CPA Letter for Mortgage Template for Quick Approval

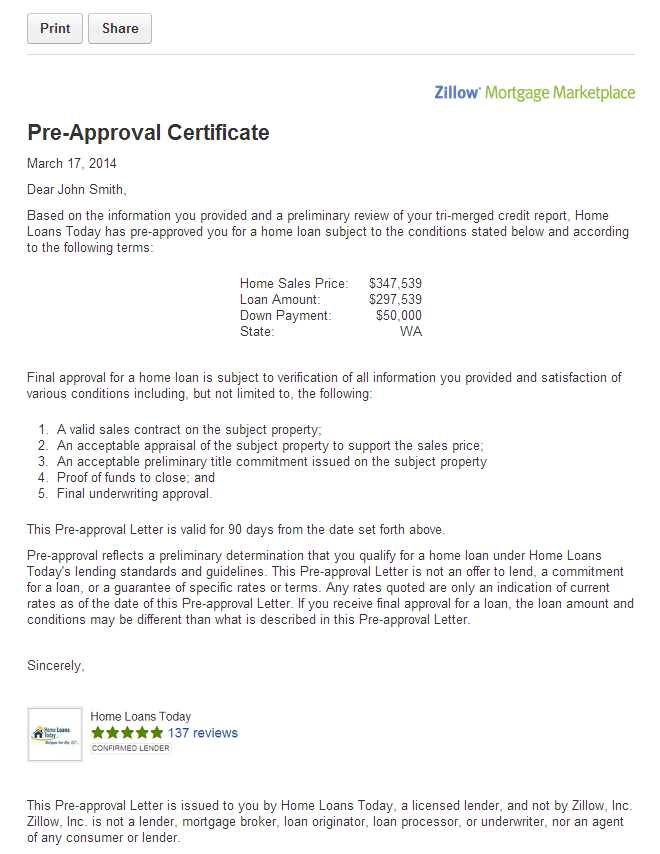

When seeking a loan, it’s often necessary to provide supporting documents that verify your financial standing. One crucial document can serve as a professional endorsement of your income and financial health. This written statement is typically prepared by an accountant or financial expert and helps lenders assess your ability to repay a loan. Having the right format can streamline the process, making it easier for both you and the lending institution.

Why This Document is Crucial

This written confirmation plays a vital role in validating your financial situation. Lenders rely on this professional assessment to determine if you meet the necessary criteria for securing a loan. It ensures that they have a clear understanding of your earnings, taxes, and overall fiscal responsibility, which aids in making an informed decision about your application.

Key Points to Include

- Income Verification: Detailed information on your income, including salary, bonuses, and other relevant earnings.

- Tax Filing Details: A summary of your tax status, including any recent filings or discrepancies.

- Debt and Assets: A breakdown of outstanding debts and assets to demonstrate your financial stability.

