Debt validation letter template 2023

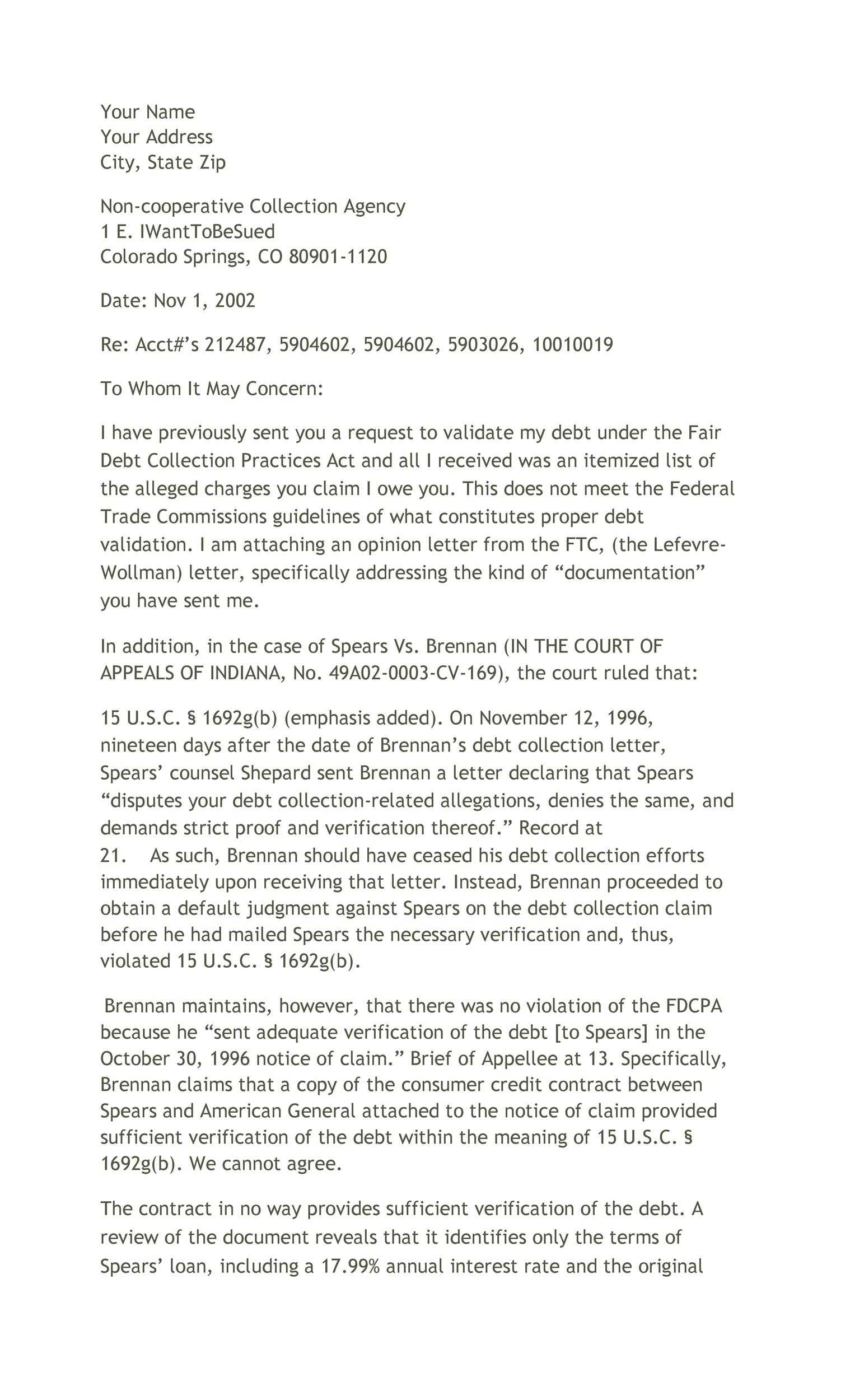

When dealing with debt collection, sending a debt validation letter can help clarify any confusion. If you believe a debt collector has made a mistake or you’re unsure of the legitimacy of the debt, use this template to request documentation of the debt they claim you owe.

