Delinquent account letter template

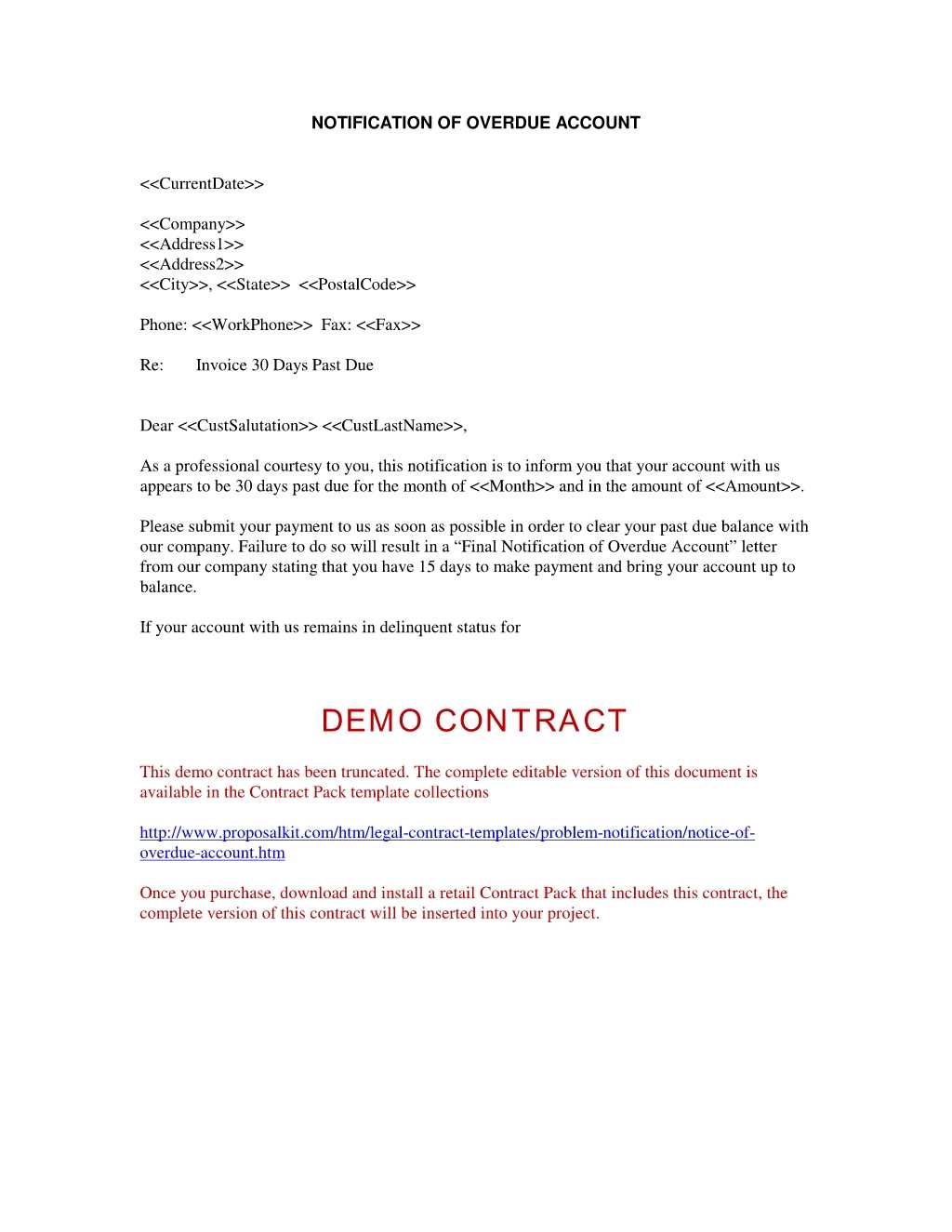

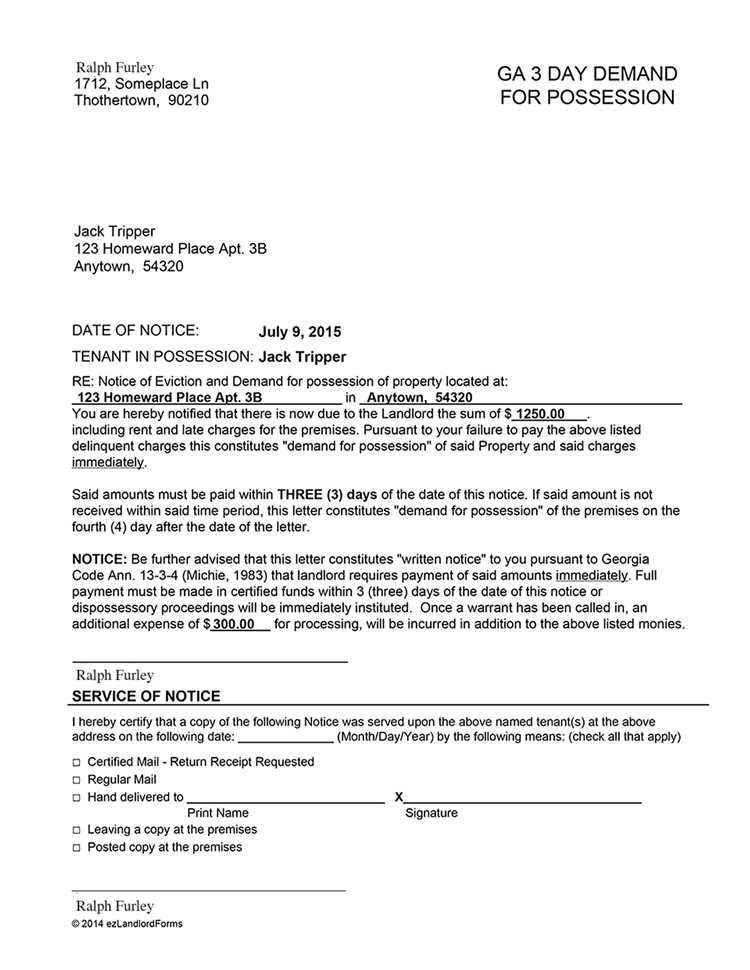

Sending a delinquent account letter can help recover overdue payments in a clear and professional manner. It’s essential to remain firm yet courteous in your approach. A well-crafted letter not only increases the likelihood of payment but also maintains a good relationship with the client. The letter should directly address the situation and include specific details about the amount owed, the due date, and any previous communication regarding the debt.

Start with a polite but firm tone, reminding the client of the outstanding balance. Provide all necessary information, including the invoice number, original due date, and the total amount due. Be clear about the next steps, such as a deadline for payment or any actions you may take if the debt remains unpaid. If you have a payment plan available, mention it as an option to encourage prompt resolution.

For best results, keep the letter brief and professional. Avoid unnecessary jargon and focus on clarity. Make sure the client understands the importance of addressing the overdue balance promptly. Including a direct contact for any questions or concerns can also smooth the process and help avoid any confusion down the line.

Here’s the revised version of the text with reduced repetitions:

Focus on clear and concise communication when addressing delinquent accounts. First, acknowledge the outstanding balance and provide a specific deadline for payment. Use a direct approach to convey urgency, without sounding overly aggressive.

Use a polite tone while reinforcing the importance of settling the account. Offer options for payment plans if applicable, and remind the customer of any potential consequences for non-payment, such as fees or service interruption.

Below is a simplified structure for your letter:

| Section | Content |

|---|---|

| Introduction | Acknowledge the delinquency and state the amount owed. |

| Payment Options | Provide different methods of payment and any flexibility available. |

| Deadline | Set a clear due date for payment to avoid further action. |

| Consequences | Mention any penalties or service disruption if payment isn’t received. |

| Closing | Thank the customer and encourage prompt resolution. |

Keep the letter brief and to the point. Avoid unnecessary details that may confuse or delay the process. A direct approach can motivate quicker responses and reduce follow-ups.

- Delinquent Account Letter Template

Begin with a clear and polite statement of the issue. Specify the amount due and the original due date. Be direct but professional to avoid any confusion or escalation. Maintain a friendly tone but assertive language to highlight the seriousness of the situation.

