Debt settlement letter templates

To settle a debt with a creditor, a well-crafted debt settlement letter can make a significant difference. Use these templates to clearly present your case and propose a fair settlement offer that both you and the creditor can agree on. The key is to maintain a professional tone while being straightforward about your financial situation and what you’re able to pay.

Start by detailing the debt in question, including account numbers and the total amount owed. Make sure to clearly explain why you’re seeking to settle the debt, whether due to financial hardship, unexpected life circumstances, or another valid reason. Offering a reasonable payment amount, along with an explanation of how you arrived at that figure, will show the creditor that you’ve carefully considered the terms.

When drafting the letter, avoid emotional appeals. Instead, focus on presenting factual information. Clearly state that you’re committed to resolving the debt, but you may not be able to pay the full amount at this time. Propose a specific settlement figure that is within your ability to pay, and request that the creditor consider this as a fair compromise.

Remember to follow up if you don’t receive a response within a reasonable time frame. Staying persistent can increase your chances of reaching a successful settlement agreement.

Here is the revised version where repetitions are minimized:

Start by addressing the lender directly, using a polite but firm tone. State clearly the reason for the settlement offer and outline your financial situation concisely. Keep the tone respectful but assertive, avoiding unnecessary details.

Include the exact amount you are proposing to settle the debt. Explain why this figure is reasonable, given your current financial position, and mention if you can make a lump-sum payment or need a payment plan. Make sure to clarify the terms for both parties, such as deadlines or conditions attached to the settlement offer.

Be specific about the request for the debt to be marked as “settled in full” once the payment is made. This ensures the lender understands the expectation of clearing the debt. If applicable, request confirmation in writing that the account will be reported to credit bureaus as settled once the terms are met.

Conclude the letter by thanking the lender for their consideration and providing your contact information for further communication. Maintain a professional tone throughout the letter, making sure each section is clear and focused on the goal of reaching a settlement.

- Debt Settlement Letter Templates: A Practical Guide

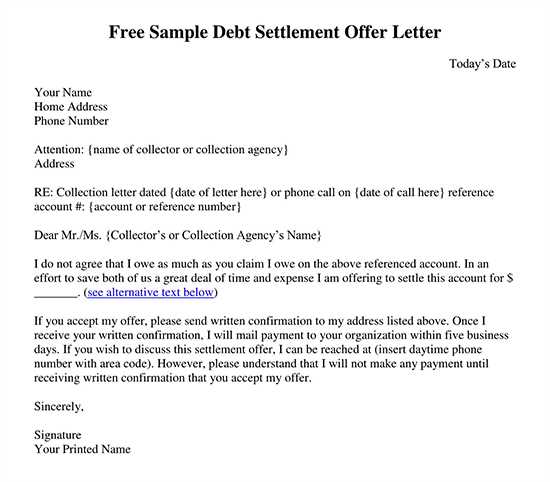

Using a debt settlement letter template can make the process of negotiating your debt much smoother. Start with a clear, concise letter that includes specific details about your debt and your proposed settlement offer. Avoid unnecessary information that doesn’t directly relate to your case. Here are some guidelines and a sample template for you to use:

- State the Purpose of Your Letter

- Include Your Personal and Debt Details

- Offer a Settlement Amount

- Request for Debt Forgiveness or Discount

- State Your Payment Plan or Timeline

- End with a Request for Written Confirmation

Begin with a direct statement about your intent to settle the debt for a reduced amount. Be clear about your offer and why you’re making this settlement proposal.

Clearly mention your full name, address, and the account or reference number related to the debt. This helps the creditor easily identify your case and ensures there’s no confusion about which debt you are referring to.

Propose a specific amount you’re willing to pay to settle the debt. Ensure it’s realistic based on your current financial situation, and make it clear you expect a written agreement before sending any payment.

Explain that you’re requesting a partial forgiveness of the debt, highlighting that you are doing this because of financial hardship. Be polite but firm about the necessity of a lower amount to settle the debt in full.

If possible, propose a payment schedule or timeline for when you can make the payment. This adds credibility to your offer and demonstrates your willingness to settle responsibly.

Make sure to request a written confirmation from the creditor or collection agency if they accept the settlement offer. It’s important to have everything documented in case there are any disputes later on.

