Debt Settlement Letter Paid in Full Template

Understanding Debt Resolution Documents

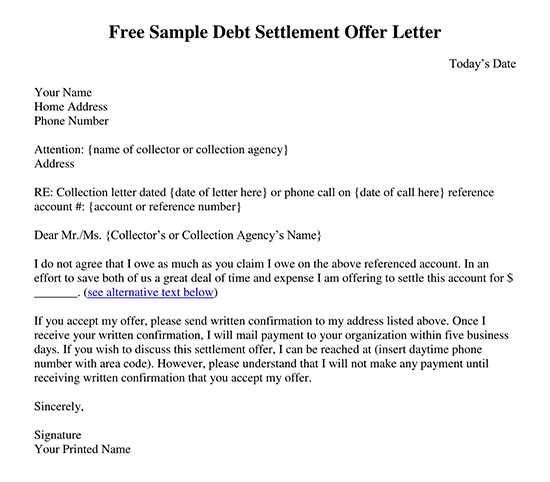

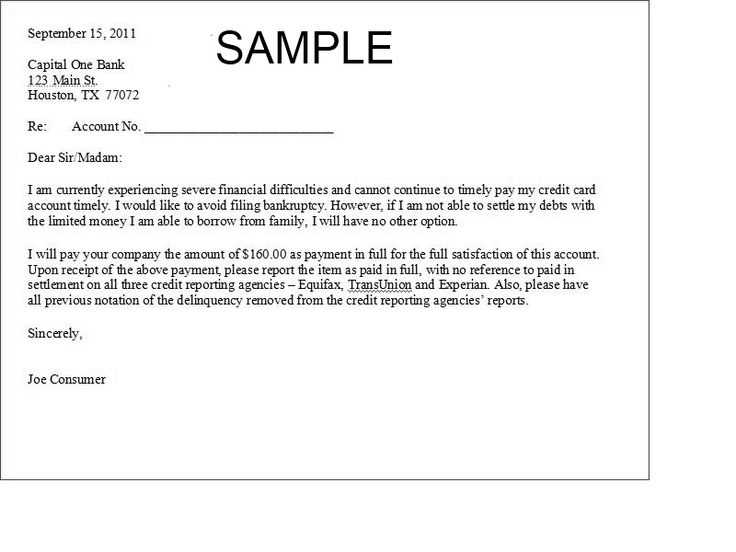

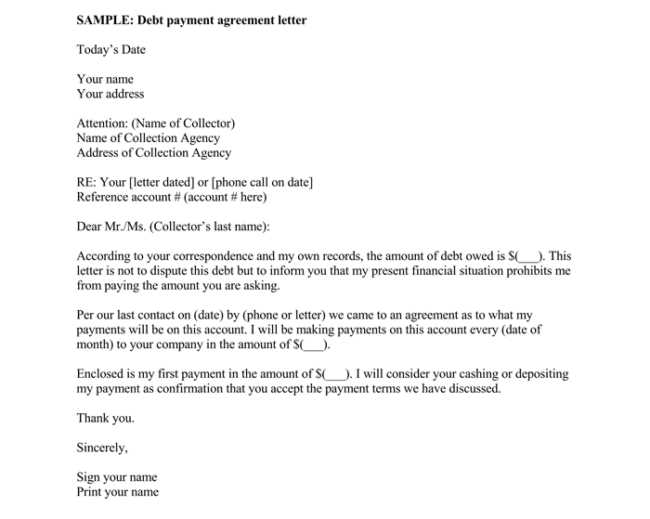

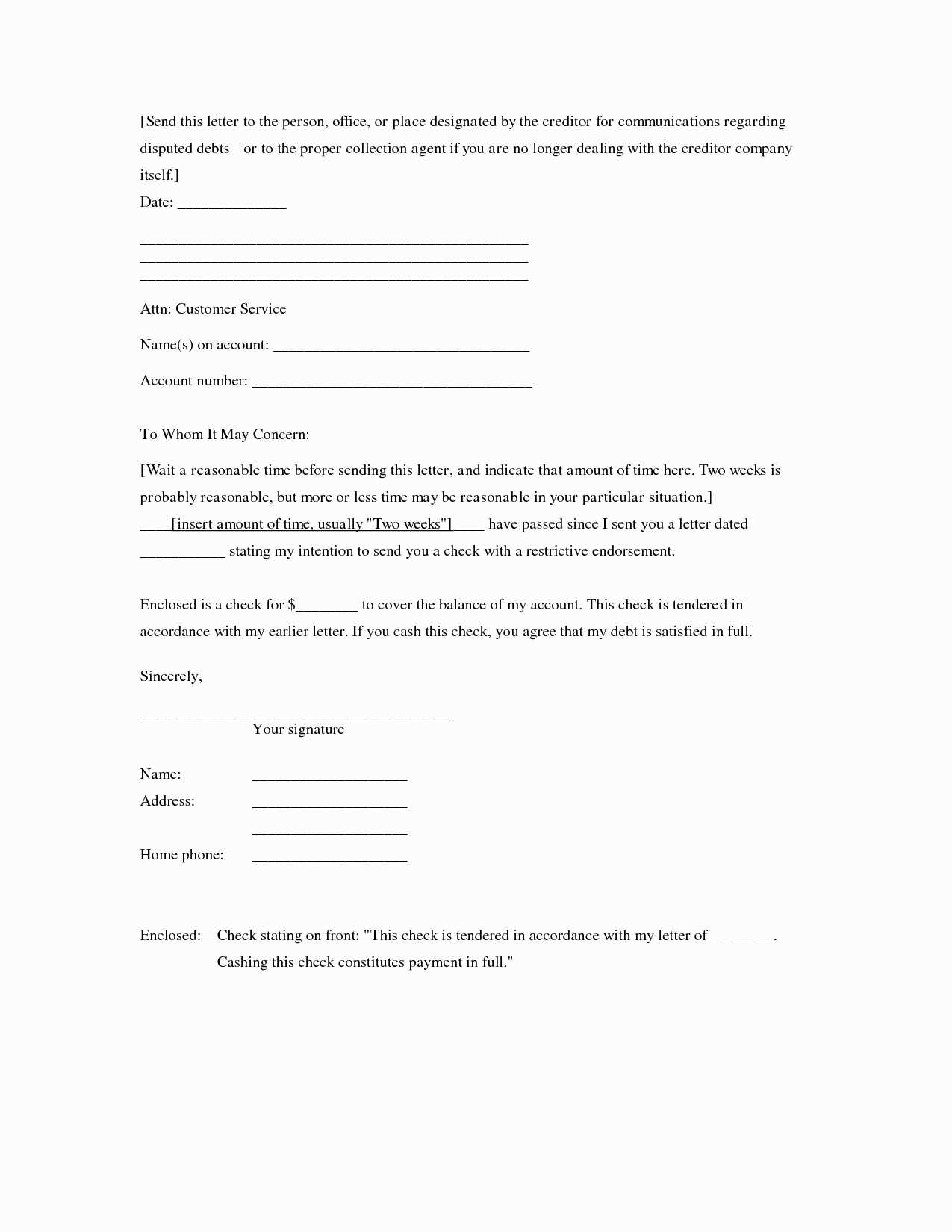

How to Draft a Paid in Full Letter

Key Components of a Debt Settlement Document

Common Errors to Avoid in Settlement Letters

Advantages of Using a Template for Settlement

When to Submit a Paid in Full Notice

How Debt Settlement Impacts Your Credit

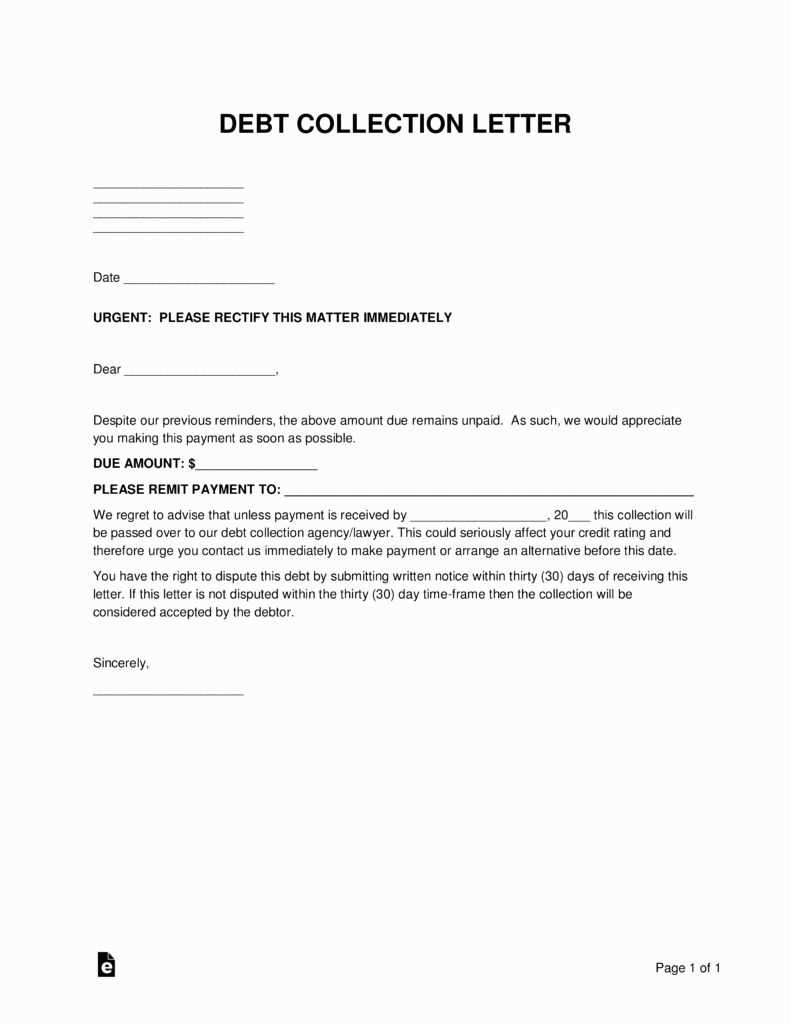

When handling outstanding obligations with creditors, it’s crucial to understand the paperwork involved in resolving these issues. Properly addressing the terms of the agreement and ensuring that all conditions are met can help in securing a favorable outcome. Crafting the appropriate documentation plays a significant role in formalizing the resolution process and ensuring mutual understanding between both parties.

Key Components of the Resolution Document

