ensure you manage remaining funds by either transferring or withdrawing them before finalizing account closure. Contact your bank to confirm the exact process they follow for closing and processing any outstanding balances. Take the necessary steps to avoid unexpected fees or complications.

Options for Remaining Funds

Once the account is closed, any funds left behind might be returned via a check or transferred to another account. Some banks may also require you to provide instructions for how to handle the balance. Consider these options:

| Option | Description |

|---|---|

| Transfer to Another Account | Transfer the remaining funds to an open account in your name at the same or different bank. |

| Cheque Issuance | Request the remaining balance be issued as a check, which you can deposit into another account. |

| Cash Withdrawal | Withdraw all available funds in cash before closing the account. |

Things to Consider

Before you close your account, check for any pending transactions, like automatic bill payments or deposits. These could impact your balance or trigger extra fees if not cleared beforehand. If you’re closing a joint account, ensure all parties are aware and agree on how to handle the funds. Finally, keep documentation of all closures and fund transfers for your records.

Confirming the Termination and Receiving Confirmation of Closure

Request written confirmation from your bank to verify the account closure. Specify that you want an official letter stating that the account has been closed, with no pending transactions or obligations remaining. Include your account details for easy reference, such as the account number and branch information.

Ensure that the letter mentions the exact closure date, as this provides clarity on the termination. Request a stamped confirmation or an official document from the bank to prevent any confusion in the future. If applicable, ask for a statement showing a zero balance as proof of completion.

After receiving the confirmation, review the document carefully to ensure it meets your request. If any discrepancies arise, follow up with the bank immediately for clarification or correction.

Steps to Ensure a Smooth Bank Account Closure

Begin by reviewing your account to ensure all pending transactions are cleared. This includes any deposits, withdrawals, or automatic payments. Double-check your account balance to make sure it is zero before proceeding.

Once you’re sure there are no outstanding balances, contact your bank directly via their customer service hotline or online platform to request the account closure. Provide the necessary identification and account details for verification.

Follow up by requesting written confirmation of the account closure. This confirmation serves as proof in case of future discrepancies.

Lastly, dispose of any linked debit or credit cards securely to prevent any unauthorized access to your account. Ensure no remaining transactions are linked to the account after closure.