Direct deposit letter template

To ensure smooth and timely payments, use a direct deposit letter template when requesting your employer or financial institution to set up direct deposit for your salary or benefits. This document should be clear and concise, outlining the necessary details to complete the process. Below is a sample template that covers key information for an efficient setup.

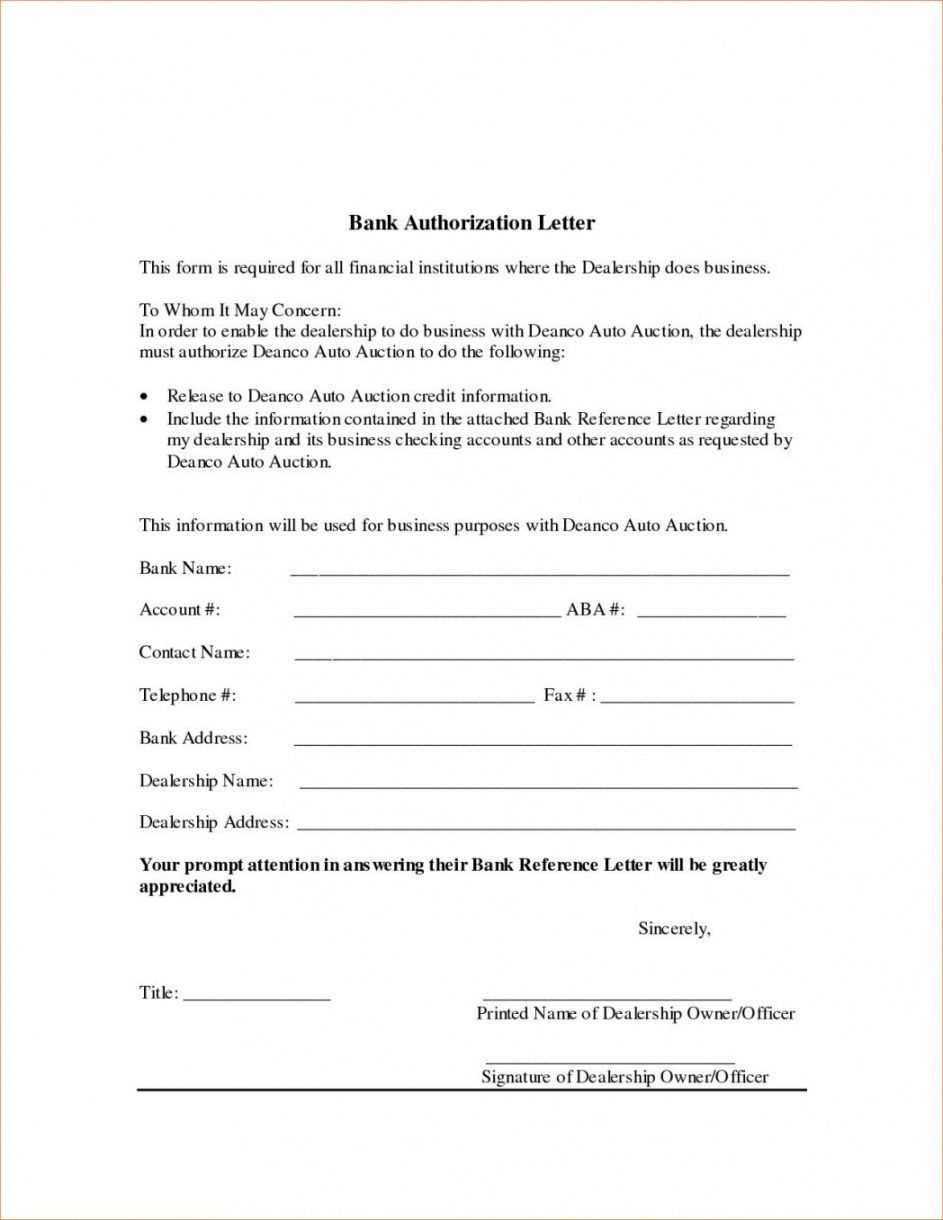

Recipient’s Information: Start by addressing the letter to the appropriate individual or department. Make sure to include their full name, title, and the organization’s name. Double-check for accuracy.

