Commitment to Pay Letter Template for Clear Financial Agreements

When it comes to managing financial obligations, it is crucial to establish clear and formal agreements between parties. These documents help ensure that all involved understand their responsibilities and the terms of repayment. Whether for personal debts or business transactions, having a well-structured document can prevent misunderstandings and protect both sides.

By outlining the repayment schedule, amounts, and deadlines, such documents offer a sense of security to both the debtor and the creditor. It provides a written record that can be referred to if any issues arise, making the process transparent and accountable. These agreements are not only beneficial but also legally significant in many cases.

Using a pre-designed structure for drafting such documents can simplify the process. It ensures that all necessary components are included, reducing the risk of overlooking important details. The goal is to create a straightforward, effective agreement that fosters trust and clarity between the parties involved.

Commitment to Pay Letter Basics

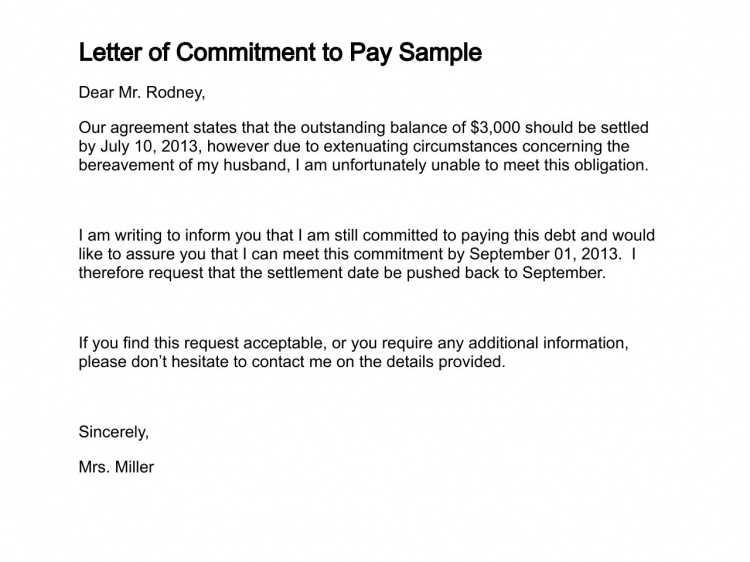

When entering into an agreement to settle a financial obligation, it is essential to outline the terms in a clear and formal document. This type of arrangement serves as a written confirmation of the borrower’s intention to fulfill their debt under specific conditions. The document provides both parties with a reference point, ensuring that the terms are understood and legally recognized.

The primary function of such a document is to define the details of the repayment plan. It specifies the total amount owed, the repayment schedule, and the consequences in case of missed payments. This structured format helps avoid ambiguity and ensures that both sides are in alignment regarding expectations.

Moreover, this type of agreement often holds legal weight, meaning it can be used as evidence in court should any disputes arise. It acts as a safeguard, protecting both the lender and the borrower by clearly establishing the terms under which the financial transaction is expected to proceed.

Why a Payment Agreement is Important

Establishing a clear understanding between a borrower and lender is crucial when it comes to financial transactions. Without a formal document outlining expectations and responsibilities, misunderstandings and disputes are more likely to occur. A well-structured agreement provides both parties with a clear framework, ensuring transparency and mutual trust.

One of the key reasons for having such an agreement is the protection it offers both sides. It defines the terms under which the money will be exchanged and sets boundaries for what is expected in terms of timing and amounts. This clarity helps prevent future conflicts and can serve as a legal reference if the need arises.

Below is an example of some important elements typically covered in these agreements:

| Element | Description |

|---|---|

| Amount Due | The total sum that needs to be paid. |

| Repayment Schedule | The agreed timeline for making payments. |

| Consequences | What happens if payments are missed or delayed. |

| Signatures | Validation by both parties, ensuring their consent. |

Having a formalized arrangement brings peace of mind to all involved, knowing that the conditions are set in writing and can be referred to at any time if necessary. This agreement serves not only as a financial arrangement but as a safety net for both parties.

Key Elements of a Payment Commitment

When creating a formal agreement regarding a financial obligation, several key components must be included to ensure clarity and avoid potential misunderstandings. These elements define the terms of the arrangement and outline what both parties can expect. A well-drafted document covers these essential points to make sure all aspects of the agreement are understood and agreed upon.

