Direct debit letter template

A direct debit letter serves as a formal notification to request payments directly from a bank account. It’s important to include all necessary details to avoid confusion and ensure timely processing. Start by clearly stating the purpose of the letter and the specific payment amount. Provide your contact details for any inquiries and include your bank account information for seamless transactions.

Key elements to include are the payment schedule, terms, and any instructions on how the recipient should proceed with the direct debit setup. Make sure to request confirmation of the agreement, and remind the recipient to notify you if there are any issues with the payment process.

Formatting tips include a formal tone, clear headings, and concise paragraphs. Avoid unnecessary jargon and keep the language simple to ensure the recipient can easily follow the instructions. Remember to proofread before sending to avoid errors in financial details or contact information.

Here are the revised lines:

Ensure your direct debit letter includes the correct details from the start. Replace vague terms with precise wording to avoid confusion. For example, instead of using “payment amount,” specify the exact sum to be deducted, like “£100 on the 15th of each month.” This helps eliminate misunderstandings.

Clear Payment Instructions

Clearly state the bank account details. Avoid generic phrases such as “Please provide your bank details.” Instead, say “Please provide the following account information: Bank name, Sort code, Account number.” This ensures no ambiguity for the recipient.

Confirmation of Agreement

To confirm the agreement, use direct language. For example, “By signing below, you confirm your authorization for the payments to be made as outlined.” This ensures that both parties understand the terms, avoiding any potential confusion about the direct debit arrangement.

- Direct Debit Letter Template Guide

When drafting a direct debit letter, clarity and precision are key. Begin with a formal greeting, addressing the recipient by name, if possible. Clearly state the purpose of the letter and mention the direct debit arrangement being initiated or confirmed. Ensure the terms of the agreement are explicitly outlined, including the amount, frequency, and due date for the payments.

Key Elements to Include

Include the following details in the letter:

- Recipient’s name and contact details.

- Your name or business name, with relevant contact information.

- Clear explanation of the direct debit setup, specifying the amount, frequency (weekly, monthly, etc.), and due dates.

- Details of the account from which the payments will be deducted, along with the sort code and account number.

- Instructions for the recipient to confirm the setup, including a contact method for any questions.

- Any terms or conditions related to the agreement, such as cancellation procedures or changes to the payment schedule.

Closing the Letter

Finish the letter by thanking the recipient for their cooperation and providing a polite closing. Offer a clear method for the recipient to confirm or dispute the arrangement, and sign the letter to give it a formal touch. Keep the tone respectful and professional throughout the letter.

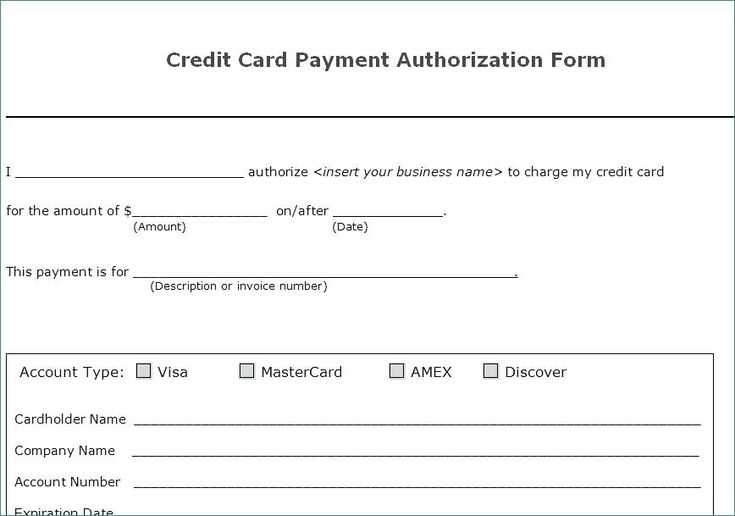

To create a direct debit letter for payment authorization, include clear and concise information that specifies the payment terms. Start with your details (name, address, and contact info) followed by the recipient’s details. Clearly state the purpose of the letter, such as the agreement to authorize recurring payments for a product or service.

Key Components

Include the following elements in the letter:

- Your account details: Mention your bank account number, sort code, and the type of account (e.g., checking or savings).

- Payment amount: State the amount to be debited, as well as the frequency (e.g., monthly or quarterly).

- Start and end dates: Specify when the payments will begin and end (if applicable).

- Authorization statement: Clearly state that you authorize the recipient to deduct payments from your account.

- Signature: End the letter with your signature and the date to confirm authorization.

Sample Direct Debit Letter

Here is a basic template you can customize:

| Section | Details |

|---|---|

| Your Information | John Doe, 123 Main St, City, Email: [email protected] |

| Recipient’s Information | XYZ Company, 456 Business Rd, City |

| Amount | $50 per month |

| Bank Details | Account Number: 12345678, Sort Code: 12-34-56, Bank: ABC Bank |

| Start Date | March 1, 2025 |

| End Date | December 1, 2025 |

| Authorization | I authorize XYZ Company to debit my account as outlined above. |

| Signature | John Doe |

Once you have filled out the details, ensure the letter is signed and sent to the recipient for processing. Double-check that all account information is accurate to avoid errors in payments.