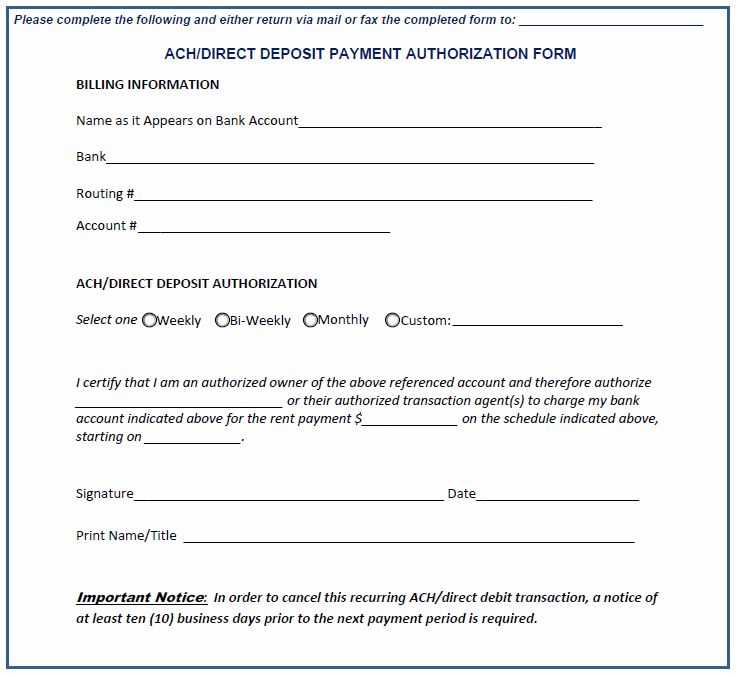

Bank Account Details: Clearly state your bank account number, routing number, and the name of the bank. These details are critical for ensuring funds are deposited into the correct account without any issues.

