Deed in lieu of foreclosure letter template

If you’re considering a deed in lieu of foreclosure, creating the right letter is a key step. This document should clearly outline your intent to voluntarily transfer property to the lender to avoid foreclosure. It needs to be direct and free from ambiguity, as this will set the stage for a smooth process. Avoid including unnecessary details or emotions–stick to the facts and keep it concise.

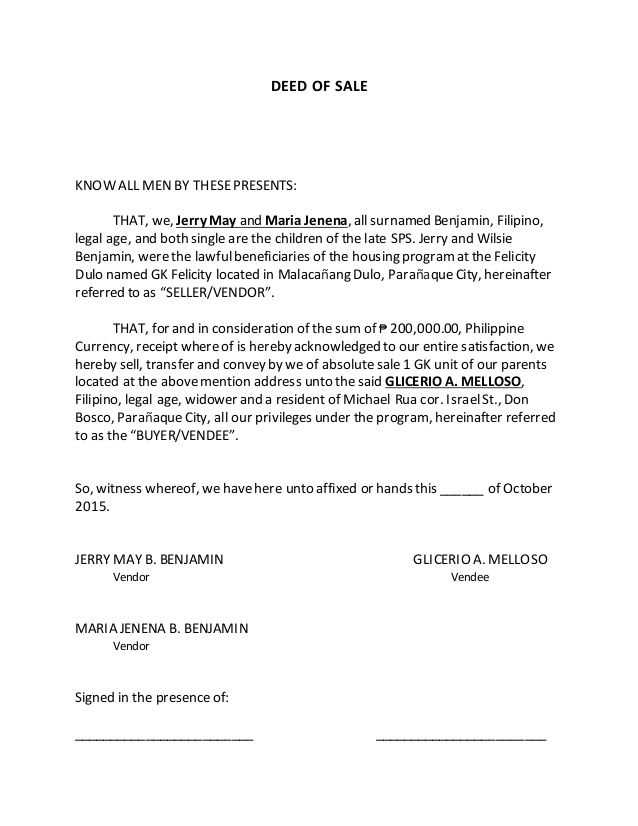

First and foremost, ensure the letter includes the necessary property details such as the address and your contact information. Mention the loan number and other identifying information the lender might require to recognize the property and loan. Clearly state that you are offering the deed in lieu of foreclosure and specify any agreements you’ve reached with the lender regarding the property’s condition or other terms.

Be sure to express your understanding of the lender’s rights and your willingness to cooperate. Showing transparency about your situation can help maintain a professional tone and foster a cooperative attitude. Ensure that the lender knows you’re ready to complete the necessary steps for transfer and clear any remaining balances as part of the deed’s conditions.

Here is the modified version:

