Dividend payment letter template

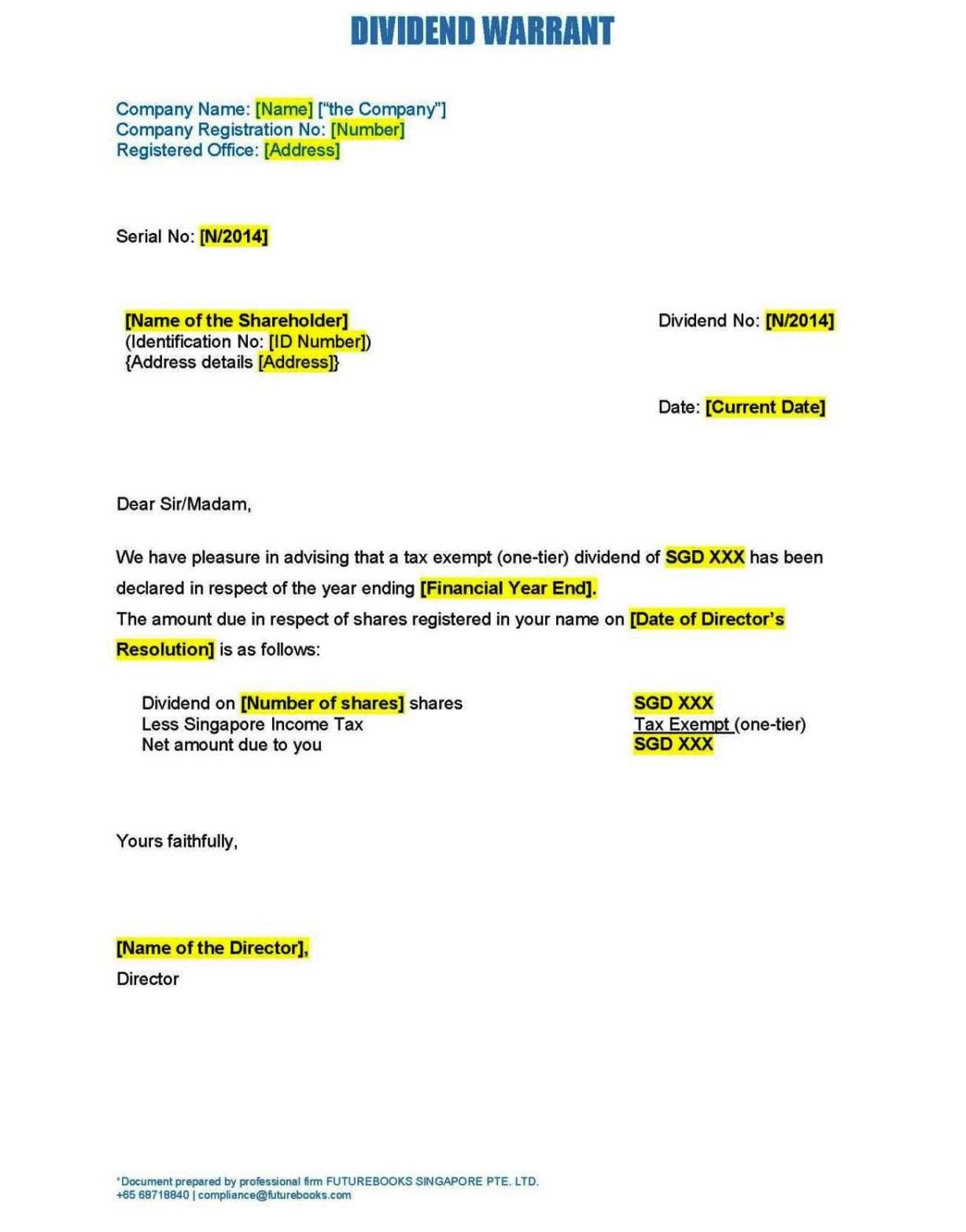

Crafting a clear and professional dividend payment letter is key for ensuring shareholders understand their entitlements and the details of the distribution. The letter should include vital information such as the dividend amount, payment date, and any applicable tax deductions. Avoiding unnecessary jargon helps maintain transparency and professionalism.

Start by addressing the recipient properly and including the company’s details, ensuring all the essential facts about the dividend distribution are clearly outlined. Be specific about the payment method, whether through check, bank transfer, or another medium. Including contact information for further inquiries also adds an extra layer of clarity and accessibility.