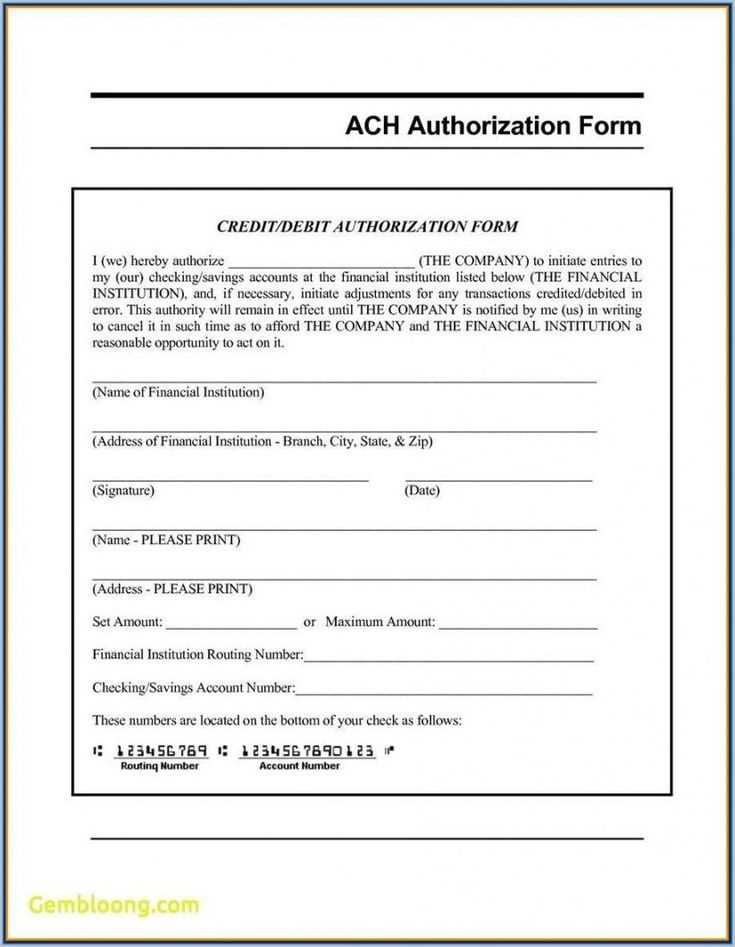

Authorization: Be sure to include a statement that authorizes the recipient to initiate the direct deposit. A simple declaration such as, “I authorize [Company Name] to deposit my payments directly into the following account,” is sufficient.

Once the template is filled out, review the letter for any errors, and make sure all the required information is included. Sending this well-organized request will ensure that direct deposit can be set up smoothly and without delays.

Here is an improved version with minimized word repetition:

To create a clear and concise direct deposit letter, focus on keeping sentences straightforward and free from redundant phrases. Start by clearly identifying both parties involved: the sender and the recipient. Avoid unnecessary elaborations about their roles or titles unless they add specific value to the context.

Key Information to Include

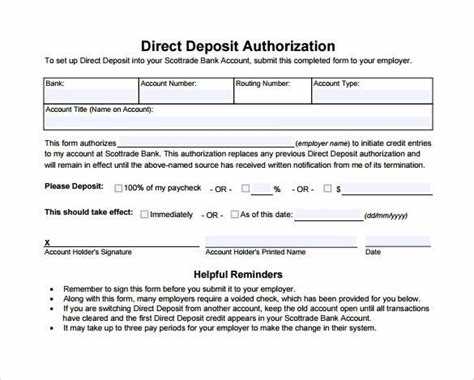

Ensure that the letter includes the following details: bank account information, the frequency of deposits, and the effective date. These elements should be presented without repetition. For example, when describing the payment schedule, avoid restating the deposit type or frequency in multiple ways.

Tips for Clarity

Keep your sentences direct and avoid filler words. For instance, instead of saying, “We are requesting that the payment be deposited into the specified account,” simply state, “Please deposit the payment into the provided account.” This approach keeps the content clear and professional.

Lastly, remember to close with a polite but firm confirmation. Avoid over-explaining the action or providing unnecessary background information. Direct and clear communication leads to a more effective letter.

- Direct Deposit Letter Template Guide

Use this template to set up direct deposit for payments directly into your bank account. It should be clear, professional, and contain all necessary details for a smooth transaction setup.

- Begin with your details: Include your full name, job title, and contact information. Mention your employer’s name and the department if applicable.

- State your request: Specify the intention to set up direct deposit for future payments. Include the specific type of payments (salary, reimbursements, etc.) and the frequency (weekly, bi-weekly, monthly).

- Provide banking information: List the account number, routing number, bank name, and branch address. Double-check these details for accuracy to avoid delays.

- Request confirmation: Politely ask for confirmation of the setup and any forms that need to be filled out, if applicable.

- Close professionally: End with a courteous thank you, offering to provide any additional information if needed.

Here’s a basic structure:

- Subject: Request for Direct Deposit Setup

- Dear [Employer’s Name],

- Paragraph 1: State your request and explain the purpose of setting up direct deposit.

- Paragraph 2: Include the necessary banking details and any other required information.

- Paragraph 3: Ask for confirmation and offer to answer questions.

- Closing: “Sincerely, [Your Name]”

Keep the tone polite and concise. Review your details before submitting the letter to avoid errors that may delay the process.

To create a direct deposit request letter, begin by including your personal details at the top, such as your full name, address, phone number, and email address. This ensures the recipient can easily contact you if necessary. Make sure to mention the date the letter is written as well.

Structure the Body of the Letter

In the opening paragraph, clearly state the purpose of the letter–requesting direct deposit for your payments. Mention the company or organization from which you are requesting this setup. Provide your employee or account number if applicable.

