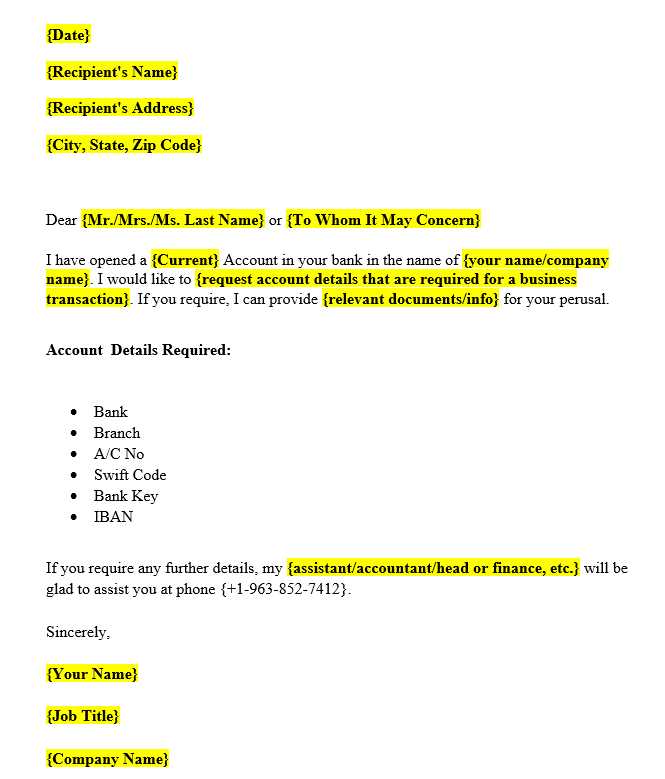

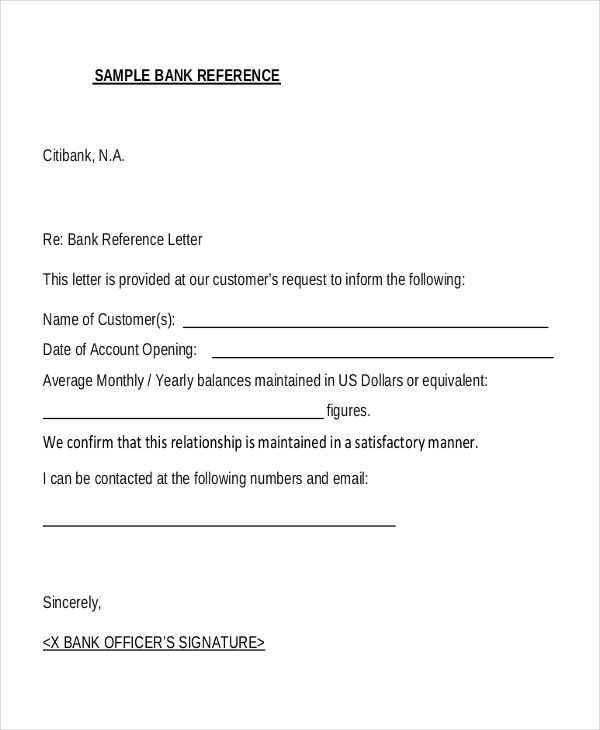

Company Bank Details Letter Template for Business Transactions

Providing important payment information for business transactions is an essential part of maintaining smooth financial operations. This documentation ensures clarity and prevents misunderstandings between parties involved. Whether you are receiving payments or making them, it is crucial to present this information in a structured and professional manner.

