Dispute letter template for collection

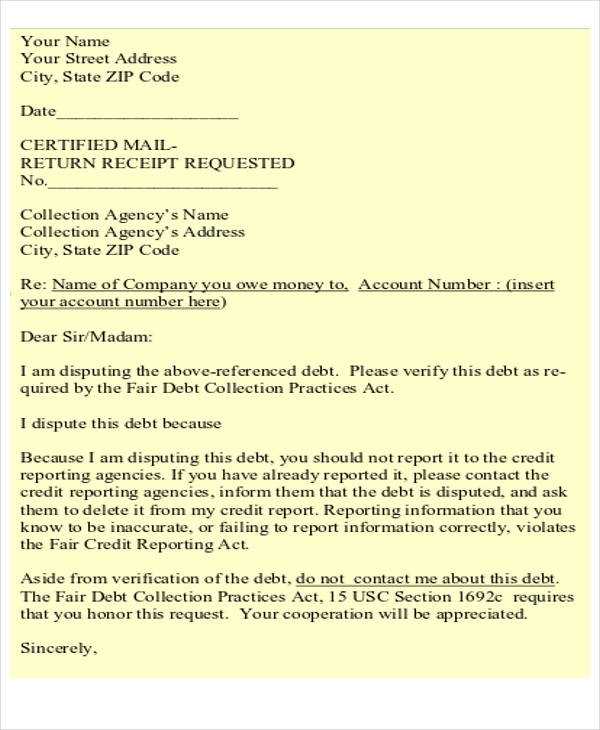

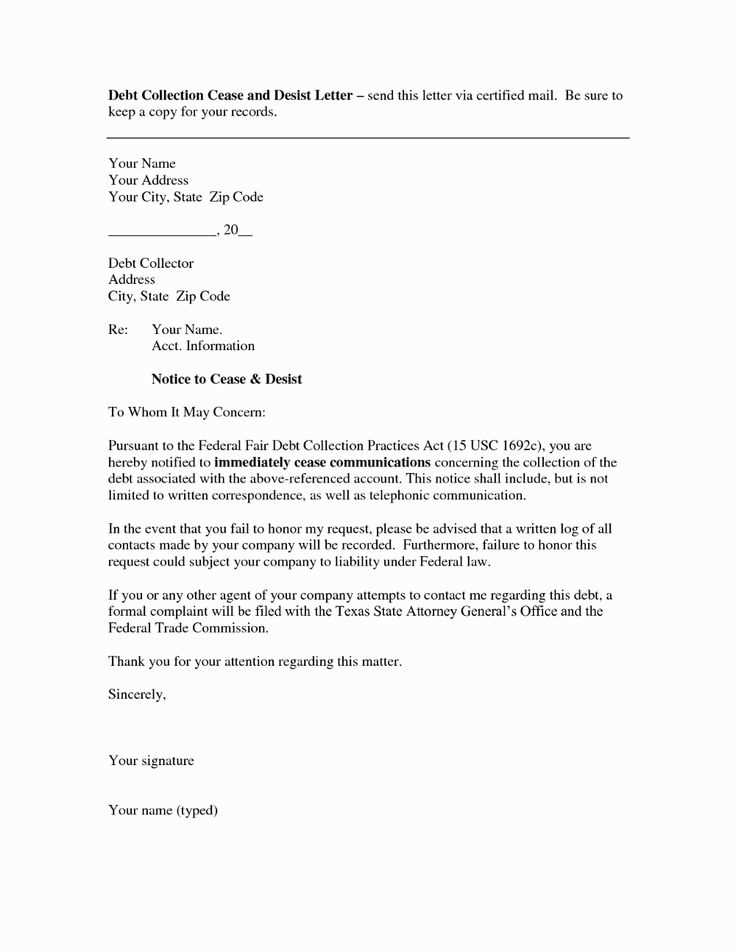

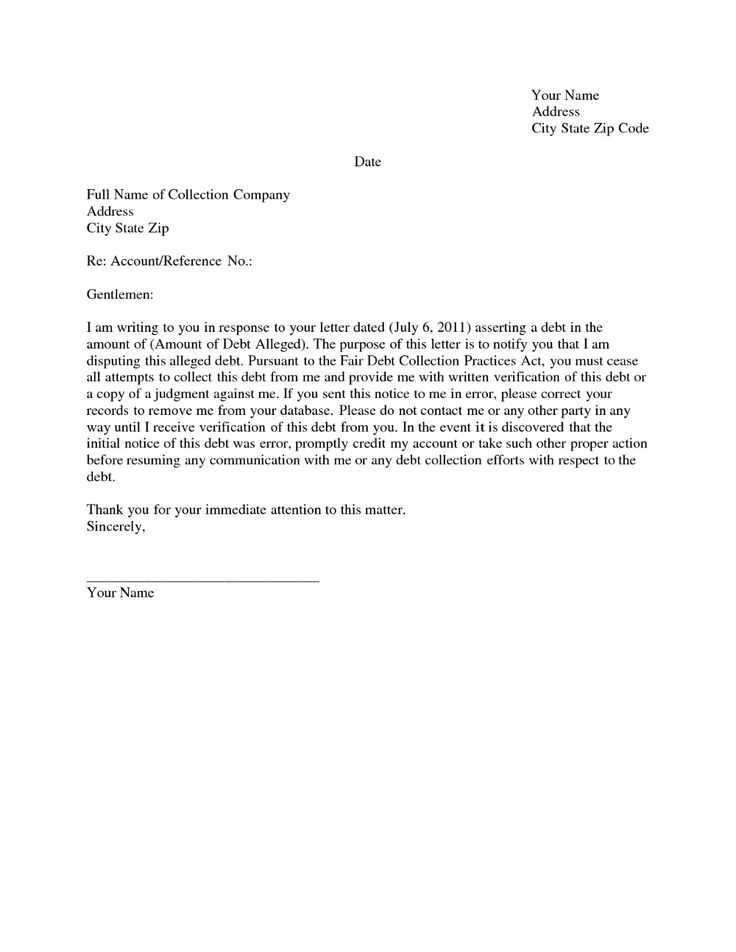

When you identify a mistake on your account or an inaccurate collection, writing a dispute letter is the first step to resolving the issue. This letter challenges the validity of the debt or requests clarification on discrepancies. A well-crafted dispute letter can prevent damage to your credit and stop further collection efforts.

Clearly state the reason for your dispute. Whether the debt amount is incorrect, or the creditor has the wrong information, be specific about what needs to be corrected. Include all relevant details, such as account numbers, dates, and any supporting documentation that proves your case. This will help the recipient process your request without unnecessary delays.

Keep your tone polite but firm, and ask for written confirmation once the dispute is resolved. Include your contact details and make sure to send the letter via certified mail so you have proof of receipt. This ensures that you are in control of the process and can follow up if needed.

Sure! Here’s the revised version with minimized repetitions:

When drafting a dispute letter for collection, be direct and clear. First, specify the amount in question and the reason for the dispute. Clearly state that you are disputing the debt, providing any supporting evidence that backs your claim, such as payment records or account statements. Make sure to include your contact details for follow-up.

Avoid ambiguous language. Keep your letter focused on the facts to increase the likelihood of a quick resolution. If the debt was settled or was incorrectly attributed to you, explain the situation with supporting documents. State your expectations regarding the next steps and set a reasonable time frame for a response, typically within 30 days.