Account Information

Next, include the necessary banking details, including your bank’s name, the branch, your account number, and routing number. Be sure to double-check the accuracy of these details to avoid processing errors. Finally, politely request that they begin processing the direct deposit for your future payments.

Conclude the letter by thanking the recipient for their time and attention, and offer to provide any additional information if needed. End with a formal closing, such as “Sincerely,” followed by your full name and signature.

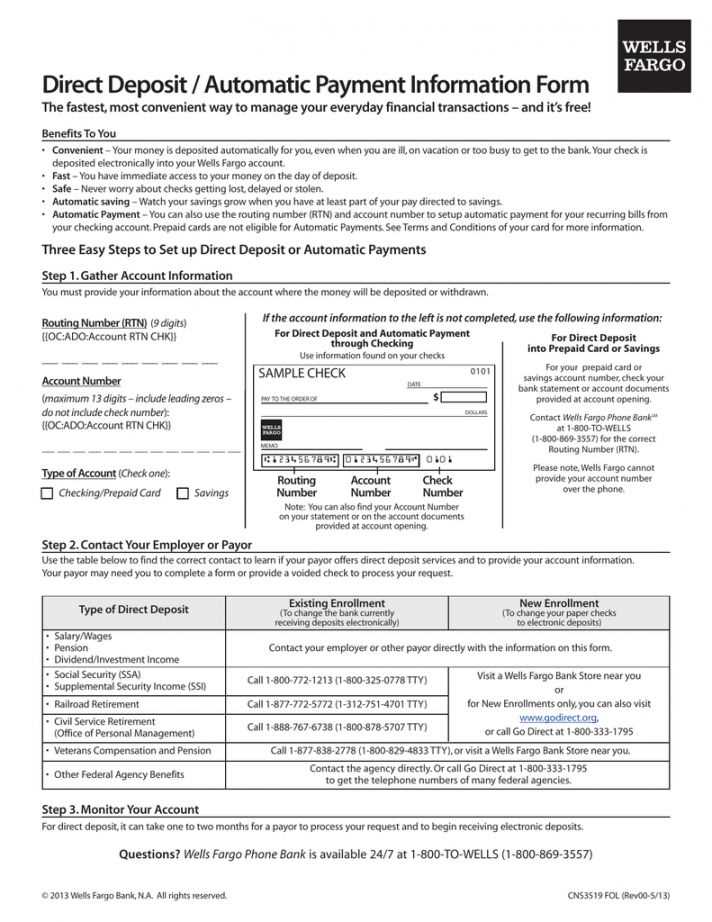

To successfully authorize direct deposit, provide the following information to ensure smooth processing:

- Bank Name: Clearly state the name of your financial institution.

- Bank Address: Include the full address of your bank, including the city, state, and ZIP code.

- Routing Number: This is a nine-digit number that identifies your bank and is essential for directing the deposit correctly. You can find it on your checks or contact your bank for verification.

- Account Number: Provide your specific account number for depositing funds. Ensure it matches the one linked to your account to avoid errors.

- Account Type: Indicate whether the account is checking or savings. This ensures the deposit is directed to the correct account type.

- Account Holder’s Name: Include your full legal name as it appears on your account. This helps the bank verify ownership of the account.

Additional Considerations:

- Deposit Amount: Specify if you want a fixed deposit amount or if it will vary.

- Authorization Signature: A signed consent or authorization letter may be required to initiate direct deposit, confirming your agreement with the terms.

Double-check all details to avoid delays or issues with processing your direct deposit.

To format your direct deposit letter properly, follow these key steps:

1. Include Your Contact Information

Start by adding your full name, address, phone number, and email at the top of the letter. This makes it easy for the recipient to contact you if needed. Align this information to the left for a clean, professional look.

2. Add the Date

Position the date just below your contact information. Use the full date format, such as “January 29, 2025,” to avoid any confusion.