How to Prepare the Document

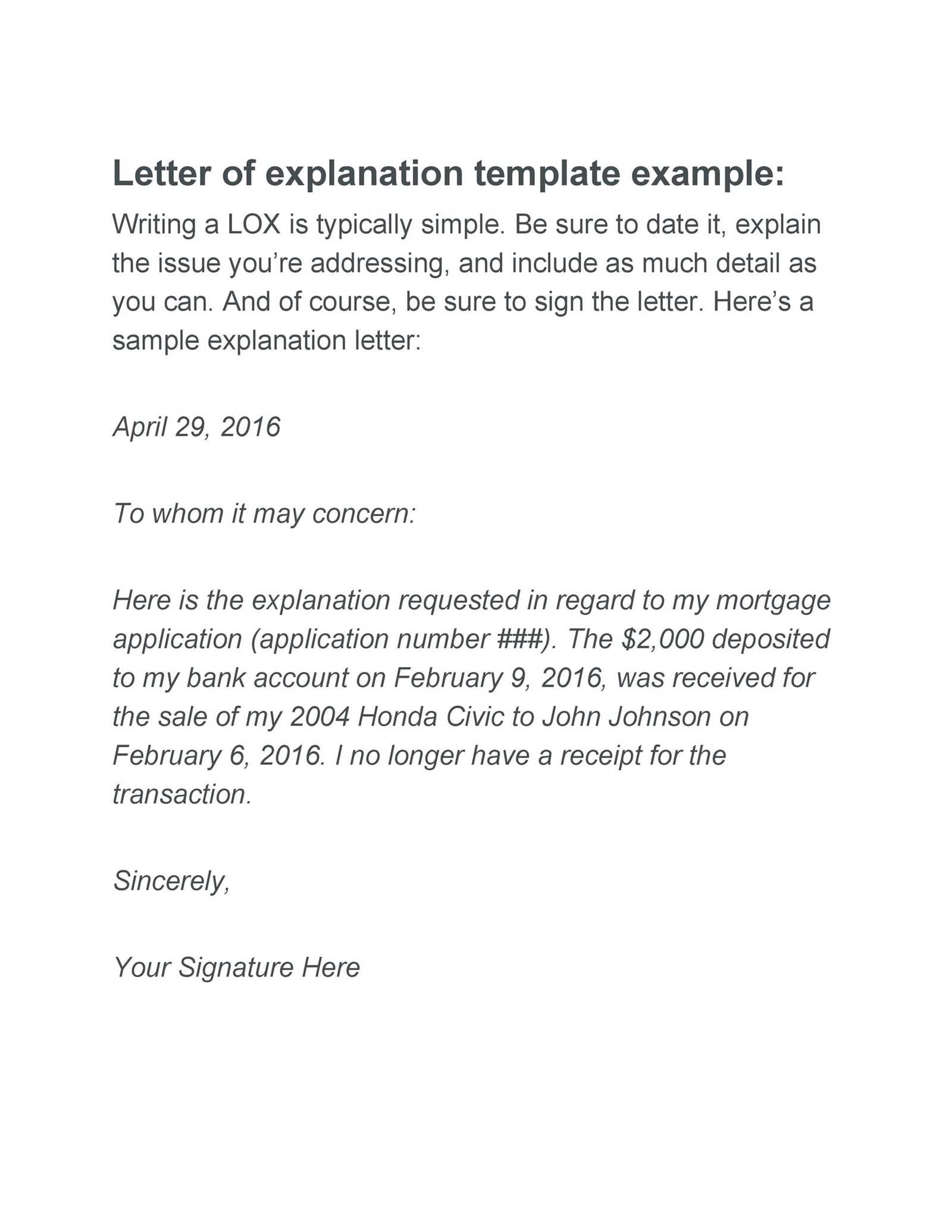

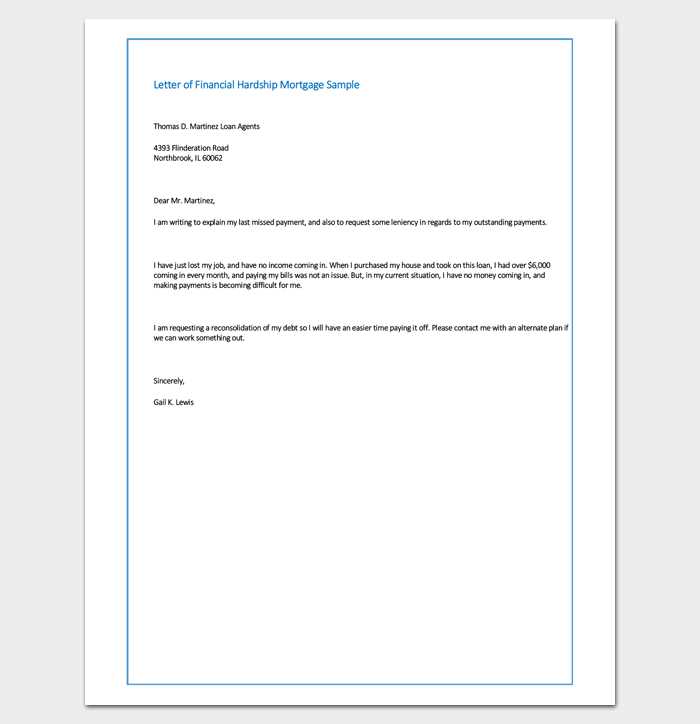

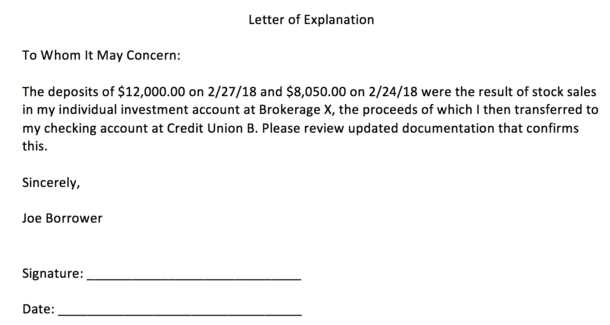

Creating this document requires precise information and attention to detail. It should begin with a formal introduction that identifies the purpose of the statement and the professional preparing it. Then, it should clearly outline all the relevant financial data, ensuring accuracy and clarity. The document must also be signed by the accountant or financial professional to give it validity.

Advantages of Using a Structured Format

By using a pre-designed format, you can ensure consistency and professionalism. A structured approach makes it easier for the lender to review and understand the information presented. Additionally, it reduces the chances of missing critical details or making errors that could delay your application process.

Common Errors to Avoid

- Inconsistent Information: Double-check all financial details to ensure they align with your records.

- Missing Signatures: Make sure the document is signed by the relevant professional.

- Vague Explanations: Provide clear, concise descriptions for all financial terms used.

Following these guidelines will increase your chances of obtaining loan approval quickly and without unnecessary complications.

What is a Financial Endorsement Document and Its Importance

When applying for a loan, providing evidence of your financial stability is essential. One way to demonstrate this is through a formal statement from a certified professional who can vouch for your earnings and overall financial health. This document plays a crucial role in assuring lenders that you have the financial capacity to repay the borrowed amount. It includes detailed information that helps lenders assess the risk and approve or deny your request accordingly.

Why This Document is Crucial

This written confirmation ensures that the lender has accurate and verified information about your financial situation. Without it, your loan application may be delayed or rejected due to lack of trust or missing details. A professional’s validation provides confidence that the figures you present are legitimate and that you are in a position to handle the loan repayment.

How to Craft the Financial Statement

To create this document, you need to ensure that it is clear, concise, and contains all relevant financial data. Start by including your income details, tax filings, and any outstanding debts. The statement should also reflect your financial responsibilities and any assets you may have. Accuracy is paramount, and the document must be signed by the preparing professional to authenticate its contents.

By structuring the document correctly and including all essential details, you make it easier for the lender to process your application smoothly. The template helps in keeping all necessary components in place, ensuring that nothing important is overlooked.

Common Mistakes to Avoid

- Omitting relevant financial details that can affect your approval.

- Providing inconsistent or inaccurate information that may raise doubts.

- Neglecting to sign or authenticate the document properly.

Using a well-organized format will ensure that the document meets the expectations of lenders and increases the likelihood of your loan approval.