Here are the critical elements that should be present in any such agreement:

- Total Amount Owed: Clearly specify the total sum to be repaid, leaving no room for confusion.

- Repayment Schedule: Outline the timeline for payments, including the frequency and due dates.

- Payment Method: Define how the funds will be transferred (e.g., bank transfer, check, cash).

- Interest or Fees: Include any interest charges or additional fees, if applicable.

- Consequences of Default: Describe the actions that will be taken if payments are missed or delayed.

- Signatures: Both parties must sign the document to confirm their agreement to the terms.

These elements serve to protect both the lender and the borrower, providing a clear framework for the financial arrangement. By including all of these key points, the document becomes a legally binding reference, reducing the chances of future disputes and ensuring smooth communication between both parties.

How to Write a Clear Payment Promise

When drafting an agreement to settle a financial obligation, it’s important to ensure the language is simple, direct, and leaves no room for confusion. A well-written document helps establish mutual understanding, ensuring both parties are aware of their responsibilities. Clear terms also reduce the likelihood of disputes and create a transparent framework for repayment.

Follow these steps to ensure clarity when drafting such an agreement:

- State the Total Amount: Clearly mention the full amount that is owed, without ambiguity.

- Define the Payment Plan: Outline the repayment schedule, including due dates and amounts for each installment.

- Specify the Payment Method: Indicate how the payments will be made, whether through bank transfer, cheque, or other means.

- Include Consequences for Non-Payment: Make sure to mention the repercussions in case of missed or delayed payments.

- Use Simple and Direct Language: Avoid technical terms or overly complex language. The agreement should be easy for both parties to understand.

- Confirm Agreement with Signatures: Ensure both parties sign the document to formally agree to the terms.

By following these guidelines, you create a document that is straightforward and legally sound, helping both parties navigate the financial arrangement with confidence. A clear and well-structured agreement can prevent future issues and ensure that everyone involved is on the same page.

Legal Implications of Payment Letters

When drafting a formal document to confirm financial obligations, it is essential to understand the potential legal consequences. Such agreements, when properly structured, carry legal weight and can be used in a court of law if disputes arise. This document serves as a binding contract that holds both parties accountable for their actions, and failure to adhere to its terms may result in legal ramifications.

For the document to have legal implications, it must clearly outline the key aspects of the arrangement, including the amount owed, repayment schedule, and consequences for default. Additionally, both parties should voluntarily sign the document, ensuring they acknowledge and accept the terms. Without proper signatures, the agreement may not be enforceable in court.

Here are some potential legal implications to consider:

- Enforceability in Court: A signed agreement can be presented in court if one party fails to comply with the terms, making it a legally binding reference.

- Collection of Debt: If the borrower defaults, the creditor may use the agreement to pursue collection actions, including legal proceedings.

- Interest and Penalties: The agreement may include clauses regarding the imposition of interest or late fees, which could be legally enforced if the borrower misses payments.

- Dispute Resolution: Many agreements include provisions for resolving conflicts, such as mediation or arbitration, which may be legally binding depending on the jurisdiction.

Understanding these legal aspects is crucial for both the borrower and the lender. A well-crafted agreement not only facilitates a clear financial arrangement but also ensures that both parties are protected under the law.

Common Mistakes to Avoid in Letters

When creating a formal document to outline financial responsibilities, it’s easy to overlook key details that could lead to misunderstandings or complications. Mistakes in the wording, structure, or missing information can weaken the effectiveness of the agreement and may even render it unenforceable. Being mindful of common errors can help ensure the document serves its purpose effectively and is legally sound.

Ambiguous Terms and Lack of Clarity

One of the most common mistakes is using unclear or ambiguous language. Vague terms can lead to confusion regarding the expectations of both parties. It’s important to be specific about the amount, repayment schedule, and payment methods. Any uncertainty in the wording can cause misunderstandings down the line, which may be difficult to resolve without legal intervention.

Failure to Include Necessary Information

Another frequent error is neglecting to include all relevant details in the agreement. For example, forgetting to mention the consequences of failing to meet payment deadlines or omitting a clear payment schedule can undermine the purpose of the document. Both parties should be fully aware of their responsibilities, including what actions will be taken in case of non-compliance. Without this information, the document might not be enforceable or could lead to unnecessary disputes.