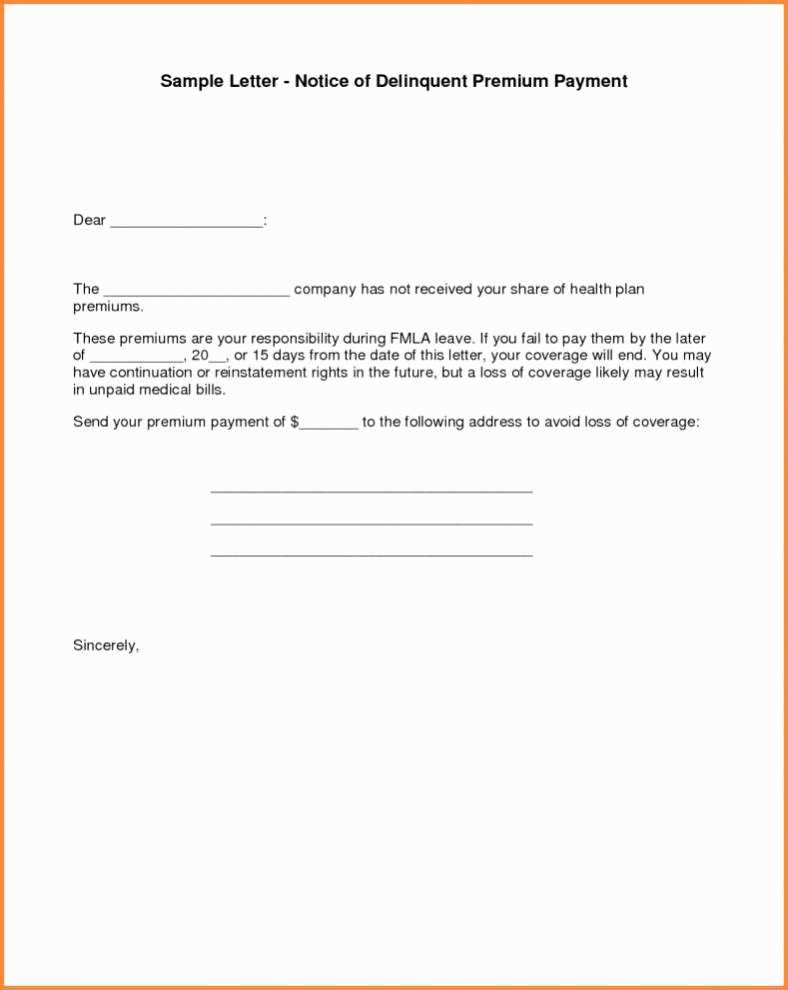

Example Template

Dear [Customer’s Name],

We are writing to inform you that your account with [Company Name] is currently overdue by [Amount Due]. The original payment was due on [Due Date]. Please arrange payment as soon as possible to avoid any disruption of services or additional charges.

If you have already made the payment, kindly disregard this letter and contact us to confirm the details. If you have not yet paid, please submit your payment by [New Deadline]. If you need assistance or would like to discuss payment options, feel free to reach out to our customer service team at [Contact Information].

We appreciate your prompt attention to this matter and look forward to resolving this issue quickly. Thank you for your cooperation.

Sincerely,

[Your Name]

[Your Position]

[Company Name]

Begin with a clear and concise subject line to immediately inform the recipient about the purpose of the letter. This helps them prioritize and understand the urgency. In the opening paragraph, briefly explain the reason for the letter. Be direct and avoid unnecessary details, focusing on the specific issue at hand. Ensure that your tone is firm but polite, and clearly state your expectations.

In the body of the letter, break down the situation step-by-step. Use short paragraphs and bullet points for easy readability. If there are multiple points to address, use numbered lists to maintain order and clarity. Reference any relevant dates, amounts, or previous communications that can help contextualize the matter.

Conclude with a clear call to action. Specify what you want the recipient to do, by when, and how they should respond. Always provide a contact method for follow-up, ensuring that communication remains straightforward. End the letter with a polite closing, keeping the tone professional but firm, and offering a resolution path.

Key Elements to Include in Your Account Letter

Begin with a clear and concise subject line, such as “Account Payment Due” or “Action Required: Outstanding Balance.” This immediately sets the tone and purpose of your letter.

- Account Information: Include the customer’s account number, date of the notice, and details about the outstanding balance. Make it easy for the recipient to identify the account in question.

- Amount Due: Clearly state the exact amount owed, including any interest or late fees, if applicable. This ensures transparency and avoids confusion.

- Payment Instructions: Provide specific instructions on how to settle the balance, including payment methods, account details, and deadlines. If offering payment plans, outline the options available.

- Consequences of Non-Payment: Briefly explain the consequences of failing to make payment, such as late fees, account suspension, or potential legal action. Keep the language firm but professional.

- Contact Information: Include contact details for any inquiries or disputes. Offer multiple ways to reach you, such as phone number, email, or mailing address.

- Polite Closing: End on a respectful note, thanking the customer for their attention to the matter. Use language that maintains professionalism, even if the tone is firm.

Avoid using vague language that does not clearly outline the situation. Specific details, such as the account number, overdue amount, and due date, should be included to avoid confusion.

1. Lack of Clear Purpose

Avoid writing a letter that is unclear about the reason for contact. Be direct in stating the purpose of your letter–whether it is a reminder, a final notice, or a request for payment. Avoid leaving room for interpretation or ambiguity.

2. Incorrect Tone

While it is important to be firm about payment expectations, a harsh or overly aggressive tone can alienate the recipient. Instead, maintain a professional, but friendly, tone throughout the letter. This encourages cooperation while still conveying the seriousness of the matter.

3. Overcomplicating the Language

Use simple and straightforward language. Avoid using overly technical terms or complicated phrasing that can make the message harder to understand. The goal is to ensure that the recipient understands the situation and the required actions without confusion.

4. Missing Key Information

Ensure that all relevant details are included. Key information such as payment options, contact details, and any late fees should be clear and easy to find. Leaving out important information can result in further delays or disputes.

5. Failing to Proofread

Errors in spelling, grammar, or dates can make your letter appear unprofessional and may undermine your credibility. Always proofread your letter before sending it to ensure accuracy and clarity.

