Collection Agency Debt Validation Letter Template

When faced with a situation involving disputed financial obligations, it’s essential to understand your rights and the proper procedures to follow. Many individuals may encounter situations where they need to address inaccuracies or verify the legitimacy of claims. A clear and structured response can often lead to a favorable resolution.

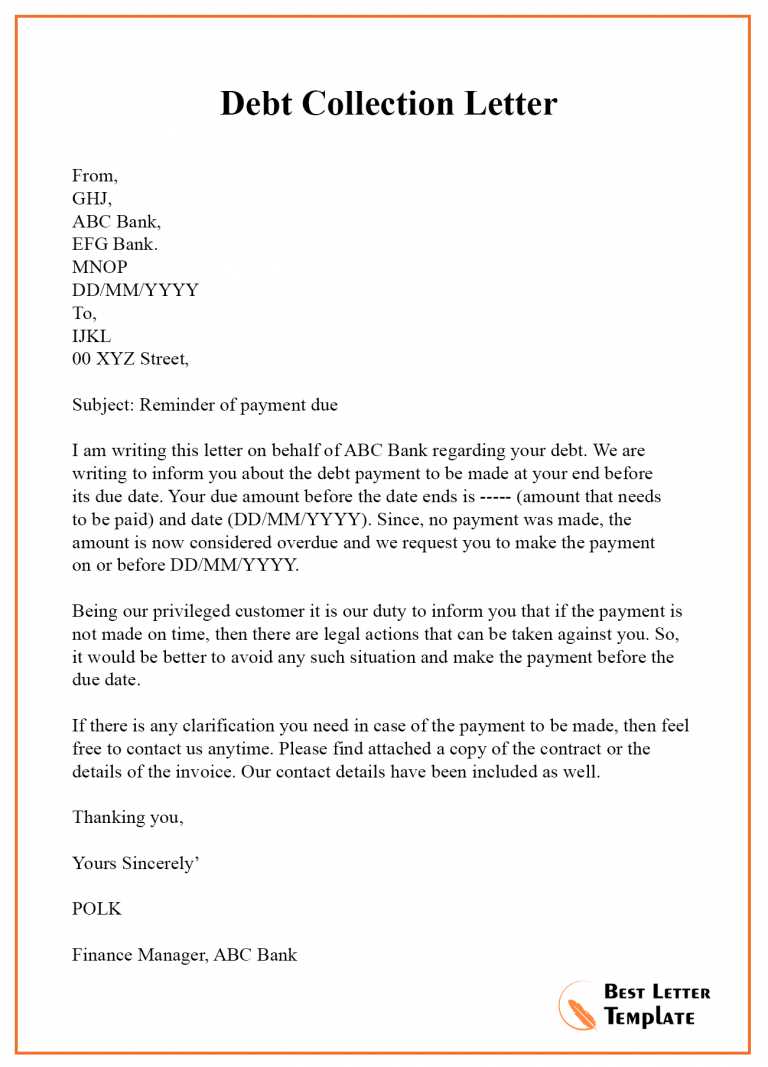

One of the most effective ways to initiate this process is by drafting a formal communication. This document serves as a method to request detailed information about the charges, ensuring that everything is in order and properly documented. It’s a proactive step to protect yourself from potential errors or fraudulent claims.

Understanding the correct approach to crafting such a message is crucial. The right format and wording can significantly impact the effectiveness of your request. It’s important to highlight the specific elements that must be included to ensure the message is taken seriously and processed correctly.

Knowing when and how to send this communication can also influence the outcome. Acting promptly and professionally helps establish credibility and shows that you are well-informed about your legal rights in these matters.