Ensure that your letter is professional, polite, and formal. Using harsh or aggressive language will likely delay the process. Stay objective and concise, avoiding unnecessary details that may distract from the main point. Once your letter is finalized, make a copy for your records and send it via a method that provides proof of delivery, such as certified mail.

- Dispute Letter Template for Collection

If you believe that a debt is inaccurate or that the collection agency is mistaken, sending a dispute letter is a key step. Ensure your letter is clear, concise, and includes all relevant details to resolve the issue. Below is a structured approach you can follow.

Dispute Letter Template

Your Name

Your Address

City, State, ZIP Code

Email Address

Phone Number

Date

Collection Agency Name

Agency Address

City, State, ZIP Code

Subject: Dispute of Debt

Dear [Collection Agency Name],

I am writing to formally dispute the debt referenced in your recent communication, dated [insert date], concerning account number [insert account number]. I believe this debt is either inaccurate or does not belong to me. Please investigate the matter and provide verification of the debt as required by law.

In accordance with the Fair Debt Collection Practices Act (FDCPA), I request that you provide me with the following information:

- The name of the original creditor

- The amount of the debt and a breakdown of any fees or interest

- A copy of the original contract or agreement, if applicable

- Proof that you are authorized to collect this debt on behalf of the creditor

Please cease all collection activities until this matter is fully resolved. I expect a response within 30 days from the receipt of this letter as per the law. If you are unable to provide the requested information, I kindly ask that you remove the debt from my credit report and stop contacting me about it.

