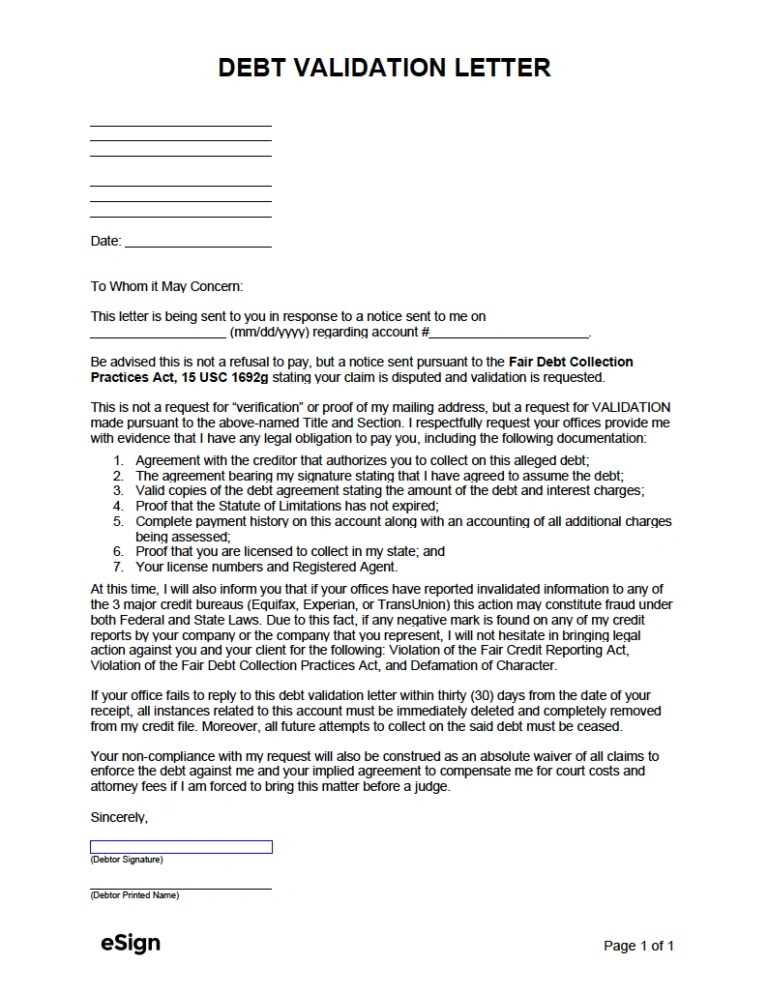

Debt Validation Letter Template to Dispute Debt Claims

When you are confronted with an unfamiliar or disputed financial claim, it’s essential to formally request proof that the debt is legitimate. This process is a critical step to ensure your rights are protected and to prevent any false charges from affecting your financial standing. Understanding how to initiate this request can be crucial in resolving such matters quickly and effectively.

Key Information to Include in Your Request

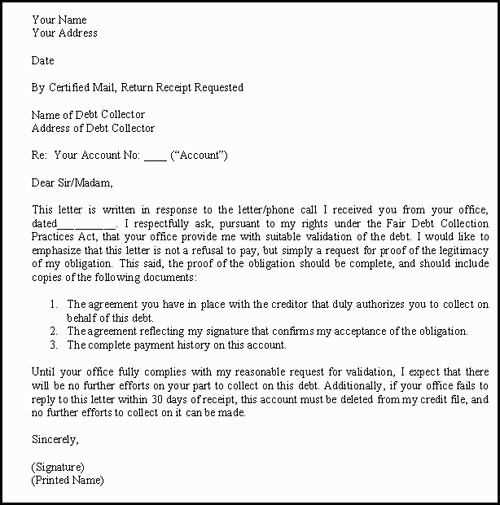

When disputing an incorrect or questionable claim, your communication should be clear and specific. Include the following details:

- Identification Details: Ensure your full name, address, and any relevant account numbers are provided.

- Claim Information: Reference the specific financial obligation you’re questioning.

- Clear Request for Documentation: Ask for verification that the amount and the original creditor are correct.

What to Avoid in Your Request

While writing your request, avoid common pitfalls. Do not:

- Include unnecessary personal information.

- Threaten legal action unless you’re prepared to follow through.

- Accept vague or incomplete responses without requesting full proof.