Why Debt Validation is Crucial

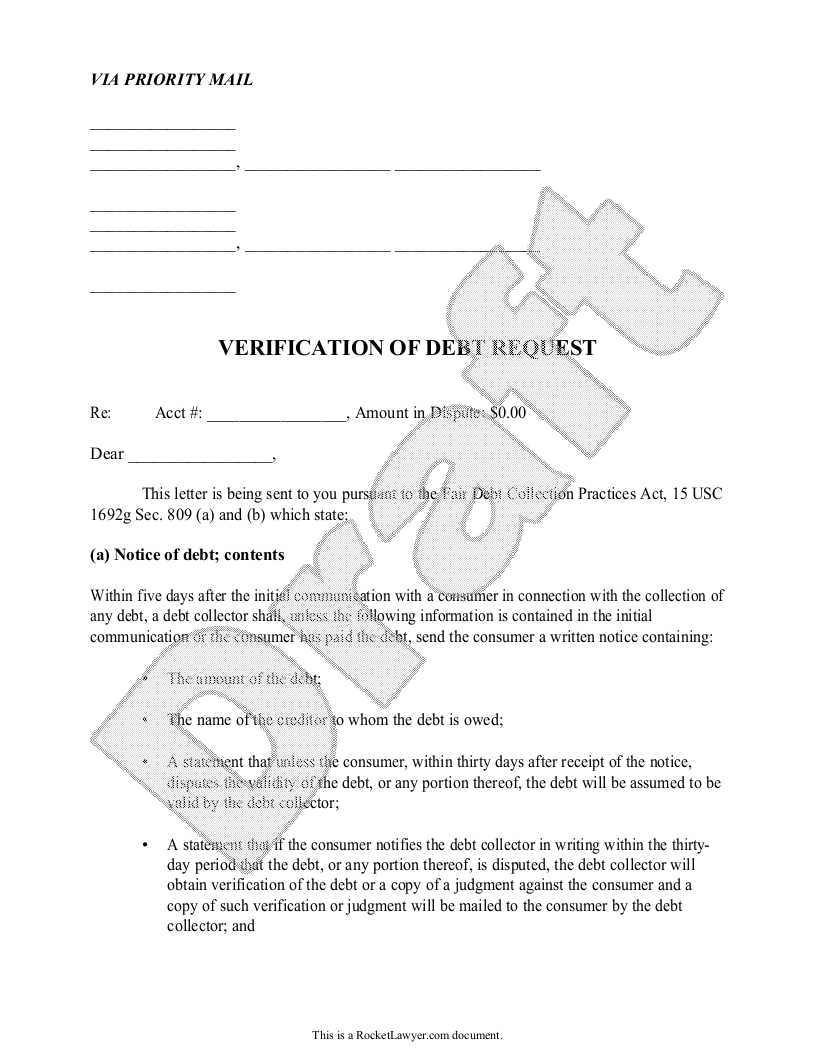

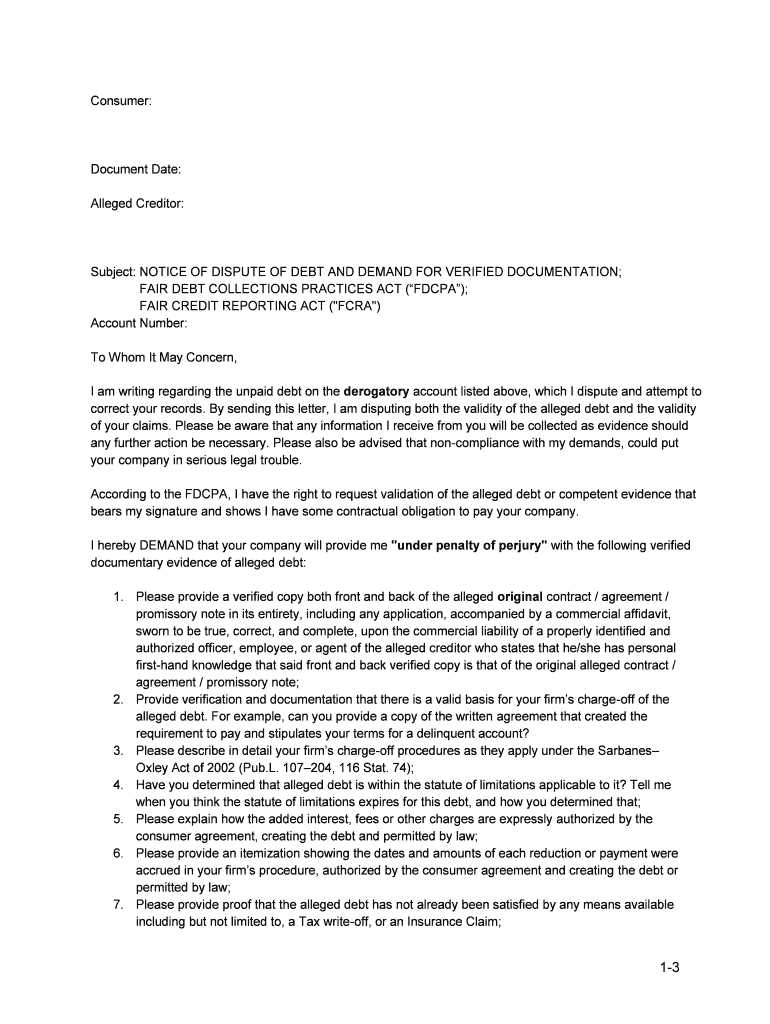

When engaging with a financial dispute, it is important to ensure that the information being presented is accurate and legitimate. Often, individuals are unaware of discrepancies or errors in records, which can lead to unnecessary stress or confusion. By formally requesting clarification, you are asserting your right to verify the accuracy of any claims made against you.