Thank you for your attention to this matter. I look forward to receiving the requested documentation promptly.

Sincerely,

Your Name

Signature (if sending by mail)

Key Tips for Your Dispute Letter

Include your full contact details to ensure the agency can respond to you directly. Avoid emotional language and stay factual. Always send the letter via certified mail to confirm receipt.

To successfully dispute a debt, it’s necessary to understand the legal grounds that allow you to challenge its validity. If the debt is not yours, or if the amount is incorrect, you can contest it. Make sure to verify whether the debt is based on a valid contract or agreement. Without a signed agreement or clear terms, a debt may not be enforceable.

Check if the creditor has followed the required legal process. For example, they must provide proof of the debt, such as an itemized statement or contract, to substantiate their claim. If they cannot provide this, the debt might not be legally binding.

If the statute of limitations has passed, you may have grounds to dispute the debt. Each state has specific laws that limit how long a creditor can pursue a debt, typically ranging from 3 to 6 years. Once this period expires, creditors can no longer sue for the debt.

Lastly, verify whether the debt was discharged through bankruptcy. If you’ve previously filed for bankruptcy and the debt was part of the discharge, it’s no longer your responsibility. Make sure to consult with a legal professional to clarify these aspects before proceeding with the dispute process.

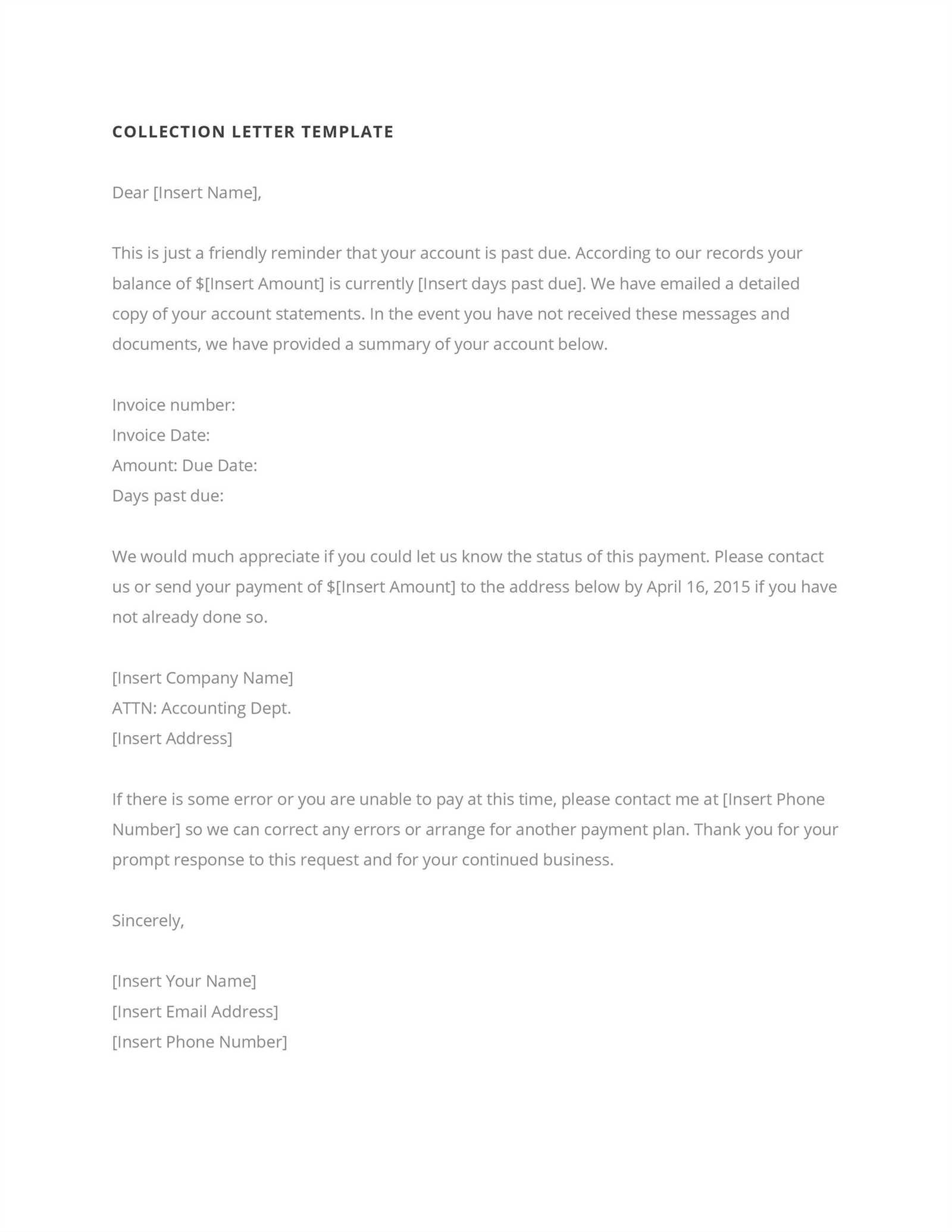

Begin by clearly stating the purpose of your letter. Specify that you are disputing the debt mentioned by the creditor. Include the date of the alleged debt and any relevant reference numbers from the creditor.

Next, request proof of the debt. Ask for copies of documents that validate the amount owed, such as contracts, invoices, or account statements. This step ensures that the debt is legitimate.

Provide your personal details, including your full name, address, and contact information. If applicable, include account numbers related to the disputed debt to help the creditor identify your case easily.

List any discrepancies or errors you’ve identified. If you believe the debt is incorrect, explain why. For instance, mention if there are charges you don’t recognize, amounts that seem inflated, or payments you’ve already made that have not been accounted for.

Request that the creditor stop reporting the disputed debt to credit bureaus until the matter is resolved. This ensures that your credit report remains accurate during the dispute process.

Wrap up by requesting a formal response within a reasonable timeframe, such as 30 days. Be polite but firm in asking for clarification on any outstanding issues.

End the letter by thanking the recipient for their attention to the matter, and include a signature line with your name and the date.

Ensure your dispute letter is clear, precise, and professional. Start with your full name, address, and account number at the top. This helps the recipient quickly identify you and the issue at hand.