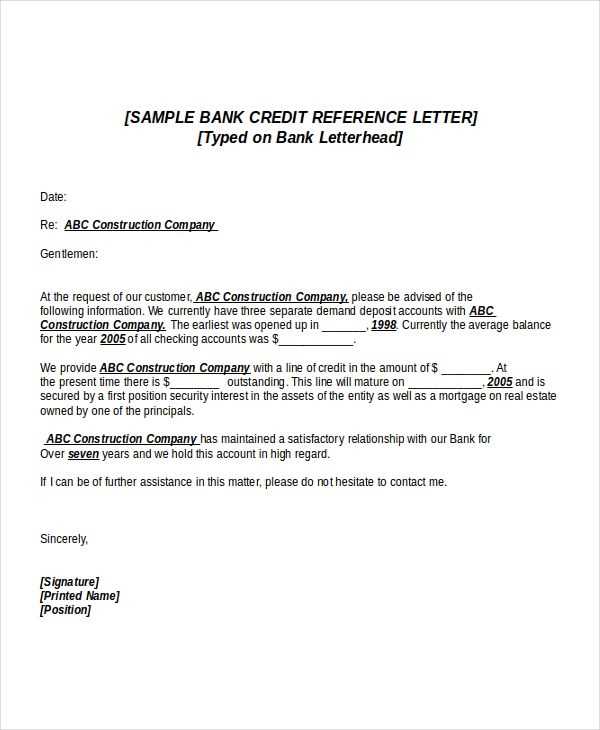

Key Components of a Financial Information Document

When sharing sensitive financial information, the document should include clear identifiers to avoid any confusion. The essential elements include account numbers, the recipient’s name, and relevant contact information. These details should be presented in a straightforward format to ensure accuracy and transparency.

Clear and Precise Contact Information

Including accurate contact details is vital for easy communication in case there are any issues with transactions. Make sure to list the proper names, email addresses, and phone numbers for direct correspondence.

Account Information for Payment Transfers

The most important part of this document is the account numbers and routing information. These allow seamless transfers between accounts and minimize errors when making or receiving payments.

Best Practices for Creating Financial Documentation

To create a reliable document, always ensure that the language is formal, concise, and free of ambiguities. Double-check all information for accuracy and avoid using overly technical terms that might confuse the recipient. Providing clear instructions on how to proceed with a transfer can also be helpful.

Double-Check the Accuracy of the Information

Before sending the document, verify that all the financial details, including account numbers and personal data, are correct. Mistakes in this area can lead to delays or misdirected payments.

Professional Tone and Structure

Maintaining a formal and polite tone throughout the document helps establish trust and professionalism. Organize the content logically so that it’s easy for the recipient to follow the necessary steps.

Avoiding Common Mistakes

- Not including enough contact details.

- Forgetting to double-check account numbers or routing information.

- Using ambiguous language or unclear instructions.

- Overloading the document with unnecessary details or information.

By following these guidelines, you can ensure that your financial communications remain clear, professional, and error-free, providing the recipient with all necessary information to complete the transaction smoothly.

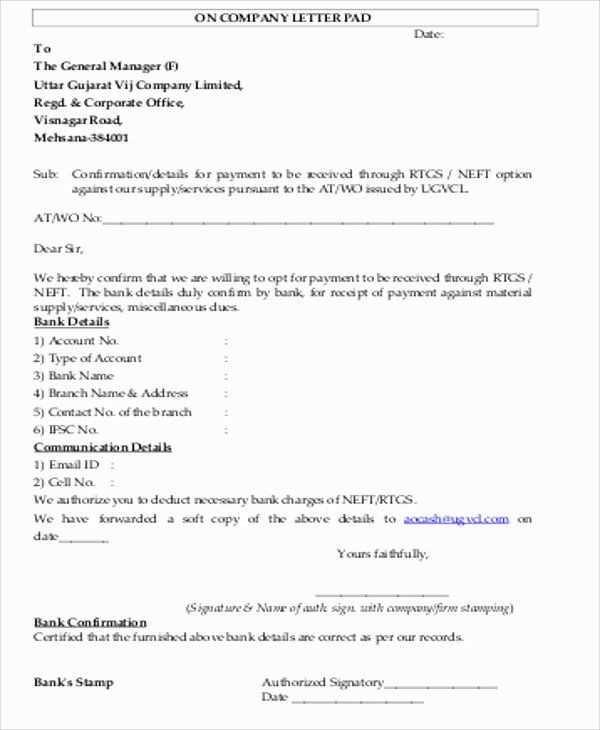

Understanding Financial Information Documentation

Providing clear and accurate financial data for transactions is crucial in maintaining smooth operations between parties. Such documents are commonly used for various types of payments, transfers, and record-keeping. Ensuring this information is organized properly prevents misunderstandings and ensures that payments are processed without issues.

