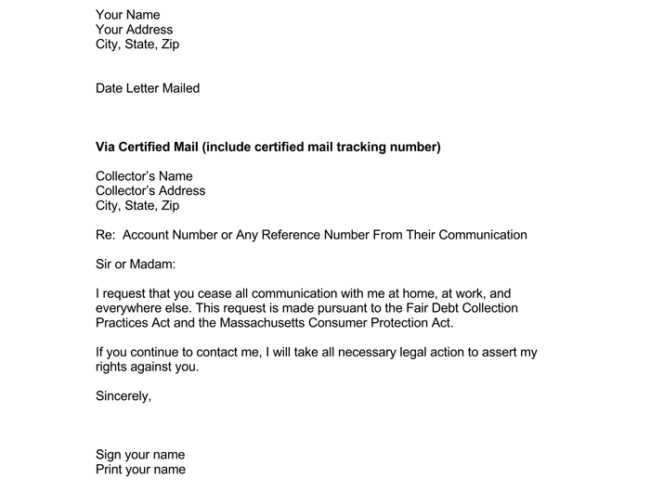

Collection agency cease and desist letter template

If a collection agency is contacting you over a debt you believe is invalid or you simply want to stop their communication, sending a cease and desist letter is an effective way to address the issue. A cease and desist letter serves as a formal request to halt all further contact, legally protecting your rights under the Fair Debt Collection Practices Act (FDCPA). Use this template to ensure your letter is clear, professional, and legally sound.

The key to a successful cease and desist letter is precision. Start by including your full name, address, and account number associated with the debt. Clearly state that you wish for the collection agency to cease all communication with you. Be firm but polite, ensuring your request is unequivocal. Avoid unnecessary details that could distract from the main purpose of the letter.

Ensure you send the letter via a trackable method, such as certified mail, to confirm the agency has received it. Keep a copy of the letter for your records. If they continue contacting you after receipt, you have a stronger case should you need to take further legal action. A well-written cease and desist letter not only protects your privacy but also puts a stop to unwanted harassment from debt collectors.

Here is the corrected text with minimal repetition:

If you want to stop a collection agency from contacting you, sending a cease and desist letter is an effective way to protect yourself. This letter informs the agency that they must halt all communication, and it can be sent via certified mail to ensure they receive it. Be specific about your request and keep the tone clear but firm. You don’t need to provide detailed reasons or explanations–just a direct statement that you want no further contact.

Your letter should include basic information such as your name, address, and any account numbers associated with the debt. Clearly state that you are requesting that they stop contacting you. You can also specify that any future contact should be directed to your attorney if applicable. Make sure you send the letter to the correct address for the collection agency’s legal department, which can often be found on their website or in previous correspondence.

Once the letter is sent, the agency is legally obligated to cease contact, with some exceptions, such as if they plan to take legal action. Keep a copy of the letter for your records and track the delivery to confirm that they received it. If the collection agency continues to reach out after receiving the cease and desist letter, you may have grounds to file a complaint with the Consumer Financial Protection Bureau or seek legal advice.