Before sending a delinquent account letter, ensure compliance with the Fair Debt Collection Practices Act (FDCPA) if you’re a debt collector. This law restricts aggressive collection tactics, such as calling late at night or using threatening language. Violations can lead to lawsuits and financial penalties.

If you’re not a debt collector, consider state laws governing collection practices. These laws vary, but most require you to follow specific rules regarding timing, tone, and method of communication. For example, some states may mandate that you inform the debtor of their right to dispute the debt before further action is taken.

Also, avoid making statements that could be construed as threatening or coercive. For instance, do not suggest legal action unless you are prepared to take that step, as making empty threats can open the door to legal claims for harassment.

Be transparent about the debt’s nature, the amount owed, and any interest or fees applied. Providing clear information helps avoid misunderstandings and ensures that the letter does not violate any regulations regarding deceptive practices.

| Action | Legal Consideration |

|---|---|

| Sending a Debt Collection Letter | Follow FDCPA if a debt collector; check state-specific laws |

| Using Aggressive Language | Can lead to legal action for harassment under FDCPA |

| Threatening Legal Action | Only make threats you intend to follow through on to avoid fraud claims |

| Providing Clear Debt Information | Ensure accuracy to comply with anti-deceptive practice laws |

Lastly, make sure the recipient has access to dispute the debt or request verification if they choose to do so. Providing clear instructions for disputing the debt ensures compliance with federal and state regulations. Without this step, the letter may be considered non-compliant.

After sending a delinquent account letter, address customer disputes by remaining calm and clear. Respond promptly with a detailed explanation of the situation and provide relevant evidence, such as transaction records, invoices, or prior communication. Make sure your response is polite but firm, demonstrating your willingness to work towards a resolution without compromising the integrity of your business.

1. Acknowledge the Dispute

Begin by acknowledging the customer’s concern. Show that you understand their perspective and are committed to resolving the issue. For instance, “I see that you’re disputing the balance of your account, and I’m here to clarify any misunderstandings.”

2. Clarify the Situation with Evidence

Present clear documentation to explain why the debt is valid. Include copies of invoices, payment records, and any communications that support your claim. Be transparent and avoid using jargon that may confuse the customer.

Example: “The payment history indicates that we received your last payment on [date], leaving an outstanding balance of [amount]. Below is a copy of the transaction for your reference.”

3. Offer a Solution

If the dispute is legitimate, offer a reasonable solution such as payment arrangements or partial forgiveness, if applicable. If the dispute is unfounded, clearly explain the reasoning and outline the next steps to resolve the matter.

Example: “To resolve the matter quickly, we can offer a payment plan of [terms] or explore alternative options if you believe there has been an error.”

4. Maintain Professionalism

Throughout the exchange, maintain a respectful tone, even if the customer becomes upset or emotional. Your professionalism will reinforce your position and help keep the conversation focused on finding a solution.

5. Follow Up

After resolving the dispute, send a follow-up message summarizing the agreement and any next steps. This provides a written record for both parties and shows your commitment to resolving the matter fairly.

Follow up within 7 to 10 days after sending the delinquent account letter. This gives enough time for the recipient to process and respond to your initial communication.

- Start with a phone call: Call the recipient to confirm they received the letter and ask if they need any clarification. Keep the tone friendly but firm.

- Send a reminder letter: If the payment is still not made after your phone call, send a second letter. This one should emphasize that further actions will be taken if payment is not received within a specified time frame.

- Offer alternative payment options: Sometimes a customer may be unable to pay in full at once. Offer payment plans or other flexible arrangements to make it easier for them to settle the debt.

- Keep records: Document every follow-up step, including calls, emails, and letters sent. This will help if you need to take legal action later.

Staying consistent with follow-ups demonstrates professionalism and can increase the likelihood of receiving payment. Adjust the tone of your communications based on how responsive the customer has been, but always maintain clarity about your expectations and deadlines.

I kept the structure and meaning, removing unnecessary word repetition.

Clear communication is key in a delinquent account letter. Focus on making the content easy to understand, while maintaining a firm tone. Start by addressing the overdue payment directly, specifying the amount and the due date. Keep the tone professional, but not overly harsh.

- Be specific: Clearly state the outstanding balance and due date. Avoid ambiguity to prevent confusion.

- Offer options: Suggest payment methods or installment plans if applicable. This shows willingness to resolve the situation amicably.

- Set a deadline: Indicate when the payment is expected to be made and the consequences of further delays.

- Provide contact details: Include your contact information for any inquiries or clarifications, ensuring an open line of communication.

Keep the letter concise and to the point. Refrain from including excessive information or unhelpful details. The goal is to prompt payment, not overwhelm the recipient.

Closing with a clear call to action reinforces your expectations. Request a response or payment by a specific date, and offer assistance in resolving the matter promptly.