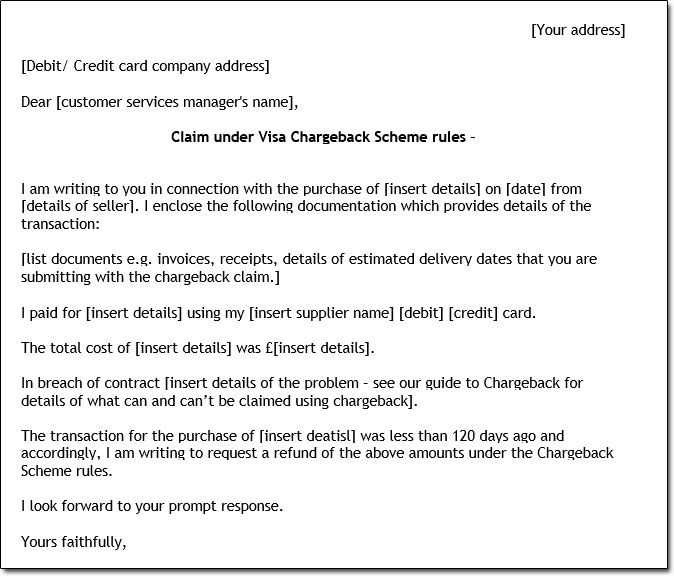

Clearly state the payment amount due. Include both the total and any breakdowns, such as taxes or fees. Specify the due date for the payment to avoid confusion.

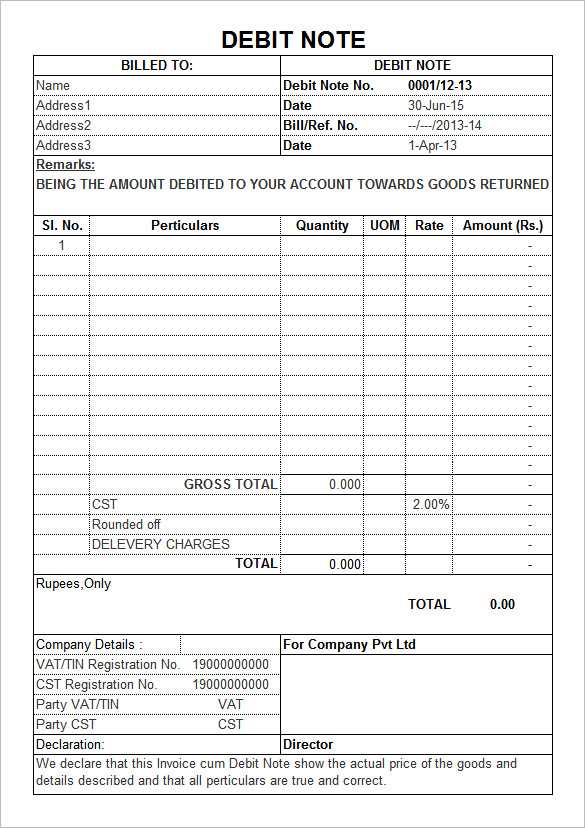

Details of the Transaction

Provide a brief description of the goods or services provided, along with any reference numbers, invoices, or order details. This ensures that the recipient understands what the payment covers.

Payment Methods and Instructions

Clearly outline how the payment can be made. Include bank account details, accepted payment methods, and any other relevant instructions to guide the recipient in completing the payment.