In addition to this, make sure to mention the specific date of the dividend distribution and the period it pertains to. This helps shareholders track their payments and confirms that the company is adhering to its financial schedule. Always end the letter with a cordial closing and invitation for further communication if needed.

Here’s the revised version with minimal repetition:

When drafting a dividend payment letter, make sure to include key details like the payment date, dividend amount, and method of payment. Use clear language and structure for easy comprehension.

Clear and Direct Language

Start with a straightforward opening, such as: “We are pleased to inform you that a dividend payment of [amount] will be made to you on [payment date].” This eliminates confusion and sets a professional tone. Avoid unnecessary jargon, focusing on the key facts.

Additional Information

If there are any changes to the usual payment method or schedule, mention them briefly. For example: “This payment will be processed via [payment method]. Please ensure your account details are up to date to avoid delays.” This keeps the recipient informed without overwhelming them with excessive detail.

- Dividend Payment Letter Template

To craft a clear and professional dividend payment letter, follow this template. Start by addressing the recipient with their full name, followed by their title or position if relevant. Make sure to include the date of the letter and reference the company name clearly.

Begin by stating the purpose of the letter: informing the recipient of the dividend payment. Clearly mention the payment amount, the dividend per share, and the date of payment. Include any relevant details about the payment method–whether it’s a bank transfer, check, or other means–and explain any necessary steps the recipient should take (e.g., confirming receipt, updating contact information).

If applicable, mention any relevant financial reports or statements attached to the letter for the recipient’s reference. Keep the tone professional but friendly, and offer assistance if there are questions regarding the dividend or payment process. Conclude with a polite closing statement, such as “Thank you for your continued support” or “We appreciate your investment in our company.”

Here’s a basic example of a dividend payment letter:

[Company Name]

[Company Address]

[Date]

[Recipient’s Name]

[Recipient’s Address]

Dear [Recipient’s Name],

We are pleased to inform you that your dividend payment for the period ending [Date] has been processed. Your dividend payment amounts to [Amount] per share, resulting in a total of [Total Amount]. This payment will be issued via [Payment Method] on [Payment Date].

If you have any questions regarding this payment, please feel free to contact us at [Contact Information].

Thank you for your continued support.

Sincerely,

[Your Name]

[Your Title]

[Company Name]

Start by clearly stating the dividend amount and the payment date. This ensures that shareholders know what to expect. Address the letter to the shareholders directly, keeping the tone professional and respectful. Include the exact dividend per share, along with the total amount payable based on the number of shares held by each shareholder. This level of transparency builds trust.

Follow with details about the dividend distribution process. Mention the payment method, such as wire transfer, check, or direct deposit, and any necessary instructions or steps the shareholder may need to follow. Ensure that this section is straightforward and easy to follow.

Next, confirm the dividend declaration. Include the date of the board meeting or annual general meeting (AGM) when the dividend decision was made. This adds credibility to the payment and reminds shareholders of the company’s formal processes.

Incorporate a thank-you note expressing appreciation for the shareholder’s continued support. A simple expression of gratitude goes a long way in strengthening the relationship between the company and its investors.

End with contact information in case the shareholder has any questions regarding the payment or needs further clarification. Always offer a channel for communication to address concerns quickly and professionally.

| Item | Details |

|---|---|

| Dividend Amount | Amount per share and total payable |

| Payment Date | Date of distribution |

| Payment Method | Check, wire transfer, or direct deposit |

| Meeting Date | Date of AGM or board meeting |

| Contact Information | Email, phone number, or other communication channels |

Ensure your payment letter for shareholders provides clear and accurate details on the dividend distribution. Start with the declaration of the dividend amount, specifying the payment per share. This amount should be straightforward, leaving no room for confusion.

Payment Date and Method

Clearly state the date when dividends will be paid out. Additionally, indicate the payment method, such as direct deposit, check, or any other means. This helps shareholders plan accordingly and track the payment.

Tax Information

Include details on any tax withholding that may apply to the dividend payment. Specify the tax rate, if relevant, and how it will affect the final payout. This section is particularly important for shareholders to understand their net dividend.

Provide contact information in case shareholders have questions or need assistance with their payment. Transparency in this area helps build trust and ensures smooth communication with your investors.

Ensure your payment letter is clear by focusing on structure and readability. Begin with a well-organized format that highlights key details at a glance.