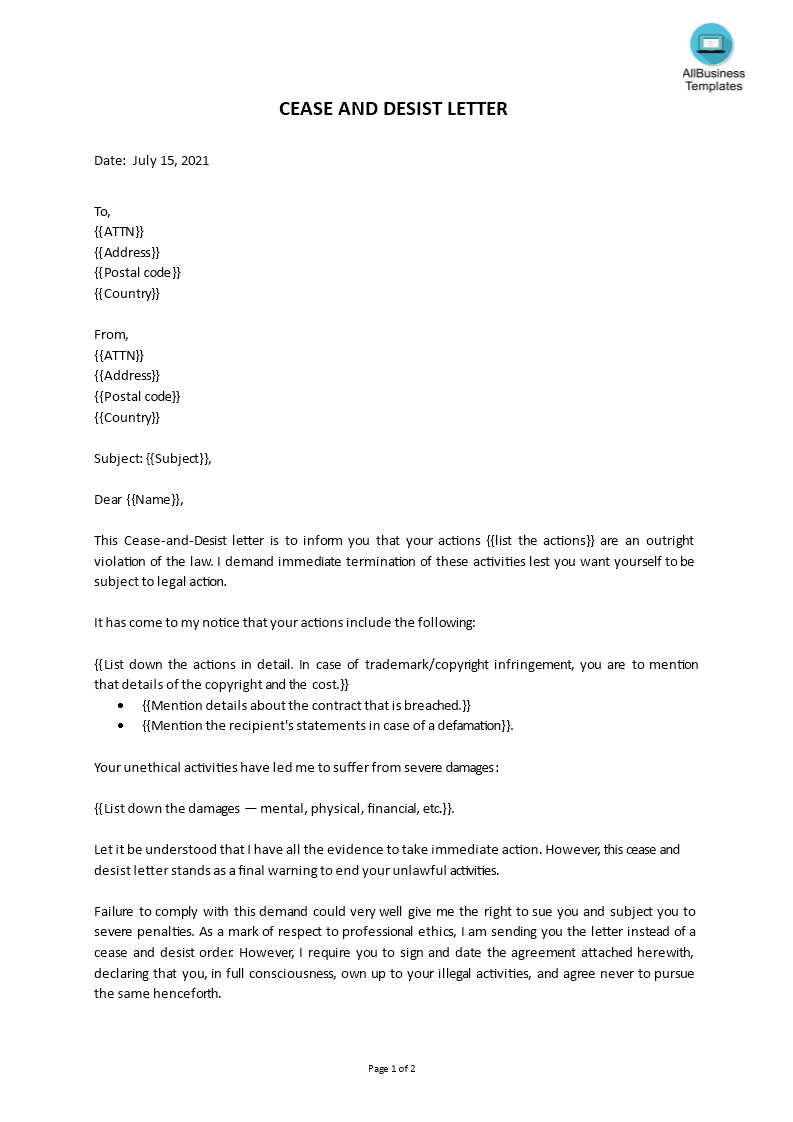

Collection Agency Cease and Desist Letter Template

How to Write a Cease and Desist Letter to a Collection Agency

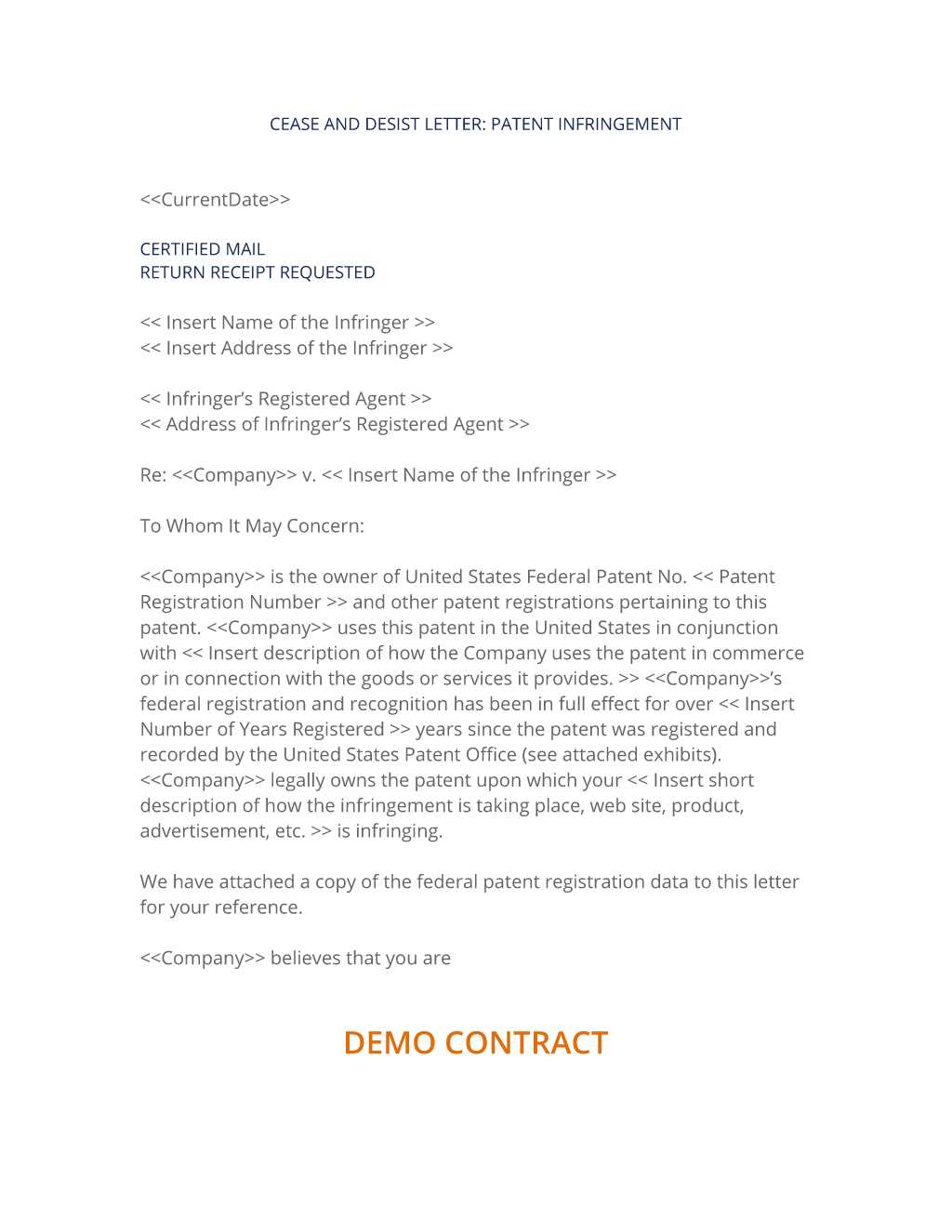

Key Legal Considerations When Sending a Cease and Desist Notice

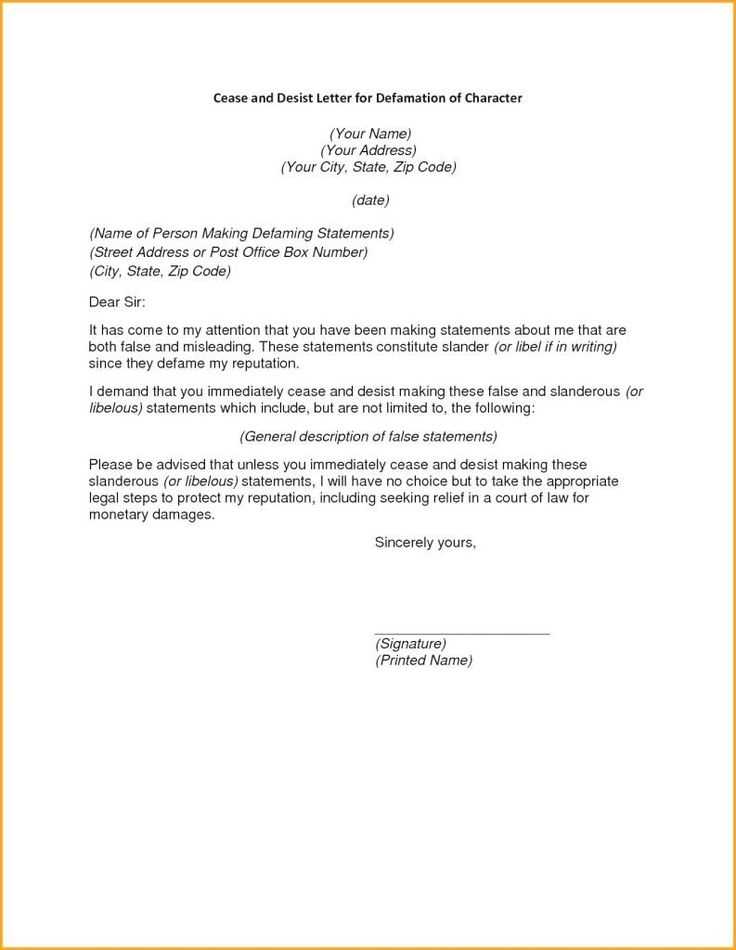

What to Include in a Cease and Desist Letter to Stop Debt Collection Calls

Understanding Your Rights Under the Fair Debt Collection Practices Act (FDCPA)

Common Mistakes to Avoid When Drafting a Cease and Desist Notice

What Happens After Sending a Cease and Desist Letter to a Collection Agency

When writing a cease and desist letter to a collection agency, you need to be direct and clear. State that you request the agency stop contacting you regarding the debt. Specify whether you want them to cease all communications or only certain types, such as phone calls. You can also include the Fair Debt Collection Practices Act (FDCPA) reference, which protects consumers from harassment and abusive practices by debt collectors. Ensure the letter is signed and sent via certified mail to get proof of delivery.

Key Legal Considerations When Sending a Cease and Desist Notice

Under the FDCPA, once a cease and desist letter is sent, the collector must stop contacting you, except to notify you about specific legal actions. This law limits harassment and requires collectors to cease all communication after your formal request. If the debt collector continues to contact you, it can be a violation of the law. It is important to keep records of all correspondence for future reference in case legal action is necessary.

What to Include in a Cease and Desist Letter to Stop Debt Collection Calls

Your cease and desist letter should include the following key details:

1. Your full name and contact information.

2. A statement requesting that the debt collector stop all communication.

3. Reference to the FDCPA, which prohibits harassment and excessive contact.

4. A request to communicate in writing only, if preferred.

