Debt Collection Letter Template for the UK

When payments go overdue, it’s crucial to address the issue in a professional and clear manner. Taking the right steps can significantly increase the chances of getting paid while maintaining a positive business relationship. Clear communication is key to resolving outstanding balances and ensuring both parties understand their rights and obligations.

One of the most effective methods is drafting a formal communication that encourages the recipient to settle their account. By using a structured approach, businesses can avoid misunderstandings and prevent prolonged delays. A well-crafted document helps to maintain professionalism while urging the individual to fulfill their financial responsibility.

In the UK, this process is guided by specific regulations that ensure fairness. Crafting an appropriate message not only enhances the likelihood of repayment but also ensures compliance with legal requirements. It’s essential to understand what to include and how to present the information for maximum impact.

What is a Payment Recovery Communication?

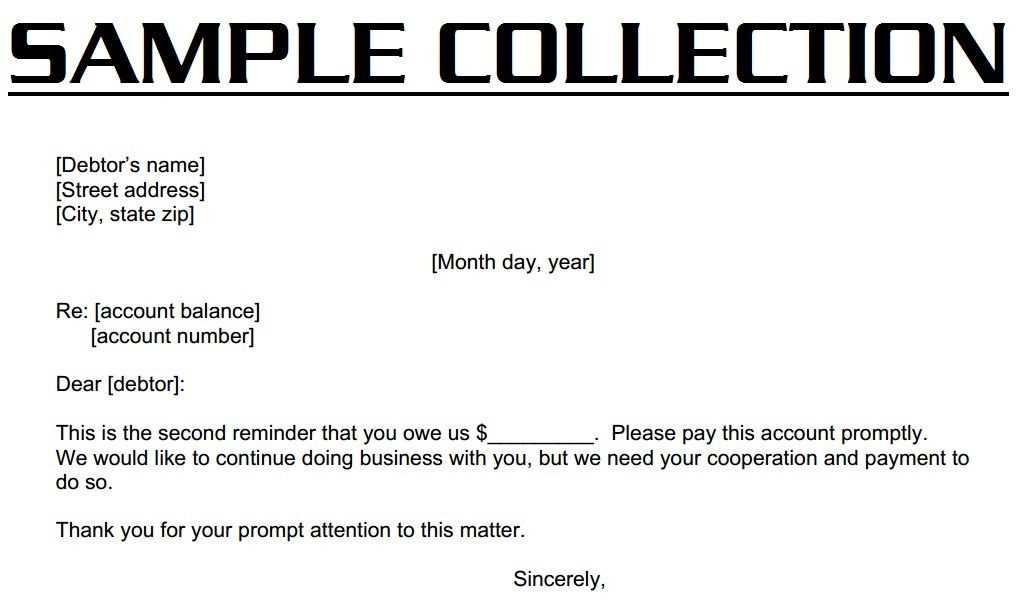

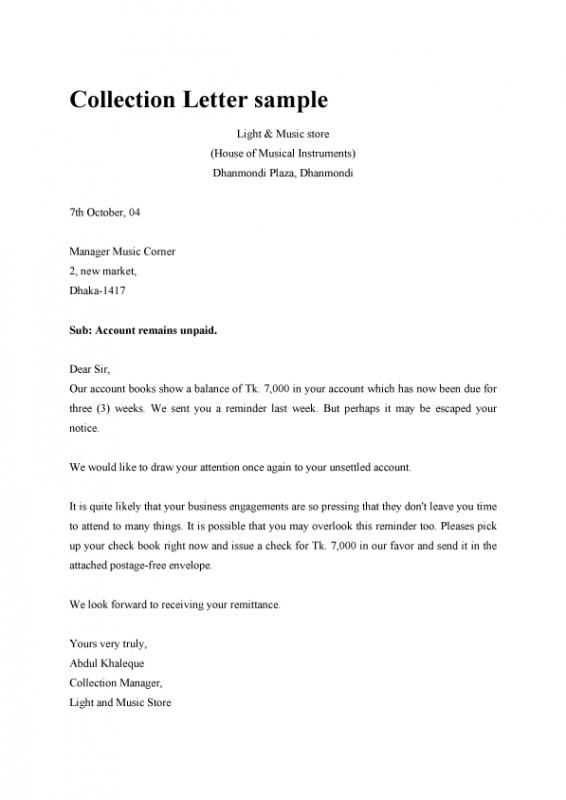

When an individual or business fails to pay what is owed within the agreed timeframe, a formal request is often necessary to remind them of their responsibility. This type of document serves as a professional means to inform the recipient of their outstanding obligation and encourage timely resolution. It is typically structured to clearly state the amount due, the due date, and the actions that may follow if the payment is not made.

Key Features of an Effective Request

An effective payment recovery communication is precise and direct, outlining the exact amount owed, the due date, and potential consequences for non-payment. It remains polite yet firm, ensuring the message is clear without being confrontational. This approach maintains professionalism while addressing the issue promptly.