Here’s a basic template you can adapt for your own use:

[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [Creditor's Name] [Company Name] [Company Address] [City, State, ZIP Code] Subject: Debt Settlement Offer for Account [Account Number] Dear [Creditor's Name], I am writing regarding the outstanding debt on my account [Account Number]. Due to [briefly mention your financial hardship], I am unable to pay the full amount owed. However, I am requesting to settle the debt for a reduced amount of [$amount]. I propose to pay this amount in [number of installments] over a period of [time frame], with the first payment being made on [date]. Once this amount has been paid, I request that the balance of the debt be considered forgiven and the account marked as "settled" on my credit report. Please confirm in writing that you agree to this settlement offer. I am looking forward to resolving this matter promptly. Thank you for your consideration. Sincerely, [Your Name]

Use this template as a starting point, but always ensure that the details match your situation. Clear communication and a reasonable settlement offer can lead to a positive resolution.

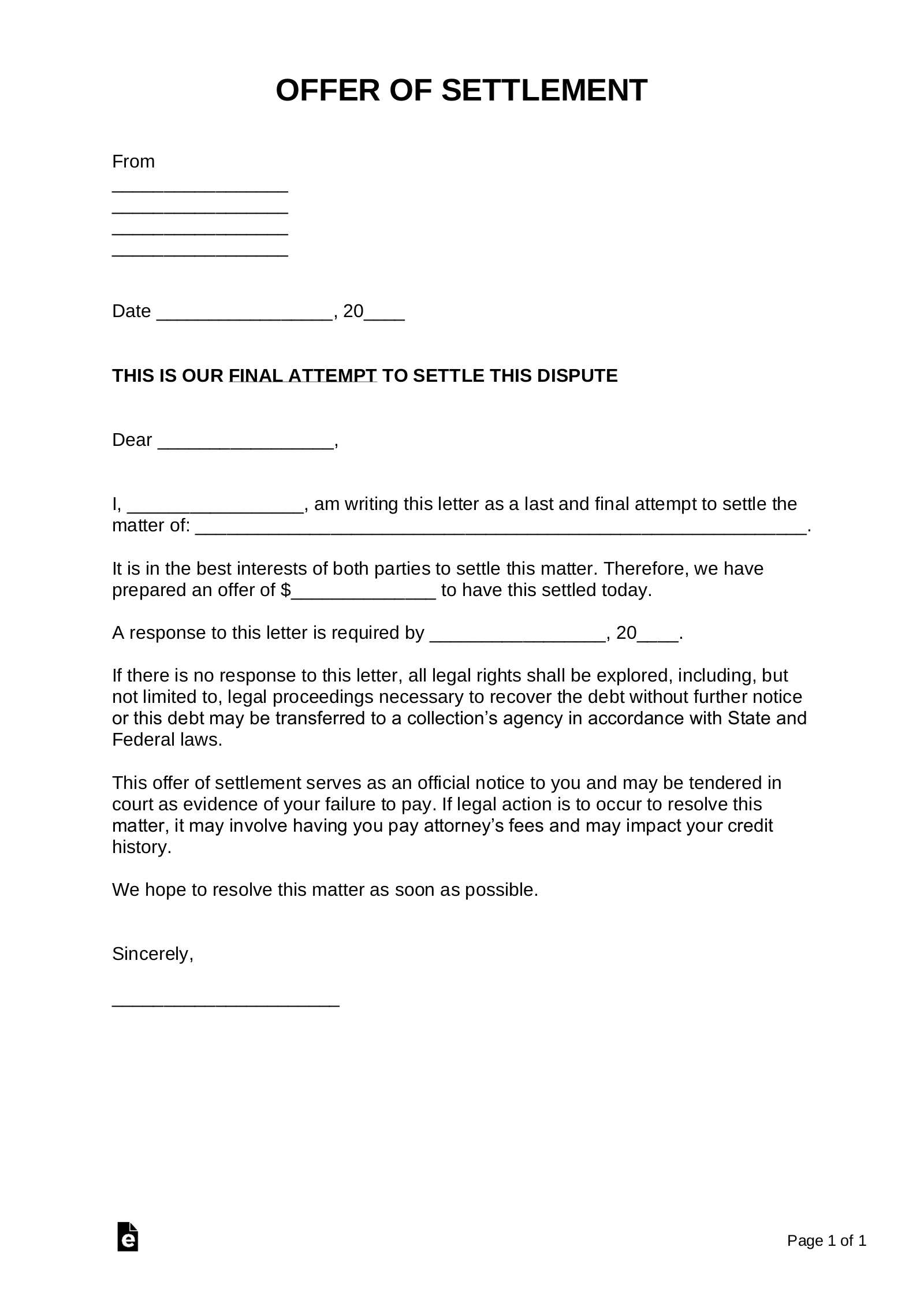

To write an effective offer letter for debt settlement, ensure it is clear, concise, and contains all necessary details. This letter serves as your formal request to the creditor to accept a reduced payment or settle your debt for less than the full amount owed. Begin by addressing the creditor directly with a polite tone, stating your intention to resolve the debt. Provide a clear breakdown of the offer and why it is in the best interest of both parties.

Key Components of the Offer Letter

Make sure the offer letter includes the following elements:

| Component | Description |

|---|---|

| Debtor Information | Include your full name, address, and contact information to help the creditor identify your account. |

| Creditor Information | State the name and address of the creditor or collection agency. |

| Account Number | Provide the relevant account number or any identifiers related to the debt. |

| Debt Amount | List the current balance owed and any accumulated interest or fees. |

| Offer Amount | Clearly state the reduced settlement amount you are offering to pay. |

| Payment Terms | Specify whether you plan to pay in a lump sum or through a series of installments. |

| Reason for Offer | Briefly explain why you are requesting a debt settlement, such as financial hardship or job loss. |

| Conditions | Include any conditions tied to the settlement, such as a request for the creditor to mark the debt as “settled” on your credit report. |

| Closing Statement | Politely express your hope for a positive resolution and your willingness to discuss further. |

Sample Debt Settlement Offer Letter

Below is a simplified example of how to format the content:

Dear [Creditor’s Name],

I am writing regarding the outstanding debt on my account [Account Number]. Due to financial difficulties, I am unable to pay the full amount of $[Total Amount Owed]. However, I am prepared to offer $[Offer Amount] in a lump sum as a settlement of this debt.

I kindly request that you consider this offer and accept the reduced amount as full payment. Upon acceptance, I ask that you report the debt as “settled” on my credit report.

Thank you for your understanding, and I look forward to resolving this matter amicably. Please contact me at [Your Contact Information] to discuss the terms further.

Sincerely,

[Your Name]