5. Date and signature for validation.

Include a brief statement about the nature of the debt, such as the account number or loan reference, to help the agency identify your case quickly.

Sending this letter will help protect your rights and limit the debt collector’s ability to contact you. However, it does not eliminate the debt, and you are still legally responsible for paying it if it is valid.

What Happens After Sending a Cease and Desist Letter to a Collection Agency

Once the debt collector receives your letter, they must stop calling or sending letters about the debt. If the collector ignores your request and continues to contact you, they may face legal consequences. Keep track of any further communication to support your case if you decide to take legal action. If the collection agency decides to pursue the debt in court, they can still do so, but they must follow the appropriate legal procedures and stop all attempts at harassment.

Changes made to avoid unnecessary repetition of words, while maintaining the original meaning and structure.

Adjusting your cease and desist letter can help improve clarity and reduce redundancy. Focus on expressing your request directly without restating the same point multiple times. A well-written letter should address the issue once and make clear what actions are expected. If a term or phrase appears repeatedly, find alternatives that still convey the message effectively.

Use Clear and Direct Language

For example, instead of saying “stop contacting me immediately and cease all communication,” you can simply say “cease all communication immediately.” The same message is delivered, but without unnecessary repetition. This also strengthens the tone and focus of the letter.

Avoid Unnecessary Phrasing

Remove filler words or vague phrases that don’t add value to the letter. Phrases like “as previously stated” or “it has come to our attention” can be omitted if the meaning remains intact. A concise, straightforward approach is often more effective in these situations.