In the opening paragraph, briefly state the reason for the dispute. Mention the specific charge or debt in question and explain why you believe it is incorrect. Be clear about what part of the bill or collection is inaccurate or disputed.

Provide supporting evidence. Attach any relevant documents such as bank statements, receipts, or communications that back up your claim. These will strengthen your argument and help clarify the issue.

Clearly state the resolution you seek. Whether it’s removing a charge, correcting an error, or halting collection activity, make your desired outcome known. Stay specific to avoid ambiguity.

Use polite but firm language. Stay professional in tone, but make it clear that you expect the issue to be resolved in a timely manner. Specify a reasonable timeline for a response or resolution.

Conclude by requesting confirmation of the dispute and a detailed explanation of any actions taken. This helps ensure transparency and that both parties are on the same page.

Once you receive a response from the creditor regarding your dispute, it’s important to address it calmly and effectively. Follow these steps to ensure your response is clear and professional:

1. Review the Creditor’s Response Carefully

Examine the creditor’s reply thoroughly. Look for any explanations, documents, or evidence they provide to support their claim. Check whether they addressed the specific points you raised in your dispute letter. Identify if there are any inconsistencies or errors in their response.

2. Address the Specific Points Raised by the Creditor

- If the creditor provides additional documentation, verify its accuracy. Compare it to your own records to ensure there are no discrepancies.

- If the creditor denies your dispute, ask for specific reasons or proof of the debt. Request any relevant contracts or agreements that validate their claim.

- If the creditor made a partial correction, acknowledge the changes and politely ask for full resolution if applicable.

3. Dispute the Debt Further if Necessary

If you believe the creditor’s response is insufficient or incorrect, provide further evidence supporting your position. Reference any relevant documents, such as receipts, account statements, or previous communications. Stay factual and avoid emotional language.

4. Keep a Record of All Correspondence

Maintain a file of all responses, letters, and supporting documents related to the dispute. This will serve as proof of your efforts to resolve the issue and can be used if the situation escalates.

5. Consider Escalating the Issue

- If the creditor fails to respond appropriately, consider escalating the issue to a regulatory body, such as the Consumer Financial Protection Bureau (CFPB), or seek legal advice.

- Ensure you follow all necessary steps to document your communication with the creditor, as this may be vital if further action is required.

Being clear and concise is key. Avoid using vague language that could be misinterpreted. Always state the exact issue and reference specific details like dates, amounts, and any disputed charges. This will help avoid confusion and demonstrate your seriousness.