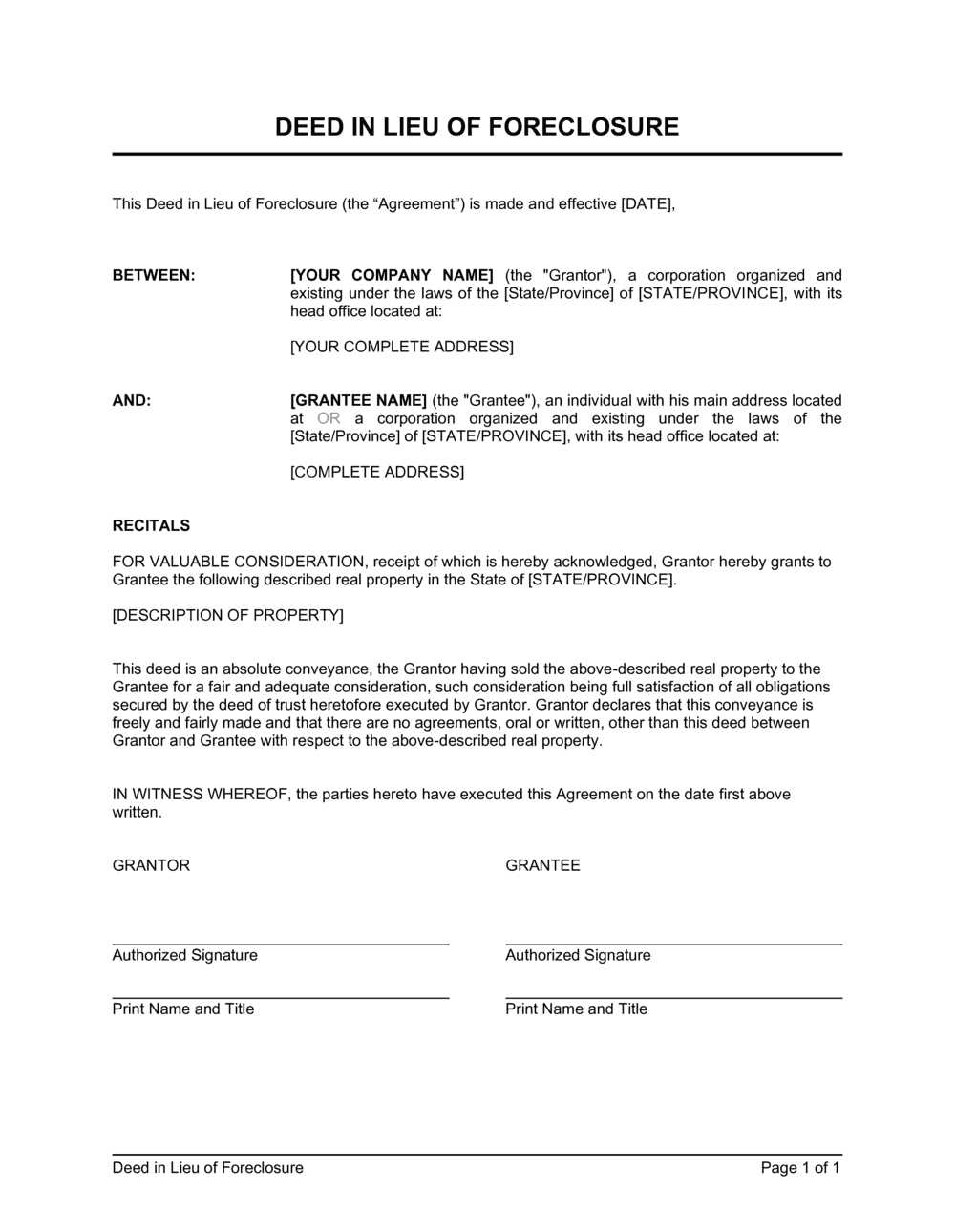

When using a deed in lieu of foreclosure, it’s important to create a formal agreement that outlines the transfer of ownership from the homeowner to the lender. The letter should include specific details that confirm the voluntary transfer of the property and clear any obligations that remain for the homeowner.

Key Points to Include:

- Property Details: Clearly state the address of the property being transferred.

- Borrower Information: Include the borrower’s full name, contact details, and loan account number.

- Lender’s Confirmation: Specify the lender’s acknowledgment of receiving the property in full satisfaction of the loan.

- Statement of Condition: Include a clause confirming the property is being transferred in its current condition, without further claims or warranties.

- Waiver of Deficiency: Mention that the lender will not pursue further payments or legal action for any remaining loan balance after the transfer.

This letter should be signed by both parties, and copies should be kept for future reference. Ensuring that the terms are clear will prevent future confusion and legal issues for both parties.

- Deed in Lieu of Foreclosure Letter Template

Start with a clear subject line to ensure the recipient understands the purpose of the letter immediately. Begin the letter by stating your full name, address, and account information related to the property. Follow up by explaining your intent to transfer the deed back to the lender to avoid foreclosure. This should include a clear statement that you are offering the deed in lieu of foreclosure to settle the mortgage.

Clearly outline the reason for the deed in lieu request, whether due to financial hardship, job loss, or other circumstances. Be concise but direct in explaining your current situation. Make sure to express your willingness to cooperate with the lender throughout the process.

Provide a date by which you plan to complete the deed transfer, if applicable. This helps the lender know the expected timeline for the action. If needed, you can offer additional documentation or details to support your request, such as financial statements or proof of hardship.

Conclude by requesting a formal acknowledgment of the offer and a clear response. Mention any expectations for further communication and how you prefer to be contacted.

- Subject line: “Offer of Deed in Lieu of Foreclosure for [Your Property Address]”

- Your full name, property address, and mortgage details

- A brief explanation of your financial situation

- Clear statement of your intention to offer the deed in lieu of foreclosure

- A date for completing the deed transfer

- Request for a formal acknowledgment from the lender

Ensure the tone is professional, polite, and direct throughout the letter. Review all details carefully before sending to avoid any misunderstandings or delays.

A deed in lieu of foreclosure letter serves a critical role in a foreclosure process. It acts as a formal agreement between a borrower and lender, allowing the borrower to transfer the property title back to the lender in exchange for the cancellation of the mortgage debt. This method avoids a lengthy and costly foreclosure proceeding. Both parties benefit: the lender avoids the process of foreclosing on the property, and the borrower can resolve the financial distress without further legal complications.

Key Legal Benefits

- Prevents foreclosure on the borrower’s record, avoiding a severe impact on credit.

- Allows the lender to take possession of the property more efficiently and with less cost compared to foreclosure proceedings.

- Potential for debt forgiveness in certain cases, depending on the negotiated terms.