Protecting Your Rights

Taking action to verify financial obligations helps prevent the possibility of being held responsible for incorrect or inflated amounts. This is especially critical when dealing with unverified charges that may not even belong to you. Having a proper procedure in place allows you to challenge any unwarranted or unsubstantiated demands efficiently and professionally.

Ensuring Proper Documentation

Properly requesting detailed documentation ensures that all claims are properly substantiated with valid records. Without this step, it’s difficult to hold any party accountable for providing transparent and truthful information. Establishing a clear record of communication further strengthens your position should legal action or further discussions become necessary.

Key Components of a Valid Letter

When crafting a formal request to verify financial obligations, it is essential to include certain elements that make the communication clear and effective. These key components ensure that the recipient understands the purpose of the message and can provide the necessary details to resolve the issue.

| Component | Description |

|---|---|

| Identification Information | Include your full name, address, and any other identifiers to ensure the recipient can locate your account details accurately. |

| Specific Request | Clearly state what information you are requesting and why it is necessary, such as details about the amount or the origin of the claim. |

| Legal Rights Reference | Reference any applicable laws or regulations that give you the right to request such information, which helps emphasize the legitimacy of your request. |

| Deadline for Response | Set a reasonable time frame for the recipient to provide the requested information, ensuring they are aware of the urgency. |

| Contact Information | Provide your contact details for follow-up or clarification, ensuring the recipient knows how to reach you. |

Including these components in your formal communication makes it more likely that the request will be taken seriously and processed efficiently, helping you resolve any misunderstandings or disputes quickly.

Legal Considerations in Debt Disputes

When engaging in financial disagreements, understanding the legal framework that governs such situations is essential for protecting your rights. The law provides specific protections and steps you can take to ensure that you are not held accountable for incorrect or unfounded claims. It’s crucial to be aware of your obligations and the correct procedures to follow when disputing financial demands.

Important Legal Protections

- Fair Practices: Laws are in place to prevent deceptive or aggressive tactics in resolving financial disputes. These include restrictions on how claims can be presented and enforced.

- Right to Dispute: You have the right to dispute any claim that you believe is incorrect. The law requires the other party to substantiate the claim before further actions can be taken.

- Time Limits: Legal time frames dictate how long you have to challenge or request documentation regarding any financial obligations.

Steps to Take for Legal Protection

- Review any agreements and correspondence carefully to identify any discrepancies or areas of concern.

- Submit a formal request for information, citing relevant legal rights to ensure your request is handled properly.

- Keep detailed records of all communications and responses in case further legal action is needed.

Understanding these legal aspects ensures that you are equipped to handle any disputes in a way that adheres to your rights and the necessary regulations.

