Effective Collection Letter Template for Debt Recovery

When clients or customers delay payments, it’s essential to approach the situation with clear and professional communication. A well-crafted document can help remind individuals of their outstanding balances while maintaining a respectful tone. Crafting such a message involves balancing firmness and professionalism to encourage prompt payment without damaging the business relationship.

Essential Elements of a Payment Request

Every payment request needs to cover several key points to ensure the recipient understands the issue clearly. These points include the amount owed, the due date, and a reminder of any previously agreed-upon terms. The tone should be firm but polite to avoid escalating the situation unnecessarily.

Important Information to Include

- Amount Due: Clearly state the total balance owed, including any late fees or interest charges.

- Due Date: Specify when the payment was originally due or when it should be paid.

- Payment Instructions: Provide clear and easy-to-follow instructions on how to settle the debt.

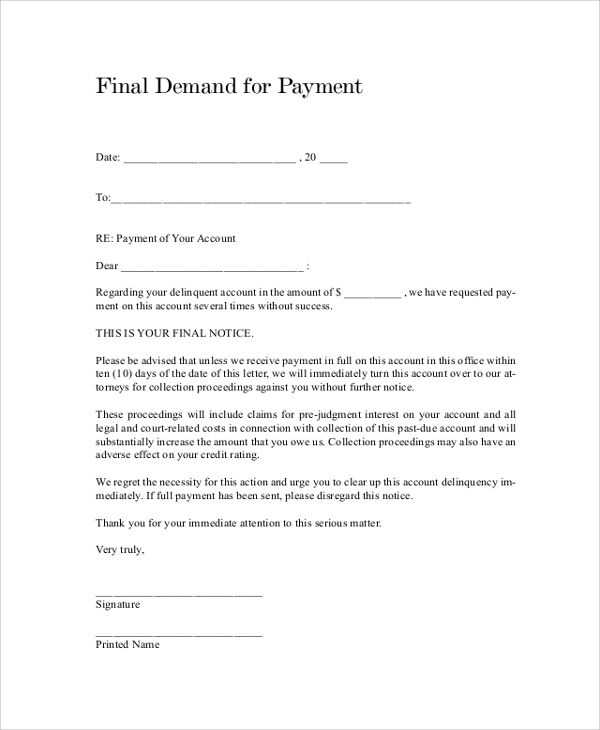

- Consequences of Non-Payment: Outline any potential actions that will be taken if the debt remains unpaid, such as legal measures or referral to a collection agency.

Maintaining Professionalism in Communication

While it’s important to be direct, it’s equally crucial to maintain a respectful tone throughout the message. Striking the right balance between firmness and courtesy can encourage timely payment without causing unnecessary tension.

Tips for a Respectful Approach

- Use polite language and avoid aggressive terms.

- Stay professional and stick to the facts.

- Express willingness to discuss payment plans or arrangements if needed.

Following Up

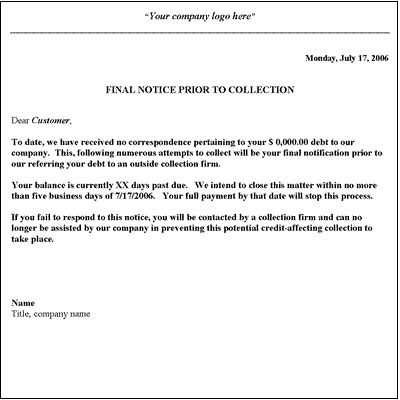

If the payment request goes unanswered, follow-up messages are important. These should be timely, clear, and emphasize the urgency of resolving the matter, without sounding confrontational. A well-structured follow-up can significantly increase the chances of receiving payment.