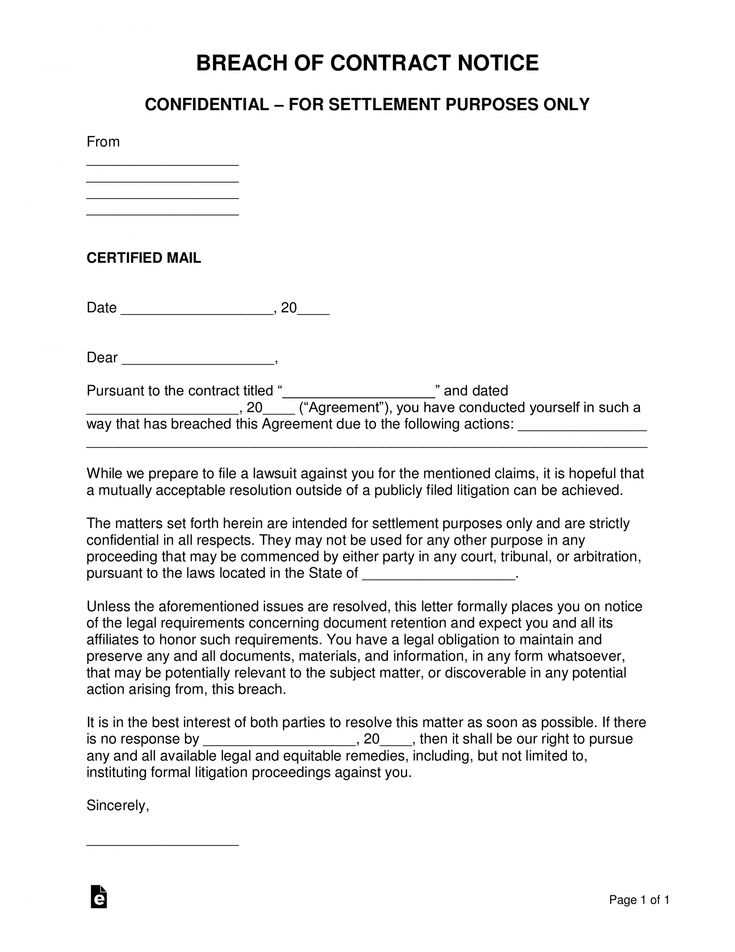

Sending Your Dispute Officially

Once you’ve drafted your communication, send it to the appropriate party. Consider using certified mail or another trackable service to ensure receipt. Keep a copy for your records in case further action is required.

What to Do Next

After sending your request, you must monitor the response. If the creditor fails to provide proof within the required time frame, they are not legally entitled to continue pursuing the claim. If you receive satisfactory documentation, review it thoroughly to verify that it aligns with your records.

