Disbursement Letter Template for Effective Financial Communication

Creating an official document to outline the distribution of funds is essential for clear communication between parties involved in financial transactions. This type of correspondence serves as a formal confirmation of the allocation process and ensures transparency in managing financial agreements. By utilizing a well-structured document, all participants can understand the terms, amounts, and timelines involved in the transfer of funds.

Key Sections to Include

When drafting such a communication, it’s crucial to include specific sections that ensure the document’s clarity and effectiveness. Below are the main components:

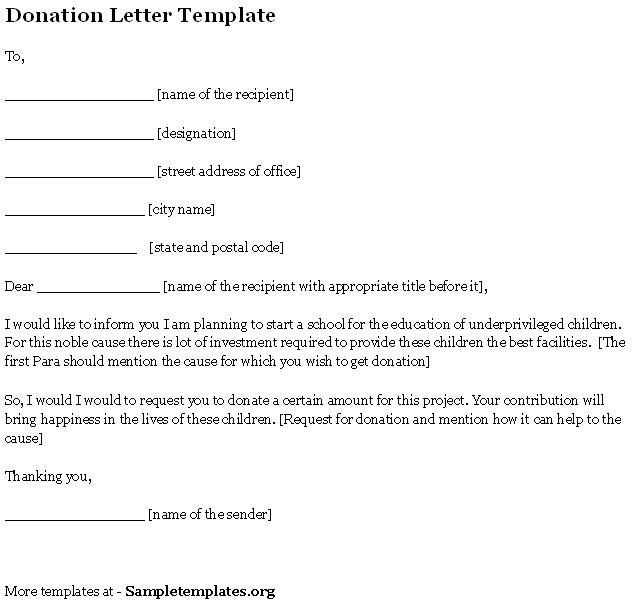

- Recipient Information: Clearly state the recipient’s name, contact details, and any relevant identifiers.

- Amount of Funds: Specify the exact amount being transferred, including any breakdowns if applicable.

- Purpose of Funds: Describe the reason for the allocation, ensuring it aligns with any pre-established agreements or contracts.

- Payment Terms: Define the timing and method of payment, ensuring both parties understand when the funds will be made available.

- Conditions or Requirements: Outline any conditions that must be met before or after the funds are distributed, if relevant.

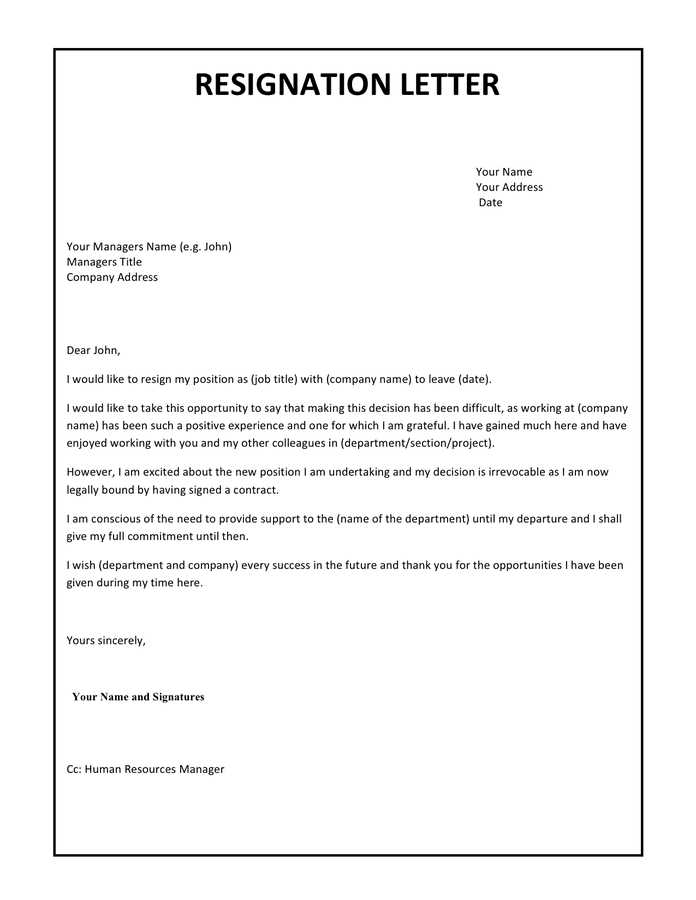

Customizing the Document for Specific Needs

Each financial arrangement is unique, so adapting the format to fit particular circumstances is essential. Whether it’s a loan, grant, or investment, ensuring that the document reflects the specific nature of the transaction will enhance its effectiveness. Customizing details such as payment schedules, contingencies, or penalties can help avoid misunderstandings.

Avoiding Common Errors

While drafting, it’s essential to avoid common mistakes that could lead to confusion or legal issues. Inaccurate details, unclear terms, or missing information can undermine the document’s validity. Always double-check the accuracy of the financial amounts, recipient details, and payment instructions to avoid any complications down the line.

When to Use This Document

This form of communication is ideal in situations where funds are being transferred, whether for business transactions, loans, grants, or investments. It provides a clear record for all parties involved and serves as proof of the agreement made. Using such a document in any financial transaction where clarity and transparency are important will help ensure everything is properly documented.

Legal Considerations: Make sure that the document complies with local laws and regulations. If in doubt, seek legal advice to confirm its validity.

Understanding Financial Documents for Fund Distribution

When managing funds between parties, it’s essential to have a formal written record that outlines the terms of the transaction. This type of document helps to clarify the allocation process, providing both transparency and accountability. By following a clear structure, both the payer and the recipient can have a shared understanding of the details involved in the transfer of funds.

Such a document typically includes specific sections that provide important details about the transfer, ensuring that all parties are aligned. These elements will vary depending on the nature of the financial transaction, but some core components should always be present to ensure clarity and legality.

Key Elements of a Financial Document

The main parts of this type of correspondence generally include:

- Recipient’s Information: Full name, contact details, and relevant identification.

- Transferred Amount: Clear breakdown of the amount being allocated.

- Purpose of the Transaction: Explanation of why the funds are being distributed.

- Payment Terms: Detailed information on when and how the funds will be transferred.

- Conditions for Distribution: Any additional terms or obligations to be met by either party.

Customizing the Document for Specific Transactions

Each financial situation may require adjustments to the standard format. Whether it’s for a grant, investment, or loan, the document must reflect the unique terms of the arrangement. Tailoring the content ensures that both parties have a clear understanding of their roles and expectations, and helps prevent future misunderstandings.

Avoiding Common Mistakes

It’s important to double-check the details to ensure accuracy. Missing or incorrect information can lead to disputes or delays. Always verify recipient details, amounts, payment instructions, and any other key points to prevent issues. Additionally, vague or incomplete terms should be clarified before finalizing the document.

Ensuring Precision in Financial Documentation

To ensure the document’s effectiveness and legal standing, accuracy is paramount. Double-checking all figures, dates, and recipient information guarantees that everything is correct. If necessary, seek assistance from legal or financial professionals to ensure that the terms comply with local regulations.