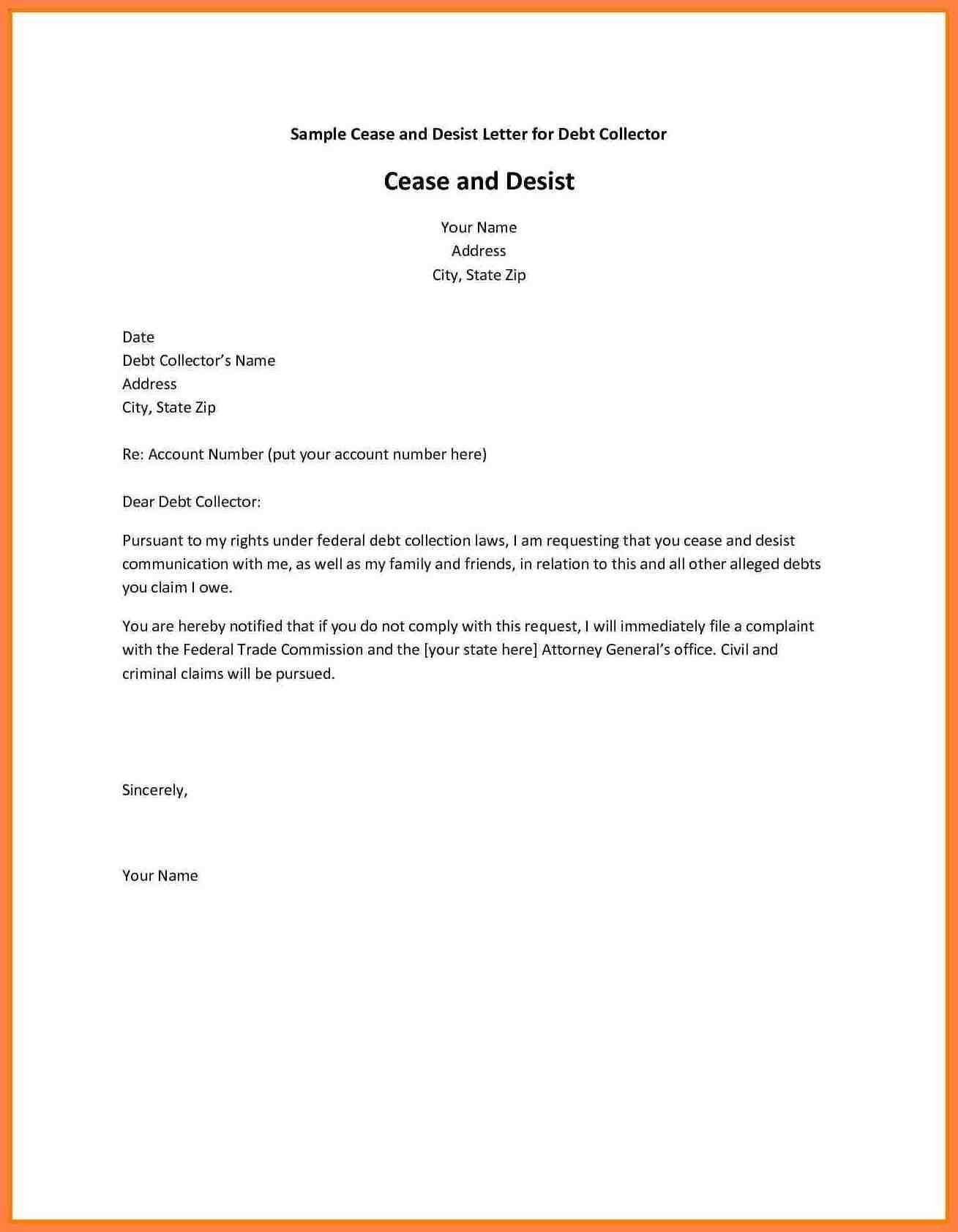

Legal Considerations

When dealing with overdue payments, businesses should be aware of legal restrictions. Some regions may have specific laws regarding how payment requests can be made and the steps that can be taken when payments are not received. It’s essential to stay informed about these regulations to avoid potential issues.