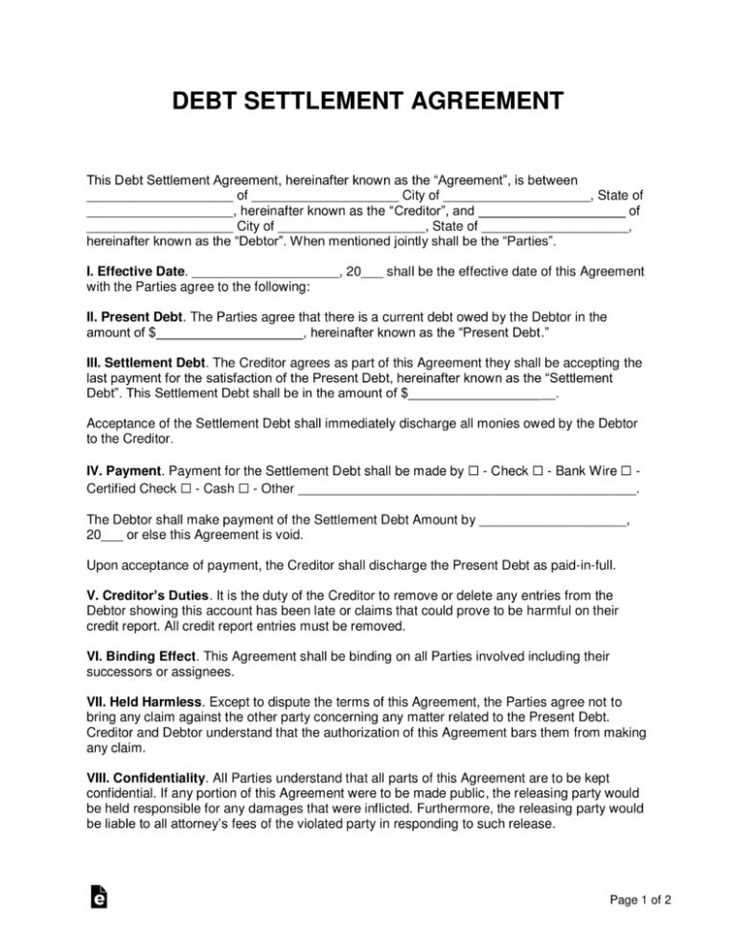

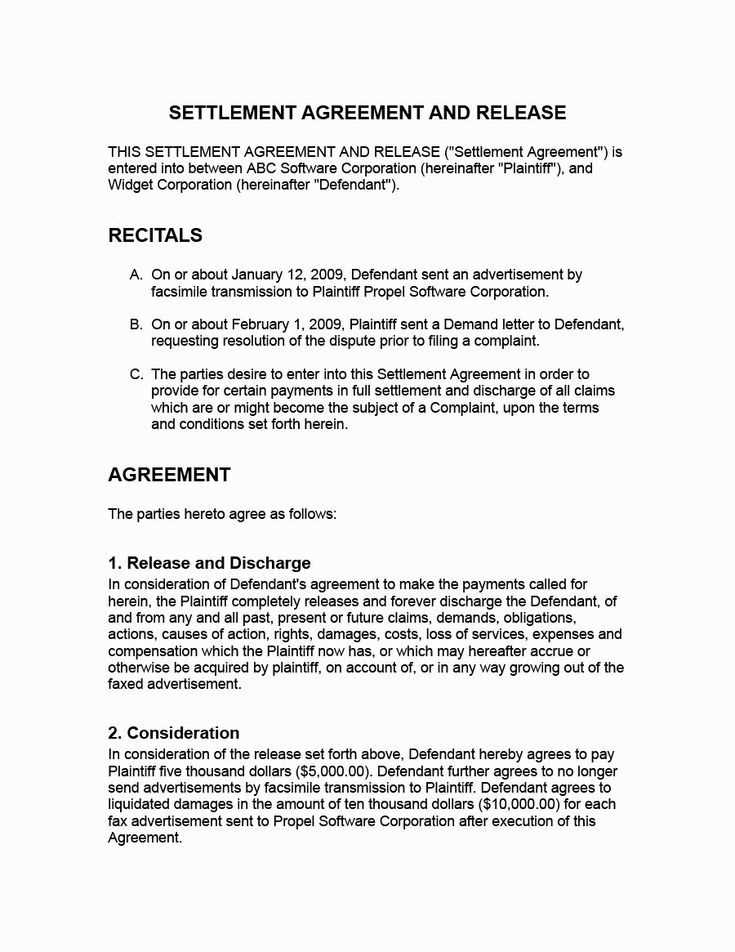

A debt settlement agreement outlines the terms between a debtor and a creditor to resolve an outstanding debt for less than the full amount owed. The following components are typically included:

1. Settlement Amount

This section specifies the agreed-upon reduced amount that will be paid to settle the debt. It should be clearly stated whether this amount is a lump sum or structured payment plan.

2. Payment Terms

Details of how the settlement will be paid, such as the due dates, payment methods, and any penalties for missed payments, should be included. This ensures both parties are aligned on expectations.

Make sure the agreement also includes provisions for what happens if the debtor fails to make payments, as well as whether the debt is considered fully settled after the last payment is made.

3. Release of Liability

This is a clause where the creditor agrees to release the debtor from any further claims related to the settled debt once the terms are fulfilled. It prevents the creditor from seeking additional payment or pursuing legal action once the agreement is satisfied.

4. Reporting to Credit Bureaus

If relevant, the agreement should specify how the creditor will report the settlement to credit agencies. For example, the creditor may agree to mark the account as “paid in full” or “settled” on the debtor’s credit report.

5. Non-Admission of Liability

Debtors should be cautious about agreeing to language that implies they admit fault or liability for the debt. This clause ensures that the settlement is not an admission of guilt but a mutually agreed resolution.

Review each of these components to ensure clarity and protect your interests before signing the agreement.