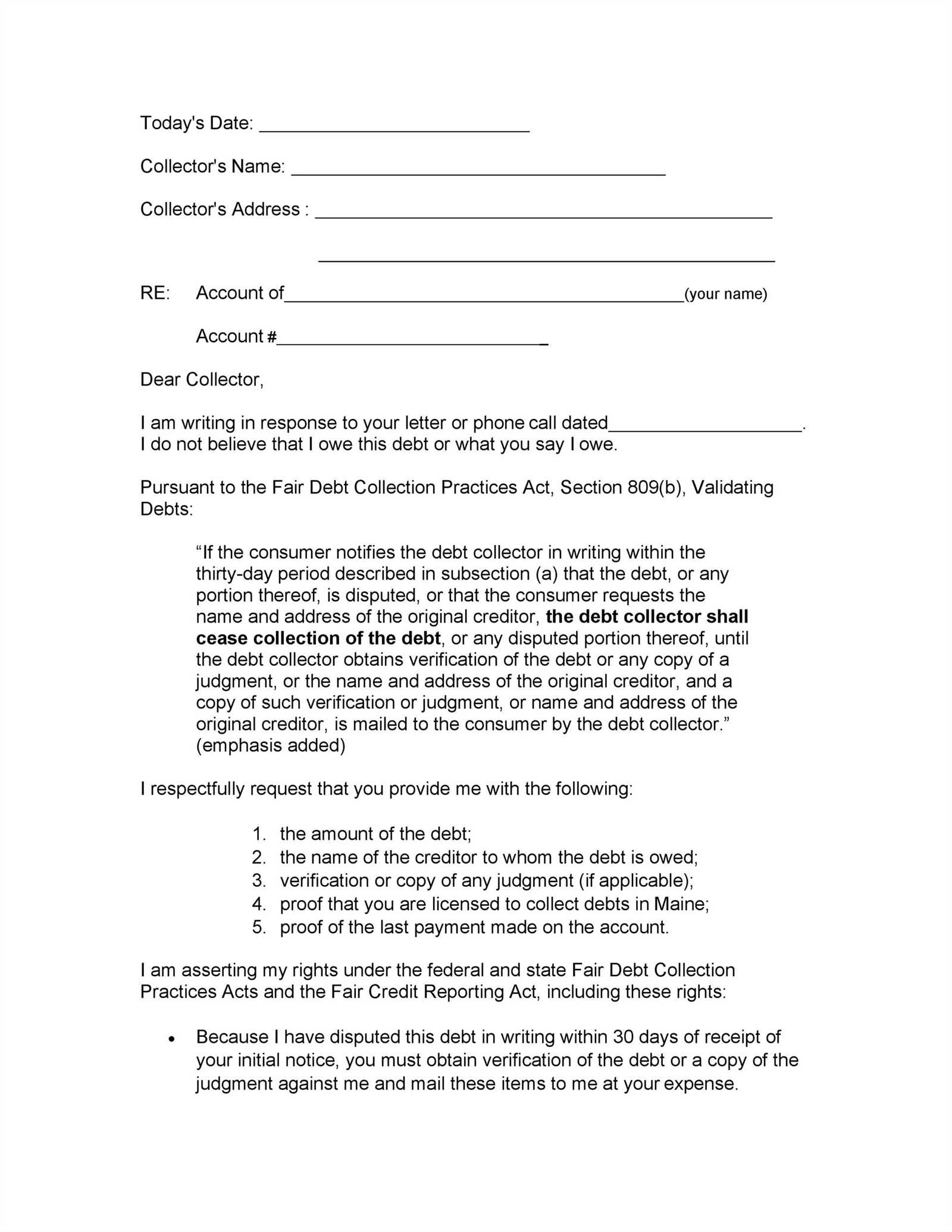

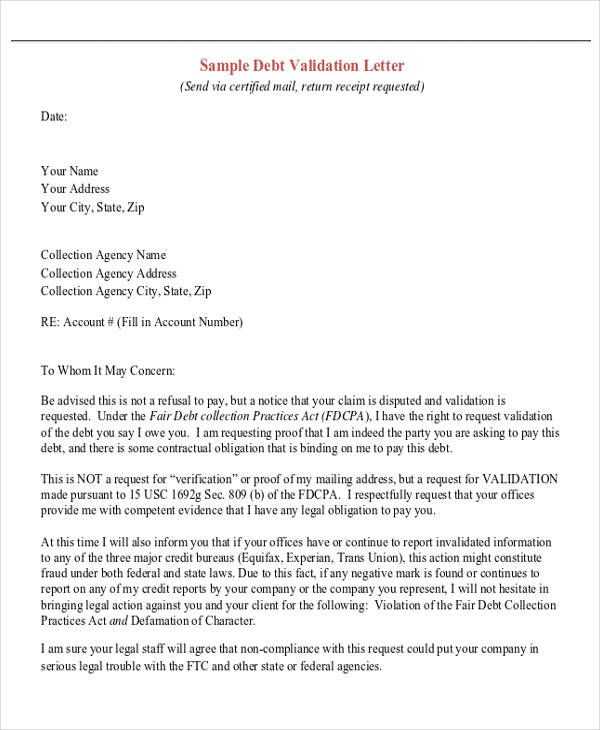

Legal Aspects of Payment Reminders

In the UK, certain guidelines govern how these formal requests should be written. They must comply with legal requirements to ensure fairness and transparency. For example, a creditor must give the recipient a reasonable opportunity to resolve the issue before pursuing further actions, such as legal proceedings. A well-structured communication can help avoid complications and ensure that the process remains within the bounds of the law.