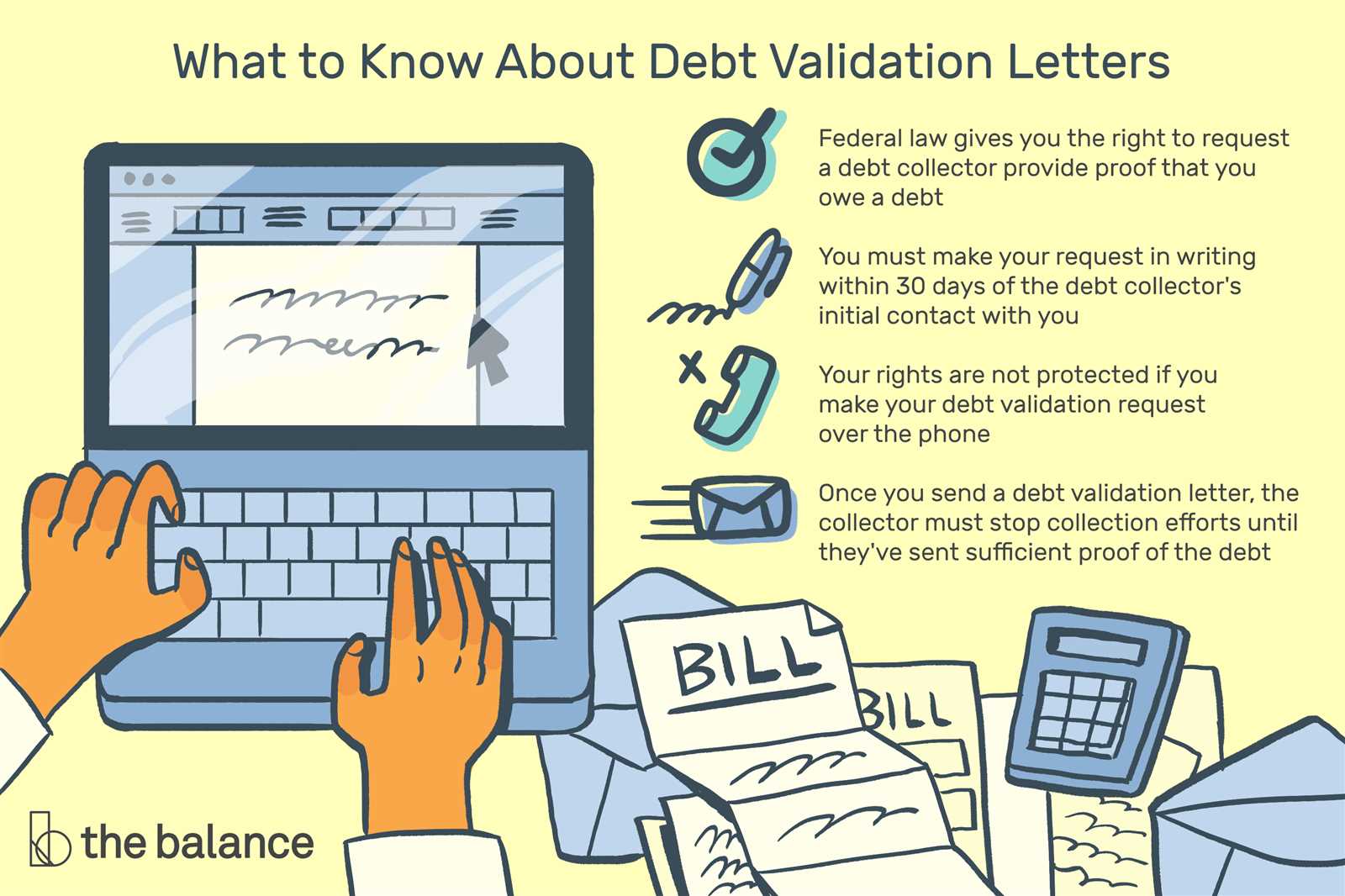

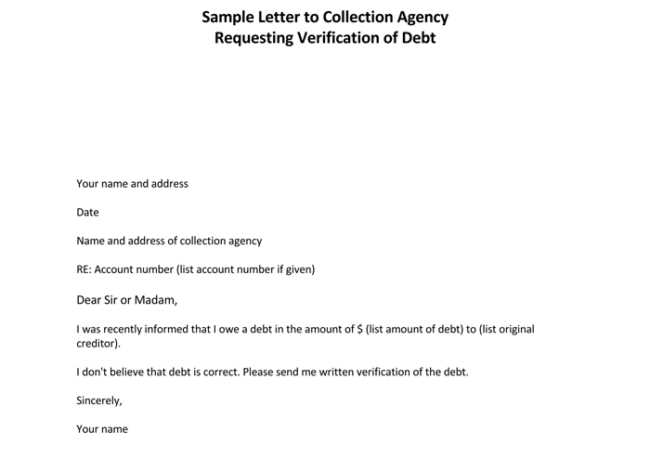

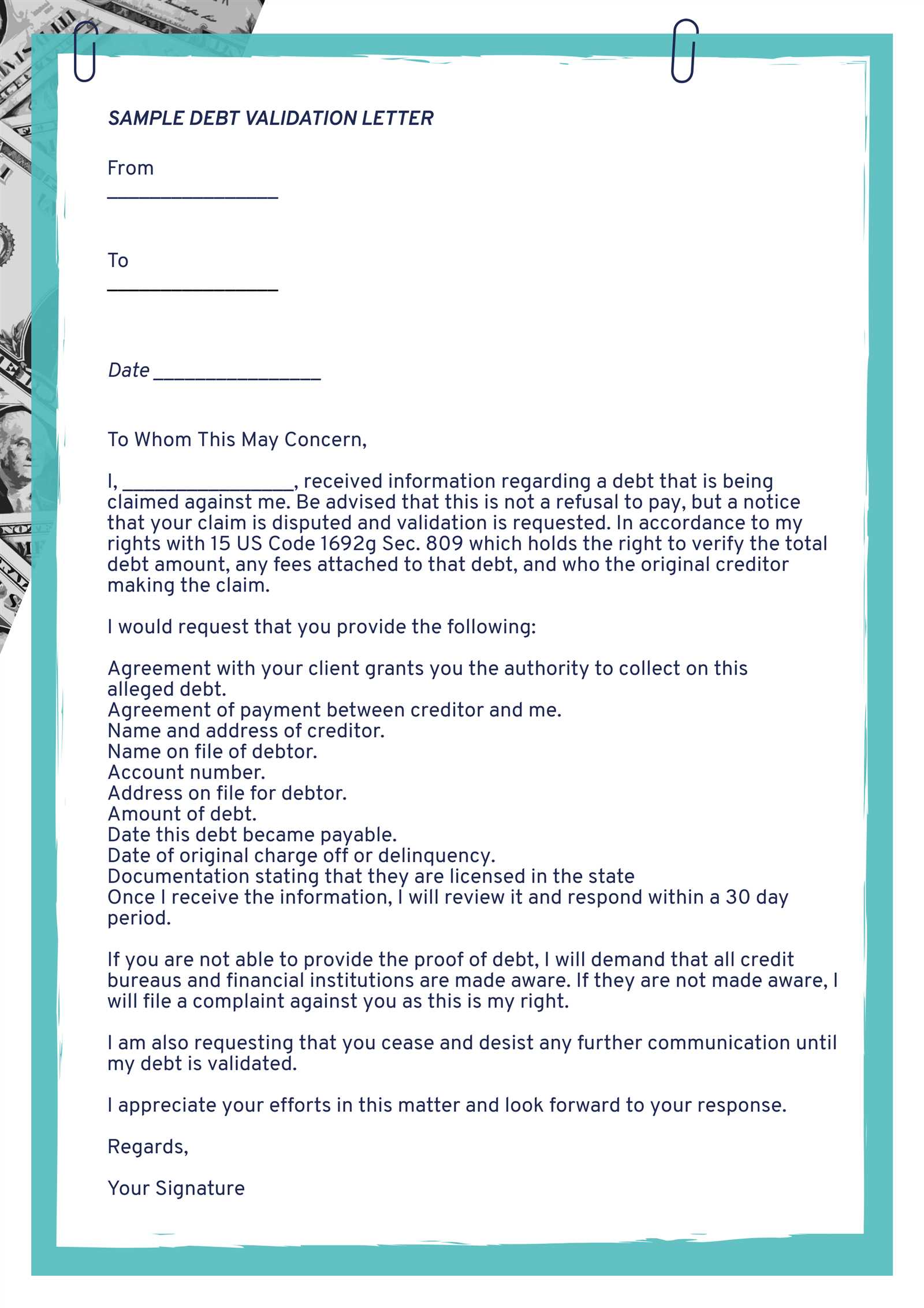

Start by addressing the collector, clearly stating that you dispute the debt, and ask for specific information to verify its authenticity. Include details like the amount owed, the creditor’s name, and any other relevant information you need to validate. The law requires them to provide proof that you owe the debt, so be specific about what documentation you need.

Here’s a basic outline to follow: Your full name and contact information, Debt collector’s name and contact information, and a formal request for proof of the debt. Be firm, yet professional in your wording. If they cannot validate the debt, they cannot legally continue to pursue collection efforts.

Ensure you send the letter through a trackable method and keep copies of everything. If the collector does not respond or fails to provide the required documents, you may have grounds to dispute the debt or request its removal from your credit report.