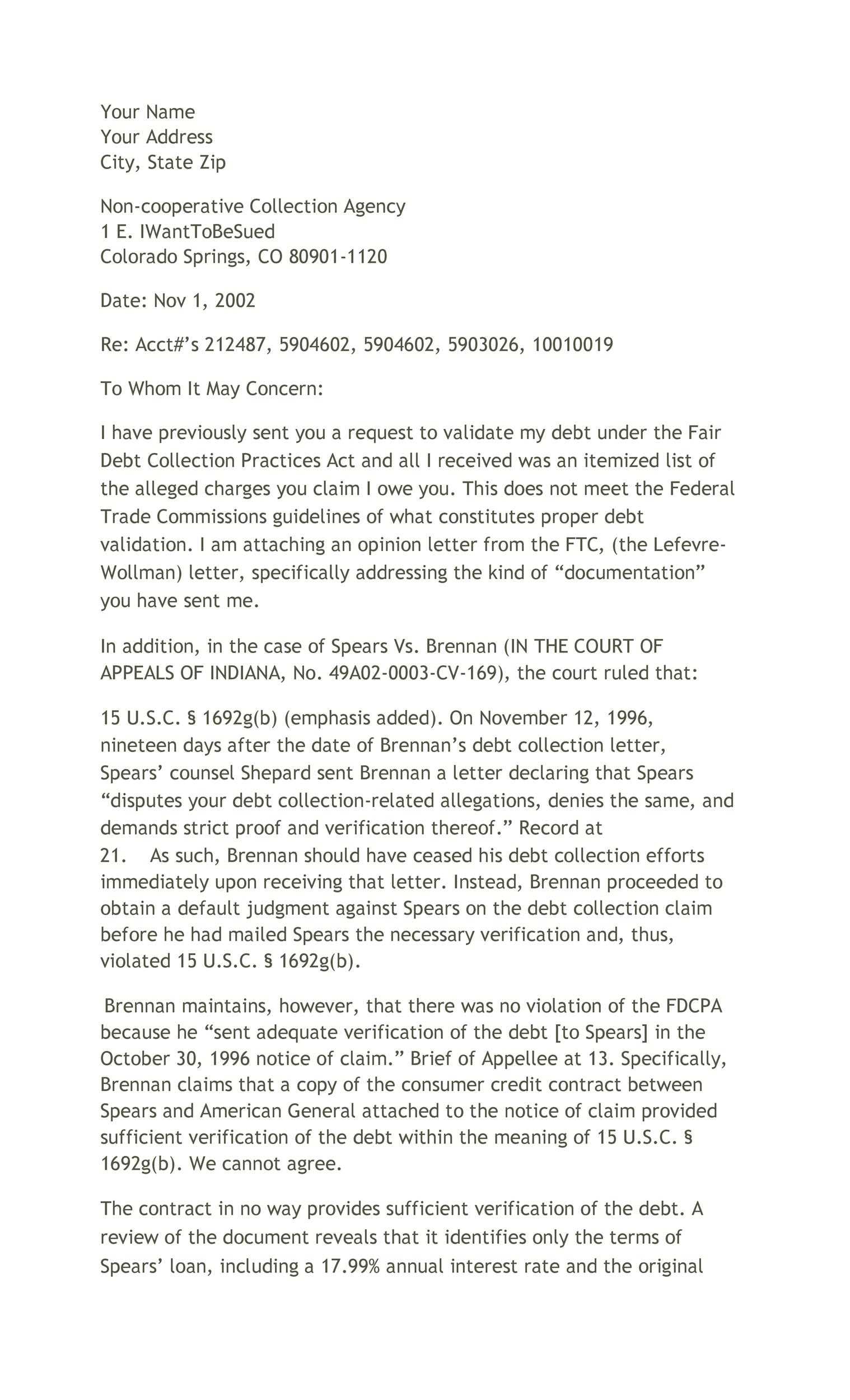

Understanding Financial Dispute Resolution and Its Importance

When facing an unclear or disputed financial charge, it is essential to request proper verification of the claim’s legitimacy. This process ensures that you are not held accountable for an error and protects your rights from unfair practices. The importance of this action cannot be overstated, as it allows you to maintain control over your finances while preventing undue stress.

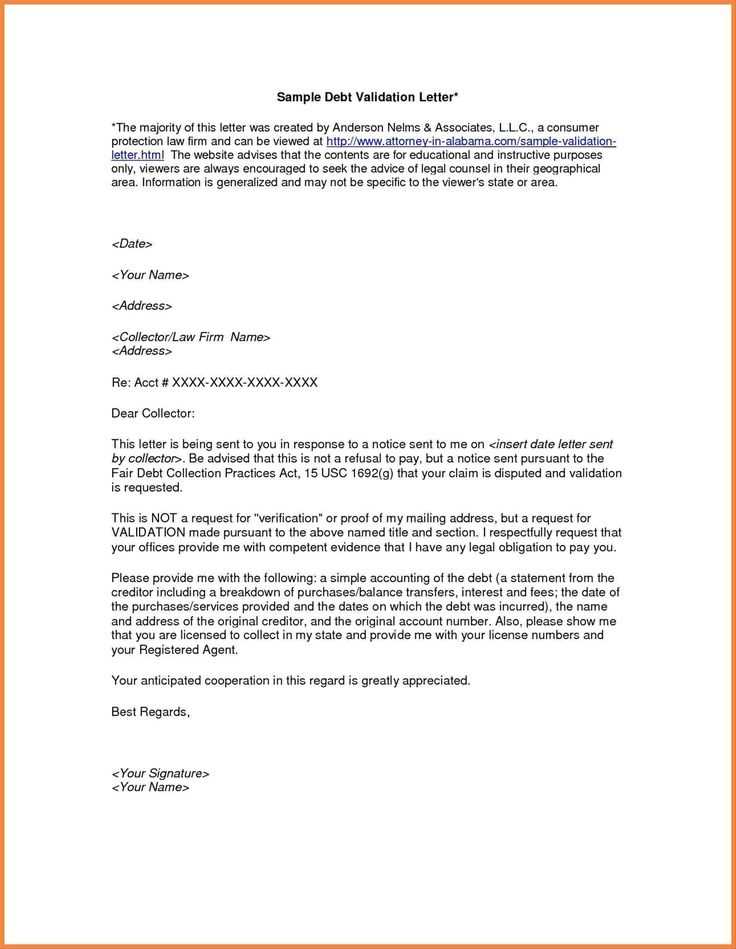

Knowing how to craft a formal inquiry for such verification is crucial. It’s vital that your request is concise and direct, providing clear instructions for the recipient to supply proof of the charge in question. Doing so helps you avoid misunderstandings and legal complications down the line.