Essential Information for Payment Recovery

To successfully recover overdue amounts, it’s crucial to include specific details that make the request clear and actionable. Providing all necessary information upfront helps avoid confusion and sets the stage for a quicker resolution. A well-drafted communication should outline the key facts without being overly complicated.

The first piece of information to include is the amount owed. Clearly stating the outstanding balance ensures the recipient knows exactly what is expected. Additionally, it’s important to mention the original due date, as this helps clarify the timeline of the obligation. If there are any interest charges or fees associated with the late payment, they should also be transparently outlined.

Another key element is the deadline for payment. Providing a specific timeframe for settlement, such as “within 14 days,” gives the recipient a clear understanding of when they need to act. If applicable, also mention the potential consequences for non-payment, such as the initiation of legal proceedings or additional fees. This creates a sense of urgency while maintaining a professional tone.

Understanding the Legal Framework in the UK

In the UK, the process of requesting payment follows a specific set of legal guidelines to ensure fairness for all parties involved. Understanding these regulations is essential for businesses or individuals looking to resolve financial disputes while remaining compliant with the law. The legal framework is designed to protect both the creditor and the debtor by setting clear rules for how payment issues should be addressed.

The law requires that any formal request for payment be made in a clear and transparent manner. Creditors must give debtors a reasonable amount of time to resolve the outstanding balance before taking further action. Failure to comply with these regulations could lead to legal complications, so it’s important to ensure all communications are accurate, respectful, and aligned with the rules set forth by UK law.

Additionally, the process is governed by various regulations, including the Consumer Credit Act and the Late Payment of Commercial Debts (Interest) Act. These laws provide a framework for businesses to follow when dealing with overdue accounts, ensuring that interest charges and late fees are applied correctly. Knowledge of these legal aspects helps prevent mistakes that could result in disputes or legal challenges.

Step-by-Step Guide to Writing Communications

Writing an effective request for payment involves several key steps to ensure clarity and increase the chances of a positive response. Each communication should follow a structured approach that provides all necessary details without being overwhelming. By adhering to a clear process, you can create a professional message that encourages timely settlement.

1. Begin with a Professional Salutation

Start the communication by addressing the recipient in a respectful and professional manner. Use their name and ensure the tone is polite yet firm.

2. Clearly State the Purpose

In the opening lines, quickly mention the reason for the communication. It’s important to be straightforward while maintaining a courteous tone.

3. Provide All Necessary Details

Ensure the recipient knows exactly what is owed and the payment terms. Include the following information:

- Amount owed

- Original due date

- Late payment charges, if any

4. Set a Clear Deadline for Payment

Specify the exact date by which the recipient should make the payment. Providing a clear deadline encourages timely action.

5. Explain the Consequences of Non-Payment

Politely but firmly outline the next steps if the payment is not made. Mention any potential legal actions or additional charges that may apply.

6. Close with a Professional Ending

End the communication with a polite closing statement, offering the recipient an opportunity to reach out if they need further assistance.

When to Send a Payment Reminder

Timing is a crucial factor when it comes to formally requesting payment. Sending a reminder too early may not give the recipient enough time to fulfill their obligation, while waiting too long can lead to further delays and complications. The key is to choose the right moment when the request is most likely to yield a positive result.

Generally, it’s advisable to wait until after the agreed-upon due date has passed. By then, the recipient is clearly aware that payment is overdue, which sets the stage for a more direct approach. However, it’s important to remember that some individuals or businesses may have legitimate reasons for being late, so a balanced and polite tone is essential.

Additionally, sending a formal request should be done before the situation escalates. If there are ongoing signs of neglect or refusal to pay, acting promptly can prevent further issues. The earlier you address the situation, the easier it is to avoid additional fees or legal actions.

Best Practices for Effective Communication

When requesting payment, it’s crucial to approach the situation with professionalism and clarity. The tone, structure, and content of your communication can significantly impact the recipient’s response. Using best practices ensures that your message is both effective and respectful, increasing the likelihood of a prompt resolution.

Maintain a Professional Tone

Regardless of the situation, always keep the tone polite, respectful, and neutral. Avoid being confrontational or accusatory, as this can make the recipient defensive and less likely to cooperate. A firm but courteous approach is the most effective way to encourage payment without damaging the relationship.

Be Clear and Concise

Ensure that all key information is presented clearly and succinctly. State the amount owed, the due date, and any actions that may follow in case of non-payment. Avoid long-winded explanations or unnecessary details that could distract from the main message. Clear and straightforward communication reduces the risk of misunderstandings.