Here is the corrected version of the text:

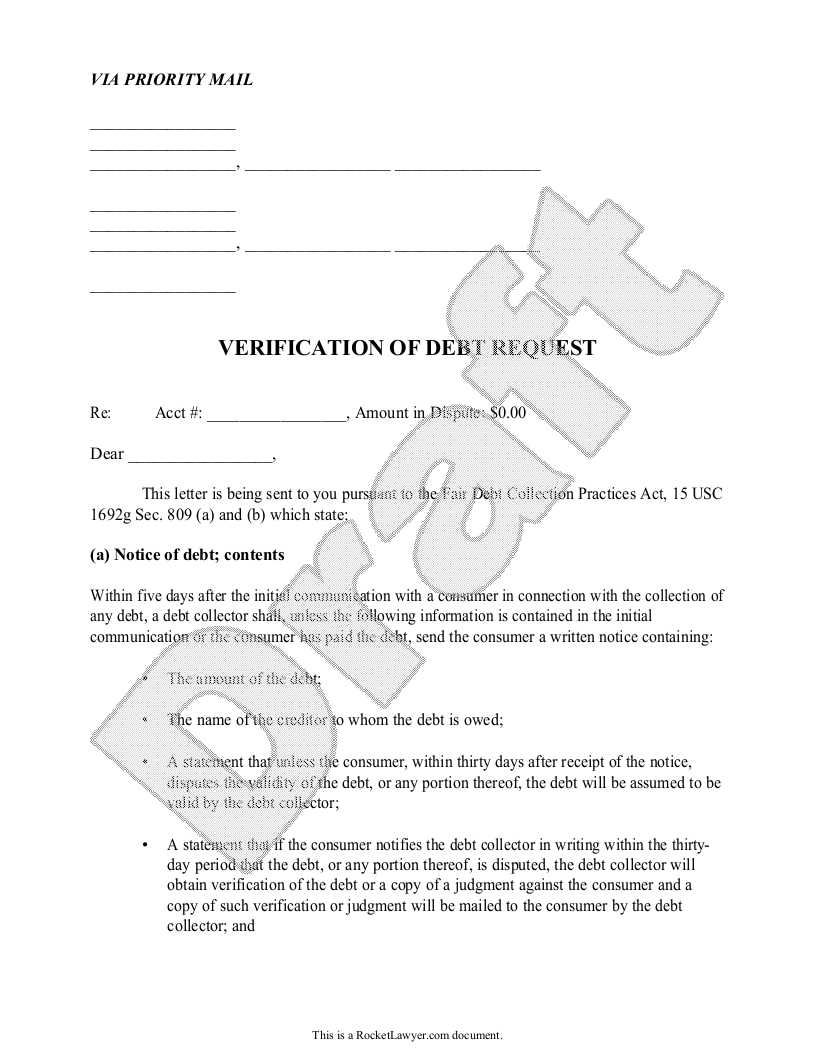

Make sure to address the debt validation letter to the correct creditor. Start by stating that you are requesting validation of the debt under the Fair Debt Collection Practices Act (FDCPA). Clearly state your full name, address, and any account numbers associated with the debt. This helps the creditor identify the account in question quickly.

Next, ask for detailed information about the debt. Request a copy of the original agreement and a breakdown of the balance, including any fees or interest that have been added. This will ensure transparency and help you verify whether the amount being claimed is accurate.

Don’t forget to request proof that the debt is yours. Ask for documentation that shows you are the person responsible for the debt, as well as evidence that the creditor has the right to collect it. If the debt has been sold or transferred, ask for documentation of the transfer as well.

Lastly, include a line stating that if the debt cannot be validated, you expect the creditor to cease collection efforts and remove any negative marks from your credit report. This step is important for your protection in case the debt is inaccurate or unverifiable.

Debt Validation Letter Template 2023

How to Start Your Validation Letter

Key Information to Include in Your Debt Letter

Common Mistakes to Avoid When Writing a Debt Letter

Legal Requirements for Debt Validation in 2023

How to Address Discrepancies in the Validation Process

What to Do After Sending Your Letter

Begin your debt validation letter by addressing the collector directly. Include your name, address, and the date you are writing. This establishes clear communication and creates a record of your request. Make sure to use the correct name of the creditor or collection agency. Be specific about your request for validation of the debt.

Key Information to Include in Your Debt Letter

Include the following details in your letter:

- Your full name and address

- The name of the creditor or collection agency

- A reference number (if applicable)

- Details of the debt in question (amount, dates, and any supporting information)

- A request for verification and documentation of the debt

Common Mistakes to Avoid When Writing a Debt Letter

Avoid vague language or general requests. Do not admit to the debt or make any promises of payment. Do not send payment with your letter; it can be misinterpreted. Refrain from using harsh language, which may harm the potential for resolution. Make sure your request is clear and professional to prevent delays.