- Use clear headings: Structure the letter with distinct sections like “Payment Amount,” “Due Date,” and “Payment Instructions.” This makes it easier for the reader to find the necessary information.

- Keep paragraphs concise: Break up long paragraphs into smaller ones to avoid overwhelming the reader. Stick to one idea per paragraph for better comprehension.

- Bold important information: Highlight the payment amount and due date in bold text. This ensures they stand out and catch the reader’s attention immediately.

- Use bullet points for instructions: If your payment letter includes several steps or details, use bullet points to organize the information. This helps the reader follow along easily.

- Choose professional fonts: Opt for simple, legible fonts like Arial or Times New Roman. Avoid decorative fonts that may reduce the clarity of the message.

- Ensure proper alignment: Align the text to the left and maintain uniform margins throughout. This creates a clean, polished look.

Clear formatting enhances the professionalism of your letter, making it easy for recipients to understand and act on the payment request quickly.

When to Send a Payment Letter to Investors

Send the payment letter as soon as the dividend is approved and the payment date is confirmed. This ensures investors receive clear communication regarding the amount and timing of their payment.

Timing After Approval

Distribute the letter within a few days after the dividend decision. This helps maintain transparency and keeps investors informed. Avoid unnecessary delays in communication.

Before the Payment Date

Ideally, send the letter at least a week before the actual payment date. This gives investors enough time to plan or address any questions. The earlier the better, but avoid sending it too far in advance, as this may lead to confusion.

Make sure the letter includes the payment amount, the distribution method, and any relevant details about taxes or other considerations. Keep the tone professional and straightforward, focusing on clarity.

One of the most common mistakes is neglecting to include the specific payment date. Always provide a clear and precise date when the dividend will be issued. This ensures that recipients know when to expect their payment.

Another mistake is failing to mention the amount of the dividend per share. Always state the exact amount each shareholder will receive. This clarity prevents confusion and promotes transparency.

- Omitting the payment method can also lead to misunderstandings. Specify whether the dividend will be paid via check, bank transfer, or another method.

- Not including the company’s contact information for any follow-up questions can create unnecessary frustration. Ensure your shareholders have a way to reach you if they need clarification.

- Falling short on detailing the tax implications of the dividend payment can lead to legal or financial confusion. Provide shareholders with relevant tax information or direct them to the proper resources.

Another key mistake is not addressing all shareholders in a personalized manner. Generic letters may create a sense of detachment. Personalizing the message shows respect and fosters a positive relationship with investors.

Lastly, avoid over-complicating the language. Use simple, straightforward language so that the letter is easily understood by all recipients, regardless of their financial knowledge.

After sending a dividend payment letter, it’s important to ensure that the payment process is on track. Start by confirming the date of the scheduled payment and any relevant terms mentioned in the original letter. If you haven’t received a response within the expected time frame, reach out to the company’s investor relations department or the designated contact person. Keep your follow-up polite and clear–mention your reference number or account details to help them locate your information quickly.

If the payment is delayed, ask for a specific update regarding the status and provide any supporting documents that may assist in resolving the issue. Be proactive in requesting the next steps or an estimated resolution timeline. If the payment is incorrect or incomplete, ask for a review and provide detailed information about the discrepancy.

Always keep a record of your follow-up correspondence, as it may be useful for tracking any ongoing issues or disputes. A timely follow-up shows you’re actively managing your dividend payments while maintaining professionalism in your communication.

I made an effort to remove repetitions, while maintaining meaning and structure.

When drafting a dividend payment letter, ensure clarity by specifying the payment amount, the dividend rate, and the method of distribution. Use straightforward language that is both professional and easy to follow. Include key details, such as the dividend payment date and eligibility criteria. Clearly state whether the dividend is a cash distribution or a stock dividend, as this affects the recipient’s expectations. Always double-check the recipient’s contact details to ensure timely delivery.

Use a direct and respectful tone. Acknowledge the shareholder’s investment, and express appreciation for their trust in the company. Avoid unnecessary embellishments. Keep the focus on the relevant financial information and any actions the shareholder needs to take. If the dividend payment requires any form of acknowledgment or action, make that clear without over-explaining. Keep the letter concise, leaving out any redundant information.

Final Steps: After reviewing the details, send the letter in the appropriate format, whether by email or postal service. Confirm that the correct payment method aligns with the shareholder’s preference. A follow-up reminder could be beneficial, but only if the shareholder has not acknowledged the letter or completed the required action.