When It’s Used

Borrowers who can no longer afford their mortgage payments but wish to avoid a full foreclosure may choose this option. It provides a quicker resolution, often seen as less damaging than a foreclosure. The deed in lieu letter essentially releases the borrower from further obligations related to the property.

Provide a clear statement of intent. Indicate that you are offering a deed in lieu of foreclosure as a solution to avoid foreclosure proceedings.

Property Details

Clearly identify the property involved. Include the address and any relevant details such as the property’s legal description. This helps ensure there’s no confusion about the property in question.

Loan Information

List the loan number and the lender’s name to help connect the letter with your mortgage account. Include any relevant details like the amount owed, including principal, interest, and any fees that are part of the loan balance.

State your willingness to voluntarily transfer ownership of the property back to the lender. Acknowledge the potential consequences, such as the impact on your credit, and express your desire to resolve the situation amicably.

Lastly, include any other documentation, such as financial hardship details, which may support your offer. This helps provide a fuller picture of your circumstances and the reasoning behind your decision to pursue a deed in lieu of foreclosure.

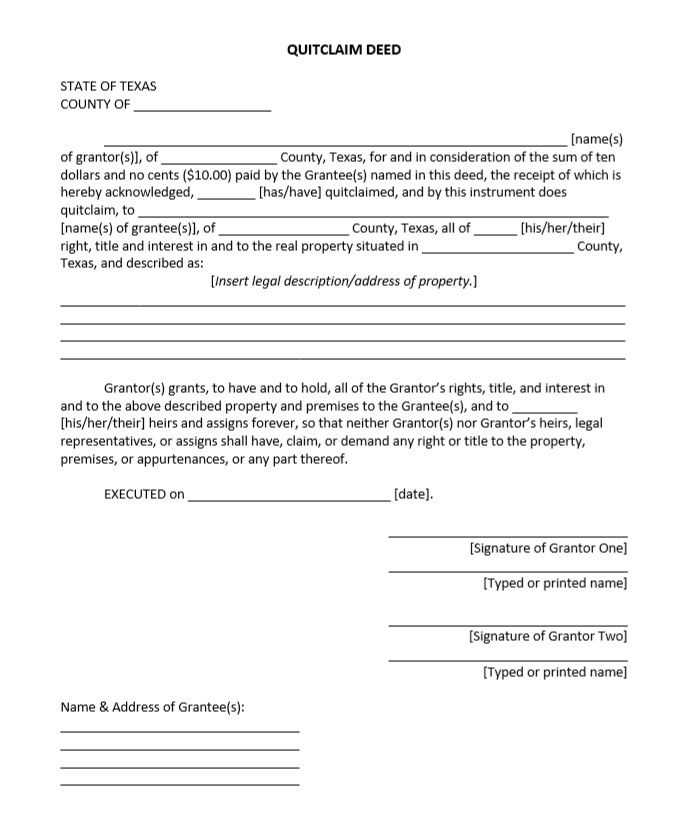

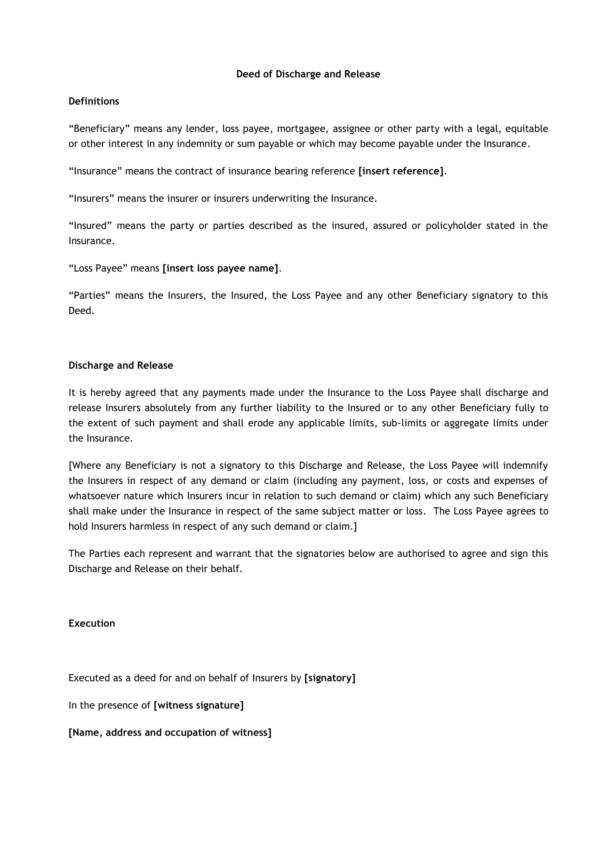

Ensure the document is clear and concise. Ambiguity in the terms can lead to confusion or disputes later on. Define key terms, such as “property transfer” and “consideration,” explicitly within the document.