Debt settlement letters often contain legal terminology that can be confusing. It’s important to understand these terms to avoid misinterpretations and ensure your rights are protected. Here’s a breakdown of the most common legal language you might encounter:

1. “Settlement Offer” vs. “Full Payment” Clause

Many debt settlement letters will refer to a “settlement offer,” which usually means you can pay a reduced amount to clear your debt. However, this doesn’t mean the debt is fully forgiven unless the letter specifically states that the agreed settlement amount is “full payment.” Be careful about what the letter promises.

2. “Release of Liability”

This clause indicates that once you make the agreed-upon payment, the creditor will no longer pursue the remaining balance of your debt. It’s crucial that the letter explicitly states that the debt will be considered “paid in full” upon your payment. Otherwise, creditors may still seek to collect the unpaid balance later on.

3. “Waiver of Right to Sue”

Sometimes, creditors will include a statement that waives their right to pursue legal action after the settlement. If you agree to the settlement terms, this waiver protects you from future lawsuits related to the debt. Make sure that this clause is clearly outlined and that it applies specifically to your debt and not any other claims the creditor might have.

Reading and understanding the language in debt settlement letters can be tricky, but knowing these key terms will help you make an informed decision before agreeing to any settlement. Always consult a legal professional if you’re unsure about the implications of any clauses.

Send a debt settlement letter as soon as you recognize you can’t fully repay your debts but want to avoid defaulting. The earlier you communicate, the more likely you are to negotiate a favorable settlement. This approach shows proactive effort, which may make creditors more willing to work with you.

Best Timing for Sending a Debt Settlement Letter

If you’ve fallen behind on payments and are facing mounting financial pressure, it’s critical to send a letter at the point where you know your debt is unmanageable but before your account goes into collections or becomes charged off. Doing so could prevent further negative marks on your credit and reduce the overall debt burden.

Consider Sending After Attempting to Refinance or Restructure Debt

If you’ve tried other methods of repayment, such as refinancing or consolidating your debt, and have not seen results, this could be the right time to send a settlement letter. It signals that you are looking for an amicable resolution and are unable to meet your original terms.

Each debt type requires a tailored approach in your settlement letter. Adjust the details based on the nature of the debt and the creditor involved.

For Credit Card Debt: Mention the outstanding balance, any interest rates that apply, and offer a lump sum settlement. Specify a percentage reduction of the total debt you’re proposing and explain your current financial hardship. Be clear about the amount you can pay and the deadline for payment.

For Medical Debt: Reference the medical provider and the services rendered. Medical debt often has specific billing structures, so break down the amounts due clearly. Highlight any insurance payments or adjustments and request a settlement based on the remaining balance, offering a reduced lump sum or installment plan.

For Personal Loans: Detail the loan’s original amount, the interest rate, and current balance. If your loan includes penalties or fees, address these as well. Propose a reasonable reduction in the principal amount or a reduction in the interest rate, given your current financial situation.

For Tax Debt: Clarify the tax authority and the type of taxes owed. Since tax authorities are less likely to reduce the principal, focus on negotiating a payment plan or requesting a penalty abatement. Include any relevant tax forms or case numbers to expedite the process.

For Student Loans: If applicable, specify whether the loan is federal or private. Federal loans may offer more flexible settlement options, so make sure to mention any income-driven repayment plans or hardship programs. For private loans, propose a settlement amount based on your financial capability and be sure to detail any attempts at negotiation with the loan servicer.

In all cases, keep your tone respectful and professional. Be sure to outline any proof of hardship, like job loss or medical emergencies, that supports your settlement proposal. Customize each letter to fit the specific debt’s characteristics for better chances of success.

Common Mistakes to Avoid in Debt Settlement Correspondence

One of the biggest mistakes in debt settlement letters is failing to clearly state your request. Be specific about the amount you are offering to settle the debt and what you expect in return. Avoid vague language such as “I would like to discuss settlement options.” Instead, state, “I am offering $X to settle the debt in full.” This leaves no room for confusion and shows you are serious about the resolution.

1. Not Documenting Everything

Always keep a record of all communication with creditors. Forgetting to document phone calls, emails, and letters could lead to disputes later on. A well-organized paper trail is vital if a misunderstanding arises. Ensure you have confirmation in writing for any agreement or modification to the terms of the settlement.