By avoiding these common mistakes, you can create a stronger, clearer document that effectively addresses both parties’ expectations and provides a foundation for resolving any potential conflicts.

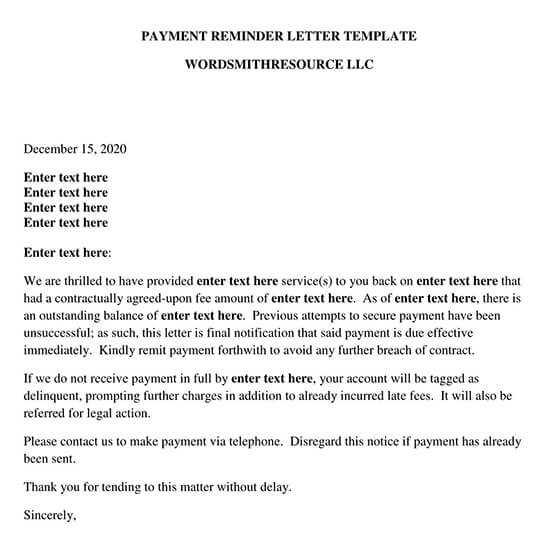

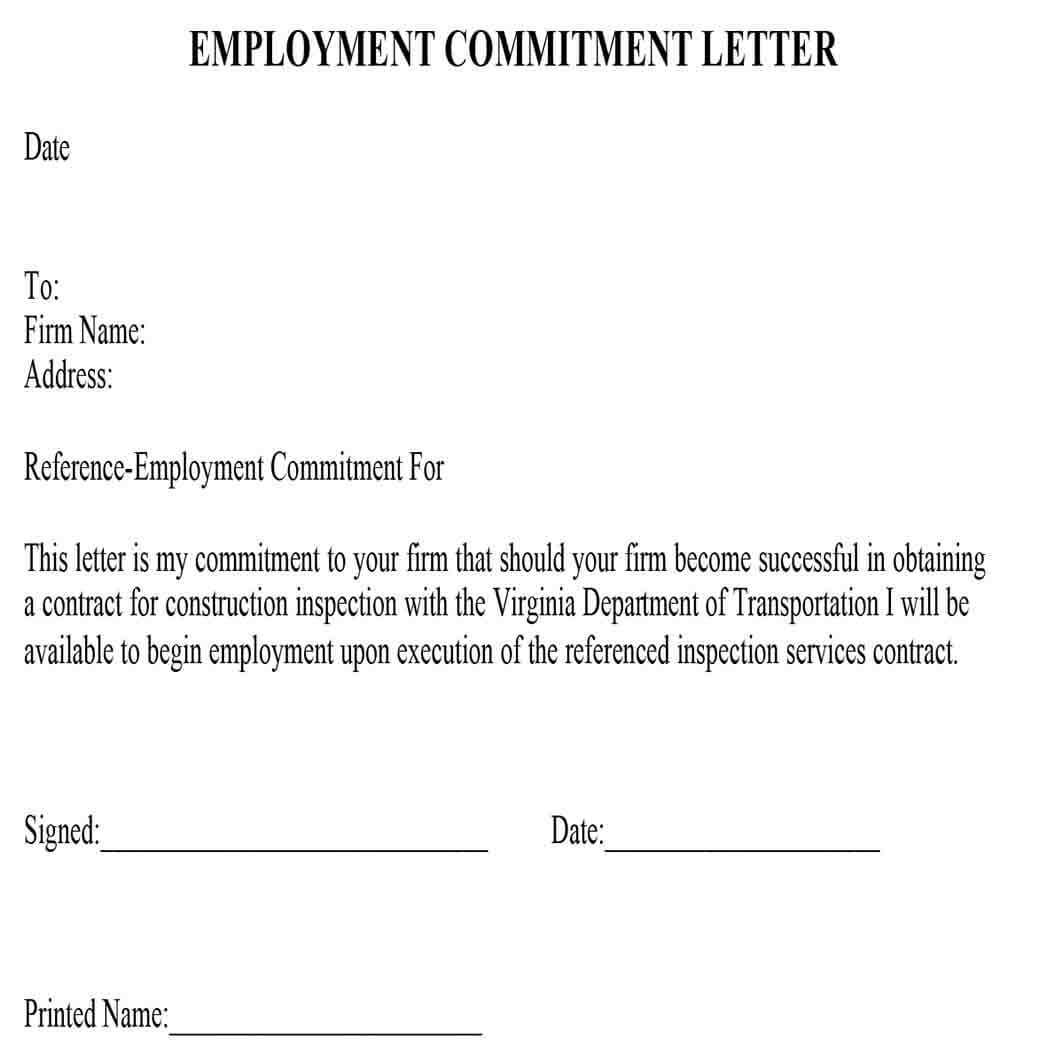

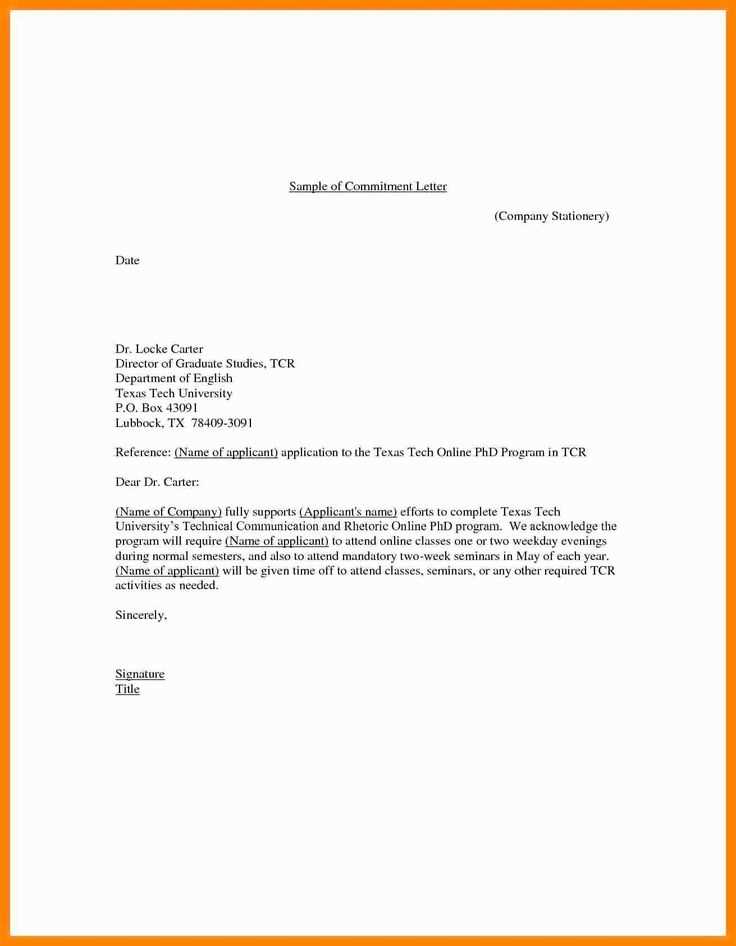

Using Templates for Faster Drafting

Creating formal documents can often be time-consuming, especially when you need to ensure every detail is included and properly worded. By utilizing predefined formats, you can streamline the drafting process, ensuring consistency while saving valuable time. Templates offer a structured framework that simplifies the process, helping you focus on filling in the relevant details instead of starting from scratch.

These ready-made formats are particularly useful when the same type of document needs to be created multiple times, such as agreements related to financial obligations. By using a well-organized structure, you can quickly adapt the document to different situations without having to worry about the format or essential components.

Advantages of Using Predefined Formats:

- Time efficiency: Save time by using a structure that is already formatted to include essential components.

- Consistency: Ensure that the same key details are covered in each document, reducing the risk of missing important elements.

- Accuracy: Minimize errors by using an established structure that includes all the necessary legal and financial terms.

- Professional appearance: Templates help ensure that the document maintains a formal and polished presentation.

Using these predefined formats can help ensure your documents are accurate, professional, and prepared quickly, allowing you to focus more on the content itself rather than the formatting. This approach can greatly improve efficiency, particularly when dealing with routine agreements.