3. State the Purpose of the Letter

Clearly mention that the letter is for authorizing direct deposit. Keep the statement short and specific, such as: “I am writing to authorize the direct deposit of my paycheck into my bank account.”

4. Provide Your Bank Details

List the necessary bank details for the direct deposit. This includes the bank name, account number, routing number, and account type (checking or savings). Double-check the numbers for accuracy.

| Bank Name | Account Number | Routing Number | Account Type |

|---|---|---|---|

| Example Bank | 123456789 | 987654321 | Checking |

5. Sign the Letter

End the letter with a polite closing, such as “Sincerely,” followed by your signature. If you are submitting the letter electronically, you can type your name or use a digital signature.

6. Proofread and Verify

Before sending the letter, review all details for accuracy. Ensure that the bank information is correct to avoid delays in the deposit process.

Ensure that the deposit amount is clearly stated in both numbers and words. Avoid ambiguity, as this can lead to errors or delays in processing. If the letter references a bank account, double-check the account number and routing information for accuracy.

- Omitting Required Information: Always include essential details, such as the payer’s name, the recipient’s name, and the date. Missing these can cause confusion or cause your deposit to be rejected.

- Using Incorrect Dates: Be sure the deposit date matches the intended transaction date. Using future or past dates could raise questions or delay the deposit process.

- Not Verifying Contact Details: Incorrect contact information makes it difficult to follow up on the transaction. Double-check phone numbers, emails, and addresses.

- Ambiguous Deposit Instructions: Provide clear, straightforward instructions on how and where the deposit should be made. Any ambiguity can cause delays in processing.

- Forgetting to Sign the Letter: A deposit letter is not valid without the appropriate signature. Failing to sign can result in the letter being considered incomplete.

By avoiding these mistakes, you help ensure that your deposit letter is processed smoothly and promptly.

Ensure that your direct deposit letter is addressed correctly and includes all necessary details, such as your full name, bank account information, and routing number. Submit it through the preferred method specified by your employer, which could be via email, an employee portal, or physically delivering it to the HR department.

If submitting electronically, attach the letter as a PDF or Word document to maintain its formatting. Avoid sending sensitive information in plain text emails for security reasons.

If mailing a hard copy, send the letter through certified mail or another trackable method to ensure it is received. Confirm the correct address with your HR department or payroll contact before sending.

After submission, follow up with your employer to confirm receipt and ensure that the necessary updates have been made to your payroll information.

If your direct deposit is rejected or delayed, take immediate action by contacting your employer’s payroll department. Verify the accuracy of your account number and routing information with them. Mistakes in these details often cause deposits to fail.

Next, reach out to your bank or financial institution to confirm there are no holds or issues with your account. Ensure that your account is active and able to receive deposits.

If the issue persists, ask for a tracking number or reference code to monitor the deposit’s progress. This information can help pinpoint where the problem lies–whether with the bank, your employer, or the payment processor.

In some cases, your employer may need to resend the deposit manually. Be sure to confirm the timing for this action and any necessary follow-up steps on your part.

Always keep a record of your communications with both the bank and employer, noting dates and the specifics discussed. This documentation will help resolve any issues more efficiently.

Direct Deposit Letter Template

Follow these steps to create a direct deposit letter that’s clear and professional:

- Start with your name and address at the top left corner.

- Include the date on which you are writing the letter.

- Address the letter to the appropriate department or individual at your company, such as HR or payroll.

- Clearly state your intent to switch to direct deposit and provide your banking details.

- List the bank name, account type (checking or savings), and account number accurately.

- Mention any additional details required, such as routing numbers or any identification specific to your bank account.

- Keep your tone formal and concise throughout the letter.

- Close the letter with a polite sign-off and your signature.

Here’s a sample table for bank details:

| Account Type | Bank Name | Account Number | Routing Number |

|---|---|---|---|

| Checking | Bank of Example | 123456789 | 987654321 |

Keep the letter short and professional, ensuring that all details are correct to avoid delays in processing your request.