2. Ignoring Legal Rights

Many debtors neglect to review their legal rights before sending a settlement letter. Ensure you understand your rights under the Fair Debt Collection Practices Act (FDCPA). Avoid sending a letter that inadvertently waives any rights you may be entitled to, like the right to dispute the debt or the right to verify the amount owed.

Another error is overlooking the creditor’s procedures. Some companies may have a standard process for debt settlement. Ignoring their requirements could delay the process or even cause them to dismiss your offer altogether. Always ask for their preferred method of correspondence and follow it.

3. Being Too Emotional

Debt can be stressful, but using emotional language in your settlement letter can backfire. Avoid phrases like “I’m desperate” or “I’m struggling to survive.” Stick to clear, professional language, focusing on the facts and your proposed solution. Your goal is to make it easier for the creditor to agree to your terms, not to elicit sympathy.

4. Not Setting a Deadline

Failure to include a specific deadline for a response can lead to long delays or an indefinite back-and-forth. Be clear about the timeframe within which you expect a response, such as “Please respond by [date].” A deadline helps create a sense of urgency and ensures that your offer is taken seriously.

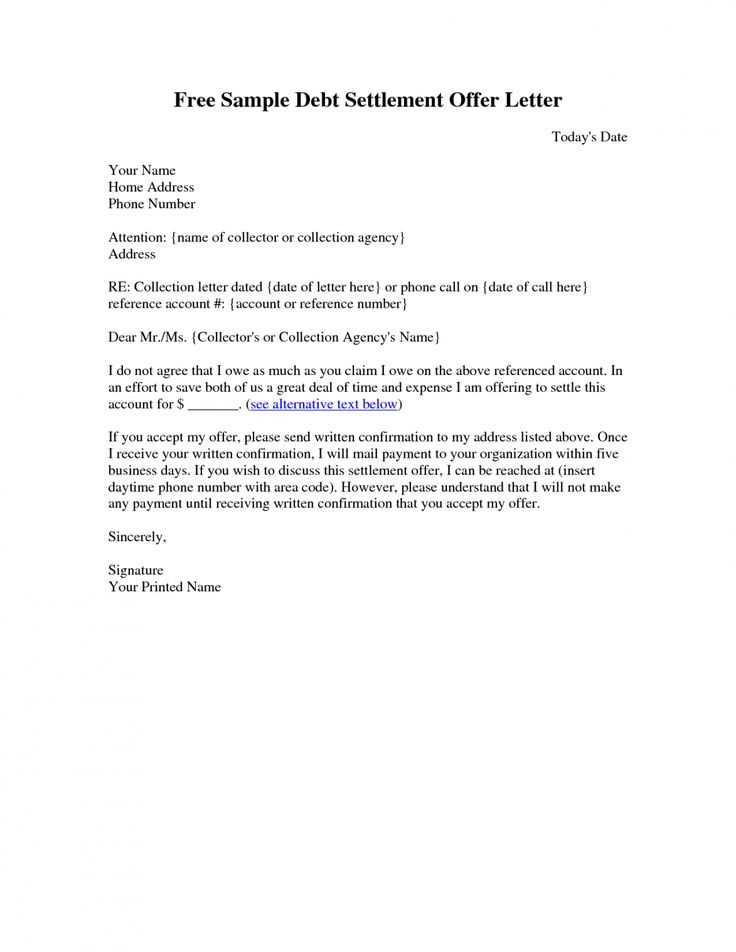

Debt Settlement Letter Templates

For an effective debt settlement letter, start by addressing the creditor directly and clearly stating the amount you are willing to pay. Ensure that the tone is respectful but firm, focusing on the financial hardship that has led to this request. Highlight any recent changes to your financial situation, such as a reduction in income or an unexpected expense, that make full repayment impossible.

- Begin with your name, address, and contact details at the top, followed by the creditor’s information.

- State the purpose of your letter early on, specifying that you are seeking to settle the debt for a reduced amount.

- Be clear about the amount you can pay and offer a reasonable explanation for why this is the best you can afford.

- Propose a specific payment plan, such as a lump sum or a series of installments, with defined deadlines.

- Request confirmation that the agreed-upon settlement will be reported as “paid in full” to the credit bureaus once paid.

After detailing the terms, express your willingness to discuss any alternative options. Conclude the letter by thanking the creditor for considering your offer and express hope for a positive resolution. End with a polite closing and your signature.