Resolution paperwork should include specific details that clarify the agreement. These typically involve the total amount settled, the date of agreement, the involved parties, and the nature of the commitment. Additionally, clear instructions on how payments were made or will be made are necessary to avoid future confusion. This ensures both sides understand their obligations going forward and provides evidence of the terms of the agreement.

Common Pitfalls to Avoid

When preparing such documents, certain mistakes can undermine the process. Ensure that the amounts are accurately reflected and that the terms are clearly outlined. Vague wording or incorrect dates may lead to disagreements later on. Always double-check that the contact information is correct and that all signatures are properly placed. Inaccuracies in these areas can result in complications during follow-up, potentially invalidating the agreement.

Utilizing a pre-designed format for creating resolution paperwork can save time and minimize errors. A structured format ensures all necessary details are included and presented in the correct order. This reduces the chance of missing essential components and enhances clarity for both the debtor and creditor. Templates can also help guide individuals through the process, offering a framework that ensures compliance with standard industry practices.

Knowing when to submit this type of confirmation is essential. It’s important to ensure that all terms are completely fulfilled before sending it to the creditor. Premature submission may cause confusion or conflict, as it could suggest that an agreement has been finalized before all obligations have been met. Timing plays a significant role in ensuring that the document holds weight and is accepted by all parties involved.

Once the agreement is made, it’s important to understand the potential effects on your credit history. Settling an outstanding obligation can reflect positively or negatively depending on how the process is carried out. Proper handling and clear documentation can lead to better outcomes, but it’s essential to monitor how the resolution appears on your credit report to understand its long-term implications.