Don’t skip the full legal description of the property. Including the accurate legal description helps to prevent future misunderstandings regarding which property is being transferred.

Failing to list all outstanding obligations can complicate the process. Be sure to clearly outline any remaining debts, liens, or encumbrances that must be addressed during the transaction.

Missing Signatures or Notary Details

Make sure to include all necessary signatures. Both parties–the borrower and the lender–should sign the document, and having the document notarized is often required to validate the agreement legally.

Not Addressing Potential Tax Implications

Neglecting to consult with a tax professional can result in unexpected tax consequences for both parties. Ensure that any potential tax liabilities or exemptions are discussed and reflected in the agreement.

| Common Mistakes | Consequences |

|---|---|

| Ambiguous terms | Confusion or disputes over the agreement |

| Missing legal description | Misunderstandings over property ownership |

| Omitting obligations | Unclear debt resolution |

| Missing signatures/notary | Invalid agreement |

| Ignoring tax implications | Unexpected tax burdens |

Focus on providing clear, concise details in your letter. Lenders appreciate straightforward communication that directly addresses their concerns. Start by specifying your financial situation, including reasons for the deed in lieu request. Highlight any extenuating circumstances that led to your inability to continue with the mortgage. This context helps lenders understand your position.

Be Transparent About Your Financial Status

Provide an accurate snapshot of your current financial situation. Share income details, outstanding debts, and any recent financial hardships. Including supporting documents, such as tax returns or pay stubs, can reinforce your case and demonstrate that you’re being open about your finances.

Explain Your Attempt to Find Alternatives

Outline the steps you’ve taken to explore alternatives to foreclosure, such as loan modifications or selling the property. Lenders want to know that you’ve exhausted all possible options before requesting a deed in lieu. This shows you’re proactive and committed to resolving the situation.

| Step | Action | Supporting Document |

|---|---|---|

| Financial Disclosure | Detail your income, expenses, and debts | Tax returns, bank statements |

| Alternative Solutions | Explain attempts to modify loan or sell | Loan modification requests, sale agreements |

| Deed in Lieu Request | Clearly request the deed in lieu option | Signed letter, additional documentation as needed |

Tailoring your letter means demonstrating both your commitment to resolving the issue and your willingness to work with the lender. Personalizing the request with accurate details can make a significant difference in their decision-making process.

Failing to draft a deed in lieu of foreclosure correctly can lead to significant legal and financial issues. Without precise wording, the document may not fully release the borrower from their obligations, causing them to remain liable for the remaining balance. This can result in further financial strain, including continued collection efforts or even lawsuits.

Legal Ambiguities

Incorrectly drafted documents can create legal ambiguities, complicating the process of transferring the property back to the lender. Such errors may lead to disputes about the ownership of the property, leaving both parties at risk of prolonged litigation and additional costs. The lender could face difficulties in selling the property, while the borrower could be left facing unwanted legal battles.

Impact on Credit Score

If the deed is not correctly executed, it may not be recognized as a valid settlement of the debt, and the borrower’s credit score may not improve as expected. This could lead to prolonged damage to their credit rating, affecting future financial opportunities such as loans or housing applications.

In short, failing to properly draft a deed in lieu of foreclosure can leave both parties exposed to legal, financial, and credit-related challenges. Always consult a qualified professional to ensure the document is correctly prepared and executed.

Once you submit the deed in lieu of foreclosure document, the lender will review the agreement to confirm all requirements are met. Expect them to assess your financial situation and the condition of the property. If everything is in order, they will begin processing the deed transfer.

Next, you may need to move out of the property, as the lender will take possession. They will provide instructions regarding the timeline for vacating and the process for returning the keys. Be sure to follow these instructions carefully to avoid delays in the process.

Once you vacate the property and complete any necessary steps, the lender will finalize the deed transfer. You should receive confirmation from them, typically in the form of a written notice, indicating the completion of the process.

If applicable, check your credit report after the deed transfer is finalized. While it will reflect a negative mark, it should not be as severe as a foreclosure. You can also inquire about any potential tax implications related to the deed in lieu and whether you might owe taxes on the forgiven debt.

Let me know if you need further adjustments!

If you’re considering a deed in lieu of foreclosure, take the time to carefully review your situation with a legal expert or financial advisor. They can help you understand the full impact of such an agreement. Ensure that all terms are clear before signing any documents.

Key Details to Include

Your letter should outline the property’s address, the lender’s name, and the fact that you are offering the deed in lieu of foreclosure. Be sure to confirm the amount of debt being forgiven and whether you’re required to pay any deficiency balance after the deed is transferred.

Next Steps

Once you’ve completed the letter, make sure to send it to the correct department at the lender’s office. Keep a copy for your records. After that, follow up to confirm receipt and to discuss any additional actions required to finalize the process.