Another common mistake is failing to keep a professional tone. While you may be frustrated, staying calm and respectful is crucial for your credibility. A rude or threatening tone could undermine your position, making it harder to resolve the dispute.

Inadequate Documentation

Do not forget to attach any supporting documents that back up your claims. This includes receipts, contracts, or any written communication with the creditor. A debt dispute letter without proof is much weaker and harder to validate.

Missing Deadlines

Timeliness matters. If your letter is meant to meet a legal deadline, ensure you send it promptly. Failing to send your letter on time can lead to missed opportunities for dispute resolution or worse, a default judgment.

If attempts to resolve a debt dispute through communication with the creditor or collection agency fail, escalation to legal authorities might be necessary. This step should be taken when the dispute cannot be settled amicably, and the creditor or agency has violated your rights under the Fair Debt Collection Practices Act (FDCPA) or other relevant laws. Legal action can help ensure that your rights are protected and the debt collection process is fair.

Recognizing When Legal Action Is Necessary

Escalation to legal authorities becomes crucial in these situations:

- The creditor or collection agency continues to pursue the debt despite clear evidence that it is incorrect.

- You are being harassed or contacted in violation of debt collection laws (e.g., calls at unreasonable hours, threats, or use of abusive language).

- The creditor refuses to provide proper documentation of the debt or verify the amount owed, as required by law.

- The dispute remains unresolved despite multiple attempts to negotiate or dispute the debt in writing.

Steps to Take Before Escalating the Dispute

Before contacting legal authorities, ensure you have taken the following actions:

- Document all communications with the creditor or collection agency, including dates, times, and content of conversations.

- Submit a formal written dispute letter, requesting validation of the debt and all supporting documentation.

- Ensure all legal timelines for response have passed (usually 30 days from the receipt of a validation notice).

Escalating to Legal Authorities

If the dispute remains unresolved, here’s how to proceed:

- Contact the Consumer Financial Protection Bureau (CFPB): If the debt collector violates the FDCPA or fails to validate the debt, you can file a complaint with the CFPB. The bureau investigates such complaints and can take action against non-compliant companies.

- File a Complaint with the Federal Trade Commission (FTC): The FTC oversees consumer protection and can help address unfair debt collection practices. Complaints are reviewed for potential investigations.

- Consult an Attorney: Seek legal advice if you believe your rights have been violated. A consumer rights attorney can help you determine if further legal action is warranted, including filing a lawsuit for harassment or unlawful debt collection practices.

- Small Claims Court: For small disputes, you can consider filing a claim in small claims court. This is often quicker and less expensive than other forms of litigation.

Possible Legal Outcomes

Legal action can lead to various outcomes, including:

- A ruling in your favor, potentially resulting in the cancellation of the debt or removal of negative marks from your credit report.

- Monetary damages for harassment or wrongful collection practices, including compensation for emotional distress and legal fees.

- An injunction to stop further illegal collection practices, preventing the agency from contacting you.

Debt Dispute Escalation Process

| Step | Action | Timeline |

|---|---|---|

| 1 | Document all communications with the creditor | Ongoing |

| 2 | Send a formal written dispute letter | Within 30 days |

| 3 | File complaints with CFPB, FTC, or state authorities | After 30 days if unresolved |

| 4 | Consult a consumer rights attorney | After receiving no response or resolution |

| 5 | Consider filing a lawsuit or taking legal action | After legal counsel and no settlement |

Let me know if you need further adjustments!

Ensure your dispute letter is clear and concise. Focus on key details: the account in question, the issue you’re disputing, and the reason for your disagreement. Avoid unnecessary details that might confuse the recipient. Double-check the amount of debt, and make sure the dates are accurate. Including these specifics ensures that your claim is addressed properly and promptly.

If you’re responding to a debt collector’s notice, mention the date you received it. If possible, attach any supporting documentation that proves your claim. This could include payment records or other evidence to back up your dispute. Clear documentation makes it easier for the creditor to investigate and resolve the issue.

- Clearly identify the debt account number.

- State the exact amount you believe is incorrect.

- Provide supporting evidence, like receipts or bank statements.

- Specify your request, whether it’s to remove incorrect charges or adjust the balance.

Once you’ve sent the letter, keep a copy for your records. It’s also a good idea to use a method that confirms receipt, such as certified mail, to ensure the dispute is being processed.

If you need help with the wording or have questions on how to structure your dispute, feel free to reach out. Let me know if you need further adjustments!