Key Information to Include in Your Request

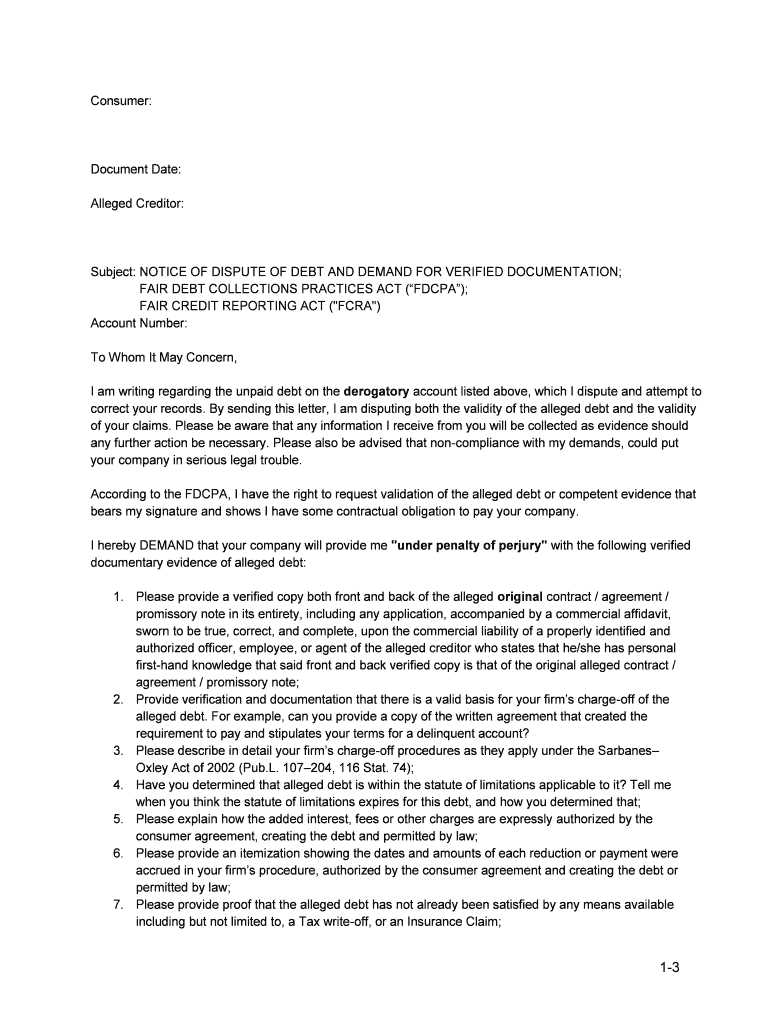

To make your request effective, make sure to include the following details:

- Your full name and address to identify yourself clearly.

- Any account numbers, reference numbers, or specific charge identifiers.

- A request for the original creditor’s name, the total amount due, and supporting documentation.

Common Errors to Avoid in Financial Disputes

When making an official inquiry, avoid these common mistakes:

- Providing excessive personal information not directly related to the dispute.

- Making threats or assumptions about the outcome before you have received adequate proof.

- Ignoring incomplete or vague responses without asking for additional details.

Legal Rights When Challenging Financial Claims

As a consumer, you have the right to question any charge that you believe is incorrect. The law requires creditors to respond with evidence within a specific time frame. If they fail to do so, they are prohibited from pursuing the claim further.

Tips for Sending Your Inquiry

Ensure that your communication is sent via a method that confirms receipt, such as certified mail. Keep a copy of your request and any correspondence for future reference. This will be important in case you need to escalate the matter.

What to Do After Sending the Request

Once your request is sent, monitor the response carefully. If the creditor does not provide sufficient evidence, they are no longer authorized to pursue the charge. On the other hand, if you receive adequate documentation, review it thoroughly and cross-check with your own records to confirm its accuracy.