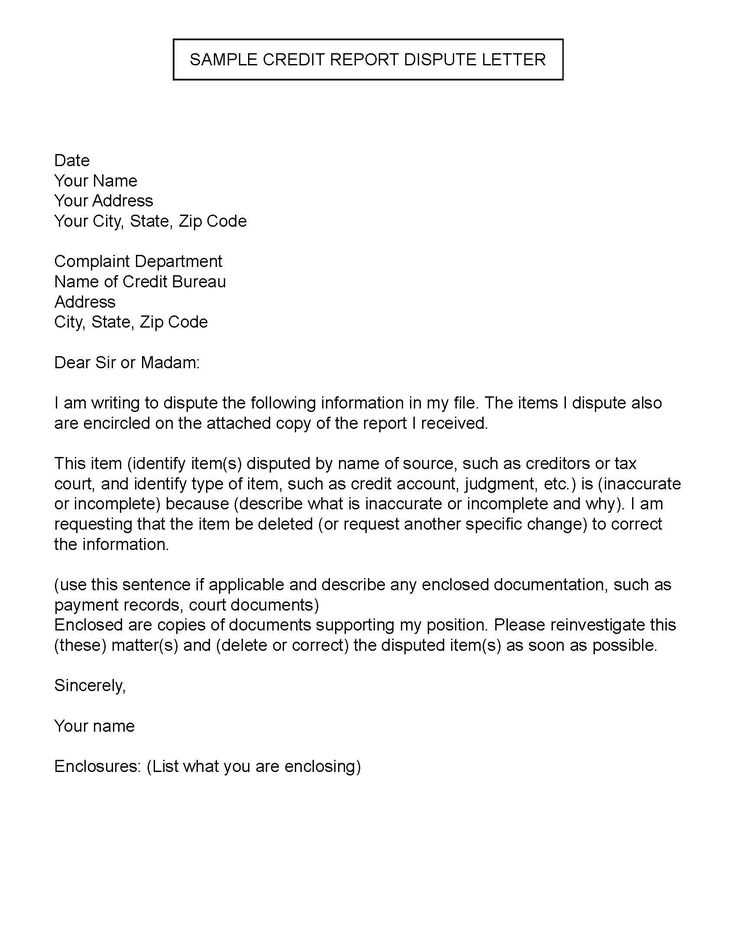

Use a clear and concise subject line, such as “Payment Reminder” or “Invoice Due Notice”. This helps the recipient quickly understand the purpose of your letter. Ensure the layout is simple and organized, with a balanced amount of white space. Start with a polite salutation, such as “Dear [Recipient’s Name]”. Address the matter directly in the opening sentence, specifying the payment amount, due date, and any relevant invoice or reference number.

Align your text to the left for readability, and use a standard, professional font like Arial or Times New Roman, sized between 10 to 12 points. Keep paragraphs short and to the point. Avoid overly long sentences. Ensure that any payment instructions or account details are easily noticeable, possibly using bold text or bullet points to highlight the key information.

For a more polished look, include a formal closing, such as “Sincerely” or “Best regards”, followed by your name, title, and company details. Remember to keep the tone polite and neutral, even if you’re sending a reminder or addressing a late payment.

Ensure you clearly specify the amount to be debited. Avoid vague terms like “approximate” or “up to.” This prevents confusion and potential disputes.

- Incorrect account details: Double-check account numbers and routing information. Any mistakes here could delay processing or lead to the wrong account being charged.

- Missing signatures: Always include both parties’ signatures. Lack of authorization can invalidate the letter.

- Vague payment terms: Clearly define the payment schedule–whether it’s weekly, monthly, or annually. Ambiguous payment frequency can lead to misunderstandings.

- Failure to specify the duration: If the payment authorization is for a limited time, state the start and end dates. Otherwise, the payment might continue indefinitely.

- Omitting cancellation instructions: Always include how either party can cancel or modify the agreement. This protects both parties in case of changes.

By focusing on these key details, you can avoid common pitfalls and ensure that the payment authorization letter serves its intended purpose effectively.

Adjust your letter based on the type of payment you expect. For fixed payments like subscriptions or memberships, clearly state the agreed amount, payment schedule, and due dates. If it’s a one-off payment, specify the total amount due and mention that no further payments will be required after this transaction.

For variable payments, such as utility bills or loans with fluctuating amounts, outline the range of expected payments and note that the amount may vary each period. Include a note indicating how the payment amount will be determined.

- Fixed Payment Types: Mention the set amount and regular payment frequency.

- Variable Payment Types: Explain how the payment may fluctuate and provide a formula or calculation method if necessary.

For payments involving installments or deferred payments, specify the total payment amount, the amount due for each installment, and the due dates. Clarify if there is an interest charge or late fee for missed payments.

Adjusting your letter based on these details ensures your message is clear and concise, reducing confusion and improving response rates.

Ensure the payment authorization letter clearly outlines the agreed terms between both parties. Specify the payment amount, frequency, and method, and include details on how and when the authorization can be revoked. Include a space for both parties to sign and date the letter, confirming their understanding and agreement to the terms outlined.

Confirm the Validity of the Payment Authorization

It’s important to verify that the payment authorization complies with relevant regulations in your jurisdiction. For instance, you may need to ensure the letter meets consumer protection standards and data protection laws, particularly if personal or financial data is being shared.

Clarify Cancellation Terms

Clearly state how the authorization can be canceled. This ensures both parties are aware of the process to withdraw consent, preventing potential misunderstandings or disputes. Make the cancellation process straightforward and easy to execute.

Optimizing the Frequency of “Direct Debit” and “Letter” in Templates

To reduce redundancy in a direct debit request, substitute “Direct Debit” and “Letter” with alternative expressions. For example, instead of repeatedly using “Direct Debit” in the same paragraph, try variations like “payment method” or “automated payment process.” Similarly, replace “Letter” with terms such as “correspondence” or “notice.” This approach maintains clarity while enhancing the flow of the content.

Incorporating these variations ensures that the message remains concise and easy to read, while preventing unnecessary repetition. By using diverse wording, the template becomes more engaging and professional.