Debt Agreement Letter Template for Easy Repayment Terms

Establishing clear terms between parties involved in a financial transaction is essential for preventing misunderstandings. This document serves as a legally binding record that defines the repayment terms, interest rates, and other necessary details. Such formal arrangements provide protection for both individuals or entities involved in the deal, ensuring that each party understands their obligations and rights.

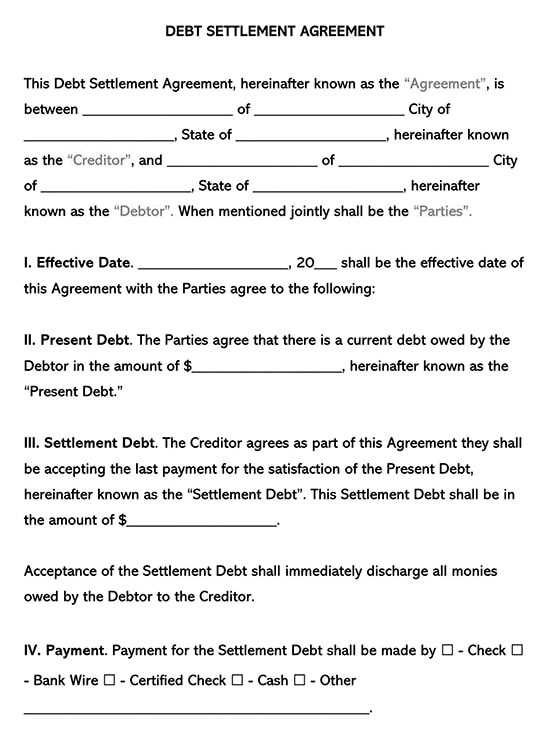

Key Elements of a Financial Document

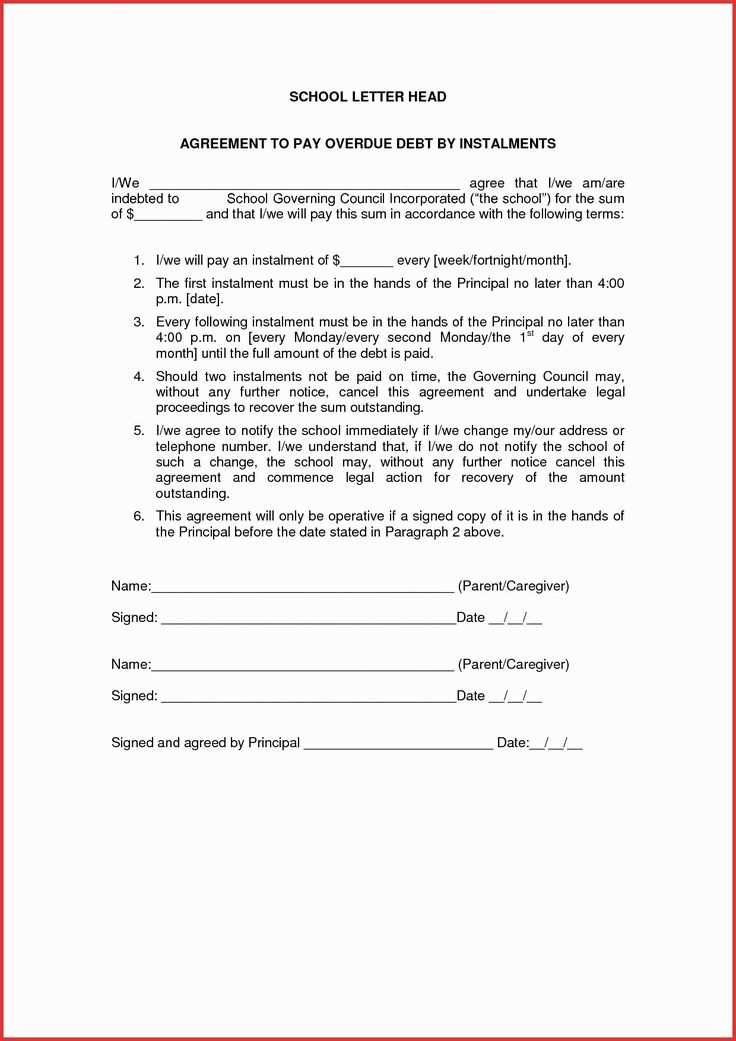

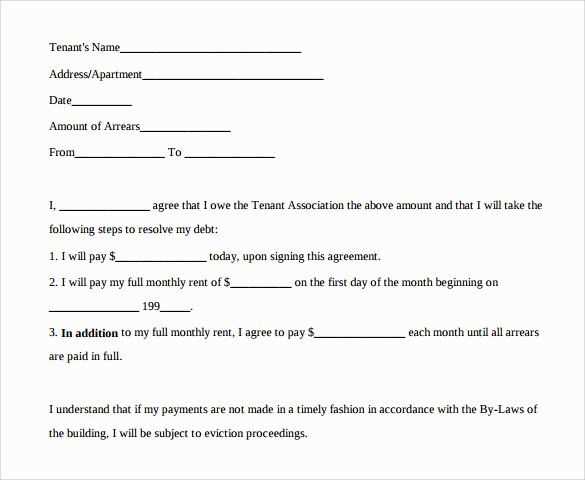

The primary purpose of this document is to outline the necessary terms in a structured format. Key elements typically include:

- Parties Involved: Clearly identify all individuals or organizations involved in the transaction.

- Amount and Payment Schedule: Define the total sum and repayment schedule, including any interest rates or additional fees.

- Consequences of Non-Payment: Outline the steps to be taken in case the agreed terms are not met, including late fees or legal actions.

- Signature Section: Each party should sign to confirm their understanding and agreement to the terms.