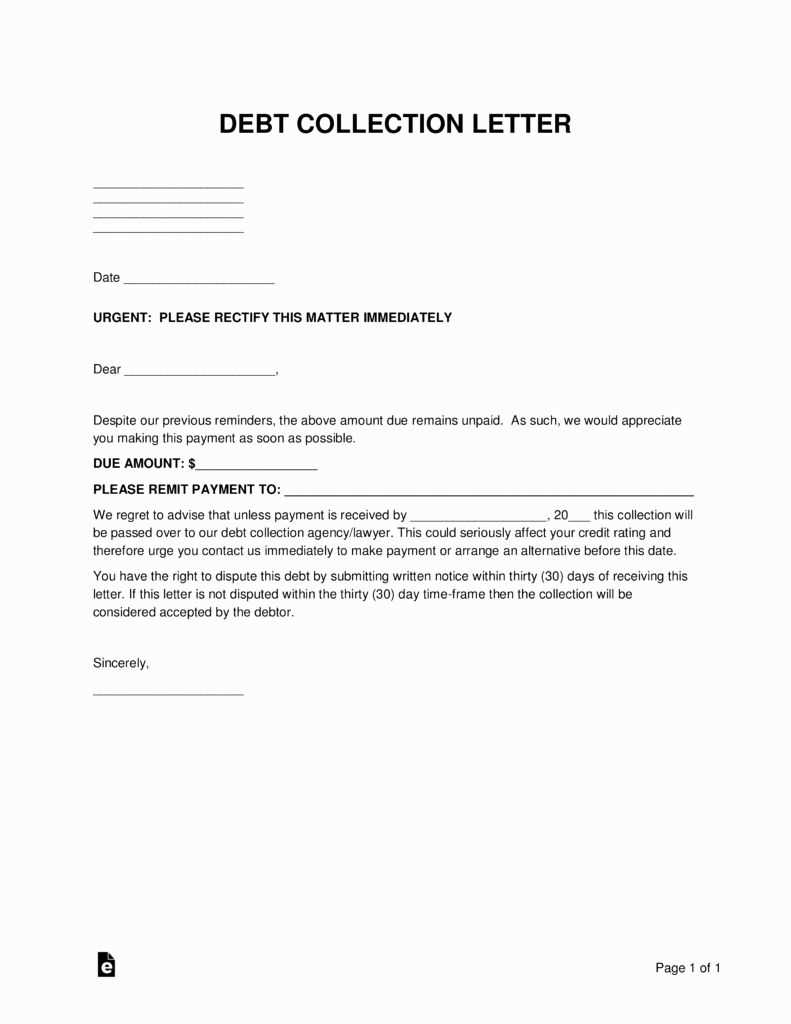

Common Pitfalls in Validation Requests

When requesting verification of financial claims, many individuals make errors that can delay or weaken their position. It is essential to approach such requests carefully to ensure that they are effective and comply with all legal requirements. By understanding the common mistakes, you can avoid unnecessary complications and increase the likelihood of a successful outcome.

Failure to Provide Clear Information

One of the most common mistakes is not clearly identifying the account or claim in question. Without specific details, the recipient may not be able to locate the necessary records, leading to delays or inadequate responses. Always ensure that you provide full identifying information such as account numbers, dates, and any relevant reference numbers.

Ignoring Legal Requirements

Another issue arises when individuals do not reference their legal rights or fail to follow the required procedures for making a formal request. Legal protections exist for individuals challenging financial claims, and these rights should be clearly stated in any communication. Failing to do so may result in the claim being dismissed or ignored.

Avoiding these pitfalls is essential for ensuring that your request is processed properly and that you can effectively address any financial disputes.

Creating a Customized Letter Template

When seeking confirmation of financial obligations, crafting a personalized communication is key to ensuring that the request is clear and effective. A well-designed message not only conveys your intentions but also ensures that all necessary information is included, making it more likely to receive the desired response. Personalization is essential to make the request legally sound and tailored to your specific situation.

Essential Elements to Include

To make your message comprehensive, it is important to incorporate certain key details that will allow the recipient to understand your request fully:

- Identification Information: Clearly state your full name, account details, and any relevant reference numbers that will help the recipient locate your information.

- Specific Inquiry: Be explicit about what you are requesting. For instance, ask for a full breakdown of the claim or the origin of the obligation.

- Legal Rights: Mention any legal protections that you are invoking to ensure the validity of your request, referencing applicable regulations or laws where necessary.

Personalizing for Effectiveness

Customizing the communication is not just about filling in the blanks with specific details. It’s about ensuring that the tone and language suit the situation. For example, if you are disputing an amount, make sure to politely request clarification or proof without sounding confrontational. A clear, professional tone increases the likelihood of receiving a prompt and adequate response.

By customizing your communication in this manner, you make it both effective and aligned with your specific needs, ensuring that the recipient fully understands your request and can provide the necessary information.

Actions to Take After Submitting the Letter

Once you have sent your formal request for verification or clarification of a financial obligation, it’s important to take proactive steps while awaiting a response. The process doesn’t end with submission; staying organized and informed ensures that you are ready to take the necessary actions if further steps are needed. Here are the key actions you should consider after sending your communication.

Monitor the Response

Keep an eye on the correspondence from the recipient. In many cases, you will receive a response within a specific timeframe, usually 30 days, depending on your jurisdiction and the nature of the request. Make sure to:

- Track all communication carefully and record any responses you receive.

- Note the dates on which you receive responses to ensure that deadlines are being met.

- Review any documents or proof provided to ensure they address your inquiry accurately.

Follow Up if Necessary

If you do not receive a response within the expected timeframe or if the response is incomplete, it’s important to follow up. You can:

- Send a polite reminder to the recipient requesting an update or additional information.

- Consult with a legal advisor if you suspect non-compliance or if the issue escalates.

- Keep a copy of all follow-up correspondence for your records.

By taking these actions, you ensure that the process remains on track and that your interests are protected throughout the verification process.