Creating a Clear Debt Recovery Document

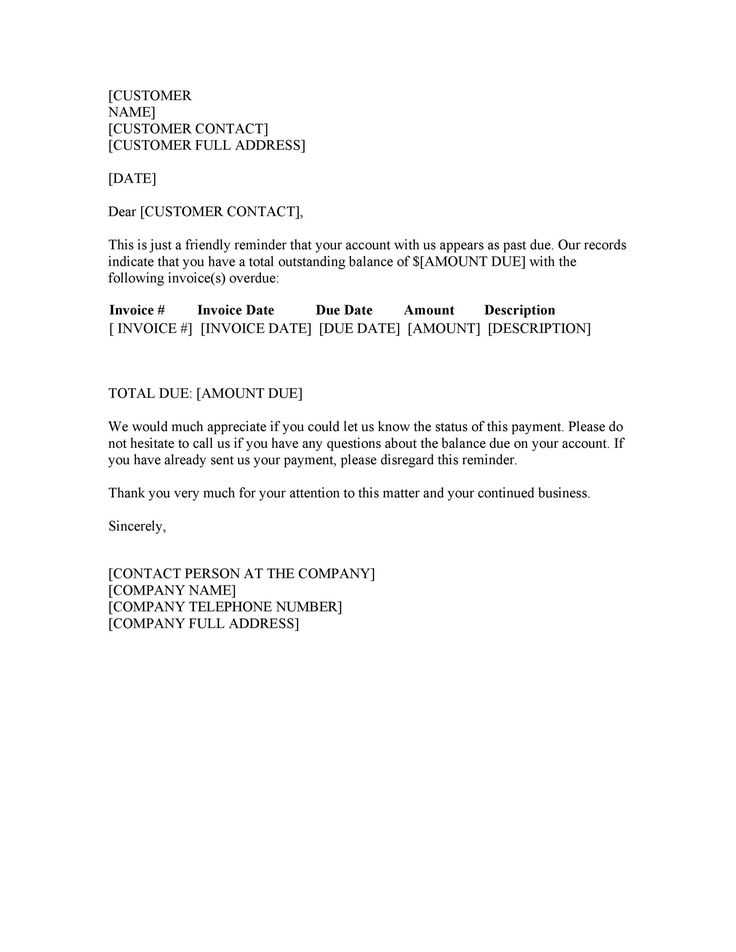

When a client fails to make a payment on time, it is crucial to send a communication that is both direct and respectful. A well-organized document can help resolve the issue while maintaining a positive relationship with the customer. This type of communication should outline the amount owed, the due date, and the next steps if the payment is not received.

Key Components of an Effective Payment Request

An efficient communication should include all the necessary details to avoid confusion. First, it should clearly state the total amount due, including any late fees or interest. Second, it should mention the original due date or the new payment deadline. Lastly, clear instructions on how to complete the payment should be provided.

How to Address Non-Paying Clients

When dealing with customers who have not paid, it’s important to remain professional yet firm. The communication should acknowledge their situation but still convey the seriousness of the outstanding payment. Avoid using accusatory language and instead focus on resolving the matter amicably.

Establishing Payment Terms in Communication

Setting clear expectations for payment is essential. Whether you are requesting the full amount or offering installment options, the payment terms should be easy to understand. Be explicit about when and how the payment should be made, as well as any consequences of further delays.

Legal Aspects of Debt Recovery Communication

Businesses should be aware of the legal framework surrounding debt collection. There are specific regulations governing how payment reminders can be sent, and what actions can be taken when payments are overdue. It’s important to adhere to these laws to avoid any legal complications.

Tips for Maintaining a Professional Tone

Maintaining professionalism is key to encouraging payment without damaging the business relationship. The tone should remain polite, even when addressing the non-payment. It’s important to convey urgency, but also show a willingness to work with the client to resolve the issue.

Following Up on Unanswered Requests

If the initial request goes unanswered, it’s necessary to send a follow-up communication. This should reiterate the importance of settling the debt while providing an opportunity for the customer to explain any difficulties. A gentle reminder can often prompt action and prevent the situation from escalating.