Why a Written Document is Necessary

While verbal agreements can be made, having a written record ensures that both parties are held accountable for their commitments. It also helps to prevent any disputes by having a clear reference point in case issues arise in the future. This ensures that both parties are on the same page and can resolve issues quickly if needed.

Steps to Create a Formal Agreement

Creating a formal financial arrangement involves several important steps:

- Begin by identifying the parties involved and their roles in the transaction.

- Clearly state the amount owed and the timeline for repayment.

- Include any additional terms or conditions that are relevant to the deal.

- Ensure both parties review the terms carefully before signing.

- Keep a copy of the signed document for future reference.

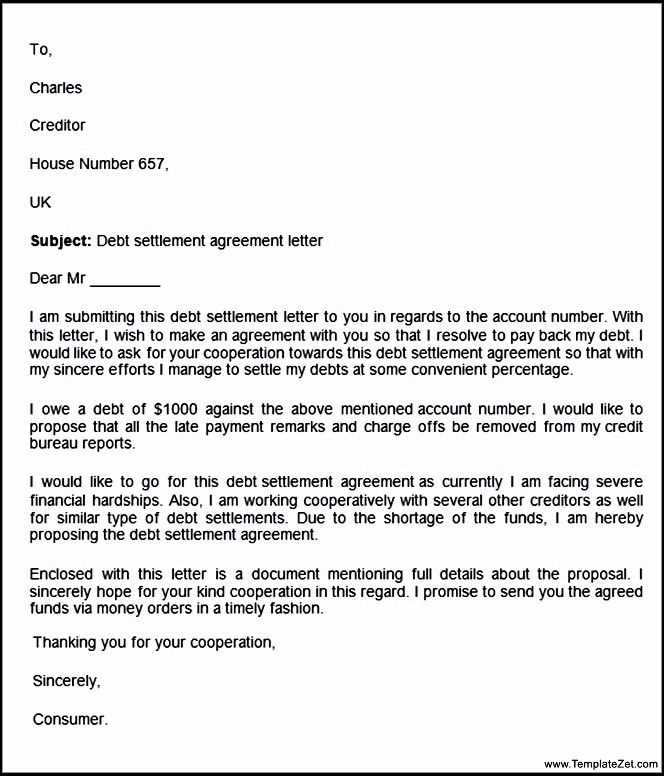

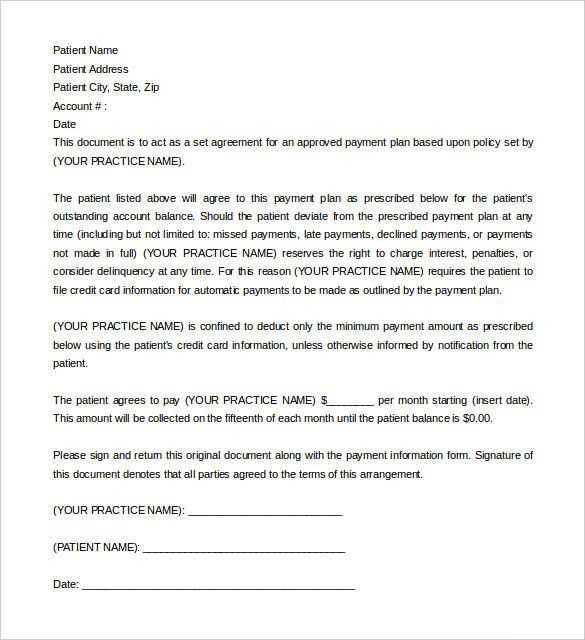

Customizing for Your Specific Needs

While many templates exist for drafting such documents, it is crucial to tailor the agreement to fit the unique circumstances of each transaction. Personalization may involve adjusting payment terms, adding clauses for collateral or security, or specifying other particularities that are relevant to the deal. Customization can make the document more comprehensive and secure for both parties involved.

Importance of a Formal Financial Arrangement

When engaging in any form of financial transaction, it is crucial to establish a clear, formal understanding of the terms. This ensures that both parties involved are aware of their responsibilities and expectations, which helps avoid future disputes. A well-structured document acts as a safeguard, providing legal backing and clarity to the entire process.

Key Elements of a Financial Agreement

To ensure a strong and binding contract, there are several key components to consider. The main factors include identifying the involved parties, specifying the amount, and outlining the repayment structure. Additionally, any penalties for non-compliance and conditions for modifying the agreement should also be defined. Clear language and mutual understanding are essential for a successful arrangement.

Steps to Draft a Financial Agreement

Creating a formal document involves several important steps. First, the details of the transaction must be outlined, including the amount and payment terms. Next, the document should include provisions for resolving any issues that arise, such as late payments or legal actions. Finally, the agreement should be signed by all involved parties, confirming their commitment to the terms set forth.

Legal Consequences of Financial Documents

Having a signed document in place gives the arrangement legal force, meaning that both parties are bound to honor the terms. In the event of non-compliance, the document can be used in legal proceedings to ensure that both parties adhere to the agreed-upon terms. Legal consequences may include financial penalties or even court action, depending on the severity of the breach.

How Formal Documents Safeguard Both Parties

By formalizing the terms, both sides are protected. The document ensures that all expectations are clearly stated, reducing the chances of misunderstandings or disputes. It also provides a way to address any conflicts that may arise by referring to the agreed terms, offering a more efficient and structured approach to resolving issues.

Personalizing Your Financial Document

Each financial arrangement is unique, and it’s important to adapt the document to suit the specific circumstances. Customizing the terms, such as adjusting the repayment schedule or including additional provisions, can help ensure that the agreement is comprehensive and relevant. Personalization allows for greater flexibility and protection for both parties involved.