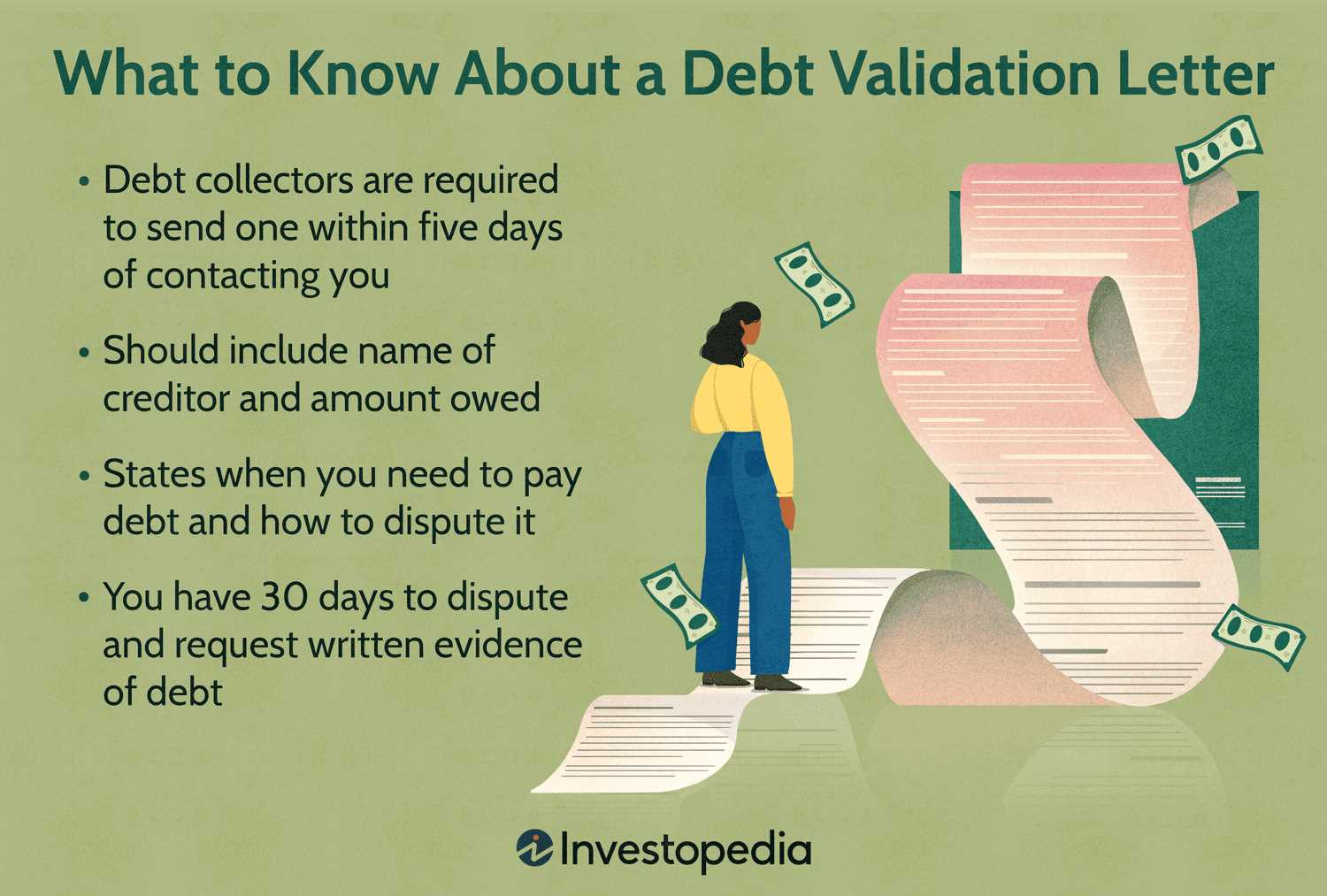

Under the Fair Debt Collection Practices Act (FDCPA), creditors must provide verification within 30 days. If they fail to respond or provide incorrect information, you can dispute the debt. The law requires them to cease collection until they provide evidence of the debt.

If discrepancies arise during the validation process, immediately request written clarification. Cross-check the information they provide with your records. If the debt is not verified properly, you have the right to dispute it with credit bureaus.

Once your letter is sent, keep copies of all communication. Monitor for responses. If you do not receive validation within the required time frame, you may need to take further steps, such as contacting a consumer protection agency or seeking legal advice.