Importance of Providing Accurate Financial Information

Accuracy is paramount when sharing financial information. Any mistakes can result in failed transactions, delays, or even financial losses. By offering precise details, you ensure that all transfers and exchanges occur seamlessly, building trust and maintaining professionalism in every business interaction.

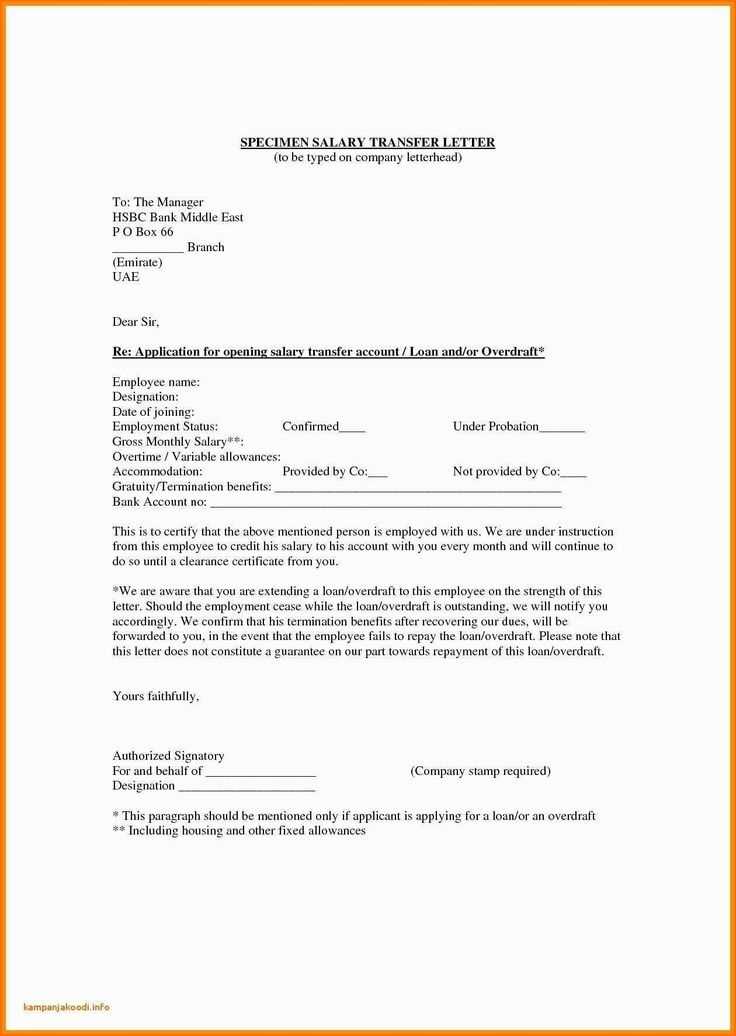

How to Format Your Financial Information Document

When drafting your financial record, it’s important to use a clear and concise structure. Begin with identifying information such as the payee’s name and account details. Follow this with specific instructions on how to complete the payment process. A well-organized document will minimize confusion and streamline the transaction.

Key Elements to Include:

- Recipient’s name and address

- Account numbers and routing details

- Clear instructions for completing the transaction

- Relevant contact information for follow-up questions

Best Practices for Drafting Financial Documentation:

- Ensure clarity and avoid using jargon that could confuse the reader.

- Keep the tone professional and direct.

- Review all details for accuracy before sending.

Common Errors to Avoid

Even small mistakes in financial records can lead to serious complications. Some of the most common errors include:

- Missing or incorrect account numbers

- Vague instructions or insufficient details

- Using informal or unclear language

By adhering to these best practices and avoiding common errors, you can ensure that your financial documentation serves its purpose effectively and efficiently, fostering smooth transactions and clear communication between parties.